Top Insurance Employers 2022

Jump to winners | Jump to methodology

A battle for talent

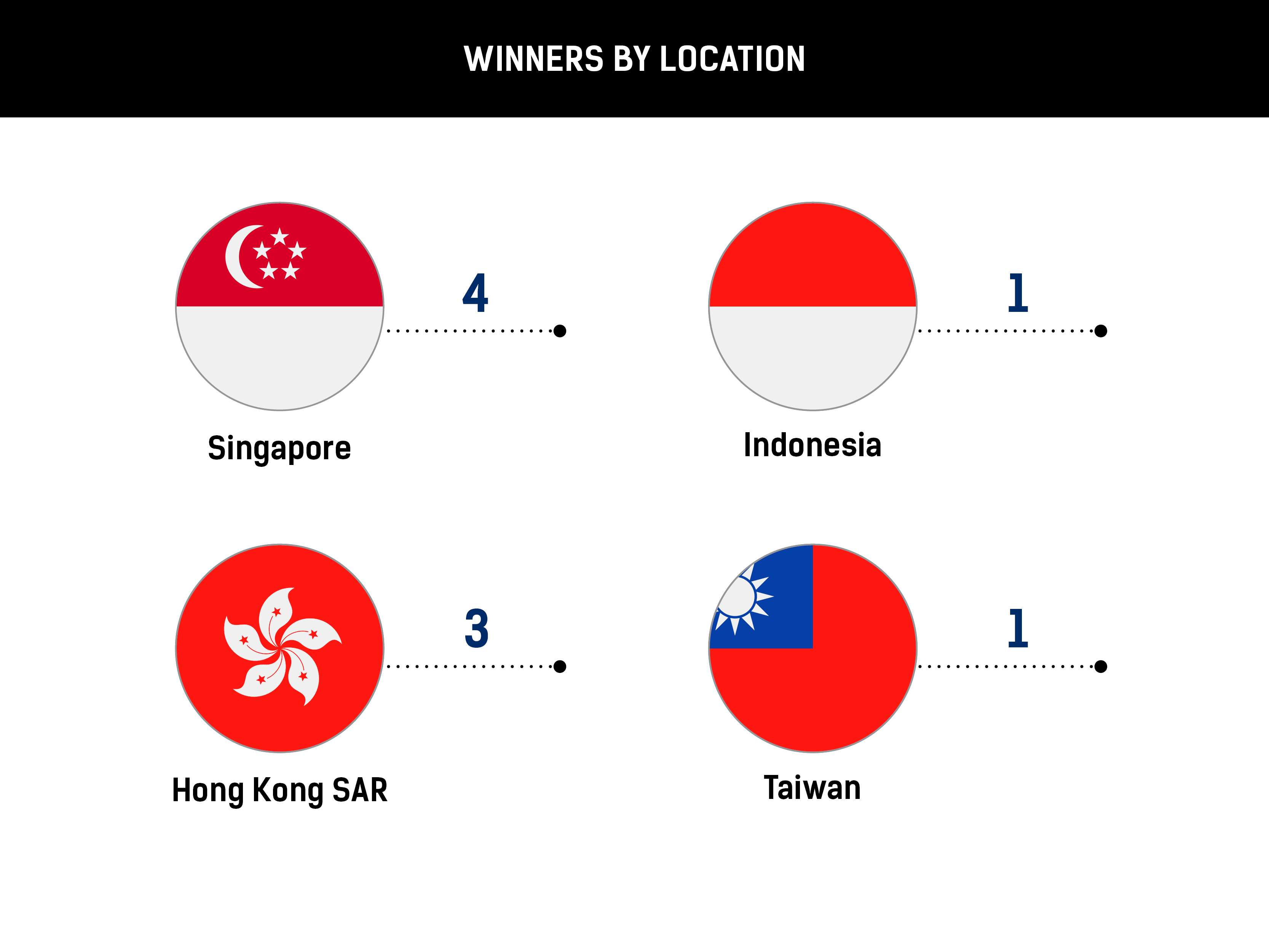

What do Hong Kong, Singapore, Taipei and Jakarta have in common? They’re all centres of global commerce and home bases of the winners of the 2022 Insurance Business Asia Top Insurance Employers awards – companies that have adopted programs and policies to attract, train, and retain outstanding employees. Like organisations in other business hubs, they’ve persevered throughout COVID, supply chain issues, inflation and now struggle with the possibility of an outflow of talent due to emigration and the Great Resignation. Unlike some western global financial capitals, these Asia-Pacific cities tend to offer a broader mix of cultures and employees with a wider spectrum of skills.

