Top Retail Insurance Brokers in the USA

Jump to winners | Jump to methodology

Linchpins of insurance

The Top Retail Brokers of 2024 have risen to the challenge and earned their place on the prestigious list.

Insurance Business America undertook a nationwide search for the top performers, who had to satisfy a series of criteria:

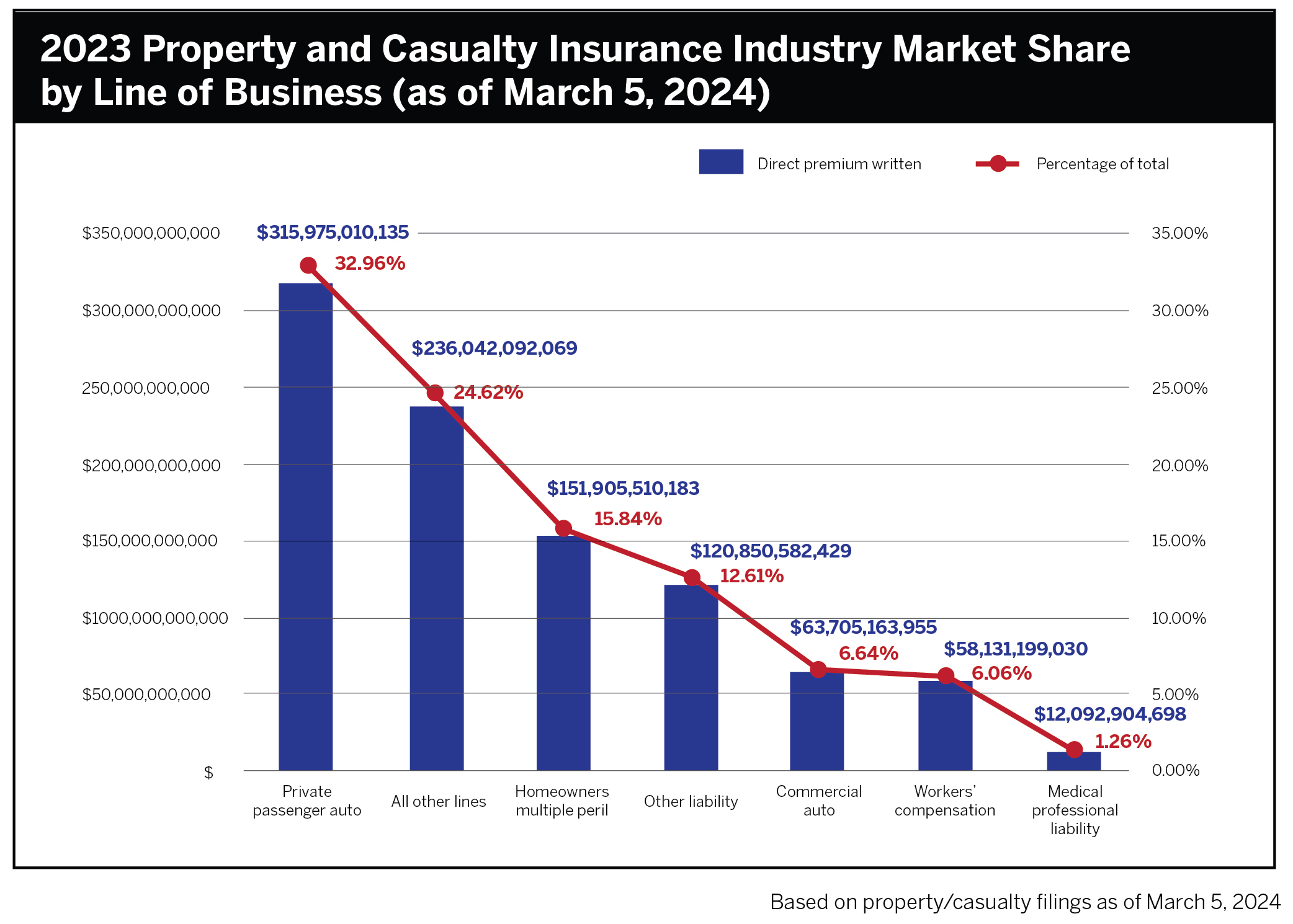

at least $1 million in premium revenue in 2023

at least 50 percent commercial P&C business

demonstrated year-over-year growth from 2022

The special status of Platinum Broker was awarded to those who exceeded $4 million in 2023 revenue.

