UCITS cat bond funds deliver 8.2% average return for H1 2023

Catastrophe bond funds in the UCITS format experienced a very strong end to the first-half of 2023, with June seeing them deliver an average return of almost 1.9%, which took the H1 2023 average UCITS cat bond fund performance to almost 8.2%.

It’s the highest return for any first-half of the year on record, reflecting the attractive yields available from investments into catastrophe bond funds today.

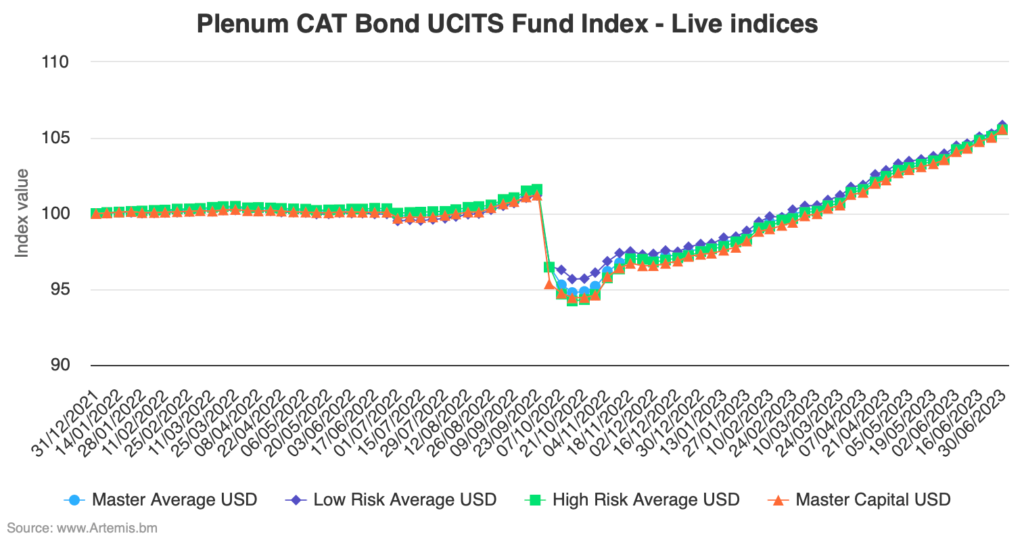

You can analyse the performance using the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format, provides a broad benchmark for the performance of cat bond investment strategies.

A combination of factors have driven the record returns for the first-half of 2023, with recoveries in value of cat bonds that had been priced down after hurricane Ian, spread recovery after capital market pressures, and perhaps most important the now much more elevated spreads available on new catastrophe bond issues.

These have all combined to deliver the best first-half of any year on-record, with these UCITS cat bond fund indices reporting an average return of almost 8.2% at the end of June 2023.

For the first-half of 2023, the lower-risk cohort of UCITS cat bond funds has actually outperformed the higher-risk strategies.

The low-risk UCITS cat bond Index delivered an 8.50% return for the first six months of this year, the higher-risk 8.25%.

More impressively, perhaps, the returns of catastrophe bonds funds over a trailing 12-month period are now approaching 6% or more in many cases, even though hurricane Ian falls into that period.

For these UCITS cat bond fund Indices, the average performance is 5.85% over the 12-months to the end of June 2023.

Again, lower-risk cat bonds funds performed better, with the low-risk UCITS cat bond fund Index delivering 6.37% for the last 12-months, compared to the higher-risk strategies Index delivering a 5.50% return for the period.

With spreads still high for new issuance even accounting for recent softening, if you look at pricing on a risk-adjusted basis it is still well-up on previous years, the forward-return potential for cat bond fund strategies remains impressive and should continue to deliver impressive returns to investors, major catastrophe loss activity aside (of course).

Analyse interactive charts for this UCITS catastrophe bond fund index.