“Asia is a fragmented and diverse region when compared to the US and Europe – from a social, political and economic perspective,” says Lucien Mounier, head of Asia-Pacific at Beazley, based in Singapore. “This presents an opportunity to build a team with an incredible breadth and depth of knowledge across culture, language, business and more. With such diversity, inclusivity is key, and so is a strong company culture that unites people through a common foundation of purpose and values.”

“Asia is a fragmented and diverse region when compared to the US and Europe – from a social, political and economic perspective”

Lucien Mounier, Beazley

Technological advancements fuelled by the pandemic have further empowered our winners to connect seamlessly and conveniently virtually anywhere at any time. According to Harshit Anand, head of people at QBE Asia, based in Hong Kong, work cultures are blending well with personnel in and outside Asia.

That’s a bonus for employees seeking more communal working cultures than those found in the West.

“Asian [Pacific] culture is encouraging of relationships, long-term bonds, and trust,” says Yungki Aldrin, compliance director, human resources division at Great Eastern Life Indonesia, based in Jakarta. “This is shown in the way Asians communicate, express their feelings or thoughts, and how they reprimand or give criticism. The bond within teams and with the leaders often become a reason for employees to stay in the company.”

Not enough fish in the sea

Helen Coult of global talent research and business transformation experts Armstrong Craven has some words of warning. Based in the firm’s Singapore office, she explains how companies have to seize the initiative. The old tactic of placing an advert and filtering out candidates is obsolete.

“Now, for the people that you really want, we’ve gone past that; you’re not going to post a job anymore and expect to find an absolute gem,“ she says. “It needs to be targeted head hunting and personalised approaches. Good people are getting headhunted left, right and centre.”

Retaining valuable employees is also equally important in the current climate. The pandemic slowed growth in the general insurance industry, and now – with many countries opening up to the world again – companies are recruiting and competing for new candidates, and one of our winners has created their own in-house production line.

Mounier lauds Singapore as an excellent talent pool. The Lion City offers an abundance of local and foreign labour. “There is a hunger for knowledge and learning the appropriate skills to succeed in insurance. This is why we focus on the long-term, both by ensuring we upskill our existing team and by attracting and training fresh talent.”

Part of Beazley’s strategy to develop new talent was launching a Singapore-based graduate program in 2021 in partnership with local universities. “This initiative has been a resounding success to date, accounting for 10% of our total workforce,” adds Mounier.

Other firms are tackling the issue in other ways. Currently, there’s high demand for personnel in fields such as actuary, IT, digital marketing and sales – all skilled employees with a deep understanding of financial markets and insurance.

Coult, Armstrong Craven’s regional president for Asia-Pacific, shares her insight into how the dynamics of the recruitment process have changed. “The smart companies are now treating their candidates like customers,” she explains. This is seen in the rise of the ‘white glove experience’ and how it’s an integral part of securing talent today.

“If someone comes to your company, has an interview and doesn’t get any feedback or has a bad experience, then that is their experience of your employer brand. They will go and tell all their friends and contacts for years to come,” adds Coult. “It’s so important to protect that employer brand and the employee value proposition.”

“In selected geographies, candidates at the mid to entry level are receiving multiple job offers with more options,” says Anand. “This has resulted in increased pressures for employee retention. On the other hand, we are seeing signs of renewed interest from mid- to senior-level candidates who have relocated out of Asia during the pandemic to move back to Asia or to relocate within Asian countries that have relaxed their safe management measures.”

For Aldrin, that places a premium on early and ongoing training. “We boldly recruit employees from the early stage of their career and even fresh graduates with high-quality skills and develop them internally to become the talent we need in the future,” he says. “We encourage our employees to have a required professional certification and education not only in their specific expertise field but also in insurance business in general.”

