The Two R’s Impacting Your Insurance Premiums: No This Not a Recession Article 2023

January 2023 saw the greatest shift in decades within insurance pricing and contract terms. As a result, the market has been chaotic with renewals going down to the wire. Reinsurance is used by insurance carriers as a way of spreading risk and smoothing losses. Without it, they could not reasonably price your insurance.

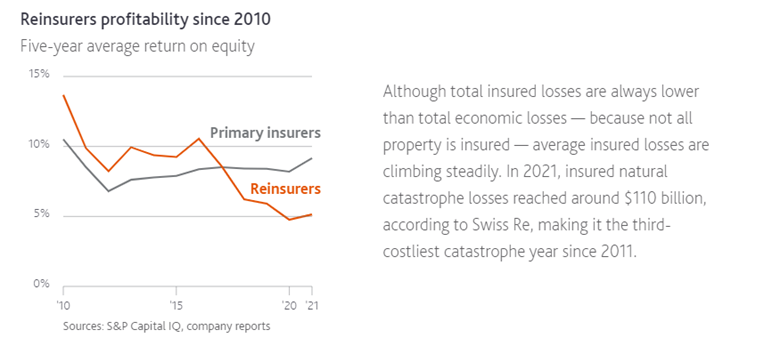

Did you know reinsurance companies also purchase reinsurance? It’s called retrocession and is a way to spread their risk, too. Retrocession rates are 165% higher than in 2017, and carriers raised both reinsurers’ rates and retentions and primary carriers’ rates and retentions which means your natural catastrophe (CAT) exposed property renewal rates and terms will change accordingly. Primary carriers’ retentions increased a median of 60%, which could fundamentally change the way they underwrite. Below is a graph demonstrating reinsueres profitability since 2010.

Why is this happening? Global CAT losses exceeded $100B for the second year in a row led by Hurricane Ian with 70% of all losses coming from the U.S. The reinsurance market is further impacted by inflation, supply chain issues, stressed asset valuations, foreign exchange rates, social inflation and the recent withdrawal of capacity by some providers. Undervalued property portfolios continue to vex the insurance industry and is another area in which buyers can expect upward pressure.

We are now facing one of the hardest CAT property markets in decades. Poor claim performing portfolios could see increases up to 150%. Primary carriers had the security of level retentions for the past 10+ years and now face the prospect of higher reinsurance retentions, which increases the rates and retentions they will offer their clients. Non-CAT property and inland marine will also see increases though not on the magnitude mentioned above.

For casualty reinsurance, a strong underlying rate coupled with underwriting improvements have prompted reinsurers to balance their more strained property portfolios with growth on the casualty side. While casualty portfolios are not immune to market challenges, we see greater capacity and more stable market conditions for placements.

Reinsurers are increasingly concerned with external economic and political factors such as interest rate environment, the Russia Ukraine conflict and inflationary recession concerns and the resulting heightened volatility to both short- and long-tail lines.

It’s important that you have a strategic approach when marketing your insurance programs. Facultative reinsurance plays a major role in the hard market, and there are relatively few reinsurers in comparison to the number of primary markets. Keep this in mind when it’s recommended that you “blanket” the marketplace or feel that’s your only alternative. The “blanketed” carriers will be approaching these limited markets, and when faced with multiple submissions these limited markets choose to decline rather than quote.

Assurance has the analytic depth and market positioning to help your business navigate these firming positions. Contact a member of the ‘A’ Team to learn more.

Related Resources:

Related Pages:

ABOUT THE AUTHOR

Michael Alberico

Michael Alberico is a Senior Vice President and Construction and Real Estate Practice Leader at Assurance. With over 35 years of experience, Michael’s primary responsibility is to provide comprehensive and integrated risk management programs that fully address risk needs while maintaining price sensitivity. Michael graduated from the University of Illinois at Champaign-Urbana with a Bachelor of Arts degree in History.