Tool insurance: everything you need to know

Tool insurance: everything you need to know | Insurance Business America

Guides

Tool insurance: everything you need to know

If your tools and equipment are essential to keep your business running, then you can benefit from tool insurance. Find out how this policy works

If your business relies heavily on your tools and equipment to get the job done, then any loss or damage to these items can prove costly. That’s why having the right tool insurance is important in keeping your operations running smoothly.

In this article, Insurance Business explains everything you need to know about this type of coverage. We will discuss how tool insurance works, what it covers, and the different factors you need to consider before taking out a policy. Read on and find out how tool insurance can protect your business.

Tool insurance is a type of policy that pays out the repair and replacement costs if the tools and equipment that you use for your business are stolen, damaged, or vandalized. It is also commonly referred to as contractor’s tools and equipment insurance or equipment floater coverage.

Tools and equipment coverage is a form of inland marine insurance, which covers goods transported on land. This means that for the items to be covered, you must be able to move them from one place to another.

Tool insurance typically covers equipment worth up to $10,000, with those valued at more than $5,000 requiring scheduling.

Most policies cover only items less than five years old, although some provide actual value coverage for older tools and equipment.

Certain policies also come with provisions that compensate you for lost income and costs incurred due to project delay if these are caused by a covered incident.

Tools and equipment insurance is not mandatory, although businesses may require you to have coverage in place before agreeing to work with you to protect their investments. You can purchase tool insurance as a standalone policy or as a rider to your commercial property insurance or business owner’s policy, which bundles property coverage with general liability insurance.

At first glance, tool insurance seems like a straightforward form of coverage. However, there are certain aspects of this policy that you need to understand to help you get the right coverage for your business. Here are some of them:

Scheduled vs unscheduled items

When you purchase a tool insurance policy, you will be asked to provide a list of two groups of items. These are:

Unscheduled items: These are tools and equipment worth less than $5,000. They don’t have to be individually listed in your policy, but you will need to provide an aggregate value for these items.

Scheduled items: These are high-value items worth more than $5,000 which should be individually specified in your policy. Having more scheduled items listed also means you will be paying higher premiums.

Per-item vs per-occurrence limit

Most policies come with a $10,000 policy coverage limit. This is the maximum amount your insurer will pay for the year. Tool insurance also has these types of coverage limits:

Per-item limit: Usually pegged between $500 and $1,000, this applies to unscheduled items in your policy.

Per-occurrence limit: This is the maximum amount your insurer will pay for a single incident or “occurrence” and covers both scheduled and unscheduled items.

Actual value vs replacement cost

You can purchase contractor’s tools and equipment insurance on an actual cash value or replacement cost basis.

Actual cash value tool insurance policies pay for the fair market value of the item at the time of the loss. This means coverage is equal to the price of the item when it was purchased minus depreciation.

Replacement value policies, on the other hand, pay out an amount equivalent to how much it would take to replace the lost or damaged item with a new one.

Actual cash value policies are less expensive than replacement value plans. But if your business owns several high-value tools and equipment that have experienced significant depreciation in the past few years, it may be worth paying the extra cost.

Coinsurance

Most tools and equipment policies come with a coinsurance clause. This requires you to carry coverage equivalent to a certain percentage of the total value of the items you want covered. This is to ensure that you have sufficient coverage in the event you make a claim.

Coinsurance rates vary depending on the insurer, but most policies require you to insure your equipment for 80% of its value for it to be covered for its full value. If you fail to do so, your insurer may impose a coinsurance penalty that puts you on the hook for a portion of the cost. Some insurance companies may also waive the clause if you take out coverage on an actual cash value basis.

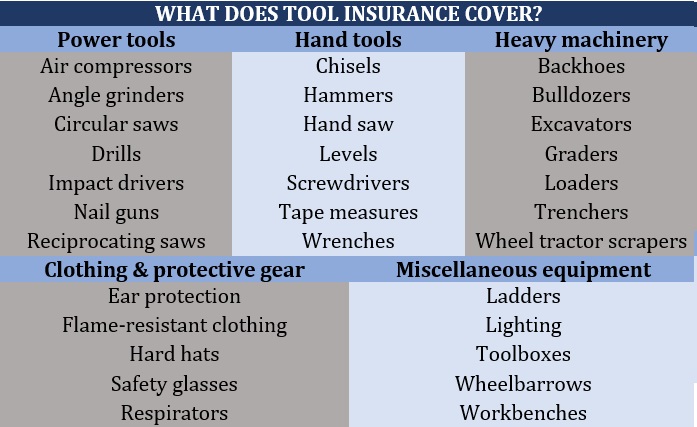

Tool insurance provides coverage for a wide range of tools and equipment that you use for your business if the items meet these three criteria:

They are movable.

They are less than five years old.

They are worth less than $10,000.

The table below lists the different items typically covered by contractor’s tools and equipment insurance.

Tool insurance is often written on an all-risks basis. This means it may cover events not specifically listed in your policy. Some of the incidents that most policies cover include:

Theft

Fire

Flooding

Accidental damage

Vandalism

Some policies provide coverage for the tools and equipment that you lease or rent. There are also policies that pay out for lost income and additional costs incurred because of project delays.

