Top 10 cheapest trucks and SUV to insure in Canada

Top 10 cheapest trucks and SUV to insure in Canada | Insurance Business Canada

Motor & Fleet

Top 10 cheapest trucks and SUV to insure in Canada

The cheapest SUVs to insure boast advanced safety features and have low maintenance costs. Find out if your vehicle of choice is one of them

Motor & Fleet

By

Mark Rosanes

SUVs and trucks have become a popular ride of choice among Canadians, comprising about three-quarters of the nation’s overall new vehicle sales based on the latest StatCan figures.

SUVs, in particular, account for more than half of the entire market share, thanks to a host of advanced safety features, lower repair costs, and cheaper coverage. But while insurance premiums are relatively inexpensive for this vehicle type, it doesn’t mean that there’s no way for drivers to boost their savings further.

If you’re in search of a vehicle that suits your growing family’s needs, then this guide can prove useful. In this article, Insurance Business ranks the cheapest SUVs to insure to help you in your purchase decision. We will also list the cheapest trucks to insure and explain the different factors that impact insurance pricing. Read on and take your pick from our rankings.

Before we go into the details of why certain SUVs have less expensive premiums compared to others, we will first give you a summary of the 10 cheapest SUVs to insure in the country. The table below is arranged from lowest to highest average yearly and monthly premiums based on data gathered by ThinkInsure.

The top 10 cheapest SUVs to insure in Canada

Rank

Model

Yearly premiums

Monthly premiums

1

Ford Escape

$1,853

$154

2

Jeep Wrangler

$1,968

$164

3

Dodge Journey

$2,065

$172

4

Honda CR-V

$2,195

$183

5

Toyota RAV4

$2,372

$198

6

Hyundai Santa Fe Sport

$2,463

$205

7

Chevrolet Equinox

$2,559

$213

8

Nissan Rogue

$2,644

$220

9

Jeep Cherokee

$2,667

$222

10

Mazda CX-5

$2,723

$227

SUVs tend to be cheaper to insure than most vehicle types – including sedans – primarily because of their higher safety ratings and parts that are readily available. These are the top 10 SUV models with the least expensive premiums.

1. Ford Escape

Average premiums: $1,853 per year

The Ford Escape is the cheapest SUV to insure in our rankings, thanks to a host of advanced safety features. Recent models of the vehicle come with automatic emergency braking, pre-collision assistance, and blind spot monitoring. These features help drive down insurance rates. It also helps that the Ford Escape uses a low horsepower engine, which decreases the risk of accidents.

The perfect getaway is here, no packing needed. Introducing the new 2023 Ford Escape® aka The Getaway Car. pic.twitter.com/Nrc2EkloxF

— Ford Motor Company (@Ford) October 25, 2022

2. Jeep Wrangler

Average premiums: $1,968 per year

If you want an off-roading vehicle that doesn’t come with expensive premiums, then the Jeep Wrangler can be an excellent choice. It comes with safety features that insurance companies like in an SUV such as backup cameras and rollover prevention. Wranglers are also relatively cheap to repair. But one of the biggest factors that lowers premiums is that more motorists now use the Wrangler for everyday driving and less for off-roading adventures, resulting in fewer claims.

https://www.youtube.com/watch?v=4etWmTFUxlA

3. Dodge Journey

Average premiums: $2,065 per year

The Dodge Journey comes with an affordable manufacturer’s suggested retail price (MSRP), which is among the main reasons why it has one of the lowest premiums in our rankings. The crossover SUV also has low theft rates, posing less risk to insurers.

Honda CR-V’s low horsepower engine makes it less prone to collisions, which auto insurers like. Most models also incorporate advanced security systems, deterring would-be thieves. Another major factor that makes the CR-V one of the cheapest SUVs to insure is its lower repair and maintenance costs.

https://www.youtube.com/watch?v=L6vHN_FBtwY

5. Toyota RAV4

Average premiums: $2,372 per year

Anti-lock brake system, blind spot monitor, smart stop technology, and vehicle stability control – these are just a few of the advanced safety features included in recent Toyota RAV4 models. These safety features lower the premiums you need to pay considerably. In addition, the RAV4 is relatively inexpensive to maintain and repair, pushing down rates further.

