Trapped capital decline means ILS growth is stronger than you think: AM Best

Over the last couple of years the amount of capital trapped in collateralized reinsurance, retrocession and other insurance-linked securities (ILS) has declined significantly, which makes for a much larger and more impactful ILS capital market than you might think, AM Best rightly points out.

ILS managers have been successful in releasing a lot of capital over the last couple of years, some being paid out for claims, but also a relatively significant proportion has also been released without any loss.

There had been a steady drip of trapped capital released back into managers strategies, or returned to investors. The upshot of which was healthier deployable capital figures and less drag from legacy exposures on ILS manager businesses and returns.

That has accelerated over the last year, with increasing amounts of trapped capital positions finalised, or released, resulting in liquidity for investors and more firepower for ILS funds to deploy anew.

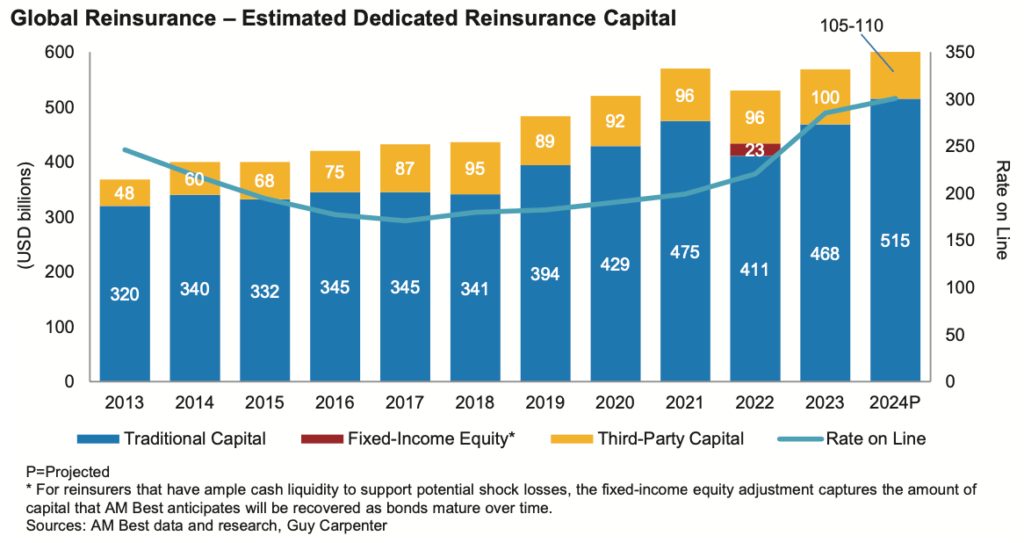

AM Best refers to this in a new report, where it reiterates the forecast from it and reinsurance broker Guy Carpenter, that third-party and ILS capital could grow to as much as $110 billion by the end of 2024, by their measure.

While that would represent 10% growth in third-party and ILS capital in reinsurance over the course of this year, the true figure, in deployable capital terms, could be much higher.

AM Best explained, “Historically, this estimate included a fair amount of trapped capital. As time has passed without significant loss events, and terms and conditions were tightened, the amount of trapped capital has declined significantly, resulting in even stronger capital growth than the numbers may indicate.”

It’s an often overlooked fact, that even while the headline figure for alternative capital in reinsurance may not have grown so much, the underlying deployable pool of capital has been increasing steadily.

In fact, the releasing of trapped capital has made a huge difference to some ILS investment managers, with a number seeing their deployable capital rebound significantly over the past year.

On top of that, a number of ILS managers have taken steps to release capital faster, through negotiated commutations, settlements with cedents, structural innovation in business models to lower the risk of collateral trapping, and even a legacy deal, as we recently saw.

While the headline growth, in AUM and ILS capital terms, is still important and representative of a healthy ILS market with growing investor interest, it perhaps underplays the increased stature and firepower of the ILS market in global reinsurance at this time.