U.S. public EV chargers set to surpass gas stations in 8 years

On April 16, piloting an electric vehicle through the north of North Dakota became far less fraught. That’s when a new fast-charging station switched on at a Simonson Station Store gas station in Minot, close to a Red Wing boot shop.

Zero-emission drivers around El Paso, Texas, can also rest easier thanks to two new stations up the road in Deming, New Mexico. So can anyone heading down the Gulf Coast by Mobile, Alabama, where a new bank of chargers started pumping electrons May 2 in Robertsdale, down the street from Buster’s Southern Pit BBQ.

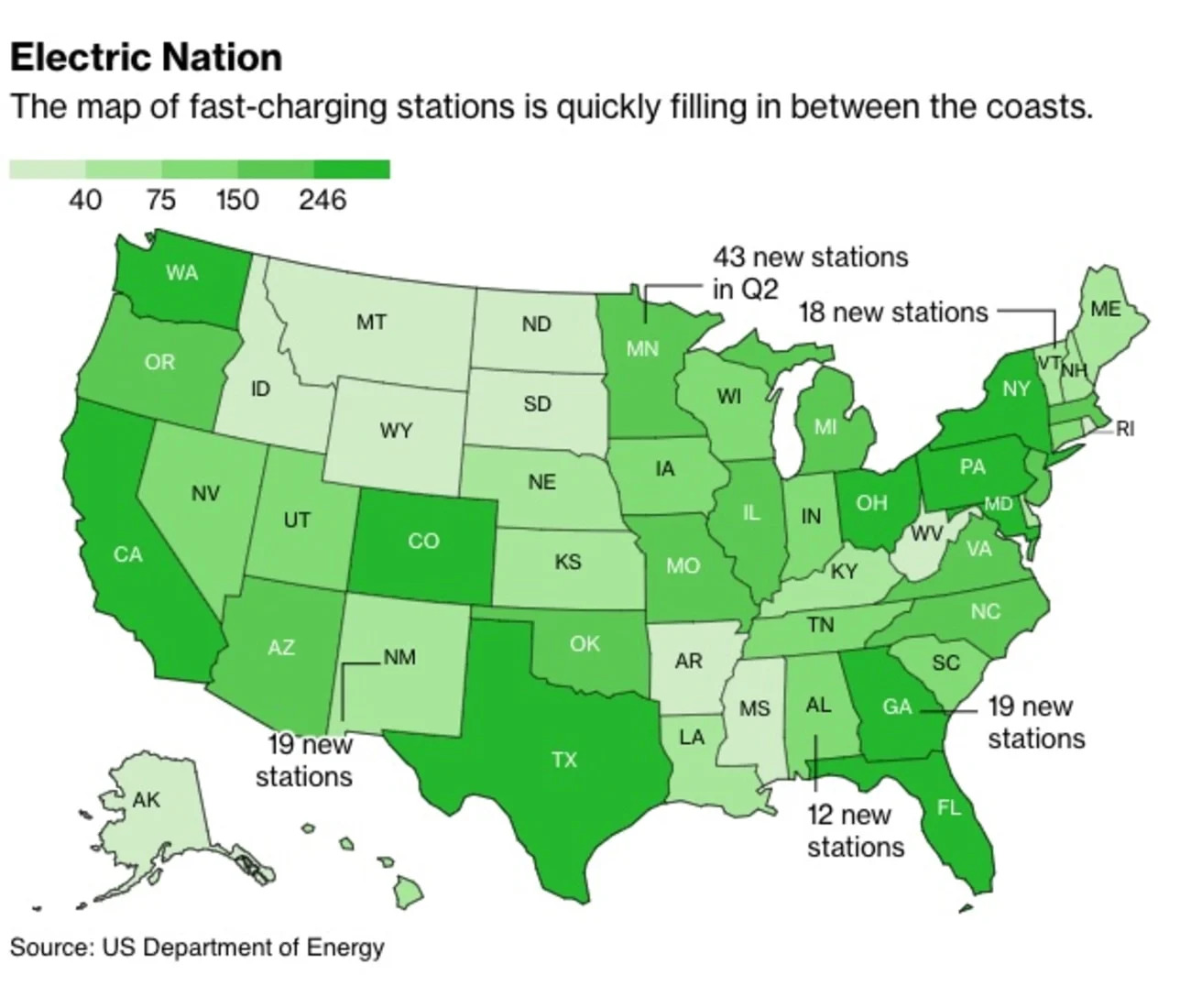

America’s EV charger deserts continued to vanish in the second quarter, as a motley array of networks switched on 704 new, public fast-charging stations, an increase of 9% in three months, according to a Bloomberg Green analysis of Department of Energy data. There are now nearly 9,000 public, fast-charging sites in the US.

At the current pace, public fast-charging sites will outnumber gas stations in the U.S. in about eight years — but charger momentum is only expected to accelerate. North American operators will spend a collective $6.1 billion on charging infrastructure this year, nearly double their 2023 investment, according to BloombergNEF estimates. That annual spend is expected to double again by 2030.

“We’re seeing demand for fast charging skyrocket,” said Sara Rafalson, executive vice president at EVgo Inc., which operates almost 1,000 stations in the U.S. “We’re continuing to build bigger and bigger stations because we need to keep up with that demand.”

EV cords are increasingly being added by retailers eager to attract the nearly 10% of U.S. car buyers who are plugging into battery-powered vehicles. Gas station operators, in particular, are jumping on the electron bandwagon. In the second quarter, Shell debuted 30 new charging stations, while Enel opened 11, Pilot Travel Centers opened eight and another seven showed up at Flying J rest stops, according to the federal tally.

“We’re getting past a turning point where fueling stations and convenience stores are really seeing the value proposition,” said Sam Houston, senior vehicles analyst at the Union of Concerned Scientists. “It’s a very welcome turn from how they were behaving in the regulatory space even as recently as a couple years ago.”

U.S. Bank also sees EV charging as business development: It switched on chargers at 39 branches in California in the second quarter. Meanwhile, Waffle House added charging cords to the parking lots at two of its Florida restaurants.

