Tremor adds digitized contract wording process to reinsurance marketplace

Tremor Technologies, the insurtech operator of a programmatic risk transfer marketplace, has announced another significant feature release, digitizing the contract wording process and making it fully auditable, embedded within its platforms workflow.

The reinsurance contract wording and its negotiation are parts of the reinsurance placement process that can become a pain point when dealt with solely via emails and documents.

We’ve all heard horror stories of reinsurance contract wordings documents that contain so many tracked changes they become all but unusable, or that someone accepts all the changes and the history is lost.

On the email side, it’s a far from ideal tool when it comes to keeping a compliance-friendly and auditable trail of negotiations over wordings.

What Tremor is launching today, dubbed Tremor Wordings™, provides for the complete digital negotiation and finalisation of complex reinsurance contract wordings right within its reinsurance marketplace, with a perpetual audit history and trail kept.

This can ensure strong compliance while also improving the clarity of what has been agreed.

But, perhaps more importantly, it’s right alongside the placement itself and embedded within the reinsurance and risk transfer placement workflow that Tremor has developed.

When reinsurance renewals go back and forth between broker, cedent and reinsurers during the negotiation process, it can be all too easy to lose track of changes, and the majority of market participants still use a combination of documents and email to get to a finalised wording that works.

Of course, there are tools available to assist with this, some owned by brokers. But none of these are embedded within a reinsurance placement platform through which cedents can access risk capital efficiently as well.

Tremor’s online contract negotiation functionality is powered by the TremorTalk Communications Platform it released recently.

“A well known industry pain point, negotiating and finalizing contract wordings for traditional reinsurance placements involves dozens of versions of documents with out of synch track changes, roughly managed with spreadsheets exchanged between insurers, brokers and reinsurers.

“Finalizing contracts while trying to solve for price and lines is not only time and cost inefficient but leads to significant compliance risk,” Sean Bourgeois, Tremor CEO explained.

