The top 10 cheapest car insurance companies – Revealed

The top 10 cheapest car insurance companies – Revealed | Insurance Business America

Guides

The top 10 cheapest car insurance companies – Revealed

Insurance Business reveals the top 10 cheapest car insurance companies for each age group. Find out if your insurer is one of them

Car insurance is a highly individualized form of coverage. Because each motorist comes with a unique profile and personal circumstances, there also isn’t one carrier that’s the low-price leader for everyone. An auto insurer that offers the cheapest policy for one driver might be the most expensive option for another.

And because of the different variables involved, it is likewise difficult to put up a single list of the top 10 cheapest car insurance companies that fit every demographic.

To cover more ground, Insurance Business crunches the numbers from various price comparison and insurer websites to identify which auto insurers offer the lowest rates in different age groups.

We also factored in gender, which is used in insurance pricing in most states. Read on and find out which insurers provide the least expensive auto policies in this guide.

The tables below show the top 10 cheapest car insurance companies for two age groups:

A 17-year-old new driver listed on their parent’s policy

A 25-year-old single motorist with a clean record

Cheapest car insurance companies for parents with 17-year-old named driver

Rank

Insurer

Average annual cost of 17-year-old female

Average annual cost of 17-year-old male

1

USAA

$3,060

$3,310

2

Erie

$3,125

$3,450

3

GEICO

$3,170

$3,555

4

State Farm

$3,235

$3,960

5

American Family

$3,620

$3,970

6

Auto-Owners

$4,160

$4,565

7

Travelers

$4,330

$5,330

8

Nationwide

$4,410

$5,355

9

Progressive

$5,080

$5,570

10

Allstate

$6,600

$7,450

Cheapest car insurance companies for 25-year-old single driver with a clean record

Rank

Insurer

Average annual cost of 25-year-old female

Average annual cost of 25-year-old male

1

USAA

$1,220

$1,280

2

GEICO

$1,350

$1,360

3

Erie

$1,370

$1,380

4

State Farm

$1,380

$1,510

5

Travelers

$1,455

$1,515

6

Auto-Owners

$1,590

$1,660

7

American Family

$1,620

$1,665

8

Nationwide

$1,730

$1,850

9

Progressive

$1,885

$1,930

10

AAA

$2,200

$2,450

Young drivers pay the most expensive rates because they also have the highest likelihood of getting involved in accidents. But as they gain more experience on the road, their premiums typically go down.

As regards gender, women generally pay less than men. Statistically, female drivers are less prone to accidents. This gender disparity is more pronounced among young and inexperienced motorists.

The premiums you pay for your auto policy begin to drop as you reach adulthood. As you may have noticed from the tables above, there’s a significant reduction in the average annual rates from the top 10 cheapest car insurance companies for 25-year-old drivers compared to those for their 17-year-old counterparts. After the age of 25, your rates will only get cheaper as long as you maintain a clean driving record.

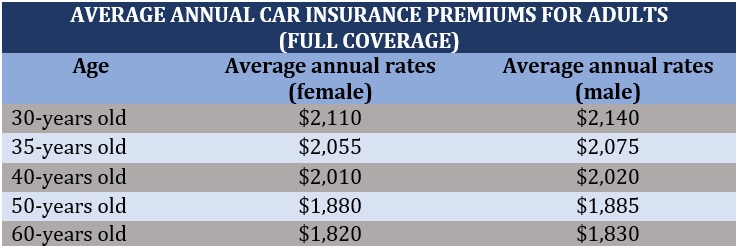

The table below shows how car insurance premiums drop as a motorist gets older.

Now, here are the top 10 cheapest car insurance companies for a 30-year-old driver.

Top 10 cheapest car insurance companies for 30-year-old driver with a clean record

Rank

Insurer

Average annual cost of 30-year-old female

Average annual cost of 30-year-old male

1

USAA

$1,150

$1,160

2

GEICO

$1,305

$1,310

3

Erie

$1,365

$1,375

4

Auto-Owners

$1,370

$1,380

5

Nationwide

$1,405

$1,415

6

State Farm

$1,500

$1,515

7

American Family

$1,665

$1,680

8

Travelers

$1,690

$1,695

9

Progressive

$1,770

$1,785

10

Allstate

$2,140

$2,180

You can find out how much coverage costs for the 10 largest auto insurers in the country in our latest car insurance comparison.

Car insurance premiums are usually the cheapest for 60-year-old motorists, although the rates slightly go up again as a driver reaches a more senior age. The tables below show the average annual premiums for senior drivers from the top 10 cheapest car insurance companies.

Cheapest car insurance companies for 60-year-old driver with a clean record

Rank

Insurer

Average annual cost of 60-year-old female

Average annual cost of 60-year-old male

1

USAA

$1,058

$1,060

2

GEICO

$1,220

$1,225

3

Erie

$1,230

$1,235

4

Auto-Owners

$1,236

$1,240

5

Nationwide

$1,262

$1,265

6

State Farm

$1,350

$1,355

7

American Family

$1,365

$1,370

8

Travelers

$1,390

$1,395

9

Progressive

$1,562

$1,565

10

Allstate

$1,975

$1,980

Cheapest car insurance companies for 75-year-old driver with a clean record

Rank

Insurer

Average annual cost of 60-year-old female

Average annual cost of 60-year-old male

1

USAA

$1,255

$1,260

2

Erie

$1,360

$1,375

3

Auto-Owners

$1,275

$1,385

4

GEICO

$1,445

$1,460

5

Nationwide

$1,465

$1,480

6

State Farm

$1,505

$1,520

7

American Family

$1,650

$1,665

8

Travelers

$1,685

$1,695

9

Progressive

$1,850

$1,870

10

Allstate

$1,990

$2,005

It’s important to note that the figures in the tables above are just estimates. The actual price you pay for coverage may be significantly higher or lower, depending on your personal circumstances.

