Top Insurance Brokerages in Australia

Jump to winners | Jump to methodology

Clients come first

There’s one way to the top in Australia’s insurance sector, and it’s by delivering customer service that stands out and provides solutions.

That’s why the nation’s top insurance brokerages value personal connections and service so highly, even as they adopt more technology to enhance their clients’ experience and satisfaction.

Katrina Shanks, CEO of ANZIIF, states that this relationship-driven approach, balanced with utilising tech advancements, is fundamental to sustainable business growth.

“Technology as a standalone may assist in decreasing administration costs and streamlining processes but is unlikely to drive revenue or client growth,” she says. “A broker’s value lies in their human interaction with their client and the professional advice they provide.”

Customer service even trumps the growing issue of more than 84% of Australians being directly affected by at least one climate-fuelled disaster since 2019. While the other major issue of rising premiums is beyond the broker’s control, meaning their concerted efforts are on customer service.

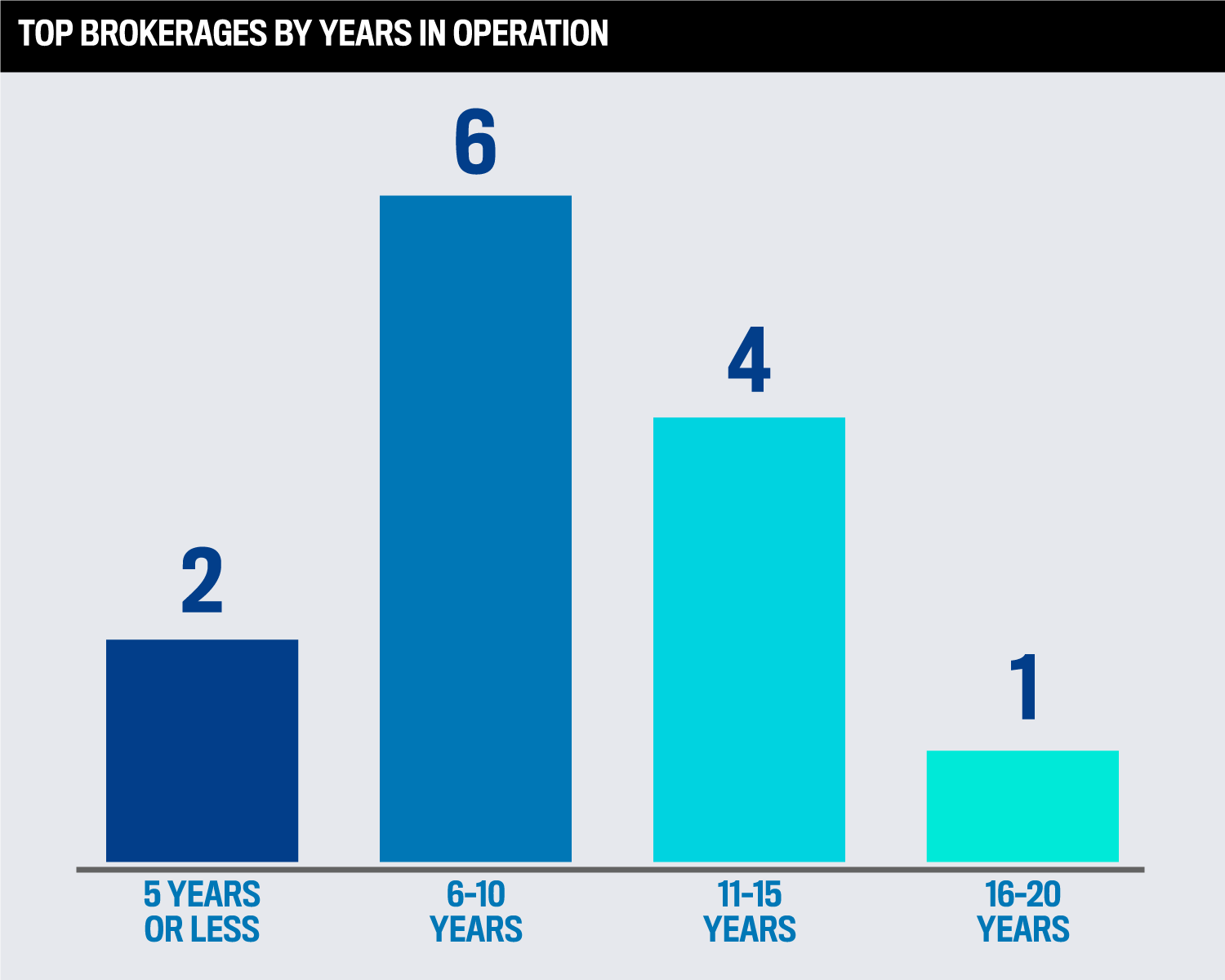

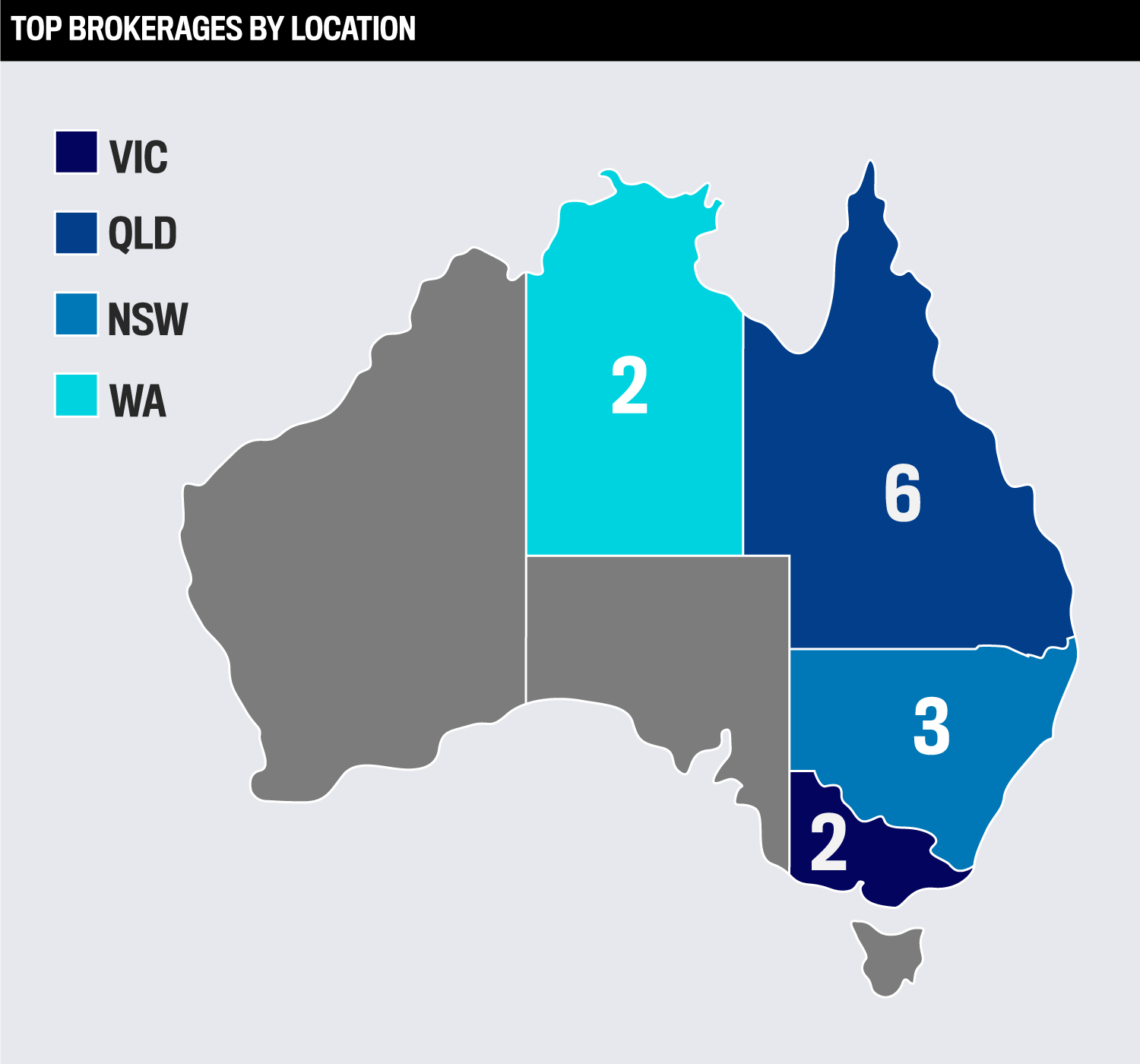

To identify the top performers, IB invited brokerages nationwide to submit entries for its 12th annual Top Brokerages list. They were required to have at least three brokers and be headquartered in Australia. Each brokerage supplied details for the 2023/24 financial year, ending 31 May 2024, and was ranked in order across all the criteria. IB’s ranking system rewards brokerages based on business per broker rather than critical mass, ensuring the best brokerages are recognised, regardless of size.

IB’s Top Brokerages of 2024 have faced growing pains in scaling operations, notably recruiting top talent, growing competition from direct insurers, the tough economy and remarketing, increasing premiums and hardening appetites.