Tool insurance, however, doesn’t cover all incidents that cause damage to your tools and equipment. Some exclusions are:

Normal wear and tear

Intentional loss

Mechanical breakdown

Stationary equipment

Because of some similar elements and overlapping coverages, tool insurance is sometimes confused with other types of policies. Tools and equipment coverage is often mistaken for inland marine insurance and equipment breakdown insurance.

Here are the key differences between these forms of coverage.

Tools and equipment insurance vs inland marine insurance

Inland marine insurance is a broad form of coverage designed to protect goods while they are being transported on land. It is an offshoot of marine insurance, which covers goods being transported by ship.

Most inland marine policies end coverage once the items have reached their destination. This is the key difference between such policies and tools and equipment insurance. Tool insurance continuously provides coverage for items as they are transported between, used on, and kept at different job sites.

Tools and equipment insurance vs equipment breakdown insurance

Contractor’s tools and equipment insurance essentially works the same way as equipment breakdown insurance. Both provide coverage if certain equipment is lost or damaged due to a covered event. Both can also be included in a business owner’s policy. The difference lies in what the policies cover.

Tool insurance covers movable items as they are transported and used on different job sites. Equipment breakdown insurance, on the other hand, provides coverage for stationary equipment such as boilers, computer systems, generators, HVAC systems, and other infrastructure-related machinery.

If you want to delve deeper into the inclusions and exclusions under contractor’s tools and equipment insurance, you can check out our complete guide to what equipment insurance covers.

For policies with a coverage limit of $10,000, tool insurance premiums typically range between $175 and $450 per year or about $15 to $38 monthly. These figures are based on the various insurer websites Insurance Business checked out.

But because each business comes with varying needs and exposure, the amount you pay may be significantly lower or higher than the figures above. Here are some of the factors that have a major impact on premium prices for tools and equipment insurance:

How much your tools and equipment are worth

How old your tools and equipment are

How you store and maintain your tools and equipment

Where your business operates

Your business’ claims history

The policy’s coverage limits

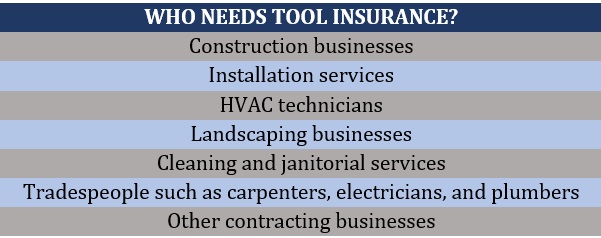

Any business that relies on their tools and equipment to keep their operations running can benefit from tool insurance. This form of coverage enables businesses to resume work quickly if an essential tool or equipment is lost or damaged. The table below lists some types of businesses that can benefit from taking out a tools and equipment policy.

The key to finding the right tool insurance policies for your business is to understand its unique needs and circumstances. Here are some of the factors that you need to consider when searching for the tools and equipment coverage that fits your business.

Level of coverage: Insurance companies allow you to pick between actual cash value or replacement value coverage. While the former cost less, it may not provide the level of coverage that you need, especially if your business operates high-value equipment that has depreciated significantly in the past few years.

Policy limit: The maximum limit of your policy should cover the total value of your tools and equipment. Coinsurance rates apply, so be sure to make an accurate assessment of the value of these items.

Premiums: In every type of insurance policy, always remember that cheaper doesn’t necessarily mean better. A less expensive policy may be good for your budget at first. But it can cost you more in the long run, especially if your plan doesn’t pay out an amount sufficient to repair or replace essential equipment.

Deductible: A higher deductible also means lower premiums because your insurer is taking on less risk. But be sure to carry an amount that you can afford to shell out if an unexpected incident occurs.

Insurance provider: It helps to read insurer reviews to see how well a company handles claims. You can also check an insurer’s financial ratings, which indicates their ability to pay claims, via the websites of various ratings agencies and industry associations.

A tools and equipment insurance policy can be quoted and issued on the same day if you have the following information ready:

An accurate estimate of the value of all tools and equipment worth $5,000

The make, model, year, serial number, and purchase price of scheduled items

Given the type of coverage it offers, tool insurance provides a relatively inexpensive means of financial protection for businesses and professionals heavily reliant on their tools to get their jobs done.

Apart from covering repair and replacement expenses of tools essential for running your operations, some policies compensate your business for lost income and additional costs incurred because of the delay caused by lost or damaged equipment.

Tools and equipment insurance come with coverage limits, which rarely covers high-value, specialized items. For the few policies that provide such coverage, they might not insure the full amount, or they may come with expensive premiums. What makes tool insurance a worthwhile investment? If it provides adequate coverage for the tools and equipment that keep your business running.

Among the industries that can benefit from tools and equipment insurance are the construction and engineering sectors. Getting coverage is just one of the steps that companies need to take to keep their businesses protected.

Such policies must also be paired with sound risk management strategies. You can achieve this by regularly visiting and bookmarking our Construction & Engineering Insurance News section, where you can find breaking news and the latest industry updates.

Is your business keen on taking out tool insurance? We’d love to see why or why not in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!