6. Hyundai Santa Fe Sport

Average premiums: $2,463 per year

The Hyundai Santa Fe Sport consistently gets high marks in various safety and crash test ratings, allowing you to save on car insurance premiums. Among its notable safety features are electronic stability and traction controls, and brake assist and lane departure warning systems. The Santa Fe Sport also has among the lowest base MSRP on our list, making it a good choice for budget-conscious motorists.

7. Chevrolet Equinox

Average premiums: $2,559 per year

Readily available parts and affordable repair and maintenance costs make the Chevrolet Equinox one of the cheapest SUVs to insure in Canada. It also helps that models boast a range of safety features, including anti-lock brakes, front and rear park assistance, and an automatic emergency braking system. The Chevy Equinox has one of the lowest theft rates among all featured vehicles in the list, helping keep car insurance costs down.

The Nissan Rogue was recently recognized as the Top Safety Pick+ by the Insurance Institute for Highway Safety (IIHS) for its crash test performance, which says a lot about the vehicle’s safety. Its latest model is also fitted with driver assistance systems that can help you avoid a collision. The vehicle’s cheaper maintenance costs not only enable you to save on repair, but these keep your premiums low as well.

9. Jeep Cherokee

Average premiums: $2,667 per year

The Jeep Cherokee scores high in crashworthiness and comes with a range of safety features that lower the cost of coverage. Among its notable safety inclusions are blind spot monitor, brake assist, and electronic stability and traction controls. Although the Jeep Cherokee has good safety ratings, these are not as high as some of the featured SUVs on our list.

10. Mazda CX-5

Average premiums: $2,723 per year

Like the other SUVs in our rankings, the Mazda CX-5 boasts a host of safety features, including a blind spot monitor, smart braking system, and stability and traction controls. The vehicle’s affordable repair and maintenance costs also contribute to decreased premiums. The CX-5 has among the lowest base MSRP on our list. Despite this, it has one of the longest possible lifespans, offering great value for your money.

The GMC Canyon is the cheapest truck to insure in Canada. The table below shows which other vehicle models made it to our list.

The top 10 cheapest pickup trucks to insure in Canada

Rank

Model

Yearly premiums

Monthly premiums

1

GMC Canyon

$1,969

$164

2

Toyota Tacoma

$1,979

$165

3

Chevrolet Colorado

$2,161

$180

4

Ram Pickup

$2,165

$180

5

GMC Sierra

$2,206

$184

6

Ford F-Series

$2,268

$189

7

Chevrolet Silverado

$2,301

$191

8

Nissan Frontier

$2,361

$197

9

Toyota Tundra

$2,499

$208

10

Nissan Titan

$2,583

$215

Pickup trucks were originally designed as utilitarian vehicles, which explains the lower cost of coverage. But as manufacturers enhance comfort, these vehicles have likewise become a popular ride of choice, especially for drivers drawn to their fuel-efficiency. Here are the 10 cheapest trucks to insure in the country.

1. GMC Canyon

Average premiums: $1,969 per year

The cheapest truck to insure in Canada, the GMC Canyon is equipped with a host of advanced safety features that reduces the risk of collisions and lowers insurance costs. Among these are rearview cameras and lane departure and forward collision warning. It also helps that the GMC brand – one of the biggest Canada-based manufacturers – is known for its reliable and durable vehicles.

The Toyota Tacoma is a compact pickup truck known for its off-road capabilities and high payload capacity. But it also comes with affordable repair and maintenance costs that push down insurance premiums. The Tacoma boasts one of the highest safety and crash test ratings among featured vehicles on our list.

If you’re looking for a reliable truck with a bunch of safety features and not that expensive to insure, then the Chevrolet Colorado may be a good pick. It packs a range of advanced features that can keep you and your passengers safe, including anti-lock brakes, stability controls, and seatbelt pretensioners. Its anti-theft system also helps keep thieves at bay.

The main factor that keeps Ram Pickup’s insurance premiums low is its cheap repair and maintenance costs. Most Ram trucks have average safety ratings while some models are prone to theft. Ram pickups’ popularity, however, hinges more on their performance and reliability.

https://www.youtube.com/watch?v=cgfpywmY2wM

5. GMC Sierra

Average premiums: $2,206 per year

Just like the Canyon, the GMC Sierra is known for its dependability and durability. Being a local brand, replacement parts are readily accessible, keeping repair and maintenance costs low. The Sierra also comes with advanced safety features common in GMC models, driving insurance rates down.