A driver’s age is one of the biggest factors that impact car insurance premiums as this often correlates with driving experience. In general, the younger you are, the higher the likelihood of you getting involved in a vehicular accident.

This is the reason why teens have the highest car insurance rates. Considered the riskiest age group to insure, motorists aged 16 to 19 years old are almost three times more likely to get into fatal car accidents per mile driven than their older counterparts. This is despite teen drivers making up just 4% of the entire driving population in the US. These figures are from the latest fatality facts data from the Insurance Institute for Highway Safety (IIHS).

The report also reveals that male drivers account for more than two-thirds, or 68%, of the overall teen crash fatality rate.

Your car insurance premium starts to drop once you reach 25 years old. The rates will typically go down further as you get older if keep a clean driving record, and in most states, maintain a good credit rating.

This will continue until you reach senior age when your premiums begin to gradually increase again. This is primarily due to age-related impairments rather than your driving behavior.

If you want to get cheaper rates regardless of your age, one of the quickest ways is to buy your policies online. Our online car insurance guide provides a step-by-step breakdown of what you need to do if you choose to go this route.

Gender is another factor that most car insurance companies consider when determining premiums. Women generally pay less than men as statistics show that female drivers are less prone to accidents.

This gender disparity is more pronounced among young and inexperienced motorists. The difference, however, closes once drivers reach a certain age as our tables above reveal. From that point on, male and female motorists are more or less on equal footing.

The practice of using gender as a basis for insurance pricing, however, is prohibited in certain states. These are:

Age and gender are just two of the many factors that car insurance companies consider when calculating premiums. Here are some of the other factors that play a huge role in determining how much premiums you need to pay.

Driving record: A poor driving record shows that you’re more likely to file a claim in the future. This drives up insurance costs. If you were involved in an at-fault accident, this could significantly increase your premiums.

Address: Where you live also has a huge effect on your auto insurance rates. If you reside in a safe area where theft and accidents are rare occurrences, this can help lower your rates. Check out the cheapest and most expensive states for car insurance to find out more.

Vehicle type: How much your ride costs, how expensive it is to repair, and how powerful its engine is all have a major impact on your premiums. The same goes for the safety features installed and how attractive your car is to thieves. Read our guide on which cars are the cheapest to insure to learn more.

Credit rating: Insurers view drivers with a good credit history as less likely to file claims than those with lower credit scores. Not all states, however, use credit-based insurance scores to calculate premiums. Find out how your credit rating impacts your rates in this guide to auto insurance scores.

Mileage: The less you drive, the lesser the risk of getting into an accident. This also decreases your car insurance premiums.

Level of coverage: Each state imposes its own minimum legal requirements for a person to operate a vehicle. Minimum coverage policies have cheaper premiums compared to full coverage plans, but these also offer limited protection.

Shopping around and comparing quotes are among the simplest and most effective ways to access cheaper rates and get the best value for your money. But you need to understand what to look for. Here are some of the factors to consider in finding the best deal:

Minimum coverage requirements: Make sure that the policies you buy comply with the minimum mandatory coverages in your state. You can do this by checking your state’s insurance commissioner’s or motor vehicle department’s websites.

Discount options: Most car insurance companies offer discounts that allow you to save on premiums. Insurers typically slash rates if you bundle policies together, insure multiple vehicles, and maintain a claims-free record.

Coverage limits and deductibles: Your coverage limits must be enough to protect you financially when accidents occur. Your deductible amount, meanwhile, should be at a level that you can afford to pay.

Company reputation: Established car insurance companies have the financial means to pay for your claims, but local carriers may be able to provide more personalized coverage. Your choice should depend on which one can offer coverage that meets your unique needs.

Getting the best coverage often starts with shopping around and comparing quotes. You can check out our guide to finding the best car insurance quotes to learn how to maximize these steps.

Auto insurance is one of the biggest costs associated with owning and operating a vehicle. For this reason, it can be tempting to go with an insurer that offers the least expensive option. But there’s a risk: policies from the cheapest car insurance companies may not always provide sufficient protection.

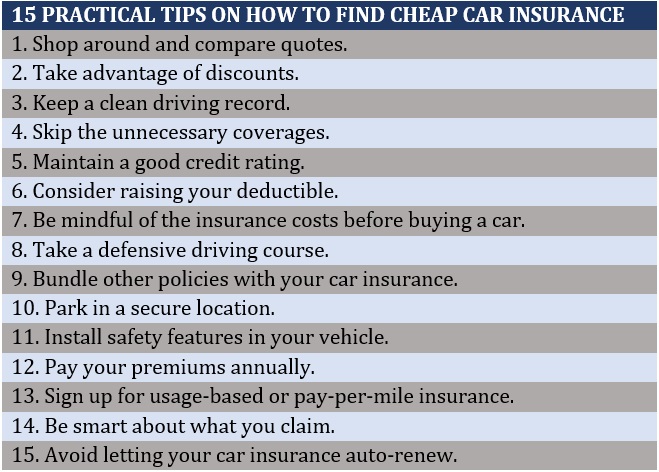

To get the most out of your car insurance, you need to understand the different options available and the quality of coverage these policies offer. The table below lists several practical tips and strategies that can enable you to access lower premiums without sacrificing coverage.

Have you experienced working with the top 10 cheapest car insurance companies on our list? Would you recommend them to your fellow drivers? Share your thoughts in the comments section below.

Related Stories

Keep up with the latest news and events

Join our mailing list, it’s free!