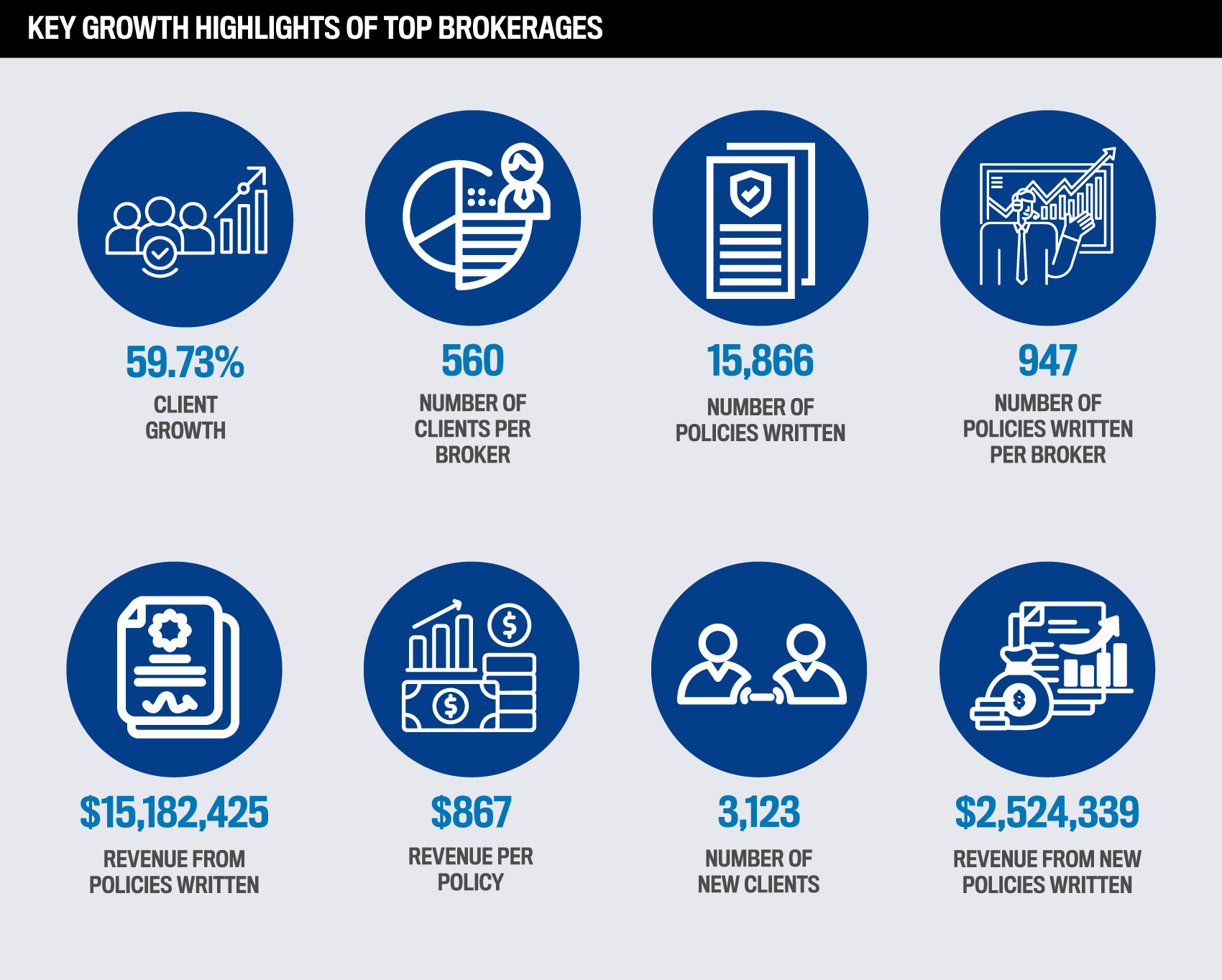

Despite these challenges, the 13 top-ranked IB brokerages demonstrated remarkable resilience and achieved substantial growth throughout the survey period, collectively reaching the following impressive milestones:

