Three Trends That May Change SMB Expectations for Group & Voluntary Benefits Providers

Published on

November 16, 2023

What do teen peer pressure, wearable sales trends, and hybrid work have to do with SMBs and value-added services for Group & Voluntary benefits? Well, let’s find out.

Teen peer pressure gives Apple a new platform for growing wearable use in Gen Z.

Currently, 87% of Gen Z teens who own a smartphone, own an iPhone, as opposed to an Android or other smartphone.[i] Apple competitors blame peer pressure for the steady growth (a major bone of contention is the green text bubble that iPhone users receive from non-Apple devices). No matter what the reason is, however, with nearly 90% brand penetration into an important group, these iPhone purchases are ushering Gen Z teens into the world of Apple. From here on, they continue to buy other Apple products, such as the Apple Watch, and they will consistently utilize Apple services such as ApplePay.

The Apple Watch is more important to the future of Group & Voluntary benefits than insurers may think. The reason is that wearables stand to impact entire employee populations by having the ability to improve health and wellness outcomes. And, this is the key, entire employee populations are a part of the growing market of wearables. Wearables are getting more popular among a broad spectrum of sub-groups, including:

Extremely-health-conscious people who are interested in all of their health data for training reasons.

Everyday users who are simply interested in keeping an eye on their health while pursuing moderate health goals.

“Connected” technology lovers who like to periodically untether from their phones while staying tethered to their information (financial, social, — not just health data.)

People with chronic conditions who need to monitor some of their numbers for medical purposes.

Even if a Group or Voluntary benefits provider doesn’t currently see a need to utilize wearables, wearable data, or connected experiences, they should seriously begin considering how and where employers might benefit from products and services that can be tied to wearables. As the market grows, SMB expectations continue to evolve as well. HR teams will be asking for connected products and services. It’s a trend that is too big to ignore. Employees themselves will be looking for ways they can use their wearables to improve their work and personal lives.

Wearable sales trends are strong and not slowing down. SMBs need to know that health tracking is on the rise.

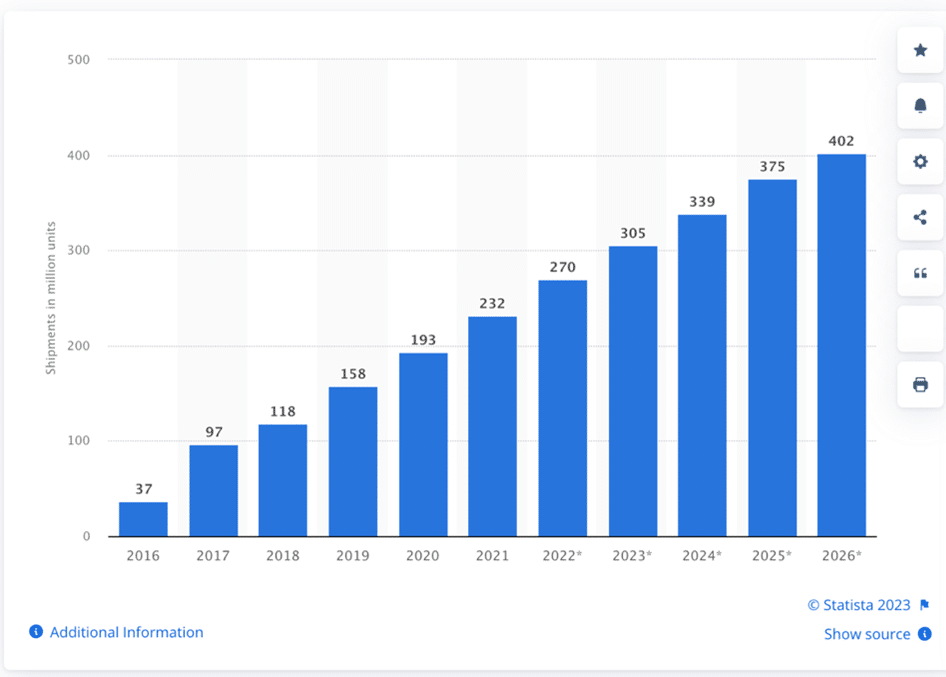

Wearable growth will also continue to be on the rise among nearly every age group, not just Gen Z. In fact, 34% of all consumers already own a smartwatch, yet by 2026, wearable shipment trends will continue to grow just as fast as they have for the last 10 years. This means that the market for wearables isn’t showing signs of saturation.[ii] It’s only showing signs of greater adoption and integration.

