The Economics of Generic Drugs

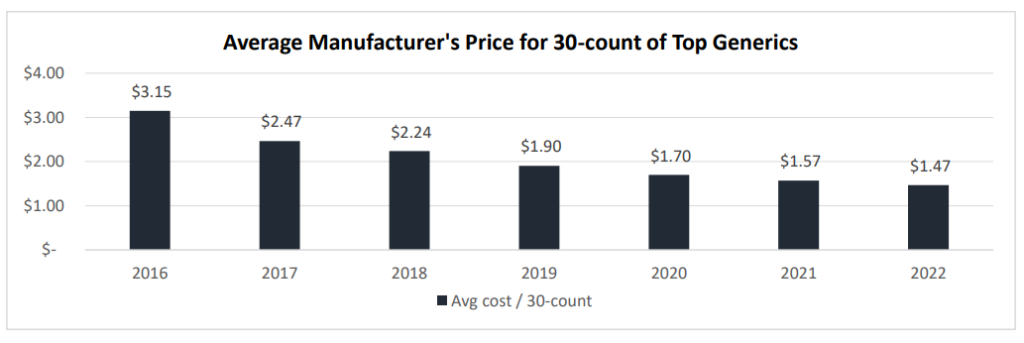

One piece of good news for consumers is that generic prices are falling. However, generic prices may be falling so much that drug shortages are occurring (which is not a good thing). Data from a working paper by Sardella (2023) finds a dramatic drop in generic prices in recent years.

The authors claim that shortages in generic drugs are caused by three primary reasons: (i) low profitability, (ii) low value for quality, and (iii) complex, global supply chains.

With no distinguishing product differentiation or quality tracking [e.g., reputation] in the industry to distinguish product quality differences, market competition in the generic drug industry, without market exclusivity, focuses on the dimension of price.

Price competition is especially intense because 3 large pharmacy benefit managers (PBMs) control 92% of the US market. Price competition has lead most generic drugs are manufactured outside the US. According to the FDA:

…as of August 2019, 72% of FDA-approved API manufacturing facilities were outside of the US. A recent 2021 deeper dive revealed that approximately 75% of COVID-19 related drugs, 97% of antibiotics, 92% of antivirals, and 83% of the top 100 generic drugs consumed have no US-based source of APIs

Foreign markets are attractive because of government subsidies, lower costs of labor, and less regulatory oversight. However, because quality is not reimbursed, there are some issues:

Greater than 80% of APIs for FDA-defined essential medicines and over 90% of top antibiotics and antivirals have no US manufacturing sourceLess than 5% of large-scale API sites, globally, are located in the US – the majority of large-scale manufacturing sites are in India and ChinaIndia and China have the greatest number of API facilities supplying the US market and over ten percent of these facilities have an FDA Warning Letter1

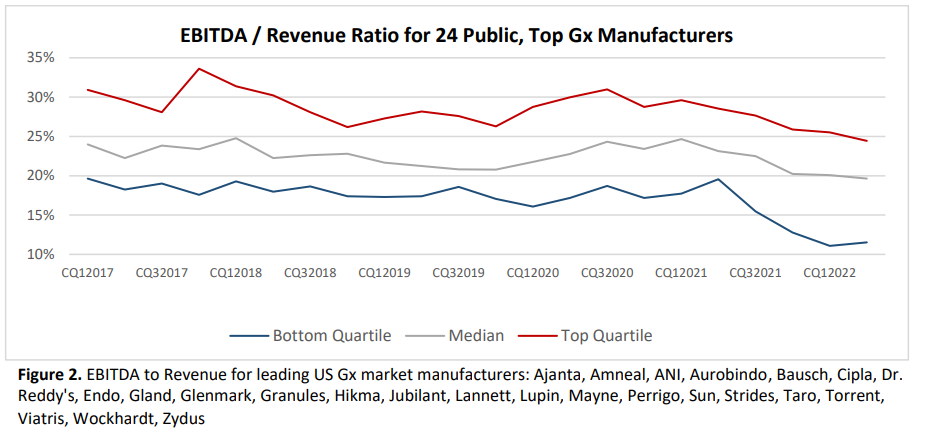

Overall, being a generic drug manufacturer is not a great business. EBITDA (Earnings before interest, taxes, depreciation and amortization) has fallen in recent years. Return on investment has fallen from close to 10% in 2013 to just 5% in 2023.

Because margins are so low, there is little room to invest in quality. Moreover, compliance with FDA quality standards is falling.

…the rate of industry close-out of regulatory issues (i.e., issues resolved to the FDA’s standards) has dropped from one-in-four warning letters closed out to one-in-twenty by 2022… 26% of the nation’s prescriptions now being supplied by companies that have received warning letters since 2020.

The author proposes 3 solutions to the problem which you can read here.