The top 10 most expensive states for car insurance

The top 10 most expensive states for car insurance | Insurance Business America

Guides

The top 10 most expensive states for car insurance

What factors drive up premiums in the most expensive states for car insurance? What does income have to do with auto coverage? Find out the answers here

Some states are more prone to car insurance claims than others. In fact, where you live is one of the biggest factors influencing how much you need to pay in auto premiums.

To give you a picture of where coverage costs are the highest, Insurance Business highlights the 10 most expensive states for car insurance in this guide. We will break down the figures and show how other key metrics can affect auto insurance rates.

If you want to find out where your state ranks in terms of premiums, you’ve come to the right place. Read on as we list the top 10 states with the highest car insurance rates.

The national average cost of full coverage car insurance is $2,543 based on Bankrate’s latest annual report. This figure represents a 26% rise from last year.

The consumer financial services firm expects the rate hikes to continue throughout the year. The approval of the premium increases petitioned by car insurance companies over the past few years are predicted to drive up coverage costs.

The report notes that “car insurance rates generally do not decline but can stabilize.” Something that may happen in 2025.

“Auto insurance rates have been rising at a breakneck pace,” explains Greg McBride, chief financial analyst for Bankrate. “And though the pace of increases will eventually slow, that doesn’t mean premiums are coming down.”

The true cost of car insurance

The report states that the true cost of car insurance isn’t reflected in the amount of premiums you pay each year. Rather, the real cost is shown by the percentage of income you spend on coverage.

The report used this metric to analyze auto insurance rates in all zip codes and insurers across all 50 states. This is to better demonstrate the impact of premiums on a driver’s overall budget.

According to the study, the average cost of car insurance in the US takes up 3.41% of a person’s yearly income. Depending on the state you live in, you may spend a much higher or lower percentage than average.

To find out how much car insurance costs in each state, Bankrate gathered data from Quadrant Information Services and used this in its analysis. Besides residence, the report shows how different life events can impact premiums.

The quoted rates in the rankings are based on full coverage car insurance for a 40-year-old driver of a 2022 Toyota Camry who covers 12,000 miles each year. The imaginary motorist also boasts a clean driving record and good credit score.

Here are the 10 most expensive states for car insurance, according to Bankrate’s True Cost of Car Insurance report.

1. Florida

Average annual full-coverage car insurance: $3,945

Percentage of income spent on car insurance: 5.69%

Percentage difference from national average: 2.28%

Most expensive states for car insurance – Florida factors affecting insurance premiums

Florida is the most expensive state for car insurance. This is due to the high number of catastrophic claims brought about by extreme weather. The Sunshine State ranks second in true cost, with motorists spending almost 6% of their income on auto coverage.

Florida is home to three metropolitan areas with the highest true cost of car insurance. These are Miami, Tampa, and Orlando.

2. New York

Average annual full-coverage car insurance: $3,840

Percentage of income spent on car insurance: 4.83%

Percentage difference from national average: 1.42%

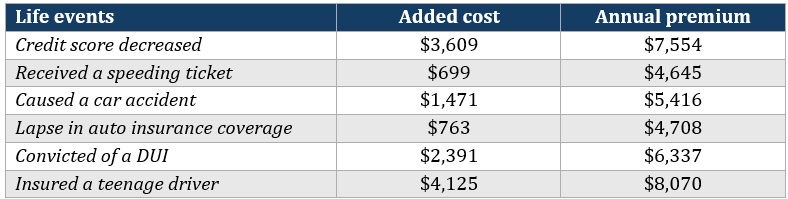

Most expensive states for car insurance – New York factors affecting insurance premiums