Figure 1: Smart wearable shipments worldwide from 2016-2026. Statista

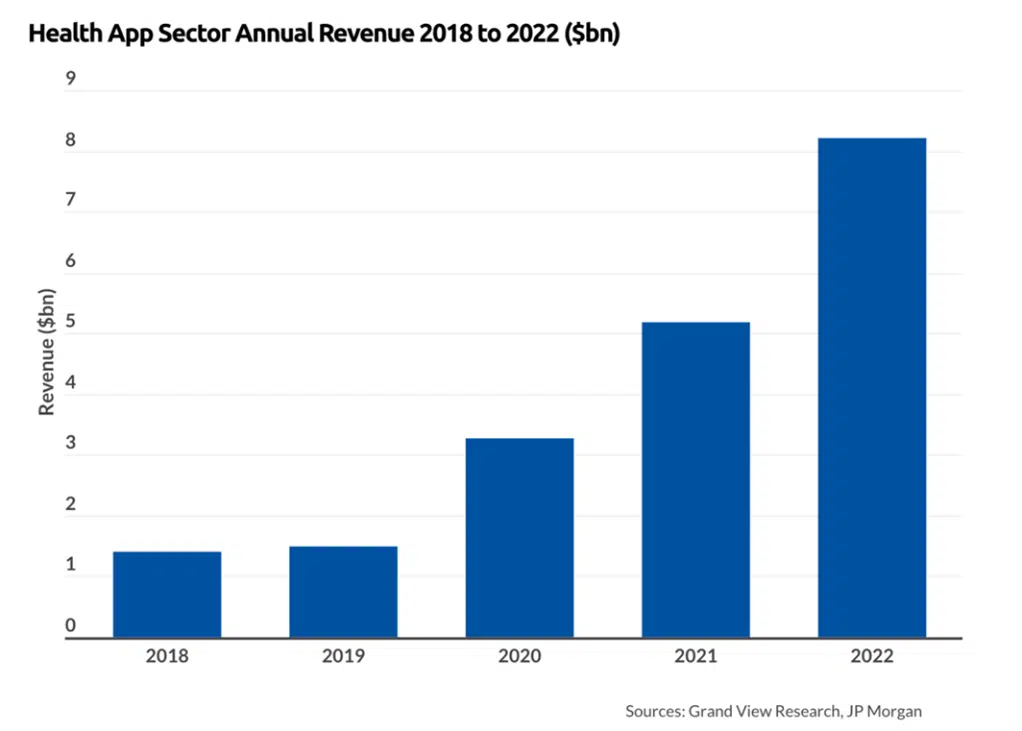

The result is that, in general, employee populations are paying more attention to their health and they may be getting healthier. Pundits might say that the wearable market growth doesn’t necessarily predict wearable usage for health-related purposes, but health apps are also in rapid growth mode. In 2022, health apps brought in $8.2 billion and by 2030, they are predicted to bring in $35.7 billion.[iii] For Group & Voluntary benefits providers, this is a golden opportunity for development — either creating wearable apps that link to new products or value-added services — or partnering with one of the many new health apps to link app and data usage.

Figure 2: Total Annual Revenue in the Health App Industry

Hybrid workforce getting healthier, commuting less, and using their time more wisely.

Soon after the pandemic, businesses small and large began to consider the future of remote work. “What are we going to do about remote work? Is hybrid work going to help us or hurt us?” It didn’t take financial teams long to figure out that hybrid and remote work could cut down on workspace expenses, help build loyalty among employees, and even contribute to the growing talent issue by allowing SMBs to hire for some roles outside of their geography.

What they didn’t know was that hybrid and remote work might improve employee health. A recent study by IWG determined that in a sampling of 2,000 hybrid workers, hybrid workers are exercising more (almost 90 minutes more per week on average). They are commuting less, which contributes to environmental goals and has “led to an extra 71 hours of sleep per year.” And, nearly a quarter of hybrid workers have lost weight — 20 lbs. or more. In addition, hybrid workers are eating healthier.[iv]

What is the potential impact of these trends from a Group & Voluntary benefits perspective?