6. Ford F-Series

Average premiums: $2,268 per year

The Ford F-Series has a reputation for being a reliable work truck as it boasts enough haulage to carry huge loads. These trucks also score high in various safety and crash performance tests, thanks to a range of advanced features. These include autonomous emergency braking, evasive steer and reverse brake assistance, and adaptive cruise control.

The Chevrolet Silverado is considered one of the safest pickup trucks because it is packed with advanced safety features. These features have allowed the Silverado to attain near perfect scores in some crashworthiness and collision tests. These are among the reasons why the vehicle is among the cheapest trucks to insure in the country.

The Frontier is one of Nissan’s pickup truck models on our list, but its lower base MSRP makes it cheaper to insure. It also has all the safety features common in the vehicles featured in our rankings. And while its safety ratings are above average, these are not as high as some of the models on our list. Overall, its safety and crash test performance are among the reasons why insurance costs are relatively cheap.

9. Toyota Tundra

Average premiums: $2,499 per year

The Toyota Tundra is considered a low-risk vehicle because of its range of safety features. These include anti-lock brakes, stability control, and airbags. Its anti-theft security system also helps prevent theft. The Tundra has excellent safety and crash test ratings, which play a huge role in cutting the cost of coverage.

Check out this stunning 2023 Toyota Tundra Limited!

This beast of a truck combines power, style, and cutting-edge technology. pic.twitter.com/lyJG6hoesJ

— Comox Valley Toyota (@comoxvtoyota) September 20, 2023

10. Nissan Titan

Average premiums: $2,583 per year

The more expensive Nissan pickup truck on our list, the Titan scored high in crashworthiness but has a slightly lower crash avoidance and mitigation rating than most vehicles in the rankings. That’s why premiums cost a bit more. Performance-wise, the Nissan Titan is dependable and durable, which are the main reasons for its popularity.

Apart from the vehicle make and model, insurers consider a range of factors when determining how much coverage costs for your truck and SUV. These include:

CLEAR rating: Also known as the Canadian Loss Experience Automobile Rating system, this is a system developed by the Insurance Bureau of Canada, which uses claims costs to determine premiums.

Age: Because age is associated with driving experience and the risk of getting into an accident, younger motorists often pay higher premiums.

Gender: Male drivers typically pay more for coverage as they are statistically more likely to get involved in accidents than their female counterparts.

Postal code: Living in a safe neighborhood where car theft and vehicular accidents are uncommon will likely qualify you for cheaper coverage.

Driving record: A clean driving record indicates a lower probability of filing a claim, which insurers reward with reduced premiums.

Mileage: The less you drive, the lower the likelihood that you will get into an accident, allowing you to save on car insurance premiums.

Credit score: Car insurers – except those in Ontario and Newfoundland and Labrador – use credit-based insurance scores to help determine premiums. This is because insurers view drivers with high ratings as less likely to file claims than those with lower credit scores.

If you’re a young driver, it can be difficult to access affordable coverage. But there are still ways to do so. Learn how in our guide to cheap car insurance for young drivers.

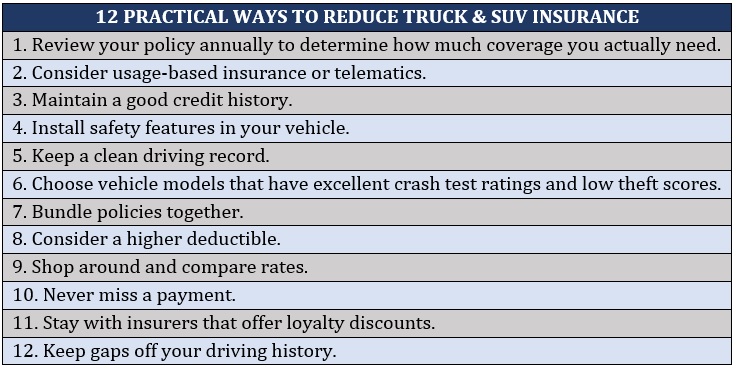

If you already own one of the vehicles on our list, there are still several practical ways for you to slash premiums further. These simple strategies are listed in the table below.

What do you think of the cheapest SUVs to insure on our list? How about the cheapest trucks to insure? Share your thoughts in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!