Travelers grows catastrophe XoL reinsurance cover 76% to $3.525bn

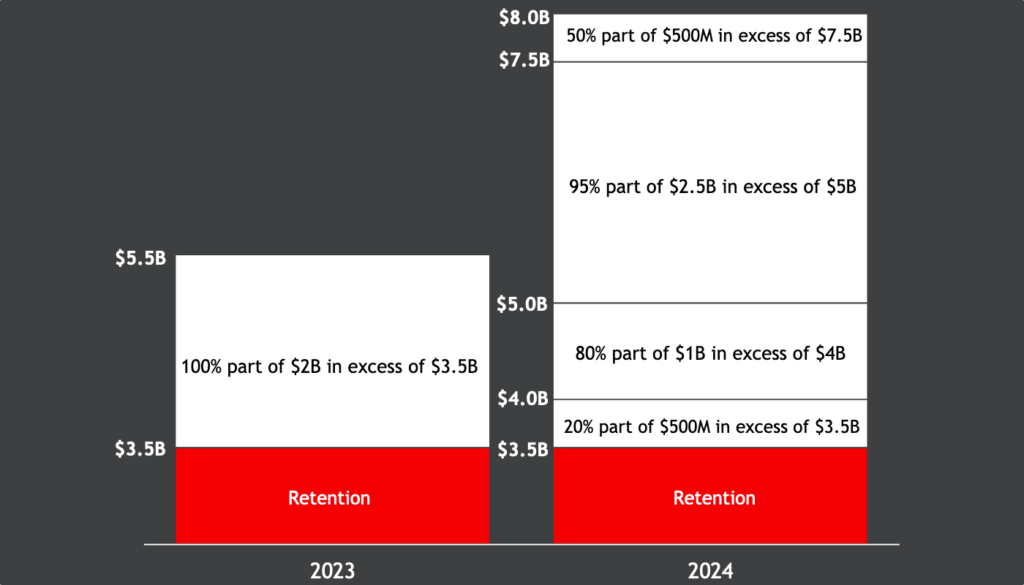

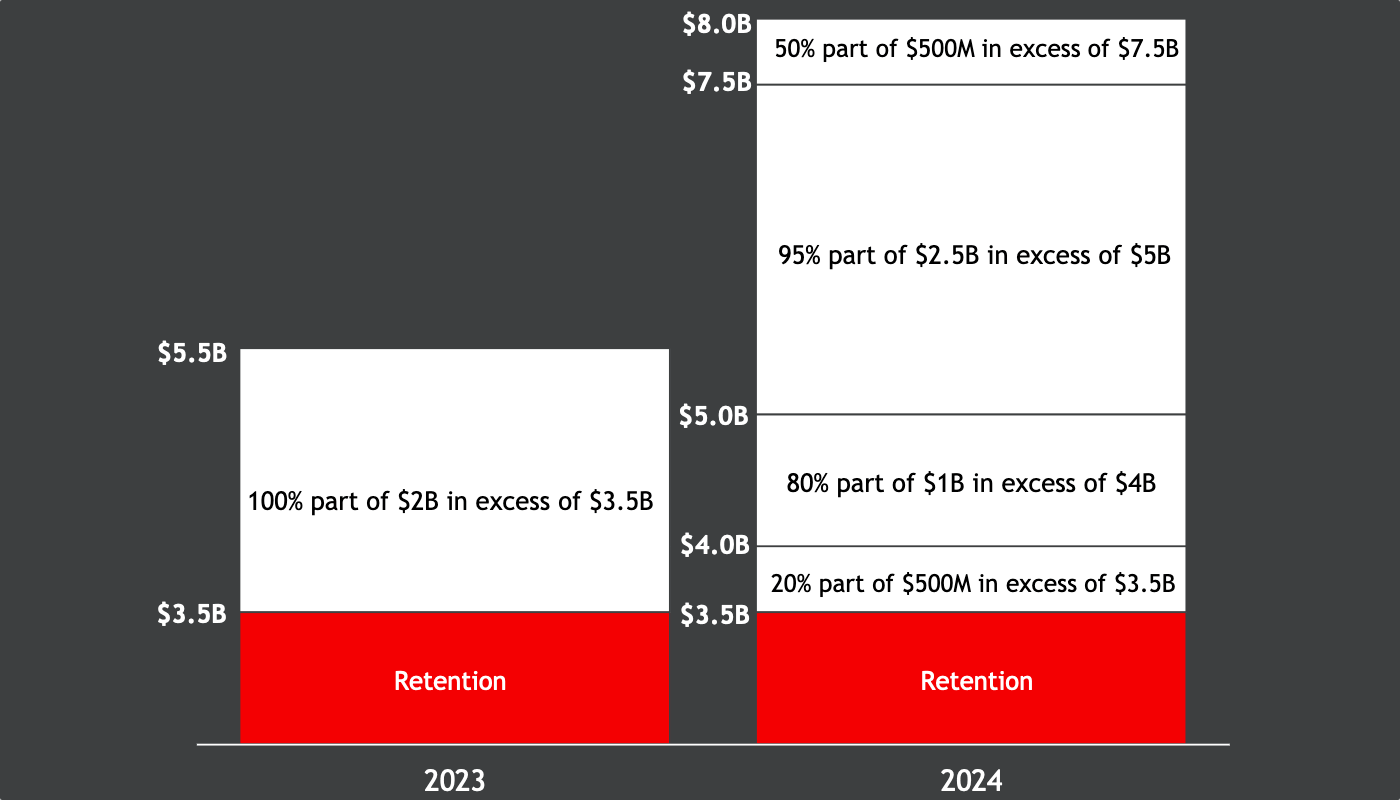

US primary insurance firm Travelers has significantly increased the amount of protection it receives under its occurrence catastrophe excess-of-loss (XoL) reinsurance treaty, lifting it from 2022’s $2 billion excess of $3.5 billion, by 76% to provide $3.525 billion of cover for 2024.

Travelers core corporate catastrophe excess-of-loss reinsurance is the insurers main per-occurrence treaty and after a big uplift in attachment point a year ago, the firm’s retention remains static for 2024.

Back for 2022, Travelers had renewed this catastrophe reinsurance treaty at a slightly expanded level, which attached at $3 billion of losses, with 90% of a $2 billion layer above that protected.

Then, a year ago, Travelers renewed the XoL reinsurance treaty to attach higher up at $3.5 billion of losses, but with the full $2 billion layer above that covered.

Now, the attachment is flat and the coverage significantly increased, while the limit also spans a wider layer of the insurers reinsurance tower as well.

Travelers has renewed the Corporate Catastrophe Excess-of-Loss Reinsurance Treaty for 2024 to provide $3.525 billion of cover, across a $4.5 billion layer of qualifying losses, above the same $3.5 billion attachment point. See diagram below.

The catastrophe XoL reinsurance treaty covers the accumulation of certain property losses arising from one or

multiple occurrences for Travelers, while qualifying losses for each occurrence are after a $100 million deductible.

The way this has been structured for 2024 now takes the top of Travelers reinsurance tower to $8 billion for 2024, a significant amount more protection and greatly reducing the chances the insurer blows through the top of the tower, even for really major catastrophe loss events.

Also, by retaining a greater share of losses across each layer, Travelers has likely managed to improve the execution of its renewal, while securing greater support from reinsurance partners for 2024.

Travelers still has $575 million of reinsurance from its most recent catastrophe bond in-force, the Long Point Re IV Ltd. (Series 2022-1) issuance from May 2022.

The insurer also has a range of reinsurance renewed at the mid-year, including the addition of more hurricane protection in 2023.

Still, Travelers has not tried to reinstate any aggregate reinsurance again this year, having not renewed that for 2023.

Read all of our reinsurance renewal news coverage.