Life, supplemental life, CI, cancer, and hospital indemnity policies may see a steady improvement in claims ratios.

Traditional health plans could see a marked improvement in SMB coverage for SMBs who utilize hybrid employees.

Exercise may be ready for its own type of insurance or value-added service products that go beyond voluntary accident insurance.

Discounts for wearable users may increase sales of those products as wearable use rises.

Hybrid and remote workers are driving less. Group & Voluntary Auto/Home policies could be created especially for the no-commute/low-commute employee.

Benefit incentives could be created for SMBs that choose to use hybrid workers for a certain percentage of their workforce.

Group & Voluntary benefits providers can now look at the whole realm of product and service opportunities in a different light than they have in the past.

Most Group & Voluntary core systems aren’t yet prepared to meet today’s SMB opportunities.

Dozens or hundreds of potential products and services will become much more viable in light of these three trends. The real question is: are SMBs ready for those new products and services right now or will it take time for them to grasp the potential of new offerings? Majesco found the answer in our surveys of SMB decision-makers — was a resounding yes!

SMBs and Employees are Ready for More Than Insurers Can Currently Provide

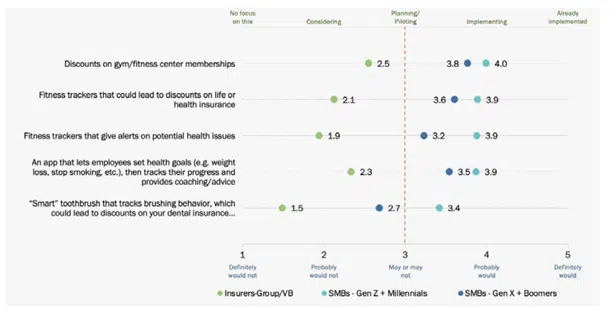

Across the board, there is a significant customer expectation gap between what customers want – regardless of generational group – and what insurers are delivering, as represented in Figure 3. These value-added services provide tangible value and enhance overall wellness with alerts and more.

In addition, these options could gather more personalized data to enhance their pricing as well as their overall experience. Many are “low hanging fruit” that would not take a lot of effort, but will create tremendous value and start insurers down the road to a more holistic, valued offering and experience for customers.

Figure 3: SMB-Insurer gaps in value-added services for group/voluntary benefits

A key strategy for insurers to address customer expectations is to increase the value of the products they offer. To do so, insurers should bundle, or offer for a price, value-added services that extend the value of the risk product/policy, such as earning points for wellness that can be used to buy things, annual financial planning assessment, roadside assistance, and more.

Value-added services can create new revenue opportunities while also strengthening the customer relationship, loyalty, trust, and value.