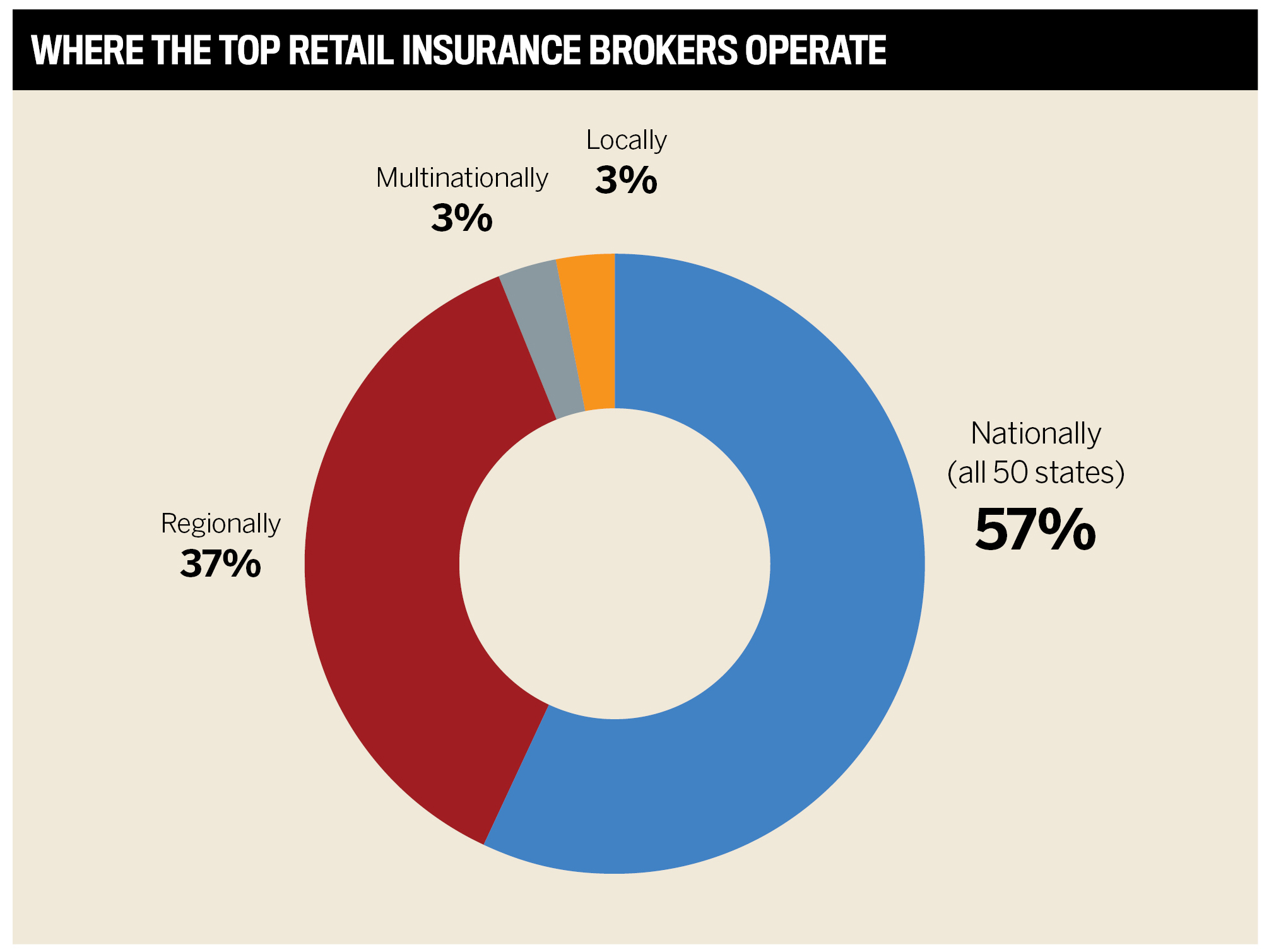

The trends from last year show that 2024’s top retail insurance brokers have had to be even more efficient and prove themselves further, illustrated by the 15 percent increase in the number of winners who operate in all 50 states.

City/State: Pleasant Hill, CA

Total commission revenue growth: 5 percent

Specialized areas: Construction, Real Estate, Distribution

The 30-year veteran puts his success down to adaptability.

“It’s not coming with a predetermined answer but really figuring out where they need help and then designing a program that fits what they need to do. On any given day, I could be talking to a nonprofit, a large contractor or even a bar owner. The answer is not going to be the same.”