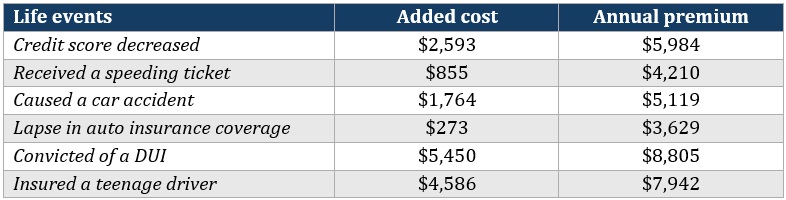

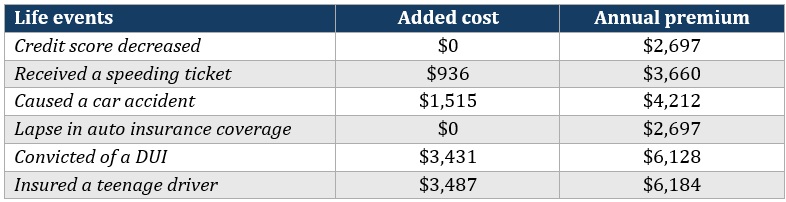

New York is the least forgiving state to drivers with bad credit. Having a poor credit score can add almost $4,200 to full car insurance coverage. This can raise premiums to almost $8,000, almost double those for motorists with good credit. The portion of income New Yorkers allocate for auto premiums dropped by 0.22%. Still, the state has the fifth highest true cost of car insurance.

3. Louisiana

Average annual full-coverage car insurance: $3,618

Percentage of income spent on car insurance: 6.53%

Percentage difference from national average: 3.12%

Most expensive states for car insurance – Louisiana factors affecting insurance premiums

Louisiana comes in third on our list of the most expensive states for car insurance. Drivers there, however, rank first when it comes to the percentage of income spent on auto coverage. Louisiana motorists set aside about 7% of their income to pay for premiums, almost 2% more compared to last year. The Bayou State is also prone to extreme weather, leading to many insurance claims.

4. Nevada

Average annual full-coverage car insurance: $3,549

Percentage of income spent on car insurance: 4.91%

Percentage difference from national average: 1.50%

Photo alt text: Most expensive states for car insurance – Nevada factors affecting insurance premiums

Nevada ranks fourth both in auto premiums and the portion of income drivers spend on car insurance. The state is also among the top five states with the highest increase in full coverage car insurance cost. It joins Florida, Michigan, Missouri, and Colorado on the list. Nevada’s relaxed alcohol laws and the high number of Las Vegas partygoers drive up auto insurance costs.

5. Michigan

Average annual full-coverage car insurance: $3,356

Percentage of income spent on car insurance: 5.01%

Percentage difference from national average: 1.60%

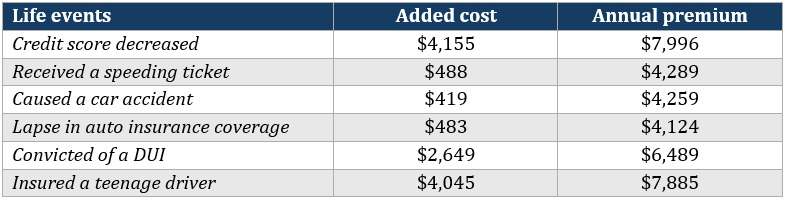

Most expensive states for car insurance – Michigan factors affecting insurance premiums

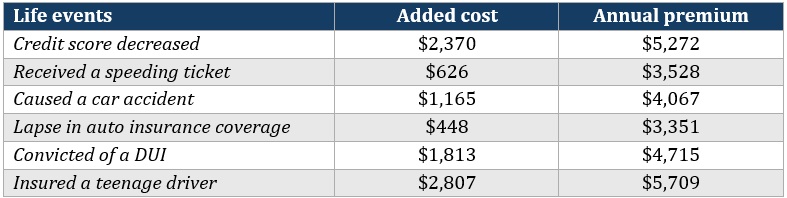

Michigan residents experience the biggest jump in premiums following an at-fault accident at around $1,706. They also receive the highest rate hikes after adding a 16-year-old driver to their policy at almost $4,690.

