UCITS cat bond funds average 9.34% return YTD

The average return across the group of UCITS catastrophe bond funds has reached a stunning 9.34% as of early August, as cat bond fund strategies continue to deliver outstanding returns in 2023.

These cat bond fund strategies are still on a record-setting pace in 2023, with the returns seen far higher than any other year on-record.

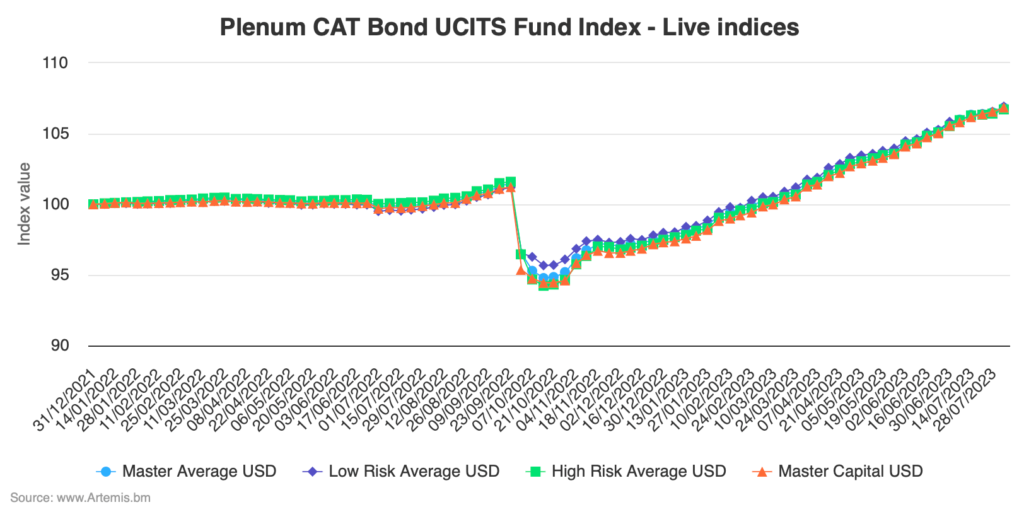

You can analyse the performance using the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format, provides a broad benchmark for the performance of cat bond investment strategies.

Cat bond fund returns are being driven at this record-setting pace by three factors, in the earlier part of 2023 the recoveries in value of cat bonds that had been priced down after hurricane Ian was a significant performance driver of this year’s returns.

On top of that, we have seen spreads recover following broader capital market pressures that affected cat bond prices.

But now, the most important factor in the returns the cat bond market offers to investors, are the significantly elevated spreads available on new catastrophe bond issues.

All of these have driven performance so far this year, but higher spreads of newer issued catastrophe bonds are now perhaps the most significant, taking returns to a stunning 9.34% as of the start of August 2023.

The pace of these returns has slowed somewhat in recent months, but the trajectory remains on a steeper upwards curve than at many points in the cat bond market’s history.

Artemis has learned that there are catastrophe bond fund strategies with 2023 returns now in the double-digits, which is unheard of for this stage of the year.

It’s also impressive to note, that Artemis’ analysis shows that the group of UCITS cat bond funds tracked by Plenum Investment’s Index have now delivered an average return of 12.72% since hurricane Ian struck and the market declined as a result of that.

But, perhaps more impressive, the return of the UCITS cat bond funds since before hurricane Ian had even formed has now reached 5.31% on average, and the 12-month return to early August stood at 6.90%.

It’s no surprise that catastrophe bond fund managers have continued to see some inflows in the last couple of months and, unlike many other years, a good number of cat bond funds are still open to investor flows, where as in previous years they would often be closed to new investor flows by this stage of the year.

The market now awaits the passage of hurricane season for issuance to return, which we understand is likely to be seen in the next quarter with the emergence of some new diversifying peril cat bond deals, we understand.

Analyse interactive charts for this UCITS catastrophe bond fund index.