Callaway primarily targets a segment of the market:

business with under 100 employees

firms where the owner has a large degree of direct control

entities who will benefit from his network

He has managed to last so long in the industry using his expertise as a broker.

“I try to position myself as their outsource risk management department. They probably are not big enough that they’re going to hire a full-blown department to do that,” explains Callaway. “They may have questions along the lines of safety, HR, risk control, fleet management, contracts and whatever it is, I’m their first calI. If I don’t have the answer, I find the resource to get it.”

This ensures clients have a one-stop shop and know that Callaway has a network that he can tap into when necessary.

“My unique value proposition is to be a client advisor and offer a broader array of services rather than the agent down the street who’s only selling a policy,” he says.

What resonates with Callaway is being able to connect directly with owners. He offers advice on things in their business he may notice but also appreciates they are fully invested.

“I’m pretty comfortable dealing with the entrepreneurs of the world, people that are willing and able to make their own decisions and make them fast. When I tell them about a policy, they either give me the money or they take it home.”

This approach works well in California, which is the biggest state by GDP and has an abundance of business owners per capita.

“Most of my competitors view their job to sell insurance. Once they do, they’re not going to talk to you for another 300 days. With me, the day you buy the insurance is the date we start working together”

Steve CallawayAcrisure West

Over the past 18 months, Callaway’s firm has grown since he joined Acrisure in 2017. Following some restructuring, he now focuses on Northern California. Not that he needed any more motivation.

“It’s enabled us to bring more services and streamline our operation for our clients, so everybody got reenergized and started selling more insurance. Did that necessarily happen to me? In all honesty, probably not because I do it every year. It’s just the nature of being a competitive person. If I’m going to do it, I’m going to do this right.”

Callaway took the business over from his father and began developing his own support staff to allow the business to have an identity away from him. He has placed more emphasis on coaching, so he doesn’t have to touch every client.

City/State: Jackson, MS

Total commission revenue growth: 31 percent

Specialized areas: Public Entities, Manufacturing, Non-Profit Organizations, Construction/Surety

Getting out of the comfort zone ensures razor sharpness.

That is Johnson’s mindset, which he describes as “total quality management.” It entails making a concerted effort to keep pushing the envelope.

The senior executive vice president’s structure is directed at:

At the start of his career, he would spend his weekends on the road in build a name.

He says, “You have to drive on writing new business every year because if you don’t, you’re unfamiliar with the marketplace and the competition. It’s a must to figure out how the insurance industry is evolving. If you’re not, in my opinion you’re losing focus.”

Johnson is reaping the rewards of building such a sterling reputation.

“I’ve spent 18 years making phone calls and knocking on doors. If you develop a reputation for always providing solutions and doing what you say you’re going to do, people will reach out. Word travels and I’ve been blessed in that regard, as I’ve always been honest and transparent.”

This is compounded by Mississippi being a relatively sparse market compared to the likes of California and Texas.

“I’ve got a lot of runway left and God willing, another 15 years left in this business, but everything has a product lifecycle. Hopefully, I continue because I’m still motivated, and mentally and emotionally invested in what I’m doing.”

A strategy that Johnson has adopted is to target clients focused on their future. This enables him to work with companies as a partner.

He comments, “I believe in long-term investments and if the mindset is to do something different, or to change brokers and insurance companies every year, then that’s not a good fit.”

Ensuring there is a meeting of ambitions and goals is the foundation for Johnson’s success.

He puts a premium on delivering results rather than signing new clients.

“When I wake up on the first of January every year, I say, ‘How do I do better than I did last year in this industry?’”

Brian JohnsonFisher Brown Bottrell

“It’s not about how many accounts there are. It’s the quality of results that you’re providing to your customer,” comments Johnson. “I would rather have one customer where I have transformed their business, improved their profitability and offered them insurance protection that saved them from enormous heartaches, rather than having 10 customers and it just being a transaction.”

Another accomplishment is Johnson’s success in becoming a role model and championing the need for greater diversity in the insurance industry.

Out of university, he was hired into the management program at Trustmark Bank and a two-month rotation at the Bottrell Agency, which led him to embark on a broking career.

“Trustmark took a chance on a young African American male and I don’t think a privately owned agency would have hired me back then. Hopefully, I will continue to be an illustration for other people to say, insurance is universal and not just for one particular type of person or gender.”