Michigan prohibits the use of credit-based insurance scores to determine insurance premiums. Car insurers, however, can use information that contributes to the credit rating.

6. Colorado

Average annual full-coverage car insurance: $2,902

Percentage of income spent on car insurance: 3.25%

Percentage difference from national average: -0.16%

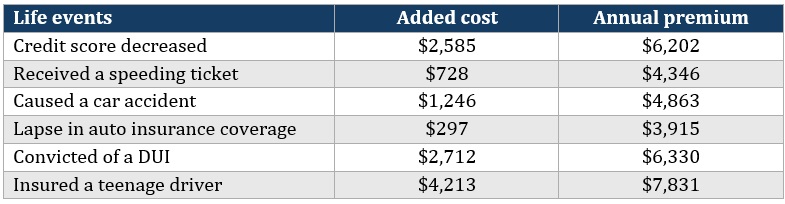

Most expensive states for car insurance – Colorado factors affecting insurance premiums

Colorado ranks among the most expensive states for auto insurance. The portion of income resident drivers spend on car coverage is slightly below the national average. Colorado is expected to register among the highest increase in car insurance rates this year. The state’s densely populated cities make it more prone to vehicular accidents, driving up auto premiums.

7. Missouri

Average annual full-coverage car insurance: $2,801

Percentage of income spent on car insurance: 4.32%

Percentage difference from national average: 0.91%

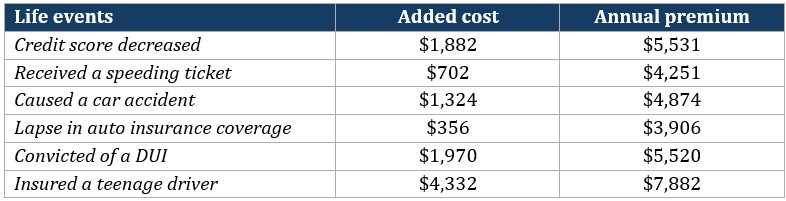

Most expensive states for car insurance – Missouri factors affecting insurance premiums

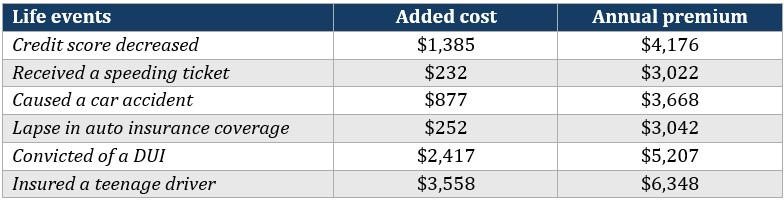

Missouri registered the largest increase in average auto insurance cost among all states. Annual full coverage car insurance premiums rose 44% from $1,943 in 2023 to $2,801 this year. Missouri ranks sixth when it comes to true cost, with motorists spending more than 4% of their income on auto coverage.

8. Pennsylvania

Average annual full-coverage car insurance: $2,790

Percentage of income spent on car insurance: 3.89%

Percentage difference from national average: 0.48%

Most expensive states for car insurance – Pennsylvania factors affecting insurance premiums

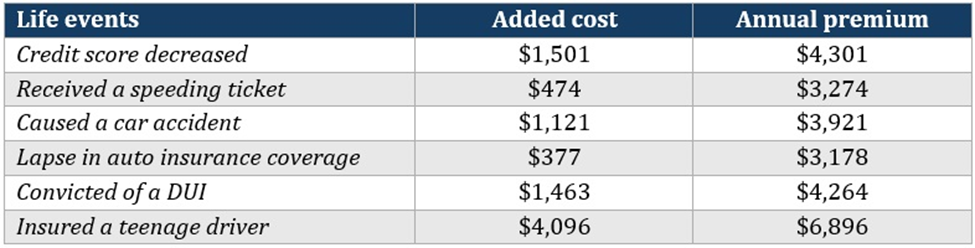

Pennsylvania is one of the states with the highest auto insurance primarily because of its no-fault state laws and large driving population. Philadelphia ranks among the top five metro areas registering the highest jump in premiums. Between 2023 and 2024, annual full coverage car insurance rates in the city increased from $3,938 to $4,753.

