Top 10 car insurance providers in the US

Top 10 car insurance providers in the US | Insurance Business America

Guides

Top 10 car insurance providers in the US

The 10 largest car insurance providers in the US dominate the market. Find out what separates them from industry rivals in this article

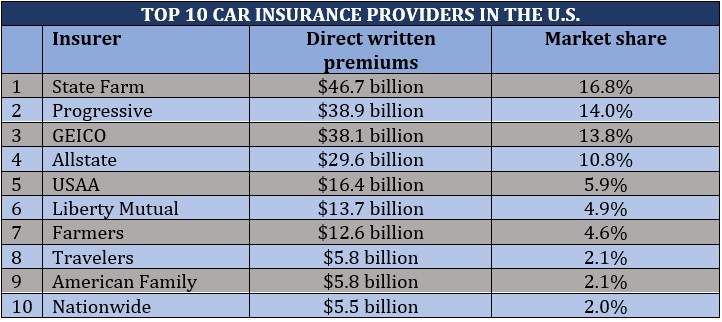

The top 10 car insurance providers in the US continue to dominate the market, underwriting more than three-quarters (77%) of the nation’s auto policies, the latest market share data released by the National Association of Insurance Commissioners (NAIC) has revealed. The figure is equivalent to slightly over $213.1 billion in direct written premiums – a 14.5% increase from the previous year.

But despite only a handful of major players controlling the auto insurance sector, these insurance giants still provide clients a diverse range of products, benefits, and services.

To give insurance buyers a picture of what the country’s top car insurers offer in terms of coverage, Insurance Business ranks the largest auto insurance companies in this article. We will also give you a rundown of the different policies you can access from these insurers and how these companies fare in terms of customer experience. Here are the top 10 car insurance providers in the US ranked according to market share.

Direct premiums written: $46.7 billion

Shopping experience rating: 877 out of 1,000-point scale

Claims satisfaction rating: 882 out of 1,000-point scale

State Farm is the largest car insurance provider in the US, accounting for almost 17% of the overall market. The figure is equivalent to over $8 billion more in direct written premiums compared to the next-ranked insurer. State Farm’s network of more than 19,200 local agents also means that drivers can easily access its policies wherever they are in the country – well almost, since the company is no longer writing policies in Massachusetts and Rhode Island.

State Farm is known for offering rates that are below the industry average, regardless of the demographic. This includes seniors, policyholders with named teens, and even drivers with past accidents and speeding violations. In addition to this, you can access a range of discount options, including:

Drive Safe & Save: Allows you to save up to 30% in annual premiums depending on how safely you drive by signing up for the mobile app.

Steer Clear: Enables new drivers or those aged 25 and under to cut yearly premiums by up to 20% if they don’t have any at-fault accidents or moving violations in the past three years.

State Farm also ranks highly in terms of purchasing experience and claims satisfaction, partly because of its user-friendly website and mobile app, where policyholders can request quotes, pay premiums, and file claims.

2. Progressive

Market share: 14%

Direct premiums written: $38.9 billion

Shopping experience rating: 853

Customer satisfaction rating: 861

The nation’s second-largest car insurance provider offers an array of coverages, some of which are not available from many of its competitors, including gap insurance and veterinary expenses coverage for pets injured in an accident. This also allows policyholders to customize policies to suit their unique needs.

Progressive sits at the middle of the pack when it comes to annual premiums, but policyholders can access a wide range of discounts to slash rates. These include the Snapshot safe driver discount, which personalizes your rate based on your driving behavior through a mobile app. The insurer, however, ranks below the industry average in terms of customer experience and claims satisfaction.

3. GEICO

Market share: 13.8%

Direct premiums written: $38.1 billion

Shopping experience rating: 857

Claims satisfaction rating: 874

GEICO is known for offering competitive rates not just for drivers with a clean record, but also for motorists who have poor credit, a speeding ticket, or those caught driving uninsured. It is a pretty expensive option, however, for drivers with a DUI record.

GEICO policyholders can also access a range of valuable additional features, including accident forgiveness and a usage-based insurance program that can help reduce premiums for safe drivers. The Berkshire Hathaway subsidiary has a user-friendly website and robust mobile app, which enable customers to get a quote, track billing, and manage their policies online.

