The Exeter Health Insurance Review (Our Rating Is 4.6/5)

The Exeter is a Friendly Society which means that it is owned by its members (customers) rather than shareholders. While it’s still a profit-making business, they don’t pay dividends and instead reinvests money into improving the quality of policies, paying claims, maintaining affordable prices and ensuring its customer service is the best it can be.

“Our measure of success is paying claims”

The Exeter website

The Exeter Health+ Review

The Exeter Health+ is their market-leading private health insurance. It boasts excellent core cover and plenty of flexibility to adapt your plan to fit your requirements. In this part of our guide, we’ll dig into what Health+ offers and explain what stands out against others in the private medical insurance market.

Benefits of The Exeter Health Insurance

Before getting into the finer detail of The Exeter’s health insurance policy Health+, we want to outline some of their policies’ primary benefits (please note that some are universal to all health insurance providers).

Receive medical treatment sooner and avoid NHS waiting listsExcellent core cover, which includes outpatient surgery (rare)Extensive cancer cover included in the core coverAccess to drugs and treatments not routinely available on the NHSOwned by its members, which promotes reinvestment and policy improvementHigh levels of customer satisfactionOne of the best insurers for paying claimsA choice between a protectable no claims discount or a community-rated schemeFlexible policies which can be easily expanded to meet your requirementsOnly provider to offer a community-rated scheme to people between 70 and 805* Defaqto ratingUnrestricted consultant accessThe standard hospital list is extensive, only excluding high-end hospitals

A choice between a No Claims Discount or a Community-Rated Scheme

One of the biggest differentiators between The Exeter and other health insurance providers is that they offer you a choice between either a traditional “Protected No Claims Discount” or a “Community Rated Scheme”. Most other insurers off one of these, but very few the choice between the two. Which is best for you is something for discussion with your health insurance broker, but it’s great to have the option. Here is a quick summary of what you can expect with both of these from The Exeter.

No Claims Discount

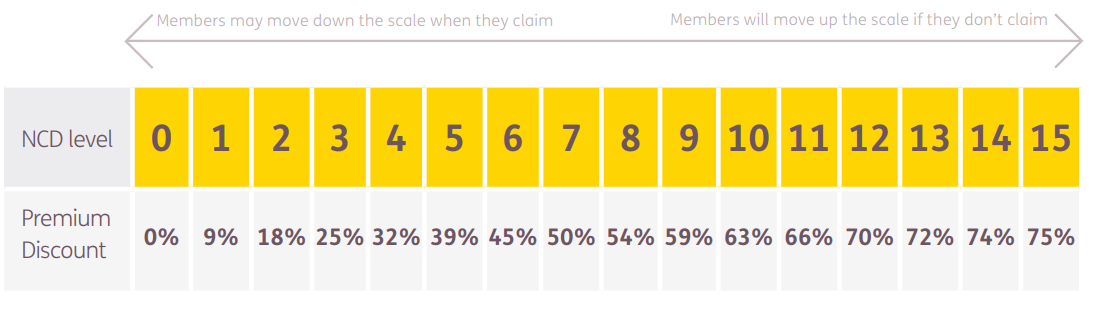

The Exeter aims to provide a fair approach to No Claims Discounts and clearly outlines how it works in their policy documentation. Every year that you don’t claim, you’ll move up on a scale of 15 levels and be rewarded with a bigger discount (maximum 75%), as shown on the scale below.

Source: The Exeter Health+ Product Guide

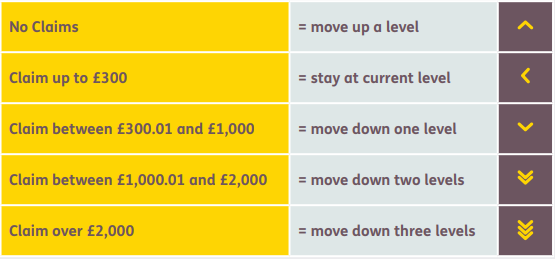

If you do make a claim, you’ll move down the scale based on the size of it, however, you’ll only ever move down a maximum of three levels in a policy year, and if you don’t claim, you’ll start to move back up.

Source: The Exeter Health+ Product Guide

Community rated scheme

As we mentioned earlier, you can opt to have a community-rated scheme rather than a traditional No Claims Discount. A community-rated scheme is where your claims don’t directly impact your premiums. Instead, the wider claims of all of their members set the price. While not for everyone and not always cheaper than a no claims discount, if you feel that you’re at a higher risk of claiming on your private health insurance, it can be an excellent option to minimise premium increases.