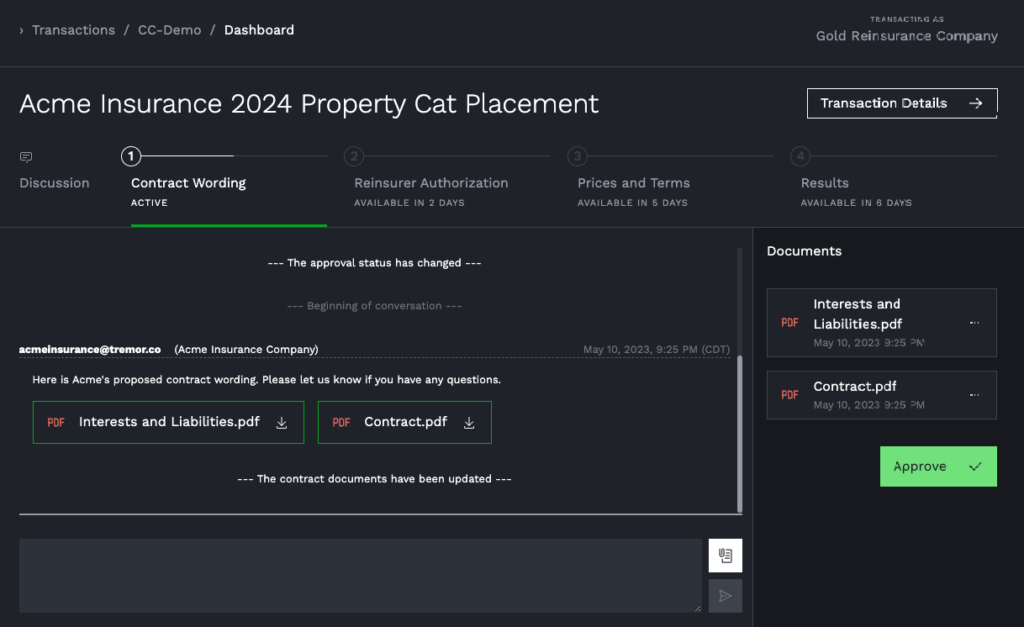

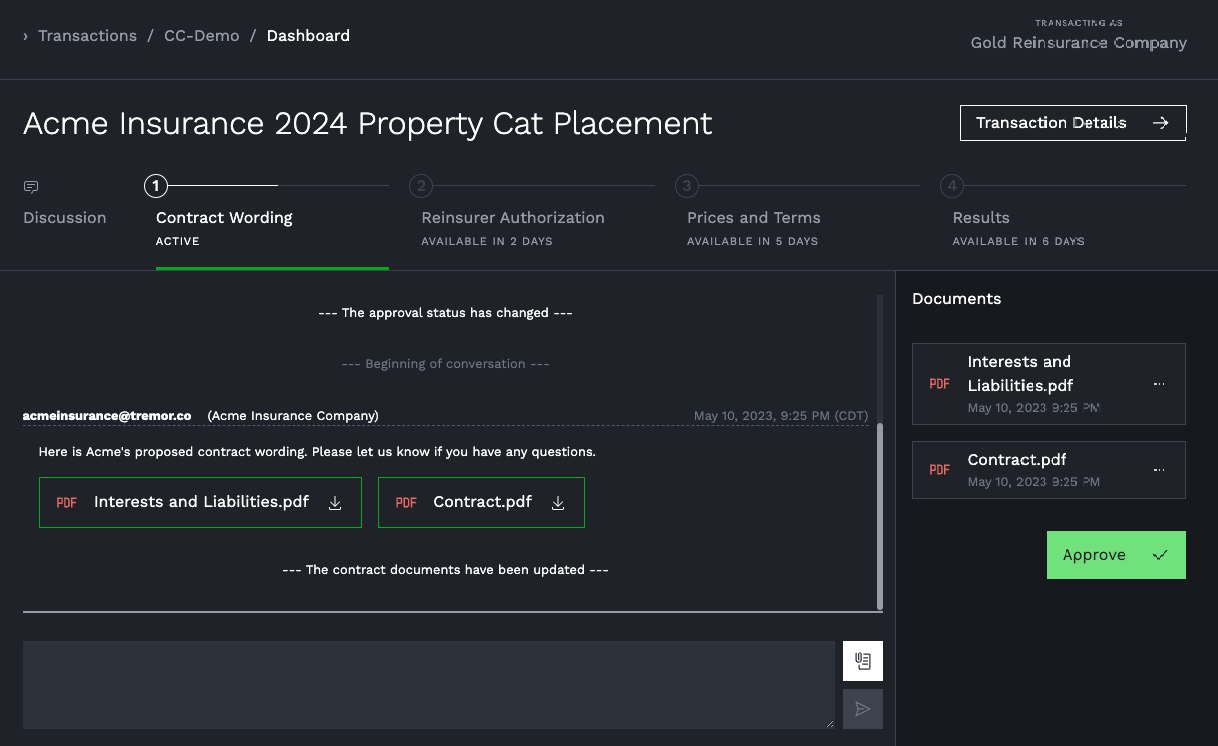

When cedents and their brokers use Tremor’s on-platform contract discussion tools as part of a placement, the platform will automatically create individual data rooms.

These bring everything together in one place, the final contracts, wording clarifications, contract discussion, and revisions, all seamlessly tied into the authorisation phase of the online reinsurance placement process.

“With Wordings, Tremor has completely digitized the process end-to-end so that base contract wordings can be negotiated and finalized before price discovery and allocation happens in our marketplace.

“This order of operations drives much more efficient trade with a perpetual audit trail so nothing is forgotten in a fraction of the time of a traditional placement,” Bourgeois said.

To fire up the Wordings features, cedents and their brokers start each conversation by posting draft contracts to Tremor, with private data rooms created for each reinsurer where they can discuss the contract and request (individualised) wording changes.

As the negotiation progresses, the data room tracks the latest version of the contract and once terms are agreed the cedent and reinsurer both click to approve the contract wording, immediately signalling that the reinsurer is eligible to authorise bindable capacity for the placement on Tremor.

Files and the conversation itself is all memorialised on Tremor alongside the transaction.

As well as bringing everything a reinsurer needs in one place, alongside the transactions it binds capacity against, for the cedent and broker Tremor’s contract tools can help to drive concurrency on base terms, while making managing contracts across reinsurers a simpler process, keeping all contract discussions in one place.

This is another great piece of functionality that can help both sides of the reinsurance trade to become more efficient, while also removing pain points that have been evident around the negotiation process, and just as importantly making the compliance process surrounding reinsurance placements much more robust as well for users.