Top 10 insurance brokers in Australia

Top 10 insurance brokers in Australia | Insurance Business Australia

Guides

Top 10 insurance brokers in Australia

The top insurance brokers in Australia shone brightly amid tough industry challenges to deliver for their clients

Insurance brokers play an important role in helping their clients achieve financial protection by matching them with the coverage that best suits their needs. This is what makes the profession truly fulfilling.

Every year, Insurance Business ranks Australia’s best-performing insurance brokers in the past financial year. Despite facing tough challenges, these insurance professionals shone brightly and delivered for their clients. The recipients of the 2023 Elite Brokers awards put themselves forward, went head-to-head with their peers, and rose above the rest. Read on and get to know some of this year’s biggest achievers as we list down the top 10 insurance brokers in Australia.

As all financial figures gathered during the entry process are kept confidential, we decided to arrange the list alphabetically.

1. Nicholas Bedggood

Role: Director and founder

Company: Citadel Insurance Services

Nicholas Bedggood started his insurance broking career rather late, only entering the profession in his early 40s. Prior to this, he spent two decades selling and managing yachts, and even owned a vessel management business.

Bedggood’s epiphany came when with a baby on the way, his wife encouraged her to find a “real job” and he thought “everyone needs insurance, not everyone needs a boat” – so he decided to switch careers. At 43, Bedggood did an insurance apprenticeship and instantly fell in love with the profession. He became a National Insurance Brokers Association (NIBA) Qualified Practising Insurance Broker (QPIB) in 2018. His career has since progressed, even establishing his own firm, Citadel Insurance Services, where he serves as director.

As one of the top insurance brokers in Australia, Bedggood has served as a NIBA mentor, guiding up-and-coming brokers and insurance professionals. Asked what separates him from the pack, he says having “an unending and relentless drive to get the job done correctly, so that in the event of a claim, it gets paid.”

2. Ken Dixon

Role: Director

Company: Dixon Insurance Services

Ken Dixon is an insurance veteran with more than three decades of experience in the industry. He began his insurance career with FAI in 1990, working in claims. From there, he worked his way up eventually progressing into the field of underwriting and as area manager for South East Queensland for VACC and CGU. Dixon moved to insurance broking in 2003 and eventually established his eponymous brokerage Dixon Insurance in 2013, which has since expanded to three offices – Toowoomba, Nambour and Brisbane – and has been servicing clients across the country.

Dixon is highly regarded in the industry as being among the top insurance brokers in Australia. He has received numerous awards from Insurance Business over the years, including Elite Broker, Diversity and Equity, and Fast Broker.

3. Frans du Plessis

Role: Director

Company: Grace Insurance

Frans du Plessis is a well-respected professional in the insurance industry, receiving several prestigious awards in the past few years. Among these was being named Insurance Business’ Broker of the Year in 2022. He was also a finalist in the NIBA Broker of the Year Awards.

du Plessis established Grace Insurance in 2015. From a small office, the insurance brokerage has since grown to three branches in Western Australia, New South Wales, and Victoria, with plans of expanding across the country.

4. Dale Hansen

Role: Chief executive officer and director of broking

Company: BMS Coast to Coast

England-born Dale Hansen knew from an early age that he wanted to be an insurance broker and eventually run his own insurance brokerage. This aspiration led him to work in the insurance sector straight out of high school, taking up broking, underwriting, risk management and sales roles with several prominent industry players.

Hansen joined BMS Coast to Coast in 2007. There he held a range of senior leadership positions, eventually becoming the firm’s sole principal, chief executive officer, and managing director in 2013. He received the NIBA Broker of the Year in Australia in 2016, which he considers his biggest achievement to date.

Hansen considers his “advocacy for clients” as his strongest professional quality, saying he always “tries to give 100% effort and attention to his clients and be available to them 24/7.” He also gives back to the industry by mentoring young insurance brokers.

5. Aimee Henderson

Role: WA state manager

Company: Grace Insurance

Aimee Henderson’s insurance career began in 2007 in New Zealand, taking up a processing role with an insurer before moving to a Wellington-based global brokerage firm in 2009. She obtained a Diploma in Financial Services (Insurance Broking) in 2012.

Henderson relocated to Perth in 2018 and joined Grace Insurance two years later. There, she blossomed into one of the top insurance brokers in Australia, moving up to the role of senior broker in 2021 and WA state manager a year later. She is also a recipient of numerous industry awards – a testament to the quality of service she provides her clients.

Vishal Kapoor started his decades-long insurance career in the late 1990s, holding a range of roles, including:

Account executive

Claims consultant

Franchise manager

Commercial team leader

He is now a director at McLardy McShane Kapoor, with some of his current roles in the field of compliance. Kapoor is a Qualified Practicing Insurance Broker (QPIB) and holds a Diploma of Financial Services in insurance broking from NIBA. He is also an inducted Fellow CIP in the Australia and New Zealand Institute of Insurance and Finance (ANZIIF) and sits on its Insurance Broking Faculty Board.

Having worked in a variety of roles both in Australia and overseas, Kapoor believes that what gives him an edge over his peers are the diverse experiences he has built over the years.