GEICO car insurance policies are available in all 50 states. However, the insurer does not have an extensive network of local agents, so if you’re one of those who prefer working directly with agents, you may have difficulty finding one depending on where you live.

Direct premiums written: $29.6 billion

Shopping experience rating: 853

Claims satisfaction rating: 889

One of the largest car insurance providers in the US, Allstate offers a range of helpful coverage options not typically available from many of its industry competitors, including:

Accident forgiveness

Disappearing deductible

Gap insurance

New car replacement

Rideshare insurance (in most states)

Allstate also has a comprehensive lineup of discounts, which include:

Early Signing Discount: if you sign your policy at least seven days before its effective date

Responsible payer discount: if you didn’t receive any cancellation notices for non-payment in the previous cycle

EZ pay plan discount: if you set up automatic withdrawal for premiums payments

eSmart discount: if you go paperless by signing up for ePolicy

Allstate has a good track record when it comes to claims handling as reflected in its above-average customer satisfaction rating. This helps offset car insurance rates that are often more expensive than its competitors.

5. USAA

Market share: 5.9%

Direct premiums written: $16.4 billion

Shopping experience rating: 874

Claims satisfaction rating: 890

USAA boasts among the highest customer experience and claim satisfaction scores of all the car insurance companies on our list. The specialist insurer, however, only offers coverage for veterans and active members of the military, and their immediate families.

USAA provides competitive rates to all types of drivers, including teens, seniors, and those involved in accidents and traffic violations. Its wide array of discounts allows policyholders to slash premiums further. USAA offers the standard coverages accessible from other insurers, but it also has a lineup of quality add-ons, including accident forgiveness, car replacement assistance, and rideshare insurance.

Direct premiums written: $13.7 billion

Shopping experience rating: 865

Claims satisfaction rating: 870

Liberty Mutual is a great option for drivers who prefer an online experience over working with an insurance agent. Among the benefits of choosing the mutual insurer as your car insurance provider is that you are given access to its user-friendly website, along with its comprehensive selection of jargon-free resources regarding your coverage. You can also download the Liberty Mutual mobile app, where you can manage your policy digitally. These are among the main reasons why the company has the second-highest shopping experience score of all large insurers featured in the list.

Liberty Mutual’s rates, however, are relatively higher compared to its industry rivals, while its claims satisfaction rating is below the industry average. But the insurer makes up for this by offering customers a wide range of coverage options and discounts, which include a decreasing deductible for every year without a claim.

Direct premiums written: $12.6 billion

Shopping experience rating: 846

Claims satisfaction rating: 882

Annual premiums for Farmers’ auto insurance policies tend to be on the high side compared to those of the other top car insurance providers in the US. Rates are even more expensive for young and senior drivers. And while Farmers ranks among the top auto insurers when it comes to claims satisfaction, it has one of the lowest shopping experience ratings.

High rates and insurance shopping aside, Farmers offers a range of coverages that may prove valuable after a collision, including accident forgiveness and new car replacement. Lyft and Uber drivers, meanwhile, can enhance their coverage with rideshare insurance.

Direct premiums written: $5.8 billion

Shopping experience rating: 848

Customer satisfaction rating: 854

Travelers is one of the several car insurance providers in the US known for offering competitive premiums. Rates are also relatively cheap for motorists with DUI on their records, although adding a teen driver can push up quotes.

Policyholders have plenty of coverages to choose from. Among the standout features of Travelers’ policies are accident and minor violation forgiveness, and a usage-based insurance program that rewards safe drivers with discounts. Travelers also offers rideshare insurance but only in a few states. Another drawback is that the insurer has below average scores in both claims satisfaction and customer experience.

9. American Family

Market share: 2.1%

Direct premiums written: $5.8 billion

Shopping experience rating: 867

Claims satisfaction rating: 874

American Family has above average scores in claims satisfaction and shopping experience. Compared to many industry rivals, it also boasts a more comprehensive portfolio, which includes OEM coverage, rideshare insurance, diminishing deductibles, and accident forgiveness. American Family provides a wide range of discounts like its KnowYourDrive program, which reduces the rates of safe drivers.

