UCITS cat bond fund assets near $12.2bn, up more than 11% YTD

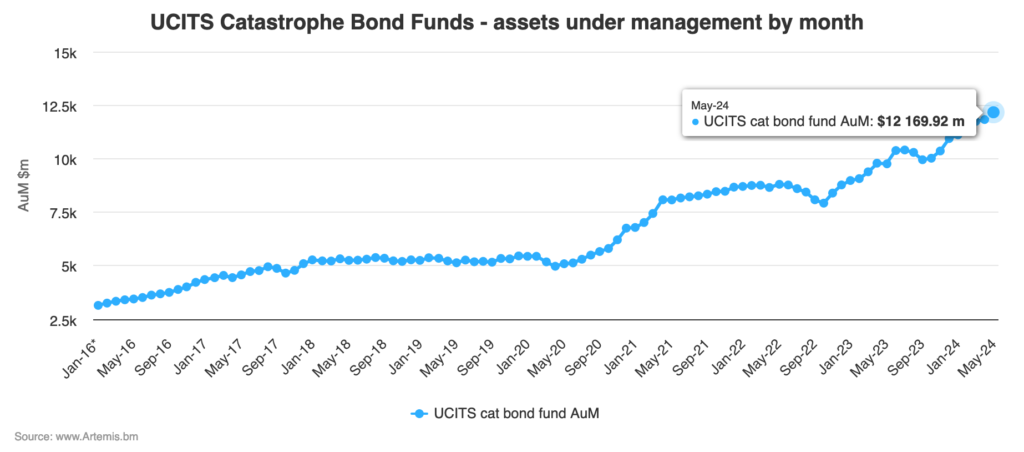

The combined assets under management of the main catastrophe bond funds in the UCITS format have now surpassed $12 billion for the first time ever, nearing $12.2 billion by the end of May 2024 and now having risen by over 11% so far this year.

Catastrophe bond funds in the UCITS format have experienced strong growth over the last year, with their combined cat bond assets under management (AUM) now up by 25% over the last twelve months.

The larger cat bond funds continue to lead the way, with the three biggest UCITS cat bond fund strategies contributing $8.7 billion of the total, or 72% of the total assets under management across the group of 16 UCITS cat bond funds.

While the group of the three largest cat bond funds has not grown at the same pace as the overall, this is due to Fermat Capital Management having launched its own-branded UCITS cat bond fund strategy this year, which has been growing strongly.

Notably, the UCITS cat bond fund sector only hit the $11 billion AUM milestone in January and so has now surpassed the next $12 billion milestone in less than five months.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

By the end of May 2024, the UCITS cat bond fund that has added the most in assets so far this year is Fermat Capital Management’s new Fermat UCITS Cat Bond Fund, which has grown to almost $541 million from its launch in January.

But, at the same time, the GAM Star Cat Bond Fund, which is portfolio managed by Fermat, lost $275 million so far this year, of which a significant amount is likely to have flowed to Fermat’s new own-branded cat bond fund strategy.

Of the established UCITS cat bond funds, the Schroder GAIA Cat Bond Fund has added $461 million in assets through the first five months of 2024, so is the faster grower.

The Leadenhall Capital Partners managed Leadenhall UCITS ILS Fund is next, having added almost $287 million in assets this year.

The recent launched Icosa Cat Bond Fund is also a notable addition, having added over $126 million in assets since its launch at the start of the year.

The largest UCITS cat bond fund at the end of May 2024 was the Schroder GAIA strategy, at approaching $3.3 billion, followed by the Twelve Capital Cat Bond Fund at $2.94 billion and the GAM Star Cat Bond Fund at $2.47 billion, then Leadenhall’s cat bond strategy at almost $900 million in size.

Notably, UCITS cat bond fund assets under management have now risen by around 39% since the end of 2022 and UCITS cat bond funds as a group now hold more than double the assets they had under their management as recently as Q3 2020.

With the catastrophe bond market pipeline still active even with the wind season approaching and the cat bond market yield still at a historically high level, we anticipate further AUM growth for the group of UCITS cat bond funds once data is available for the full first-half of this year.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.