Disadvantages of The Exeter Health Insurance

For the sake of balance, we want to point out the disadvantages of The Exeter Health Insurance, of which there are only a couple.

No option to include dental coverNo option to include travel cover

Health+ Core Cover

All Health+ policies are based on an excellent level of Core Cover, which, unlike most others, includes some outpatient treatment (surgery only). Here is a summary of what you can expect from their base product:

Unlimited inpatient and day-patient treatment – The Exeter has no limits on treatments where you are admitted to hospital for a day or overnight. Includes all specialist fees, diagnostic and pre-admission tests and hospital charges.Outpatient surgery – it is rare for health insurance providers to include outpatient cover in their base product, but The Exeter does. While it’s only surgical procedures they cover, it’s still more than others provide.Excellent cancer cover – cancer is a significant worry for many of us, so The Exeter priorities it in their Core Cover. They provide you with cover for all stages of cancer and access to the latest treatments and drugs.Post-operative physiotherapy – after surgery, people often need some recovery support, which is why The Exeter includes up to 3 post-op physiotherapy sessions following surgery.NHS cash benefit – if you receive inpatient treatment via the NHS rather than via your health insurance policy, The Exeter will pay out £150 per night for a maximum of 30 nights (assumes the treatment is covered under the policy terms).Home nursing – If you need nursing after you leave hospital following inpatient or day-patient treatment, it’s covered by your Health+ policy

Cancer cover

As for many people, cancer cover is an essential component of their health insurance; we want to focus on precisely what The Exeter includes in its core policy.

Full Cover

All of the following are covered in full with The Exeter’s core health insurance policy:

Cancer treatment at any hospital on your hospital list and the option for chemotherapy to be administered at home.Any specialist consultations, tests and scans after the cancer has been diagnosed. (If you would like your diagnosis to occur privately, you will need to opt for their outpatient cover.)Surgery, including the removal of a tumour and any reconstructive surgery.All types of drug therapy for cancer have received NICE approval.Radiotherapy along with radiotherapy for pain relief.Palliative treatment aimed at controlling cancer symptoms rather than curing them.Stem cell or bone marrow treatments provided they are not experimental.Hormone therapy during cancer treatment.Care of terminal cancer at any hospital on your hospital list while awaiting admission to a hospice.

No Cover

Preventative screening, treatment or vaccines.

What’s not covered by the Core Cover?

Much like all of the UK’s health insurers, The Exeter won’t cover certain things and has a list of standard exclusions. While not an exhaustive list (you can refer to the policy documentation for more information), here are the main exclusions.

Chronic conditions, including diseases such as diabetes, asthma and multiple sclerosisAlcohol, drug or substance misuseCosmetic and plastic surgery (unless it is to restore appearance after cancer treatment)Self-inflicted injuriesEmergency treatmentExperimental treatmentLearning disordersMajor organ transplants (some transplants related to cancer are covered)Mental and psychological treatment (available as an additional add-on)Pre-existing conditionsPregnancy and fertility treatmentProfessional sports injuriesPreventative screeningsSelf-elected treatmentsSight, hearing or dental disordersGP treatmentsTreatment overseas

“I recently got a family health insurance policy through myTribe and the service was excellent from start to finish. The adviser that I spoke to was very patient and took time to explain all of the intricacies to me so that I felt confident and informed when making a decision. The fact that they compare the market for you makes the process really quick and easy and I think I came away with not only the best policy for me but a much better understanding of how private health insurance works.”

“I recently got a family health insurance policy through myTribe and the service was excellent from start to finish. The adviser that I spoke to was very patient and took time to explain all of the intricacies to me so that I felt confident and informed when making a decision. The fact that they compare the market for you makes the process really quick and easy and I think I came away with not only the best policy for me but a much better understanding of how private health insurance works.”

by Chris Stratton – 12th May 2022

Compare Policies

Additional options (Benefit add-ons)

Many people will look to enhance their cover by adding one or more policy extras, with outpatient cover and therapy cover (physiotherapy, for example) being among the most sought after. Here is an overview of the additional options you can choose from to tailor your policy.

Outpatient cover

While The Exeter’s Core Cover includes outpatient surgery, you will need to be diagnosed via the NHS before seeking private treatment unless you opt for their Outpatient cover. The Exeter gives you several options in this respect to balance the amount of cover you would like against your budget. You can choose from:

Unlimited outpatient coverUp to £1,000 per policy yearUp to £500 per policy yearNo cover

Outpatient cover includes specialist consultation fees and diagnostic tests such as x-rays and ECGs, and pathology tests at any private hospital on your hospital list.