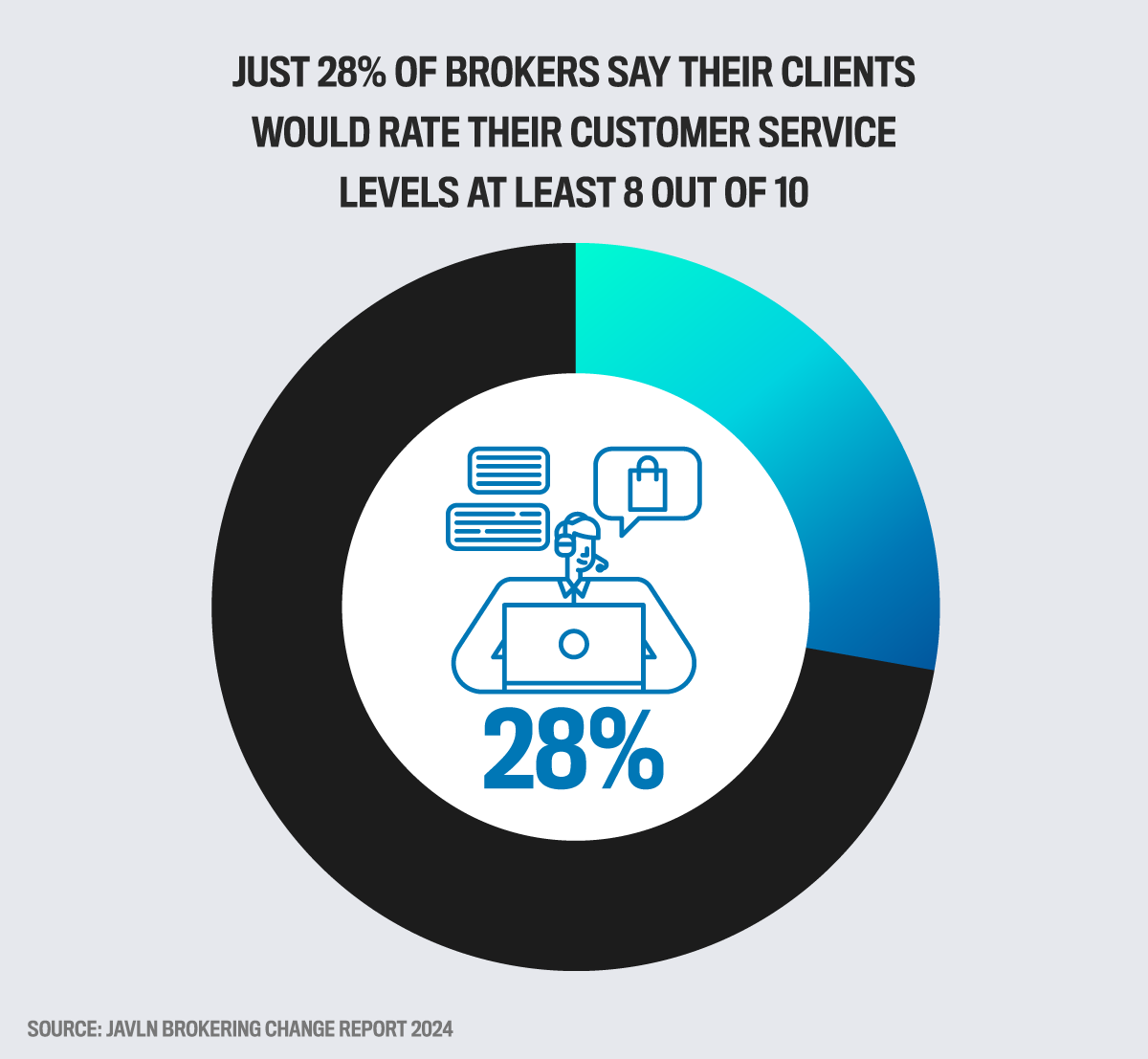

These numbers reveal that IB’s Top Brokerages are among the elite that are managing to meet customer demands with their levels of service. JAVLN’s 2024 Brokering Change Report recorded that 72% of brokers said their clients would rate their customer service levels below 8 out of 10.

Archer’s testimonial: “Dealing with Anthony (Bonanno) and the team at Archer is always easy. They’re professional, experienced and provide excellent customer service. They look after all my insurance needs.”