While much has been made of a slowdown in EV demand in the U.S., retailers have good reason to consider chargers a customer magnet: More and more drivers are going electric. In April, the International Energy Agency estimated that U.S. sales of fully electric vehicles will soar to 2.5 million in 2025, from 1.1 million last year.

“It’s worth remembering that the number of EVs sold [in the first] quarter is roughly equal to what was sold in all of 2020,” EVgo Chief Executive Officer Badar Khan said on an earnings call on May 7.

Meanwhile, charging stations are now getting busy enough to start making money. At the end of the first quarter, the average U.S. fast-charging station was plugged into a car 18% of the time — nearly five hours a day, according to Stable Auto, a charging network consultant. Stable estimates that a charging station must be pumping electrons around 15% of the time to turn a profit.

EVgo says demand is being juiced by people driving their electric cars farther than they used to, and by a greater share of EV owners living in multi-unit developments, where they often aren’t able to charge at home. Newer EVs are also able to charge more quickly than older models, Rafalson pointed out, which is encouraging more drivers to top up in the wild. The company’s fastest growing markets are Texas and Florida, followed by Michigan and Arizona.

The second-quarter charger blitz was fueled in part by the Biden administration’s National Electric Vehicle Infrastructure (NEVI) Formula program, a $5 billion plan to fill in the gaps on the charging map. It’s still early days, but the NEVI program is already in the crosshairs of former US President Donald Trump: In an interview with Businessweek, Trump claimed the White House has spent $8 billion to open just seven chargers.

Eight NEVI-backed stations opened across six states in the second quarter, but those figures that should increase quickly. Some 23 states have awarded contracts or signed agreements for another 550 stations, according to the government.

Still, charging anxiety remains one of the top reservations for drivers hesitant to buy an EV. Houston at the Union of Concerned Scientists says that’s partly because there’s still a wide gap between perception and reality. Most drivers have no idea how many charging cords are actually all around them.

“You have a few anecdotes that suggest a lack of charging and that gets conflated to charging overall,” Houston said. “It’s important to make sure people are aware of how quickly these stations are coming online.”