American Family car insurance, however, is available only in 19 states. Its rates are also more expensive that those of its competitors.

Direct premiums written: $5.5 billion

Shopping experience rating: 861

Claims satisfaction rating: 868

Nationwide rates can be relatively inexpensive, but it depends on the type of driver you are. Just like with most car insurance providers in the US, safe drivers with a clean record can access competitive rates from Nationwide. Drivers with poor credit can also get cheaper rates but motorists with DUI are in for higher premiums. In general, Nationwide rates are more expensive than most of its competitors.

The insurer, however, provides an extensive list of coverages and helpful add-ons. These include usage-based and pay-per-mile options for those who want to potentially save on insurance costs. Nationwide’s shopping experience score is at a par with the industry average, although claims satisfaction rating is a bit low. Nationwide’s car insurance policies are also not available nationwide. It does not sell policies in Alaska, Hawaii, Louisiana, and Massachusetts.

The rankings are based on the latest market share data that NAIC released. The list is arranged according to overall market share, which also reflects each company’s direct written premiums. To give readers a clearer picture of the type of service each auto insurer provides, we included the scores from the most recent insurance shopping experience and claims satisfaction survey J.D. Power conducted. We also included the companies’ financial strength ratings from A.M. Best.

Here’s a summary of the top 10 car insurance providers in the US.

Almost all states require motorists to carry car insurance to be able to legally operate a vehicle. The only exception is New Hampshire. If you’re caught driving without insurance, you can be slapped with a hefty fine and have your future eligibility for obtaining coverage affected.

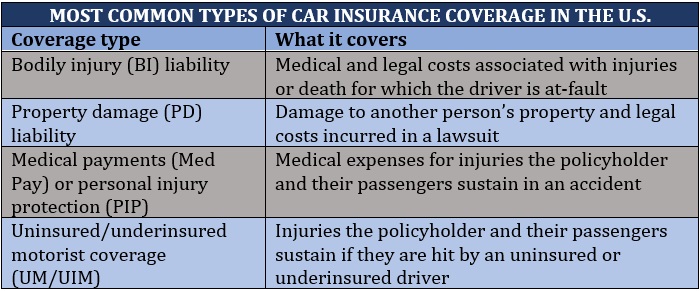

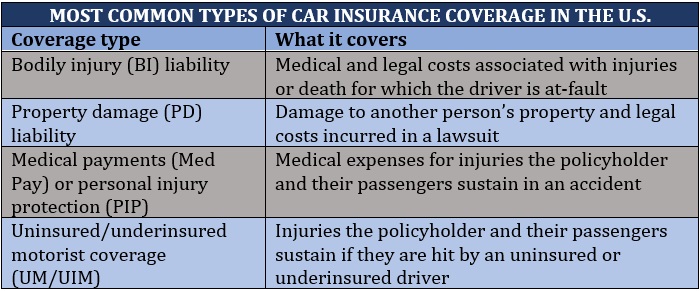

The types of coverage required, however, vary in each state, although there are certain similarities. The table below details the most common types of policies drivers need to take out, according to the Insurance Information Institute (Triple-I).

Whether your car insurance rates will be on the cheaper or more expensive side depends on the risks you present as a driver. To determine how much a motorist should pay in premiums, car insurers look at a range of factors, including:

Here’s an estimate of how much the average annual premiums cost from the top 10 car insurance providers in the US. Your rates may be significantly higher or lower depending on a range of risk factors, including those listed above.

Our Best in Insurance Special Reports page is the first place you need to check out if you’re searching for the car insurance providers in the US that offer the best coverage. The insurers featured in our special reports have been chosen by their peers and vetted by our team of experts as reliable and trusted leaders in the industry. By choosing these companies, you can be sure that you’re getting the right protection that suits your unique needs.

The car insurance market is constantly evolving, and changes can happen without warning. If you don’t want to get left out of the latest industry developments, be sure to visit and bookmark our Motor & Fleet section. Here, you can keep abreast of the latest industry news and updates.

Do you like our ranking of the top car insurance providers in the US? Have you experienced working with any of them? Feel free to share your story below.

Keep up with the latest news and events

Join our mailing list, it’s free!