The Pharmacy Benefit Managers (PBMs) Unveiled: Your Guide to Understanding Prescription Drug Costs

Navigating the healthcare system can sometimes feel like solving a puzzle, especially when figuring out who sets the price of your medications. One key part of this puzzle involves Pharmacy Benefit Managers, also known as PBMs. They have a big but often overlooked role. Let’s look at what they do, specifically focusing on the three main companies. Then, we’ll explore how they handle the finances of a $300 brand medication.

The Multifaceted Role of PBMs

PBMs are essential intermediaries connecting health plans, pharmacies, and patients. Their key functions include:

Negotiating Drug Prices: Bargaining with drug manufacturers to reduce medication costs.

Managing Formularies: Deciding which drugs are covered under health plans and their reimbursement levels.

Processing Claims: Handling the logistics and payment for each prescription filled, directly affecting out-of-pocket costs.

Through these activities, PBMs significantly influence the affordability and accessibility of medications.

How PBMs Generate Revenue

The revenue models of PBMs are diverse and include:

Spread Pricing: Charging health plans more for drugs than the reimbursement rate given to pharmacies.

Pass-Through Pricing: The actual cost paid to pharmacies, plus a service fee, is charged to the health plan.

Rebate Strategies: Securing rebates from drug manufacturers for favorable placement on formulary lists, impacting drug promotion and patient costs.

The Dominance of the Big Three

The prominence of three major players marks the PBM landscape:

CVS Health (Caremark)

Express Scripts (Part of Cigna)

OptumRx (Under UnitedHealth Group)

In 2023, these giants managed a staggering 79% of all prescription claims, showcasing their considerable influence over drug pricing and availability across the United States.

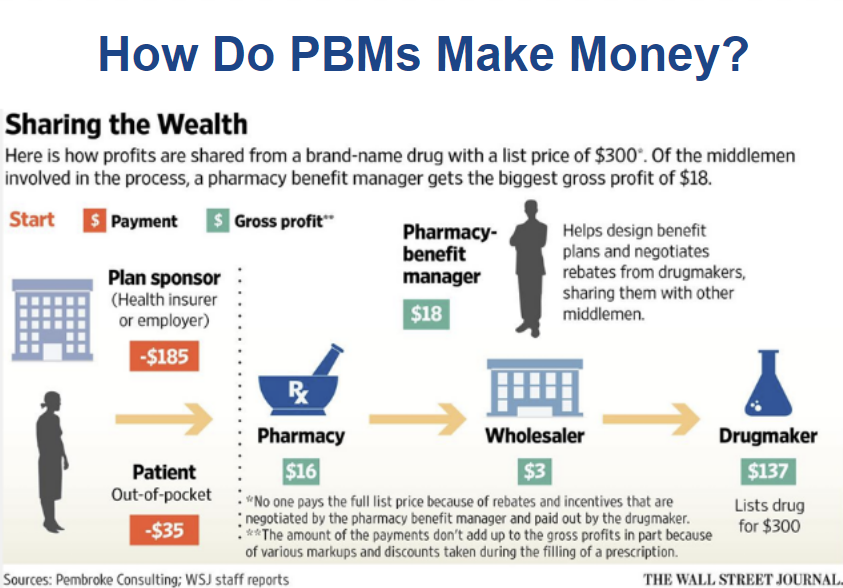

Breaking Down a $300 Brand Drug (Source Wall Street Journal)

To understand how costs are distributed for a $300 brand-name drug:

Plan/Insurer Pays: $185

Patient Copay Pays : $35

Manufacturer’s Earns: $137

Wholesaler’s Share Earns: $3

Pharmacy’s Fee earns $16

PBM’s Earnings: $18

Open Balance $ 46 gets spread by PBM

This leaves us pondering the remainder, often wrapped up in intricate rebate agreements and pricing strategies that are not immediately evident.

Looking Ahead

As the healthcare sector evolves, so does the role of PBMs. With ongoing debates about transparency and the fairness of drug pricing, grasping how PBMs operate is more critical than ever for informed healthcare decisions.

Takeaway

Understanding the substantial role PBMs play in effectively managing the healthcare system and advocating for affordable medication is crucial. Moreover, it is paramount to recognize the concentrated power of the big three PBMs and their influence on prescription drug pricing.

The cost of prescription medication remains a significant concern. Consider the cost-plus pharmacy model, where pharmacies sell medications without insurance, charging customers only the medication cost plus a fixed fee, like $10. For instance, pharmacies sell imatinib, a cancer drug, for $17, while Medicare pays $2,400. This vast difference sheds light on the influence of pharmacy benefit managers (PBMs), who often inflate prices for their gain through a commission-based model. Filling all imatinib prescriptions at these pharmacies could save $596 million. This emphasizes the importance of consumer vigilance and the need for fair pricing practices to ensure affordability and accessibility for all.

Feel free to reach out to us at Solid Health Insurance Services. We can provide you with a personalized quote and discuss the health care and prescription plan options available to you in California. You can contact us at 310-909-6135 or email us at info@solidhealthinsurance.com. Stay informed and proactive about your healthcare choices!