9. California

Average annual full-coverage car insurance: $2,697

Percentage of income spent on car insurance: 2.95%

Percentage difference from national average: -0.46%

Most expensive states for car insurance – California factors affecting insurance premiums

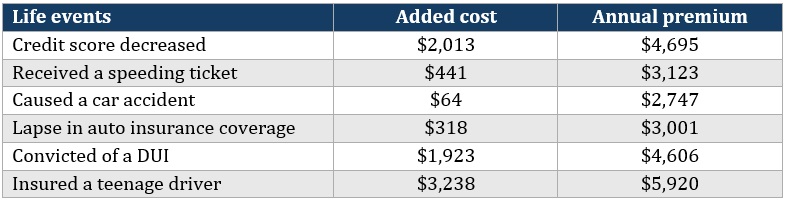

California has one of the most expensive car insurance premiums in the country largely due to weather-related risks. It also prohibits the use of credit scores in insurance pricing. Drivers in the Golden State see the largest average increase following an at-fault accident at 56%. The state, however, ranked 27th overall when it comes to the true cost of car insurance. This means that residents there spend the least of their incomes on auto coverage compared to their counterparts on our top 10 list.

10. Rhode Island

Average annual full-coverage car insurance: $2,683

Percentage of income spent on car insurance: 3.28%

Percentage difference from national average: -0.13%

Most expensive states for car insurance – Rhode Island factors affecting insurance premiums

Rhode Island’s large urban population and high repair costs make it among the most expensive states for car insurance. The portion of income that drivers spend on auto coverage is slightly below the national average. The state ranks 31st on Bankrate’s true cost of car insurance rankings.

If you’re searching for a policy that fits your budget and coverage needs, this car insurance checklist can help.

Car insurance companies use different metrics to determine how much risk a driver poses to them. Here are some common factors auto insurers consider when calculating premiums.

Residence: Drivers living in safer areas will likely pay cheaper premiums than those who reside in areas prone to extreme weather, vehicular accidents, and car theft.

Age: Because age is linked to driving experience and accident risk, young drivers typically pay the most expensive car insurance rates. This guide to cheap car insurance for new drivers can help you find a good deal.

Gender: Male drivers are statistically more likely to get involved in accidents than female motorists. This is why men pay higher premiums.

Driving record: A poor driving record shows that you’re more likely to file a claim in the future. Because of this, at-fault accidents can drive up rates significantly.

Mileage: The less you drive, the lower the likelihood that you will get into an accident. This helps lower your car insurance premiums.

Vehicle type: How much your car costs, how expensive it is to repair, and how prone it is to theft are among the factors that affect your car insurance rates.

Credit rating: Most states allow the use of credit-based insurance scores to determine car premiums. Insurers believe that drivers with poor credit tend to file more claims than those with solid credit scores. This raises the premiums they need to pay.

Level of coverage: Minimum coverage policies require lower premiums than full coverage plans but offer limited protection.

Find out the different types of car insurance policies you can purchase in the US in this guide.

Car insurance is one of the biggest costs associated with owning and operating a vehicle. When it comes to purchasing a policy, it can be tempting to go with the cheapest option. But there’s a catch: you risk losing more, especially if the level of protection these cheaper policies provide is inadequate.

To get the most out of your car insurance, you need to understand the different options available and the quality of coverage these policies offer. One way to do this is by keeping up to date with the latest trends. Visit and bookmark our Motor & Fleet News Section so you don’t get left out of the latest industry developments.

Do you live in one of the most expensive states for car insurance? What do you do to keep your car insurance costs manageable? Feel free to share your thoughts below.

Keep up with the latest news and events

Join our mailing list, it’s free!