Understanding Medicare Coverage and Payments for Skilled Nursing Facility (SNF) Care

As we age, it becomes increasingly important to have a comprehensive understanding of healthcare coverage options, particularly when it comes to long-term care needs. Medicare, the federal health insurance program primarily for individuals aged 65 and older, provides coverage for a wide range of medical services, including skilled nursing facility (SNF) care. In this blog post, we will delve into the intricacies of Medicare coverage for SNF care and explore how payments for such care are handled.

Note: You may be eligible to get Medicare earlier if you have a disability, End-Stage Renal Disease (ESRD), or ALS.

A Skilled Nursing Facility (SNF) is a healthcare facility that offers round-the-clock nursing care for individuals who require short-term rehabilitation or long-term nursing care. SNFs provide a higher level of medical care and assistance compared to other types of eldercare facilities, such as assisted living facilities or nursing homes. They are staffed by licensed medical professionals, such as registered nurses, who provide skilled care and therapy services.

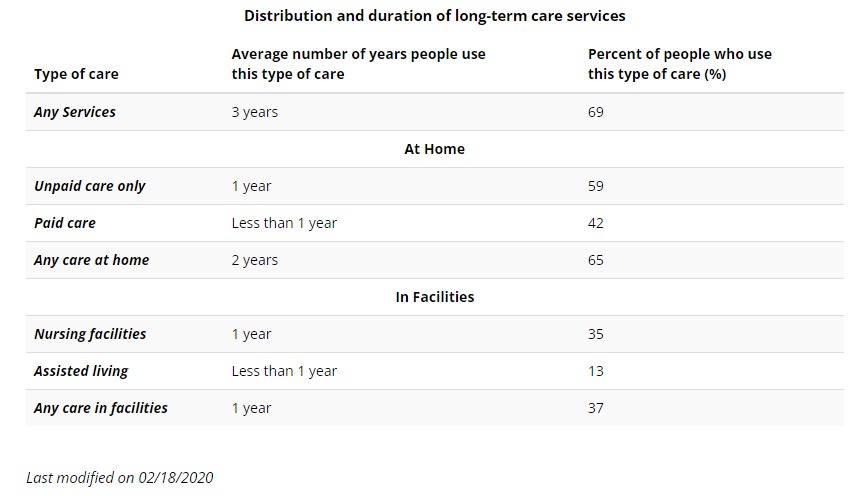

The duration and level of long-term care will vary from person to person and often change over time. Here are some statistics (all are “on average”) you should consider:

Someone turning age 65 today has almost a 70% chance of needing some type of long-term care services and supports in their remaining years.

Women need care longer (3.7 years) than men (2.2 years)

One-third of today’s 65 year-olds may never need long-term care support, but 20 percent will need it for longer than 5 years

The table below, sourced from longtermcare.gov, shows that, overall, more people use long-term care services at home (and for longer) than in facilities.

Medicare Part A, also known as hospital insurance, covers SNF care under specific conditions. To be eligible for coverage, the following criteria must be met:

1. Prior Hospitalization

Medicare requires that an individual has a qualifying hospital stay of at least three consecutive days. The hospital stay must be medically necessary, and admission as an outpatient or observation status does not count towards meeting this requirement.

2. Admission to a Medicare-Certified SNF

Medicare coverage only applies to care provided in a Medicare-certified SNF. It’s crucial to ensure that the chosen facility is certified to receive Medicare payments. You can check a facility’s certification status on the Medicare website or by contacting Medicare directly.

3. Skilled Care

Medicare covers skilled nursing care and therapy services in SNFs. Skilled care refers to services that can only be performed by licensed medical professionals, such as registered nurses or physical therapists. These services must be ordered by a doctor, and they should be needed on a daily basis for the treatment of a condition that was either caused or worsened during the hospital stay.

Medicare coverage for SNF care is subject to specific limitations:

1. Coverage Period

Medicare covers up to 100 days of SNF care per benefit period. A benefit period starts when a patient is admitted to a hospital or SNF and ends when the patient has not received any skilled care for 60 consecutive days. If a new illness or injury occurs after the 100-day limit, coverage may be extended for additional days.

2. Payment Responsibility

Medicare fully covers the first 20 days of SNF care. From day 21 to day 100, there is a daily coinsurance payment that the patient is responsible for. The coinsurance amount can change annually, so it is essential to check with Medicare or the SNF for the current rate. It’s important to note that Medicare Part A covers the cost of the room, meals, skilled nursing care, therapy services, and other medically necessary services. However, it does not cover personal or custodial care, such as assistance with bathing, dressing, or eating.

If SNF care is needed beyond the coverage period or if the patient does not meet Medicare’s criteria, there are alternative payment options to consider:

1. Private Insurance

Some private insurance plans may offer coverage for SNF care. It’s crucial to review the policy details, including coverage duration, limitations, and any out-of-pocket costs.

2. Medicaid

Medicaid is a joint federal and state program that provides healthcare coverage for individuals with limited income and assets. Eligibility criteria vary by state, but Medicaid often covers long-term care services, including SNF care.

3. Personal Funds

If other coverage options are not available or insufficient, individuals may need to pay for SNF care using personal funds. It’s advisable to consult with the SNF facility to determine the cost and payment arrangements.

Conclusion

Understanding Medicare coverage and payments for skilled nursing facility (SNF) care is crucial for individuals and their families as they navigate long-term care needs. Medicare provides coverage for SNF care under specific conditions, including prior hospitalization, admission to a Medicare-certified SNF, and the need for skilled care ordered by a doctor. Medicare covers up to 100 days of SNF care per benefit period, with the patient responsible for a daily coinsurance payment after the initial 20 days. However, it’s important to note that Medicare coverage does not extend to personal or custodial care.

For individuals who require SNF care beyond the coverage period or who do not meet Medicare’s criteria, alternative payment options should be explored. This may include private insurance coverage, Medicaid for those with limited income and assets, or utilizing personal funds.

It’s essential to carefully review the terms and limitations of any insurance coverage and consult with the SNF facility to understand the costs and payment arrangements. Additionally, staying informed about changes in Medicare regulations and coverage rates is crucial to make informed decisions about long-term care.

Ultimately, navigating Medicare coverage and payments for SNF care requires a proactive approach, understanding the eligibility requirements, coverage limitations, and alternative payment options available. By being well-informed, individuals and their families can make informed decisions and ensure that they receive the necessary care while managing the financial aspects of long-term care effectively.

NOT AFFILIATED WITH OR ENDORSED BY THE GOVERNMENT OR FEDERAL MEDICARE PROGRAM.

We do not offer every plan available in your area. Any information we provide is limited to those plans we do offer in your area.

Please contact Medicare.gov or 1-800-MEDICARE to get information on all of your options.

For a complete list of available plans, please contact 1-800-MEDICARE (TTY users should call

1-877-486-2048), 24 hours a day/7 days a week or consult www.medicare.gov.

Please note that each insurer has sole financial responsibility for its products.

Not connected with or endorsed by the U.S Government or the federal Medicare program.

This is a solicitation of insurance A licensed insurance agent/producer may contact you.

Bancorp’s insurance agents are available to provide you with a free review and consultation. Contact Us – Bancorp Insurance Call 800-452-6826

Disclaimer: This content is provided for general information purposes and is not intended to be used in place of consultation with our agents.