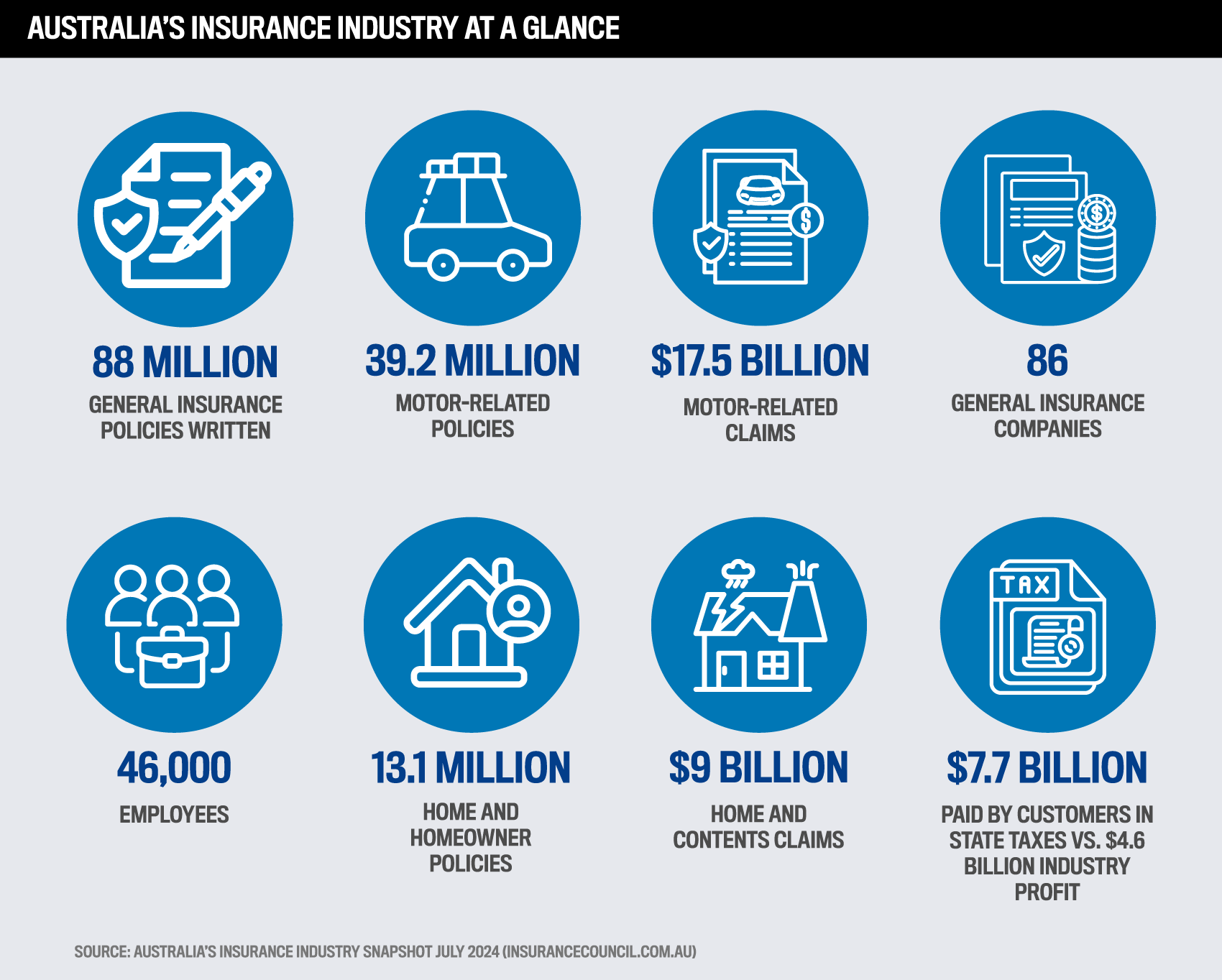

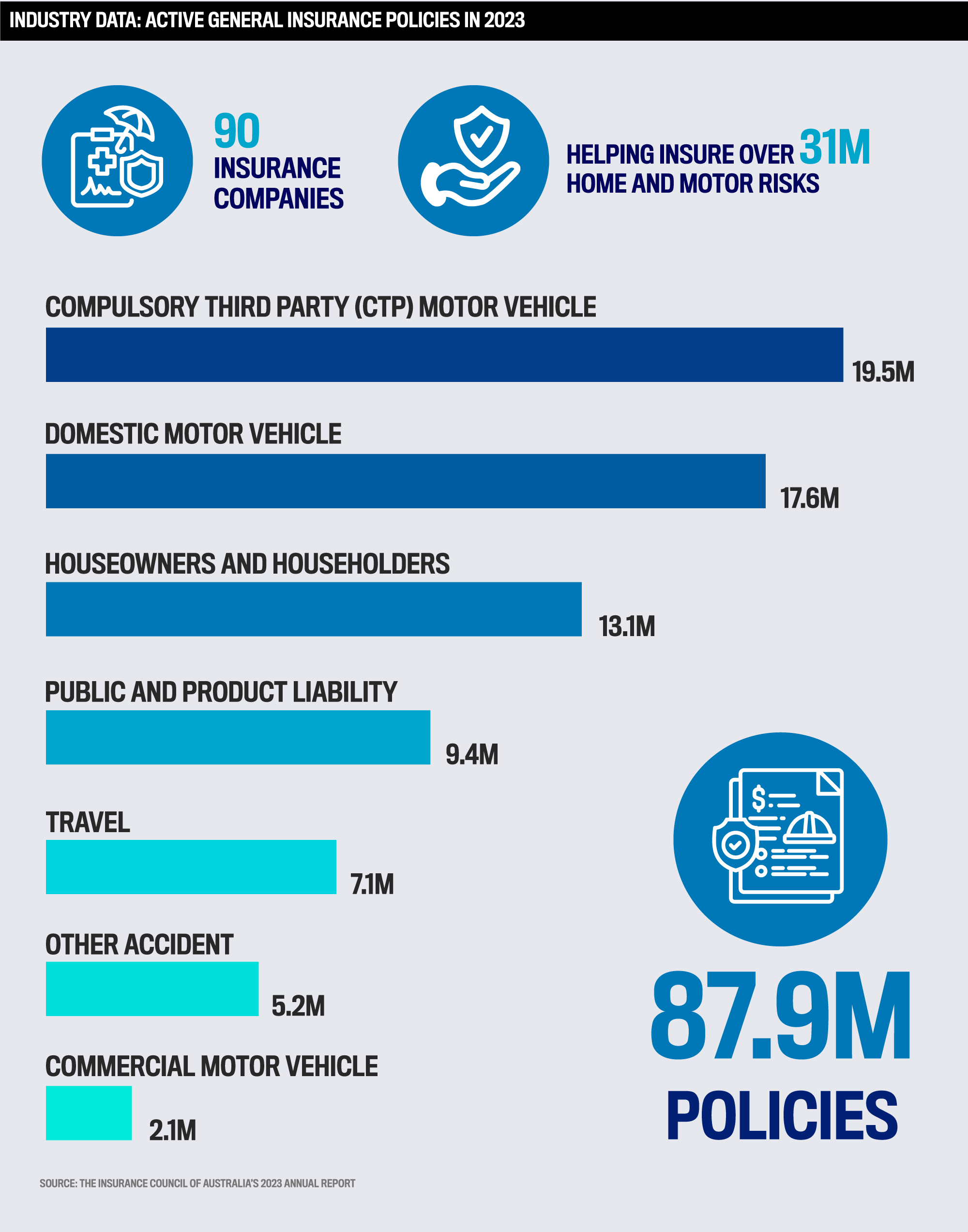

As the industry’s mid-2024 statistics show, this year’s top insurance brokerages are an integral part of a bustling sector that serves substantial numbers of clients, handles tens of billions in claims and supports a significant workforce, despite a high tax burden compared to profit.

One focus area for top brokerages in 2024 that Shanks highlights is regulators have signalling that brokers will need to focus on transparency of remuneration, consistent and professional advice and declaring conflicts or potential conflicts of interest from an end-client perspective.

She says, “From an internal perspective, a top Australian brokerage should be balancing technological advancements such as AI while still providing an even higher level of client service – especially concerning claims, which are experiencing the highest level of complaints, according to Australian Financial Complaints Authority statistics.”

Vero’s SME Insurance Index 2024 shows that trust in brokers and brokerages has weathered the tough economic times and challenging marketing.

Anthony Pagano, Vero’s head of distribution, commercial insurance, equates this “predominantly due to the sector’s ability to establish strong relationships with its customers, to really look at clients’ businesses, see their challenges, look at ways to help mitigate risk and have the foresight and vision to provide insurance products that can lead to better outcomes.”