Scroll down to get to know the top retail insurance brokers of 2024.

Alka Manaktala

Managing Partner

IOA Insurance

Bob Middleton

Director, Arts Insurance Program

Maury, Donnelly and Parr

Brandon Cooney

Chief Operating Officer

Capital Gate Insurance

Brian Gilberg

Vice President

Acrisure

Brian Schneider

Managing Director

Higginbotham

Brigitte Egbert

Managing Principal

Acrisure

Carlos Chinchilla

Executive Vice President

Acrisure

Chase Carlisle

Energy Practice Leader

Acrisure

Chip Renno, CIC, ARM, CRM, CPIA

Commercial P&C Agent/Agency Principal

Snellings Walters Insurance Agency

Dave Wissel

Client Advisor and Partner

Acrisure

David McKinnon

Executive Vice President

FBBInsurance

Edward Nagel

Energy Practice Leader

Acrisure

Garet Marr

Regional Managing Director

Franklin Street

Greg Tober

Executive Vice President

Acrisure

Gregory W. Havemeier

Client Advisor Partner

Acrisure

Hiroki Baba

Vice President and Japanese Practice Leader

The J. Morey Company

Hunter Cox

Executive Vice President

FBBInsurance

James Singleton

Assistant Vice President

The Glatfelter Agency

Jason Hollis

Executive Vice President

FBBInsurance

Jason Young

Senior Vice President

FBBInsurance

Jeff Mentel

Principal

AssuredPartners

Jeffrey Sanders

Client Advisor and Partner

Acrisure

Jim Untiedt

Construction Practice Leader

Acrisure

Joe Thompson

Client Advisor/Partner

Acrisure

John Baldwin

Construction Insurance and Bond Consultant

FBBInsurance

John Sirabella Jr.

Senior Vice President, Client Advisor, New York Region

Acrisure

John Henry Ward

Agency President

AssuredPartners

Justin Failoni

Senior Vice President

Acrisure

Karl Henley

Executive Vice President

SeibertKeck Insurance Partners

Kenneth Christian

Vice President/Producer

Fisher Brown Bottrell Insurance

Kevin Turner

Vice President

Acrisure

Kirk Aguilera

Managing Partner, National Workers’ Compensation Practice Leader

The Liberty Company Insurance Brokers

Kyle Schielack

Managing Director

Higginbotham

Marcus Eagan

Vice President

Eagan Insurance

Matt Armstrong

Senior Vice President

FBBInsurance

Matt Bevins

Agency President

AssuredPartners

Michael Malinowski

President and CEO

EHD

Mitch Noguchi

President

Noguchi & Associates

Nick Wichmanowski

Client Advisor and Partner

Acrisure

Nick Rallo

Principal

AssuredPartners

Paul Praxmarer

Executive Vice President

AssuredPartners

Paul Zizzo

SE Transportation Practice Leader

Acrisure

Phillip Masi

Agency President

AssuredPartners

Rob Foote

Risk Advisor

Acrisure

Robert McLendon

Executive Vice President

FBBInsurance

Ruben Medina

Commercial Producer

Acrisure

Ryan Moses

Managing Partner

Acrisure

Ryan Schmidt

Area President and Partner

Acrisure

Sam Sackler

Senior Vice President

FBBInsurance

Sean King

Agent

Acrisure

Steven Payne

Agency Managing Partner

Insurance Placement Alternatives

Timothy Spear

Client Advisor, Partner

Acrisure

Tony Bozzuto

Partner

Bozzuto Insurance Services

Trevor Gilstrap

Senior Vice President

AssuredPartners

Walter Kiyota

Producer

Noguchi & Associates

Will Denbo

President

Commercial Insurance Associates

Zachary Fanberg

Managing Director

Eagan Insurance

PLATINUM PRODUCERS

Brian Schneider

Managing Director

Higginbotham

Chase Carlisle

Energy Practice Leader

Acrisure

Edward Nagel

Energy Practice Leader

Acrisure

Gregory W. Havemeier

Client Advisor Partner

Acrisure

Joe Thompson

Client Advisor/Partner

Acrisure

Justin Failoni

Senior Vice President

Acrisure

Michael Malinowski

President and CEO

EHD

Paul Praxmarer

Executive Vice President

AssuredPartners

Phillip Masi

Agency President

AssuredPartners

Rob Foote

Risk Advisor

Acrisure

Will Denbo

President

Commercial Insurance Associates