Unlimited outpatient diagnostics

Any outpatient diagnostic tests won’t be deducted from your outpatient benefit limit by taking this option. If you opt for £500 in outpatient cover and unlimited outpatient diagnostics, only specialist consultation fees and treatments will be taken from that limit.

Therapies cover

The Exeter gives you the same monetary options as their outpatient cover for alternative therapies (Unlimited, £1,000 and £500 per policy year, and no cover). All of the following GP or specialist referred treatments are included:

PhysiotherapyChiropracticOsteopathyPodiatrySpeech therapyPain clinicsDietary (max two consultations per year per policy member)

Mental health cover

The Exeter’s optional mental health cover gives you unlimited outpatient psychiatric, psychological, and cognitive behavioural treatments, with inpatient and day-patient treatment limited to 28 days.

Health insurance underwriting

We’re not going to spend too much time explaining the intricacies of health insurance underwriting in this review, but we will highlight the options afforded to you. The Exeter gives you four options to choose from concerning policy underwriting. We suggest discussing which is best for you with your health insurance broker or The Exeter directly.

1. Full medical underwriting

This is usually a good fit for those with a complex medical history to ensure some clarity on what is and what isn’t covered. You’ll provide your medical records to The Exeter, and then any exclusions will be shown on your policy certificate.

2. Standard moratorium

Usually, the fastest way to get a policy, moratorium underwriting, automatically excludes any pre-existing conditions you’ve suffered from in the five years leading up to taking out your policy. If you don’t experience any symptoms or need treatment for the pre-existing condition for two years after taking out your policy, the exclusion will be removed.

3. Continued personal medical exclusions

This type of underwriting allows you to switch insurers and maintain the exclusions you had with your prior insurer.

4. Continued moratorium

Continued moratorium underwriting allows you to switch health insurance providers without starting from scratch again. For example, if you are part way through your moratorium period with another insurer and have not suffered any recurrence of symptoms, be close to having it covered by your policy.

Customer satisfaction and reviews

As you might expect from a company owned by its customers, its overall customer satisfaction is among the best in the industry.

Trustpilot reviews

The Exeter collects customer reviews via Trustpilot, where it currently enjoys an overall rating of 4.6 out of 5 stars, based on 632 reviews.

Customers frequently praise them for how claims are handled and how professional and considerate they are, along with the fact they are prompt with communications and provide easy to read literature and letters.

Defaqto rating

The Exeter’s Health+ has scored the maximum 5-star rating from the independent rating provider Dafaqto for 2022. This rating is based on policy comprehensiveness rather than customer satisfaction. It demonstrates that The Exeter’s health insurance is among the best currently available.

Our independent review of The Exeter Health+ (4.6/5)

Based on policy comprehensiveness, a fair approach to claims, affordability and customer satisfaction, our health insurance experts have given The Exeter Health+ 4.6 out of 5. This puts them in the top three health insurers in the UK, making them a serious contender for those looking for a policy.

How much does The Exeter health insurance cost?

In February of 2022, we got quotes for The Exeter health insurance for ages in ten towns and cities across the UK. We opted for a policy with a traditional no claims discount. We set the policy excess at £250 and included £1,000 of outpatient and therapies cover. Please note that the prices below are averages of all of the locations we sampled across the UK. The cost of your policy will differ based on your postcode and many other factors.

Age

Average price

20-year-old

£33.06

30-year-old

£47.99

40-year-old

£58.05

50-year-old

£74.97

60-year-old

£115.89

70-year-old

£183.36

Conclusion

We sincerely hope that you found this review of The Exeter’s health insurance useful. It helps you understand the policies and options they offer. As we have explained, we believe that The Exeter is currently one of the best health insurance providers in the UK and, therefore, an excellent choice if you are looking for a policy. The fact that the company is owned by its customers and not shareholders is significant. It means that money can be invested into what matters most.

Why it always pays to compare health insurance

While The Exeter is undoubtedly one of the best providers you can choose for your health insurance, it won’t necessarily make them the best for your circumstances. Before deciding to take out a policy, we strongly recommend that you request a comparison quote via our website. A qualified financial adviser will review your requirements and provide you with a comparison quote and answer any questions you may have. The service we and health insurance broker

Frequently asked questions

How can I get a quote for a Health+ policy?

The two ways you can get a quote for The Exeter Health+ is by requesting a comparison quote via myTribe or by visiting The Exeter’s website.

What is health insurance?

Health insurance is protection policy that gives you access to private medical care in the UK when you need it.