Typhoon Shanshan seen as unlikely to trouble cat bonds or ILS positions

Typhoon Shanshan struck Japan’s southern island of Kyushu yesterday and while it is being called one of the strongest storms to hit the country in decades, the ultimate impact to reinsurance markets is expected to be minimal, while catastrophe bonds and other insurance-linked securities (ILS) are expected to be largely or completely unaffected.

Insurance and reinsurance broking group Aon has said that the typhoon is likely to drive hundreds of millions of dollars of losses, although that is a very preliminary estimate at this early stage.

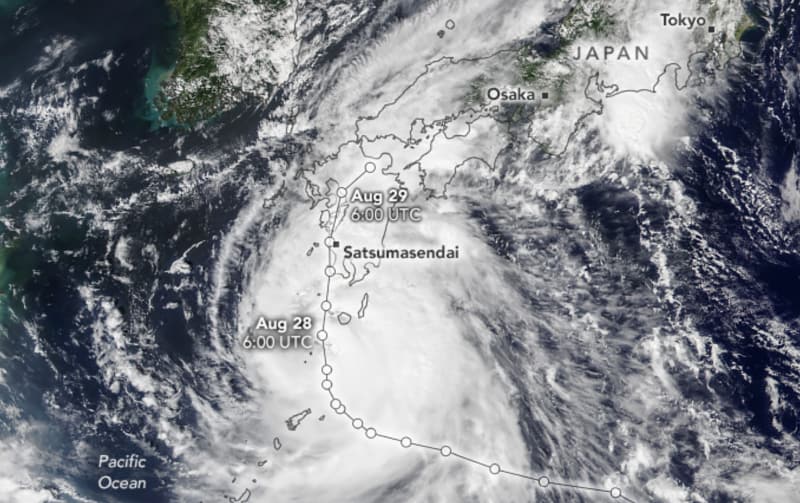

Typhoon Shanshan made landfall near Satsumasendai, Kagoshima Prefecture with maximum sustained winds of 110 mph and higher gusts and a minimum central pressure of 935 hPa.

Aon noted that if that pressure level is verified, typhoon Shanshan will have the lowest sea-level pressure during landfall in Japan since 1993 and the fifth lowest on record.

Land interaction further weakened typhoon Shanshan, although widespread damage was reported from winds, surge and rainfall.

The heavy rainfall has continued and Aon reported, “The typhoon’s slow progression has made heavy rainfall, flash flooding, and landslides especially hazardous for areas north and east of the storm’s center. Prefectures such as Kagoshima, Kumamoto, Oita, and Fukuoka have received over 400 mm (15.7 inches) of rainfall, while the Miyazaki Prefecture has seen more than 600 mm (23.6 inches) of rain. Other prefectures across Shikoku and Honshu islands have also experienced downpours and landslides due to the storm’s outer rainbands.”

Flooding and landslide impacts remain possible, even as Shanshan dissipates, with rainfall continuing.

Aon said that, “Early damage reports and assessments due to Typhoon Shanshan indicate that total economic and insured losses may reach into the hundreds of millions USD.”

Despite the deep low pressure at landfall, typhoon Shanshan does not appear to have caused the levels of property damage needed to overly trouble reinsurance markets, and early indications are that catastrophe bonds exposed to Japanese typhoon risks and flood are likely to remain safe from attaching as well.

Specialist ILS investment manager Twelve Capital said in an event update that given Shanshan had tracked further west that expected, “this scenario looks to be less impactful than some of the earlier forecasts which had the storm landfalling into the populated areas of Tokyo or Osaka.”

But also noted that, “Significant wind and rainfall has already been reported in the impacted areas,” and that, “The storm is expected to continue along a north-east path, where it is likely to continue causing widespread damage, primarily through flooding and landslides.”

Despite this though, Twelve Capital, one of the largest managers of catastrophe bonds and also an investor with private ILS, or collateralized reinsurance, strategies said, “Given the current characteristics of the storm we do not expect any impact from our positions, however we will continue to closely monitor the event given it is still active.”

As typhoon Shanshan’s track shifted westward and before landfall, cat bond fund manager Icosa Investments AG had also commented on the storm.

Icosa Investments said, “Given the updated trajectory, the potential for direct impacts on populated areas—and consequently, the risk of cat bond losses—appears minimal at this stage. However, flood risk remains a key uncertainty. Due to its localized nature, predicting flood impacts accurately is challenging.”

Flood does remain an uncertainty, as the impacts from typhoon Shanshan are widespread and rainfall continues related to the storm.

A number of Japanese typhoon catastrophe bonds are exposed to flood risk, but typically are more concentrated on areas further east, from Osaka to Tokyo it seems.

Of course, there is likely to be some leakage of losses via quota share reinsurance arrangements, that is almost a given with any significant catastrophe loss event.

Shanshan is likely to be a largely retained catastrophe event, albeit with some chance of certain reinsurance arrangements responding, it appears.

At this stage, it does seem that the impacts to the reinsurance market will be easily manageable from Shanshan, while the chance of losses to the ILS market seems limited at this time, although again quota shares or sidecars can always be a source of attrition.