Tropical depression 4 expected to develop into tropical storm Debby near Florida

Over night Invest, or investigative area, 97L developed into tropical depression 4 and is expected to become the fourth tropical storm of the 2024 Atlantic hurricane season, with what could be named Debby currently organising and heading towards Florida.

Meteorologists have been watching Invest 97L for a number of days now and the latest forecast model runs are showing a strong chance for it to achieve tropical storm status and be named as Debby.

It became tropical depression 4 last night and is now forecast to become Debby, with a chance seen for it making low category hurricane status by landfall.

The National Hurricane Center (NHC) has said in its latest update, “Maximum sustained winds are near 30 mph (45 km/h) with higher gusts. Strengthening is forecast during the next several days, and the depression is expected to become a tropical storm later today and continue strengthening over the eastern Gulf of Mexico through the weekend.”

Currently, the depression is tracking along the south of Cuba, with convection said to be becoming increasingly robust and forecast models trending towards a more westerly track that could take a tropical storm Debby over the straits of Florida and into the Gulf of Mexico.

Forecasters say conditions are set to become more conducive for development as tropical depression 4 moves on its north-westerly track, with most models now opting for it to head into the Gulf and towards the Florida Big Bend area of the Panhandle at this time.

The image below from Tomer Burg’s excellent weather resources shows the forecast path and cone of uncertainty, as well as wind intensity forecasts:

There’s a good deal of uncertainty, not just in the track but also in the potential intensity of a tropical storm Debby, if it is named.

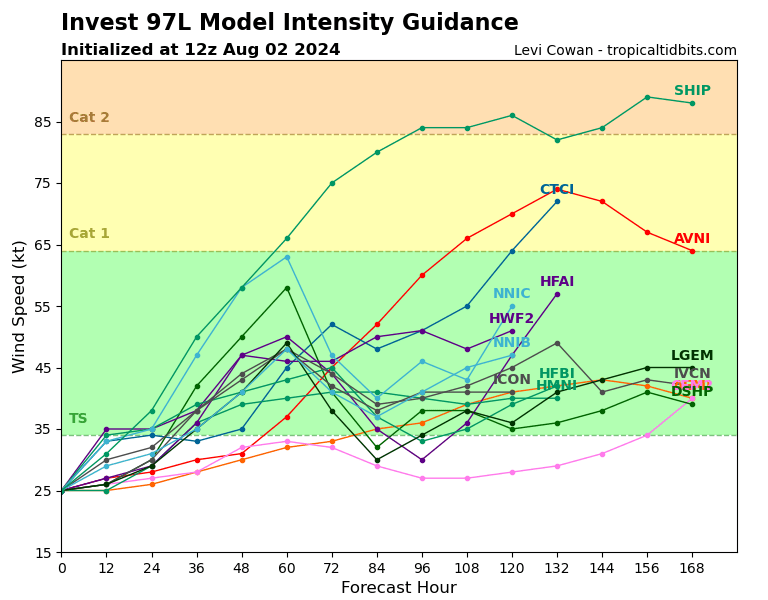

The model intensity guidance from TropicalTidbits.com shows most opting for tropical storm Debby, but only a few for Debby to attain hurricane status.

Forecasters are warning that this system could pick up a lot of moisture as it moves towards Florida and the south eastern United States, with some cautioning that flooding could be a concern no matter how strong the winds from any tropical depression or tropical storm Debby become.

Meteorologists say the steering flow that directs Invest 97L is going to be critical, as if it comes straight at southern Florida it likely won’t have time to gain much intensity, where as a track further into the Gulf of Mexico could give it more time to strengthen before curving back towards the west coast of Florida or the Panhandle.

On the other hand, any track more up the eastern side of Florida or offshore could allow any tropical system to strengthen will heading for the Carolinas.

So a lot of uncertainty still and hence something for the insurance, reinsurance, catastrophe bond and insurance-linked securities (ILS) markets to track this weekend.

Catastrophe bond fund manager Icosa Investments AG has commented on the potential area of development, saying it is tracking the system closely, as other cat bond and ILS fund managers will be.

Icosa Investments said, “While forecasts vary regarding its path, the general consensus is that the system will approach Florida from the western coast (possibly near Tampa), cross the Floridian peninsula, and then move back into the Atlantic before moving Northeast.

“Most intensity forecasts do not anticipate for the system to reach hurricane strength. However, given the warm sea surface temperatures and low wind shear, there’s still a small possibility that models underestimate the potential for intensification, similar to what occurred with Hurricane Beryl recently. Fortunately, the system’s current lack of organisation limits the time available for significant strengthening before it makes landfall.

“At this point, we do not expect any impact on cat bond investors, even though a Category 1 hurricane could still cause billions of insured losses if it directly hits the densely populated Tampa area. Such an event might result in some attachment erosion, but is unlikely to result in significant outright losses in the cat bond market. There is also some uncertainty regarding the storm’s path after it reemerges into the Atlantic, with potential impacts in North Carolina — a region well-represented in the cat bond market — still possible.”

You can track this and every Atlantic hurricane season development using the tracking map and information on our dedicated page.