7. Dean Kennedy

Role: Account manager, wholesale construction placements

Company: Cruden Read

Dean Kennedy began his insurance broking career working across all lines, before specialising in wholesale broking and underwriting. His industry experience spans over 15 years, focusing on construction and hard-to-place liability risks. He is now an account manager for whole construction placements for Cruden Read.

Prior to this, he served as a Lloyd’s of London cover holder at an underwriting agency. He also had servicing and placement stints with suburban and international broking houses. According to Kennedy, specialising in construction and engineering gives him an edge over the other top insurance brokers in Australia.

“Fulfilling one area of the market means I need to have a deeper knowledge of the industry to stand out from the competition, which ensures I am achieving the best possible solution for our clients,” he says. “There are so many different classes of insurance out there, it is difficult to be an expert across all lines and occupations.”

8. Luke McMahon

Role: Chief executive officer

Company: Bespoke Insurance Group and First Nations Insurance Group

Luke McMahon owns businesses in the insurance, financial services, and hospitality sectors. He uses his almost two decades of experience in business development, sales, and customer service to train and manage his team. McMahon is also passionate about working with chief financial officers and business owners to ensure they have the best coverage.

9. James Skiadas

Role: Director and principal broker

Company: IMC Insurance Brokers

As the principal of IMC Insurance Brokers, James Skiadas acts as the technical driver of the firm. He established the company in 1994 and has helped it grow into among the best-performing brokerages in the country.

Skiadas is a Qualified Practicing Insurance Broker and a member of the NIBA. He is also a senior associate of the ANZIIF. Skiadas holds an Advance Diploma in Financial Services – Insurance Broking. He is regarded in the industry as one who can provide high-level guidance and advice in insurance coverage, underwriting, claims and risk management, product development, and corporate leadership.

10. Hannah Tormey

Role: Client manager

Company: Honan Insurance Group

Ireland-born Hannah Tormey moved to Australia on a working holiday visa and took a job as a waitress while she looked for an office-based role. She got her first job in insurance as a claim service officer for Allianz before moving on to Zurich. Tormey joined Honan Insurance Group in 2020 as a service executive. She has since risen through the ranks, becoming a client manager in 2021 and among the top insurance brokers in Australia.

Despite the top insurance brokers in Australia in our list chalking up impressive numbers the past year, all of them identified several challenges that can have a huge impact on the sector’s profitability moving forward. These include:

Hard market conditions: Bedggood describes the current market conditions as “brutal,” adding that the industry is between the third and fourth years of a hardening market. “There’s a lot of people overpaying,” he told Insurance Business. “I’ve conditioned my clients, but every renewal is a difficult discussion. So, it’s taxing in the extreme.”

Talent crunch: The current labour market is so tight, du Plessis said that their current inflow of new business exceeds their capacity 4:1. He adds that while this is a good problem to have, they “also do not like it if we cannot keep to our high level of client service and professionalism.”

Regulatory changes: Skiadas noted that while compliance requirements set by regulatory authorities can be challenging, it is best for insurance brokerages to “take them on board and follow the rules.”

Ancillary factors: The Elite Brokers report cited New South Wales’ fire services levy – a fee collected by insurers to fund fire and emergency services – as among the factors that can push up premiums. This is similar to the taxation system and mortgage cliff that are predicted to push people out of the real estate line.

Insurance brokers act as a representative of the consumers, meaning they are mostly responsible for helping insurance buyers assess their risks and help them find the right coverage based on their risk profiles and financial situation.

In general, clients may work with three types of insurance brokers:

Retail insurance brokers: These client-facing professionals work closest with the insurance buyers, assisting them in finding the best possible coverage. They also often handle less complex policies that cover common risks.

Wholesale insurance brokers: These brokers rarely have direct contact with clients and mostly provide more specialised policies. Retail brokers often rely on these professionals for coverage of more complex risks.

Surplus lines insurance brokers: These professionals hold special licenses, enabling them to access policies for highly complex risks that traditional insurance companies are not willing to cover. They can serve as either wholesale or retail brokers and offer products from surplus lines specialists.

Many insurance brokers also provide risk management services, including advising policyholders on how to control risks that may not be covered under their policies.

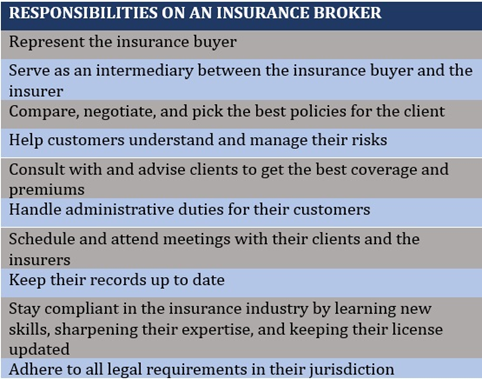

But despite their primary role as a representative of their clients, insurance brokers also owe insurers certain responsibilities. These include making sure that the information they disclose to underwriters during application is truthful and accurate. They must also ensure that their policyholders make premium payments on time. The table below sums up the duties and responsibilities of an insurance broker.

What are your thoughts about this year’s batch of the top insurance brokers in Australia? Do you have experience in working with them? Feel free to share your story in the comments section below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!