“In selected geographies, candidates at the mid to entry level are receiving multiple job offers with more options. This has resulted in increased pressures for employee retention”

Harshit Anand, QBE Asia

Driving towards greater diversity

Our winners were judged on employee engagement, training, career progression, access to technology, communication, work-life balance, health, and rewards. They were also evaluated on their diversity, equity, and inclusion (DE&I) policies – a global trend that’s not taken root as much in Asia. According to a new report from Mercer March Benefits, only 24% of organisations based in Asia have effective and measurable plans to advance DE&I. Nonetheless, DE&I policies are being pursued.

“The diversity of Indonesia is unique,” says Aldrin. It’s a tough task to blend that identity into the workplace as a national census reported between 700 and 800 languages are spoken, and the country is made up of 13,400 islands inhabited by over 200 ethnic groups.

Aldrin adds: “Our employees come from various cultures, races, and religions. By living our corporate values – integrity, initiatives, and involvement – in everything we do, we create an environment where everybody is encouraged to work together, cross function, and support each other and maintain the idea of high integrity and responsibility.”

Meanwhile, Mounier says achieving diversity of thought is an integral part of the Beazley strategy and culture. In addition, the company is committed to hiring and maintaining a diverse workforce.

Anand says: “QBE DNA is our global culture and interlinks cultural attributes which are fundamental to who we are and how we need to operate to achieve success now and into the future. One of the attributes which relates to diversity and inclusion is ‘we are inclusive’ and we promote it with hashtag #ValueAllViews to recognise inclusive behaviour in our everyday work; and we embrace diversity throughout our hiring process from selection to recruitment.

“We recognise our ways of working are changing and will continue to do so in the future. Flexibility looks different for every person, role and team and we are open-minded about how and when we work.”

QBE also has a team-building social club and generous PTO.

“The diversity of Indonesia is unique. Our employees come from various cultures, races, and religions”

Yungki Aldrin, Great Eastern Life Indonesia

Standing still is not an option

Ultimately, Beazley, QBE, Asia, and Great Eastern Life Indonesia are doing something different. What is it?

Based on our insight into the winners’ operations, it’s clear that creating an appealing environment for employees is an ongoing process.

One proof of that is Beazley, which has introduced additional initiatives, hence scoring 71%, 83%, and 89% in employee engagement evaluations in 2017, 2019, and 2021, respectively.

“We pride ourselves on always seeking to go above and beyond,” Mounier says. “We also believe that delivering to our values of being bold, doing the right thing, and striving for better helps us to differentiate ourselves and is core to our success.”

In addition to a hybrid working program, QBE Asia distinguishes itself with employee care programs like a wellbeing challenge, a meeting-free lunch time, and a 3% salary increase to help employees deal with cost-of-living increases.

Other offerings include a learning and development program. “We offer a range of training programs and educational resources to support our people to learn, develop and grow,” says Anand. “They can also make use of the study and examination leave to pursue additional accreditations and skills. Employees have access to the LinkedIn ‘My Learning’ platform, our in-house ‘Super 5’ initiative to gamify digital learning, and the ‘Qurious’ platform to enhance their underwriting capability.”

Aldrin cites Great Eastern Life Indonesia’s solid top management leadership, strong mid-level management, and a comprehensive and structured development program.

Beazley, QBE, Asia, and Great Eastern Life Indonesia are three of the nine winners of the 2022 IBAP Top Insurance Employers award.

AIA Singapore

AIG Asia Pacific Insurance

Allianz Taiwan Life Insurance

Aon Singapore

AXA Asia

Beazley

PT Great Eastern Life Indonesia

QBE Asia

In May 2022, Insurance Business Asia invited companies in the sector across the region to recommend candidates for the 2022 Top Insurance Employers list. Nominations were open to insurers, brokerages, underwriting agencies, and other firms.

Nominees were asked for details of their operations, number of employees, average tenure of staff and turnover rate over the last 12 months. They were also asked to provide an employee engagement score and details of the methodology used to obtain it.

Nominees described their key achievements, activities, programs and results across several areas including remuneration, training and professional development, career progression, diversity and inclusion, access to technology and resources, communication, work-life balance, health and wellbeing, and rewards and recognition.