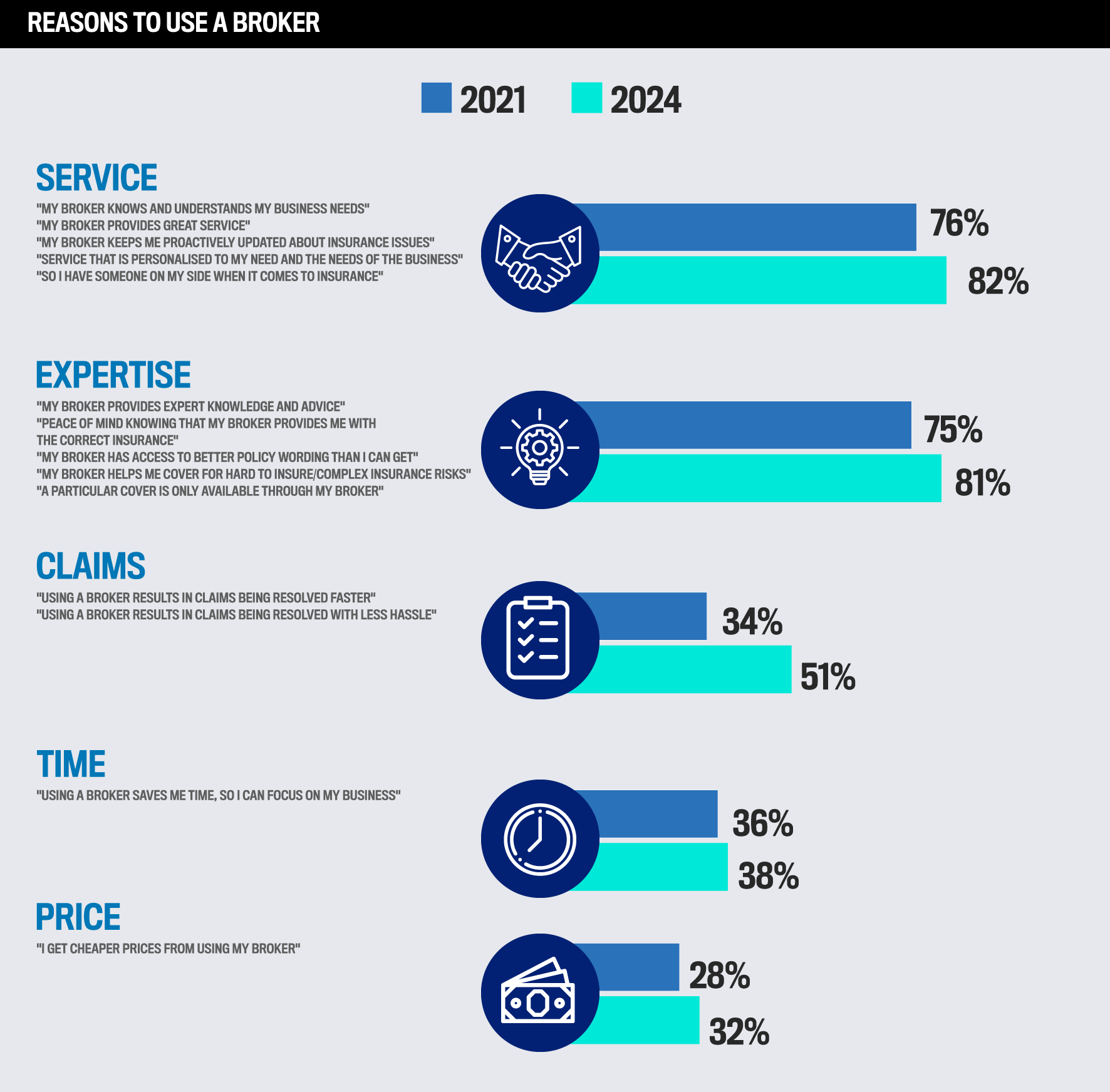

The data also confirms that for clients, customer service is the most important factor in deciding to use a brokerage. It has also increased by 6% since 2021 to 82%. As a comparison, price is far less critical, with only 32%.

What’s driving growth at the top insurance brokerages?

Archer Insurance

Rank #7

Providing a first-rate customer service journey is as important as the products at this top insurance brokerage in Victoria. The tight-knit team considers this mission as their motto and credits this with boosting their comprehensive growth over the past 12 months.

“That’s our bread and butter: we need to make sure clients are happy and having a great experience, and that they’re insured properly so they don’t have to worry about losing that asset, whether personal or business, if something does happen,” says business operations manager Maria Tepelidis. “Clients will refer their friends, and they will come back to us, and that’s what it’s all about.”

Several factors have influenced Archer’s client, policy and revenue performance, including:

referrals and organic growth: trust and client loyalty helped the company retain business and generate new clients

team collaboration: a top-down approach ensures professional, personalised solutions across a broad range of risks

personalised service: a designated account manager provides tailored risk assessments for each client

knowledge and expertise: extensive experience is leveraged to provide innovative, cost-effective solutions that protect clients’ businesses

“We’ve got a great team here, and we all work together to get the job done. Whether I, the CEO or the chief managing director steps in to help out, we’re all on the same level”

Maria TepelidisArcher Insurance

CEO and founder Anthony Bonanno explains their recognition comes down to “building strong relationships through exceptional service, a keen sense of urgency and meticulous attention to detail, ensuring their clients’ needs are met with efficiency and care every step of the way.”

Archer’s leaders all agree that, given the current market especially, they are working harder than ever to maintain client satisfaction, and this constant drive is only achieved with dedication and vigilant attention.

“My passion for insurance is more than servicing and building relationships. The ongoing challenge to ensure our clients understand what they are paying for is of utmost importance,” says Vesna Bizimoski, chief managing director. “We must thrive and adapt daily to be valued, and nothing less is enough to maintain strength in the broking world.”

For 12 years, treating customers as lifelong friends rather than one-off transactions has fuelled the top insurance brokerage’s consistent growth and recognition.

Founder and principal Spencer Hon ranked third in IB’s Elite Brokers of 2024 and also led his team to earn a Fast Brokerage nod this year for stellar revenue and gross written premium increases.

“We handle as much as possible for our clients directly,” he says. “If a property needs a survey, we help arrange it for them, so they don’t have to do it on their own. This level of service contributes to our success.”

The brokerage operates from locations in Sydney and Melbourne and is laser-focused on helping customers achieve their goals. Its underlying philosophy puts customers’ best interests above everything else.

“We believe in solving the problem for them, not just focusing on the money we receive,” says Hon.

“We make sure our customers don’t need to worry about anything; we take care of it all”

Spencer HonEternity Insurance and Financial Services

A combination of contributors has influenced Eternity’s client, policy and revenue growth, including:

continued investment: ongoing investments in all aspects of operations, including expanding the team by four members

dedicated teams: specialised teams provide personalised service in policy renewals, service and administrative tasks

client-focused brokers: brokers maintain a sole focus on client interactions to enhance relationships and service

Hon says, “This structure helps us maintain our high service standards even as we grow.”

How the top brokerages grew their client base

At Archer, growing its client base by 16% while maintaining lasting relationships involved a commitment to 24/7 service, especially when a claim arises.

