UCITS catastrophe bond fund growth slows in Q1. GAM extends lead

Assets under management (AUM) of the main UCITS catastrophe bond funds as a group increased during the first-quarter of 2022, but perhaps a little surprisingly growth has slowed somewhat, despite new issuance having been buoyant.

At the top of the UCITS catastrophe bond fund pile, the GAM Star CAT Bond Fund, which is managed by Fermat Capital Management, remains the largest and extended its lead slightly during Q1, as it added roughly 3% in size to the strategy.

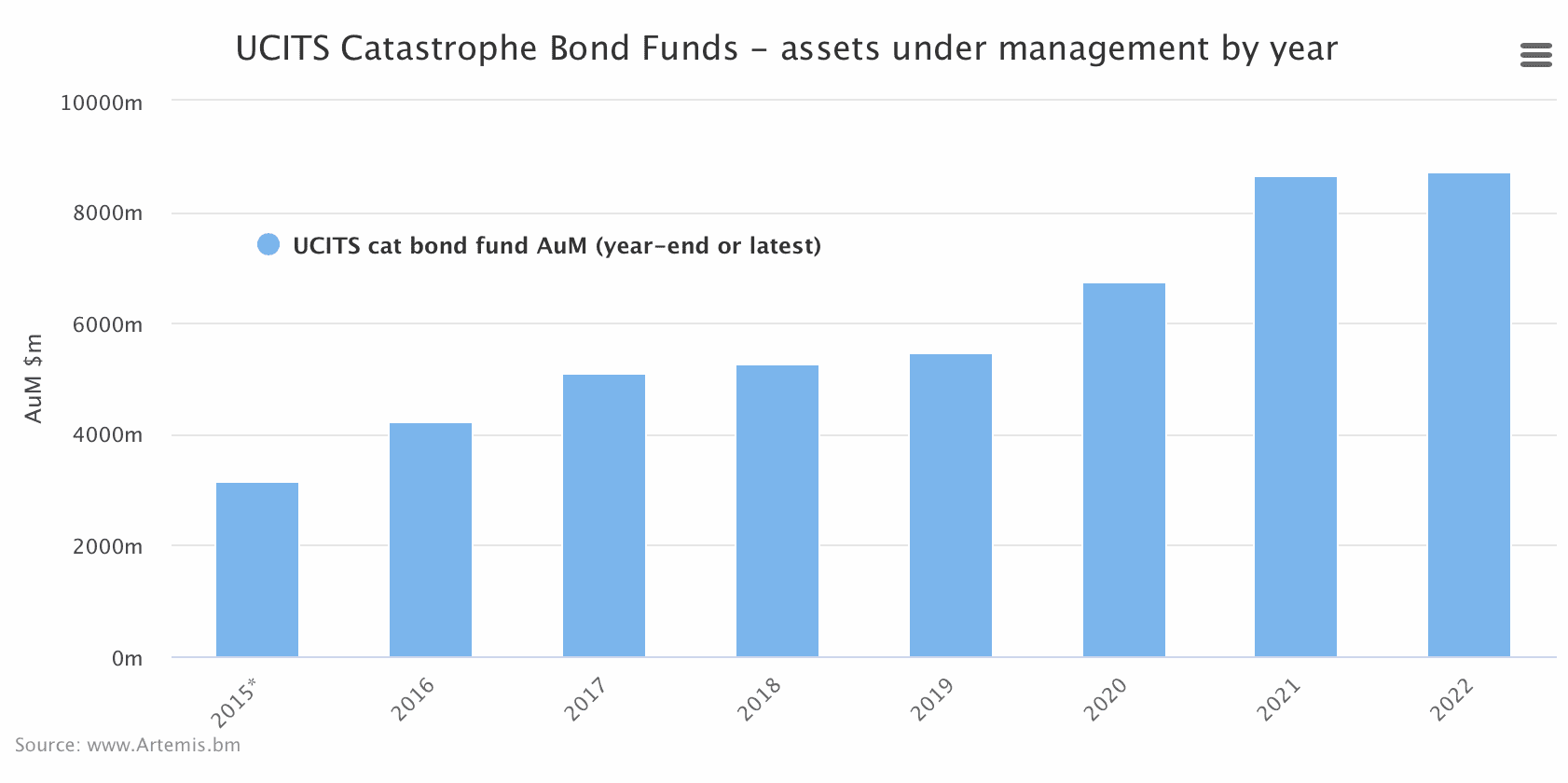

When we last reported on the growth of the UCITS catastrophe bond fund segment at the beginning of the year, assets held in these more liquid cat bond fund strategies had increased by some 28% across the group during full-year 2021, to reach roughly $8.6 billion.

We track UCITS cat bond fund assets here in this chart with the help of partner Plenum Investments AG, a specialist insurance-linked securities (ILS) and cat bond investment manager.

From roughly $8.6 billion in assets at the end of 2021, the main UCITS catastrophe bond funds we track grew by only around 1.1% in the first-quarter, to reach just under $8.72 billion by the end of March 2022.

It means that year-on-year growth in UCITS cat bond fund assets stood at almost 18%, a bit of a slow-down from the growth seen in full-year 2021.

As well as being able to analyse UCITS cat bond fund assets by year, our new page also displays the data by month as well, so you can more clearly see periods of inflow and outflow from the UCITS cat bond fund segment.

That’s despite primary market catastrophe bond issuance having been buoyant in Q1 2022, with roughly $3 billion of 144A property cat bonds, $331 million of 144A cat bonds covering other lines of business and $240 million of private cat bonds issued, as detailed in our latest cat bond market report.

The outstanding cat bond market expanded by almost 5% during the first-quarter of 2022, as maturities fell well-below issuance, although that figure has now come down as maturities accelerated in early April.

The fact UCITS cat bond funds grew more slowly than the market is both a function of what they can invest in, as well as the appetite of cat bond funds that are not in a UCITS format.

The first-quarter saw mixed results, in terms of asset growth, with some UCITS cat bond funds reporting a strong period of new capital raising, while others shrank, likely in part as they turned over their portfolios to accommodate newer vintage and better returning bonds.

Plenum Investments Cat Bond Dynamic Fund reported the fastest growth in the quarter, adding almost 45% in terms of assets, while the Tenax ILS UCITS Fund, managed by London based hedge fund manager Tenax Capital, grew second fastst in percentage terms, adding some 30%.

Of the larger UCITS catastrophe bond funds, Twelve Capital’s Cat Bond Fund added 4.5% to reach almost $1.75 billion in assets by the end of the first-quarter of 2022.

The Schroder GAIA Cat Bond Fund shrank slightly, by 1.9%, but ended Q1 2022 in second place, in terms of size, with just over $2.3 billion of UCITS cat bond assets under management.

But it was the Fermat Capital managed GAM Star CAT Bond Fund that ended the quarter at the top, growing by just over 3% to reach almost $2.55 billion of cat bond assets under management at the end of March 2022.

With issuance in the primary catastrophe bond market remaining strong so far in April and many expecting that to continue in that way up until the hurricane season gets meaningfully underway, these UCITS catastrophe bond funds should have a chance to continue growing their portfolios over the coming months.

Analyse UCITS catastrophe bond fund asset growth using our charts here.