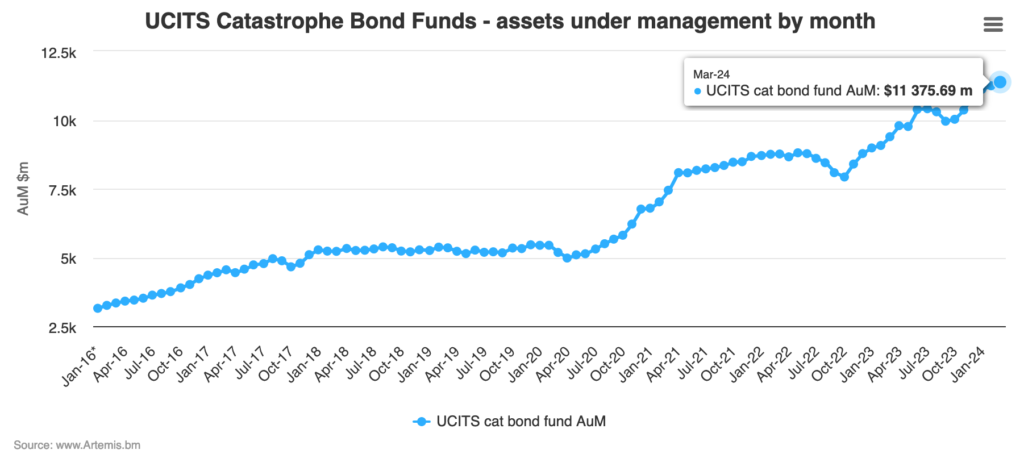

UCITS cat bond fund assets grow by 4% to reach $11.4bn in Q1 2024

The assets under management of the main catastrophe bond funds in the UCITS format increased by 4% over the first-quarter of 2024, to reach a new high of almost $11.4 billion by the end of the period.

Catastrophe bond funds in the UCITS format have been growing rapidly over the last year, with their assets under management (AUM) now up by more than 21% over the last year.

At 76% of the total almost $11.4 billion in UCITS cat bond fund AUM, the three largest funds now make up a significant proportion of this market segment.

However, over the last year the AUM of those three largest UCITS cat bond funds as a group has only increased by 15%, so was outpaced by the overall segment growth in the same period.

The $11 billion in combined assets milestone was passed earlier this year and overall assets have continued to expand, with a combination of capital raising and cash generation taking the group of UCITS catastrophe bond funds to almost $11.4 billion at March 31st 2024.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

The biggest gained for 2024 so far, in percentage terms, is the Credit Suisse Insurance-Linked Strategies managed Credit Suisse (Lux) Cat Bond Fund, which added almost 218% to its assets in the first-quarter of the year, to end the period with roughly $110 million in AUM.

After that, the Leadenhall Capital Management operated Leadenhall UCITS ILS Fund added over 22% in assets to reach almost $750 million in size at the end of March.

In dollar terms, the biggest gainer for Q1 2024 was the Schroder Capital managed GAIA Cat Bond Fund, which added $283.6 million in assets.

As a result, at the end of Q1, the Schroder UCITS cat bond fund was the largest in the market, with over $3.114 billion in assets under management.

The Twelve Cat Bond Fund, managed by Twelve Capital, was next at just slightly under $3 billion, followed by the Fermat Capital managed GAM Star Cat Bond Fund which has shrunk a little further in the quarter to almost $2.53 billion.

Elsewhere, there was notable 19% growth for the HSZ Group’s Maneki UCITS Cat Bond Fund, 17% asset growth for the Solidum CAT Bond Fund, 15% for the AXA Investment Managers WAVe Cat Bond Fund and 8% for the Plenum Dynamic Cat Bond Fund.

Finally, the Icosa Cat Bond Fund, managed by former Twelve executive Florian Steiger under his new investment advisory firm Icosa Investments, had surpassed $30 million in assets by the end of March since its launch in early January.

As we also reported this week, UCITS catastrophe bond funds as a group delivered a 3.65% return for the first-quarter of 2024, continuing the strong performance of the previous year.

With the catastrophe bond market pipeline still bulging and the cat bond market yield still at a historically high level, we expect there will be further growth for the group of UCITS cat bond funds over the second-quarter of this year.

Analyse UCITS catastrophe bond fund assets under management using our charts here.

You can also analyse UCITS cat bond fund performance, using the Plenum CAT Bond UCITS Fund Indices.