“We have strict time frames in place to ensure our clients feel we are putting them first and acting in their best interests,” says Tepelidis. “We always do what we say we will.”

With a solid team that can adapt, and by continually reviewing and improving the brokerage’s processes, Archer can facilitate its growth now and in the future.

For Eternity, its 10% client growth is built on a solid base of client trust and loyalty. Even given the economic downturn, if a client decides to close their business, they often recommend the team to the new owners.

“It’s been tough for a lot of people, but we’re still growing, mainly because our client referrals are so strong,” says Hon.

Balancing increasing workloads with delivering excellent servic

A bespoke CRM system at Eternity enables brokers to store information, access documents and work efficiently from the office or home.

“This has really helped save time,” says Hon.

While Archer’s team thrives in providing fast, competitive service and the right advice to maximise protection for clients. Its leaders empower staff to take time to understand a client’s unique requirements.

“Our clients appreciate that we thoroughly review their insurance to ensure everything is done correctly,” says Tepelidis. “It’s not always about price; it’s about ensuring they’re properly insured.”

The brokerage also prides itself on offering its team ongoing professional development, training and mentoring, equipping them with the necessary skills to provide personalised service.

Boosting revenue through service and product expansion

Archer’s team is exploring creating specific wordings for certain occupations that will enhance the business’s further growth.

Tepelidis says, “There are so many underwriting agencies now offering specialised insurance in cyber, professional indemnity and management liability. We’re starting to prioritise these areas now. As our staff receive more cyber and professional indemnity training, they feel more confident offering these products to our clients.”

This involves prioritising:

educating clients about various niche insurance products, relating benefits and protections through real-world claims examples

following policies, procedures and regulatory changes

leveraging outsourced services to improve operations

enhancing customer retention

providing 24/7 claims service

“Everything needs to be done straight away,” Tepelidis says. “Clients expect the same expediency of their broker as they do with other facets of their experience navigating an online world. Gone are the days that you wait three to four days for a quote.”

Also positioning themselves as specialists is Eternity in commercial insurance. The brokerage is focusing on industry-specific risk policies, as its brokers pride themselves on addressing customers’ needs and goals, recognising they can’t control the overall environment in which they operate.

Hon says, “But we can ensure we’re doing everything we can for our clients.”

The brokerage’s strategies to continue its impressive levels include:

outsourcing IT needs to remain up to date on the latest tech advancements

maintaining a singular focus on the customer

promoting professional development and mentorship

fostering a supportive culture

Adapting to stay competitive

The Insurance Council of Australia’s (ICA) priorities for 2024 included trust, which it defined as protecting and enhancing trust in the insurance sector by embracing feedback, adopting best practices, maintaining transparency and always focusing on customer outcomes.

Hon agrees, saying, “These are all key points we strive to achieve.”

For brokerage leaders, attracting new talent to the industry is paramount to driving innovation, and as a result, they are making concerted efforts to raise awareness of insurance as a rewarding career option.

Hon emphasises that a customer-centric focus is a resounding key to staying competitive, along with prioritising exceptional service at every stage of the process, something he has implemented at Eternity.

“If we maintain that focus, industry changes won’t affect us much,” he says.

There are also extraneous factors too, such as climate change, cyber, commercial insurance and emerging technologies, which all dominate conversations at Archer.

The team attends industry events to build and maintain relationships to be updated on the latest developments. They also leverage their key partners through Steadfast and various underwriting agencies and embrace innovation by utilising SCTP and Sunrise, an online broking tool for quick quoting and binding.

“I’m involved in compliance here, and I think it’s important to keep our account managers and support team constantly trained, especially with new products coming onto the market and evolving insurer requirements,” Tepelidis says.

This relates to another of the ICA’s 2024 priorities, sustainability, which it describes as collaborating with industry, regulators and communities to lead an inclusive and responsible sector addressing economic, social and environmental opportunities and challenges.

“To achieve this, we have implemented several initiatives, such as promoting sustainable practices within our operations, engaging in community outreach programs and advocating for policies that support environmental stewardship,” says Tepelidis. “By fostering these collaborations, we aim to create a more resilient and sustainable future for our industry and the communities we serve.”

Top Brokerages

Apollo Risk Services

Archer Insurance

Bell Partners Insurance

Clear Insurance

Grace Insurance

INSURE TODAY

McLardy McShane Insurance Brokers

Morgan Insurance Brokers

Shielded Insurance Brokers

Stonewell Insurance Brokers

Strata Insurance Solutions

Top Brokerages – Listing in order

1. McLardy McShane Insurance Brokers

2. Shielded Insurance Brokers

4. Apollo Risk Services

5. Grace Insurance

6. Stonewell Insurance Brokers

7. Archer Insurance

8. Bell Partners Insurance

10. Strata Insurance Solutions

11. INSURE TODAY

12. Morgan Insurance Brokers

13. Clear Insurance