The most straight forward and entertaining guide to Careshield Life for Dummies [Full Money Back Guarantee Included]

![The most straight forward and entertaining guide to Careshield Life for Dummies [Full Money Back Guarantee Included]](https://www.cheapsr22.us/wp-content/uploads/2022/02/1644444121_The-most-straight-forward-and-entertaining-guide-to-Careshield-Life.png)

What in the world is going on?

As we age, there is a significant chance of us getting severely disabled. The causes could be from illnesses, accidents, or simply old age.

So our bffs from the Ministry of Health have come up with a mandatory long-term care insurance scheme called Careshield Life, and it provides basic financial support to those that are severely disabled.

(We call him Ganny, as a term of endearment)

Careshield Life is an upgrade to its predecessor, Eldershield. (For one it sounds a lot better, cos no one wants to admit they are elderly and aging. Smart move, MOH)

What is Careshield Life?

A compulsory policy that pays you cash each month if you qualify (ie. become severely disabled). We cover that requirement later.

What is Eldershield?

An older, but also a compulsory policy that pays you cash each month if you qualify (ie. become severely disabled). It is being phased out by Careshield Life.

How exactly do they work?

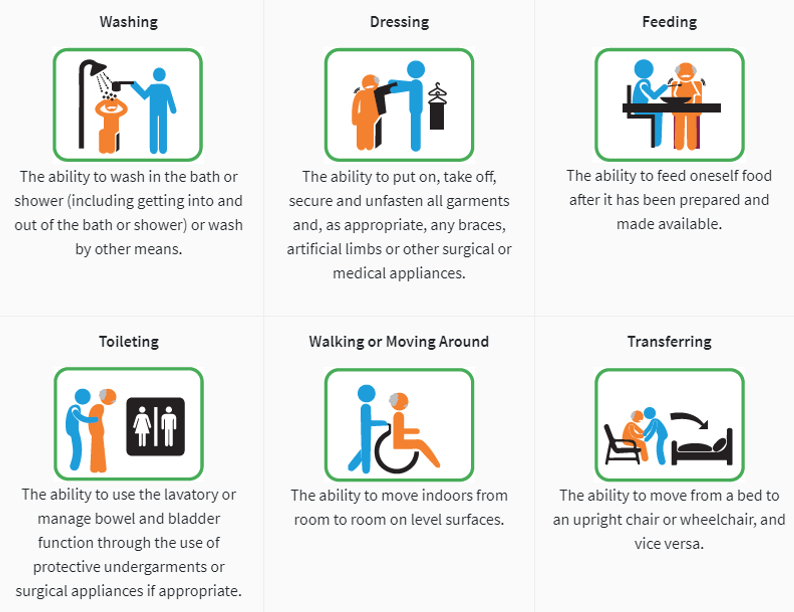

There are 6 Activities of Daily Living (ADLs) that are prescribed:

The stuff you could do since 6 might be a challenge at 60. Source: MOH

In order to qualify as severely disabled, you must be proven to be unable to perform at least 3 out of the 6 ADLs.

Once you are proven to be severely disabled, you then receive monthly payouts under each respective scheme.

How is Careshield Life an improvement over Eldershield?

Lets take a quick trip back in time to see the evolution of these 2 schemes.

The year is 2002. Back when Christina Aguilera was still a “thing”, MJ dangled his 9 month old baby out the window, and Lord of the Rings released its 2nd movie, The Two Towers.

This scene still brings back the chills. Everytime

MOH first unveils Eldershield, with a payout of $300 per month for up to 5 years upon severe disability (the ADLs remain unchanged)

In 2007, someone received a memo about 300 bucks being kinda “not enough leh”, and the MOH bois upgraded the Eldershield payout to a whopping 400 bucks a month instead, for a maximum period of 6 years.

Fast forward to 2020, where Careshield Life has replaced its Eldershield predecessor, giving a monthly payout of $600, but it is set to increase yearly (2% for now, till 2025). And you can receive a payout for life, instead of only 5 or 6 years.

So how am I affected?

It depends on your year of birth.

If you were born after 1990: you will be automatically covered before you reach 30 years old, regardless of pre-existing illnesses or disabilities (that’s nice)

If you were born between 1980 to 1990: you will be covered automatically after 1st Oct 2020 or when you turn 30, whichever is later. (I fall within this category, FYI) Again, everyone is covered regardless of pre-existing illnesses or disabilities.

If you were born between 1970 and 1979: you will be automatically enrolled into Careshield Life from end of 2021. Provided you are already insured under ElderShield. But you can opt out by 31st Dec 2023, if you decide that ElderShield 400 is good enough for you.

If you were born in 1979 or earlier: Participation is optional, and applications to join Careshield Life will be open from end 2021 onwards, provided you are not already severely disabled.

Wow, this is not quite applicable to me yet. I was born after 2000.

Congrats, you young punk. Wait your turn, and you will get old enough eventually. If you should be so lucky.

Even she will qualify someday

What are the costs?

It depends on your age and existing conditions, but personally speaking, my Annual Premium before subsidies is $272. After applying all subsidies, it is $120.40, fully payable by Medisave. (I am a 38-year-old extremely healthy male)

You can check out your premiums using this link.

What are the benefits?

1. It is compulsory – I consider this a plus point because taking action can be the hardest thing to do sometimes.

2. $600 a month (and increasingly more) per month for people that are severely disabled can go a long way to defraying costs of long-term health care.

3. Life Long payments. Enough said

4. Affordable premiums. Speaking personally at this point in time, the premiums look quite low. They might increase in the future, but let’s see.

Is it enough protection for me?

I do not possess a Financial Advisory License, so I cannot advise you on the adequacy of this plan, insofar as long term care needs are concerned.

What I do possess are:

many years in the finance and insurance industry, in almost every function (from product management to agency management to sales management)

a Masters degree in Financial Engineering (it means I can at least do maths stuff); and

fucking common sense.

So while I cannot legally advise you on this plan’s suitability, I can tell you that I am upgrading this plan, pronto.

Because $600 a month works out to be 20 dollars a day.

What else can I do?

As aforementioned, I can’t advise you on what to do, but I sure as hell can tell you what I am going to do.

There are 3 private insurers that offer upgrades to the Careshield Life Plan:

Aviva, NTUC Income, and Great Eastern.

I will be evaluating their pros and cons and then choosing one insurer to upgrade my plan with. They either provide less stringent disability requirements (only 2 out of 6 ADLs need to be met), or higher payouts, or other incidental benefits.

PS. If you need a recommendation, I suggest you complete our Financial Discovery Journey by signing up for an account here. You will get a gift pack upon completion, and get gems that can be converted to cash upon any purchase of policies via our agent partners. Its a win-win-win.

(Our agent partners will be able to advise on the upgrade should you desire it, since they are legally allowed to do so)

That’s all for this dummies guide – remember to share this with your friends as a way of helping us out!

www.ClearlySurely.com is a refreshing new way to approach Life Insurance – with humour and fun, bound together by imagination.

Our Financial Discovery Platform provides hours of entertainment while providing an overall view of your insurance adequacy.

If you’re curious about how we can make a dry subject nearly as wholesome as Keanu Reeves, join our community today.

We have been eradicating the knowledge gap between consumers and Life Insurance since 2015, and have a vision that one day, every Man, Woman, and Child will be properly insured.