Turkey earthquakes insurance industry loss estimated US $3.5bn by PERILS

A first estimate for the insurance and reinsurance market industry loss from the recent Kahramanmaras Earthquake Sequence that struck Turkey and Syria in February has been pegged at US $3.5 billion by PERILS AG.

The catastrophe loss data aggregator said that the series of earthquakes which caused widespread devastation across parts of the Republic of Türkiye and the Syrian Arab Republic on February 6th 2023 is so far only estimated to have caused TRY 65.4 billion of property insurance market losses, which equates to around US $3.44 billion today, but US $3.5 billion on the date of the quakes.

That’s a way below industry loss estimates from some risk modellers, for example Moody’s RMS said the losses would likely be above US $5 billion.

However, it aligns closely with global reinsurance firms, such as Hannover Re that estimated the quakes were a EUR 3.5 to 4 billion industry loss event.

PERILS estimate is based on data collected from the Turkish insurance market, for the property insurance line of business only and does not include any estimate for losses in Syria.

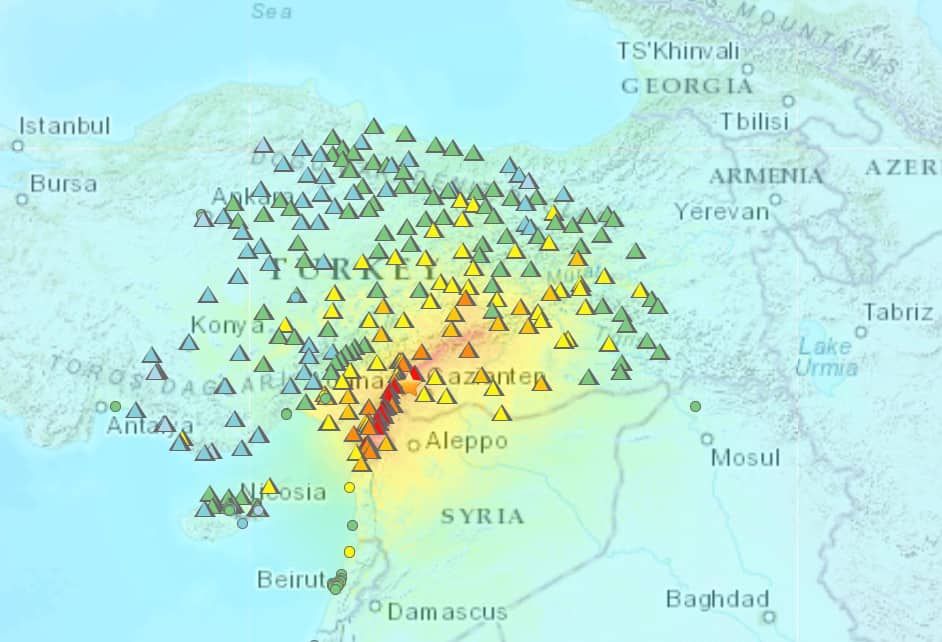

Eleven provinces in south-eastern Turkey were affected by the earthquake sequence, having a combined population of approximately 14 million, with Hatay, Kahramanmaras, Gaziantep, Malatya and Adiyaman the worst affected.

Over 56,900 deaths were reported from the earthquakes, 48,448 in Turkey and 8,476 in Syria, and close to 130,000 people were severely injured by the earthquakes.

Official estimates suggest that over 160,000 buildings containing 520,000 apartments were destroyed, damaged or will need to be demolished after the earthquakes, PERILS noted.

Many structures are partially damaged and will need to be repaired as wel.

The Department of Economics of the Koç University estimated that the economic losses in Turkey from the quakes would be in the range of US $70bn to US $87bn.

PERILS noted that, the TRY 65.4bn insurance industry loss from the earthquakes represents the costliest catastrophe event in Turkey’s recorded history (USD 3.5bn at exchange rates of 6 Feb 2023).

Luzi Hitz, CEO of PERILS, commented: “First and foremost, I would like to express our deepest sympathies to those affected in the Republic of Türkiye and the Syrian Arab Republic by this incredibly tragic and truly devastating event.

“Shallow earthquakes of magnitudes Mw 7.8 and Mw 7.5 cause severe devastation in any built environment. Although the insurance industry in Turkey offers protection for the financial consequences of such events, the take-up rate remains low, or the coverage limits purchased are far below reconstruction costs. Earthquake insurance is not only a challenge in Turkey, but also in other regions exposed to high seismic activity such as Japan or California, where insurance penetration for the peril remains low.”