UCITS cat bond fund Index accelerates past 14% YTD. AUM recovers to $10bn

Catastrophe bond funds in the UCITS format have now delivered around 14% in returns year-to-date on average, while their assets under management as a group had recovered to more than $10 billion by the end of October 2023.

The capital-weighted average return of the group of UCITS catastrophe bond funds tracked by Plenum Investments had reached an impressive 14.4% as of November 3rd.

It puts the returns delivered so far this year at a level well-beyond any other, with these cat bond funds likely to set an annual return record that will be hard to beat in future given the additional performance delivered on the back of recoveries of value of certain cat bond positions after last year’s hurricane Ian.

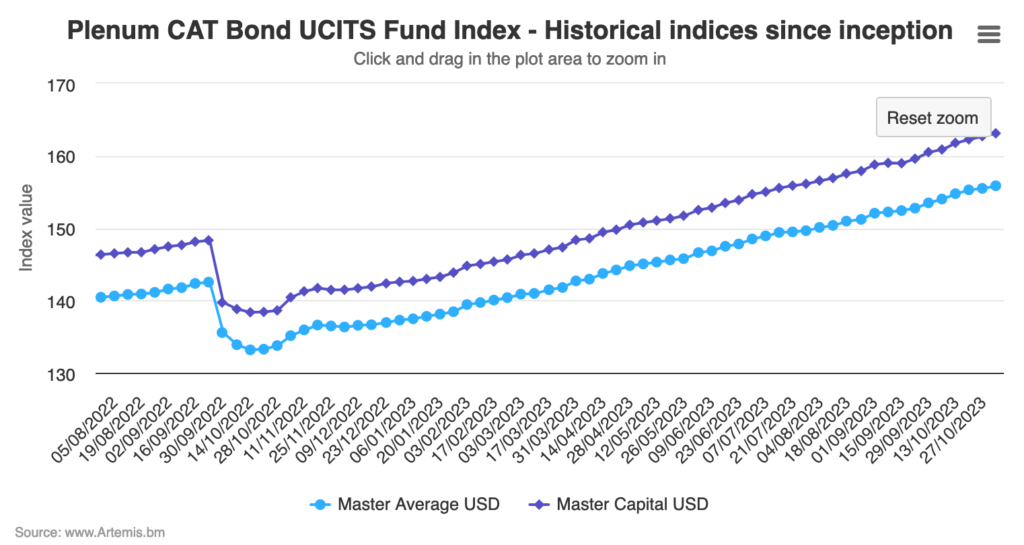

You can analyse the performance using the Plenum CAT Bond UCITS Fund Indices, which tracks the performance of a basket of cat bond funds structured in the UCITS format, provides a broad benchmark for the performance of cat bond investment strategies.

By November 3rd, the average return of the lower-risk group of UCITS cat bond funds stood at 13.2% and the higher-risk group was 13.8%, while the capital-weighted average reached 14.4%.

This was on the back of a very strong October, when the lower-risk UCITS cat bond funds delivered a return of 1.3% and the higher-risk group 1.8%.

As the chart below shows, which you can click and view an interactive version of, the only trajectory for the cat bond funds since hurricane Ian last year has been upwards.

Looking at the rolling twelve month return for the group of UCITS catastrophe bond funds tracked in the Plenum Investments Index, the low-risk average stands at 14.5%, the high-risk average at 15.8% and the capital-weighted average at 16.2%.

With almost two full months left to incorporate into the Index returns this year, this UCITS cat bond fund Index is going to set a very strong record.

Turning to the assets under management of the leading UCITS catastrophe bond funds, which we track here with the help of Plenum data, a return to growth was seen in October 2023.

As we reported in early October, catastrophe bond funds in the UCITS format experienced some outflows in the third-quarter of the year, with their combined assets under management falling by 4% or roughly $430 million, to just over $9.95 billion in the period.

A range of factors caused that decline, including currency effects.

Now, it’s become clear that after October was completed, the group of UCITS cat bond funds has seen their assets return to growth.

The AUM total recovered to just slightly above $10 billion for the group of UCITS cat bond funds, which still sits some way below the record of $10.4 billion that they reached in July.

But that record is likely to be broken over the coming weeks, as the very active cat bond pipeline provides an opportunity for UCITS cat bond fund managers to welcome more investor flows into their structures.

Right now, the capital raising opportunity for these cat bond fund managers is strong, with returns still extremely attractive and issuance providing ample investment opportunities to absorb any fresh capital that is raised.

Analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.

Analyse UCITS catastrophe bond fund assets under management using our charts here.