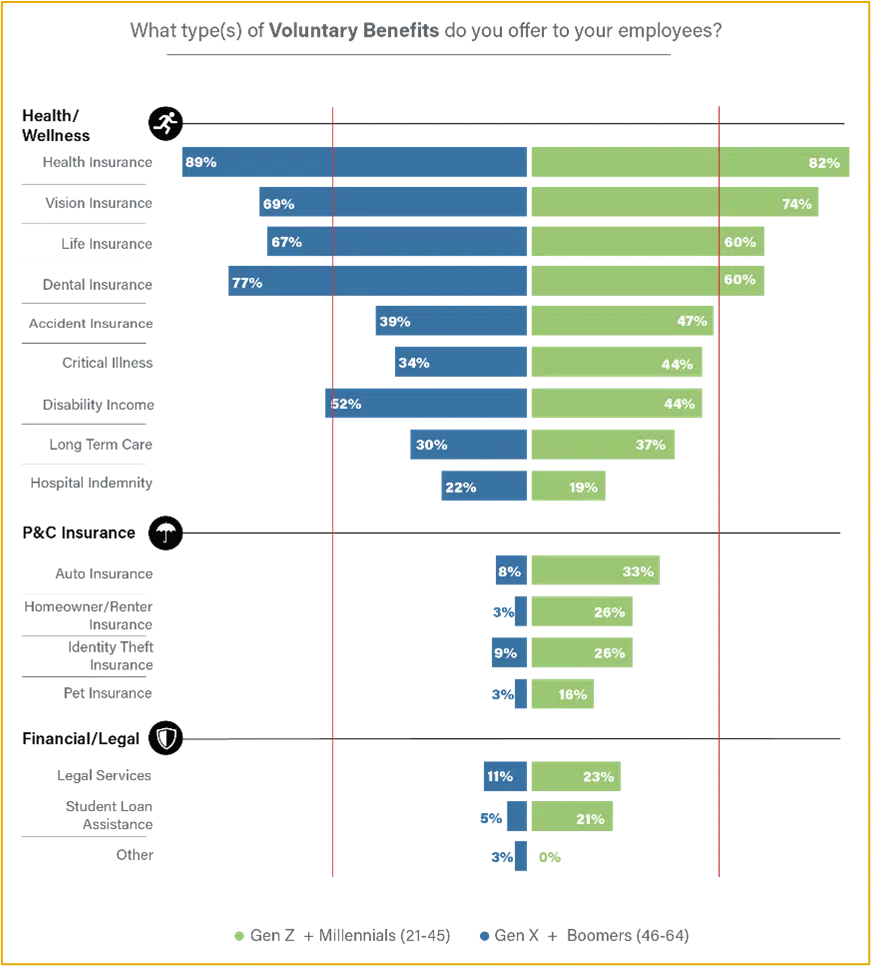

As SMB companies are growing their benefits offerings for employees, it’s clear that they are thinking about holistic protection for their employees that will encompass health, wellness, financial stability, social and emotional support, and all kinds of security. When Majesco looked at what kinds of benefits SMBs were offering, there was a sharp contrast between Gen Z/Millennials and Gen X/Boomers. (See Figure 4.) These differences highlight the direction of SMB benefits offerings. To meet the needs of SMBs, insurers must prepare, not just for new products, but for entirely new ways to take in and manage data.

Figure 4: Voluntary Benefits offered

Innovating to Meet the SMB Market Demands

The need for innovation around employee benefits and coverages for a younger generation who have different lifestyle needs and for an older generation that want to port insurance after retirement or may work as an on-demand/Gig worker are together a dominant part of the workforce. Innovative new plans and insurance options and portability are increasingly important to attract and retain employees as well as keep them as customers as they change jobs.

Insurers must strike the right balance in terms of the product, value-added services, and experience to support the breadth of generations within the workforce. With the emergence of a more diversified workplace across all generations, employees, and subsequently, employers, expect a broader portfolio of group and voluntary benefits products that will meet their personal needs, life stage, and lifestyle. While many employers continue to offer the traditional products of health, dental, vision, STD, LTD, and life, there is an increasing demand for new, innovative products as well as financial wellness offerings.

To retain and grow their business, insurers must rethink their scope to a broader lifestyle experience across health, wealth, and wellness.

The opportunities are still growing, but capturing them requires technologies that aren’t currently used by most Group & Voluntary benefits providers — because most are on decades-old legacy systems! Yes legacy systems are not a roadblock to the future.

Majesco has created core solutions for group and voluntary benefits and value-added services that will not only bring insurers into the digital age but will also prepare to give the data and analytic feedback insurers and employers need to optimize their offerings. This is crucial! Without the ability to adequately handle data, insurers won’t get the most out of their customer relationships, either with the employer or with the employee. Majesco is working with a number of insurers who are bringing innovative group benefits products to market, along with value-added services to meet the demands of a rapidly changing employer and employee marketplace.

Find out more about Majesco’s market-leading solutions that bring what you need for the future today including L&AH Intelligent Core Suite, Majesco IDAM, Intelligent Sales & Underwriting Workbench, and Digital 360 solutions that are helping Group and Voluntary insurers meet the increasing demands of employers and their employees.

For an in-depth look at the results of Majesco’s SMB customer surveys, you can download, Bridging the Customer Expectation Gap for Group and Voluntary Benefits.

[i] Mok, Aaron, Apple has a stunning stranglehold over GenZ — and it’ll pay off for decades to come, Business Insider, October 2023.

[ii] Laricchia, Federica, “Smart wearable shipments forecast worldwide from 2016 to 2026,” Sept. 12, 2023, Statista

[iii] Wylie, Louise, Health App Revenue and Usage Statistics (2023), August 16, 2023, Business of Apps

[iv] Tsipursky, Gleb, “Does Hybrid Work Lead to a Healthier Workforce?,” Forbes, March 30, 2023