The Best Insurance Underwriters in Canada | Brokers on Underwriters

Jump to winners | Jump to methodology

Brokers crown underwriters of excellence

IBC’s 5-Star Underwriters for 2024 are textbook examples of how to earn the trust and business of the broking community.

The Brokers on Underwriters survey recognizes the top 20 insurance risk specialists nationwide, acknowledged for setting the benchmark by prioritizing what matters most to their broker partners. They exhibit:

a deep understanding of their products

a solutions-oriented approach

responsiveness

flexibility and accessibility

approachability and open-mindedness

Brokers nominated insurance underwriters they considered the best in the field and ranked them across time-tested metrics. The 5-Star Underwriters exceeded brokers’ expectations with outstanding service.

“I appreciate when they trust I have done my job on the front line and dealt with the issue at hand without going through everything with a fine-tooth comb”

Emily BullHub International

Best underwriters work with brokers to uncover solutions

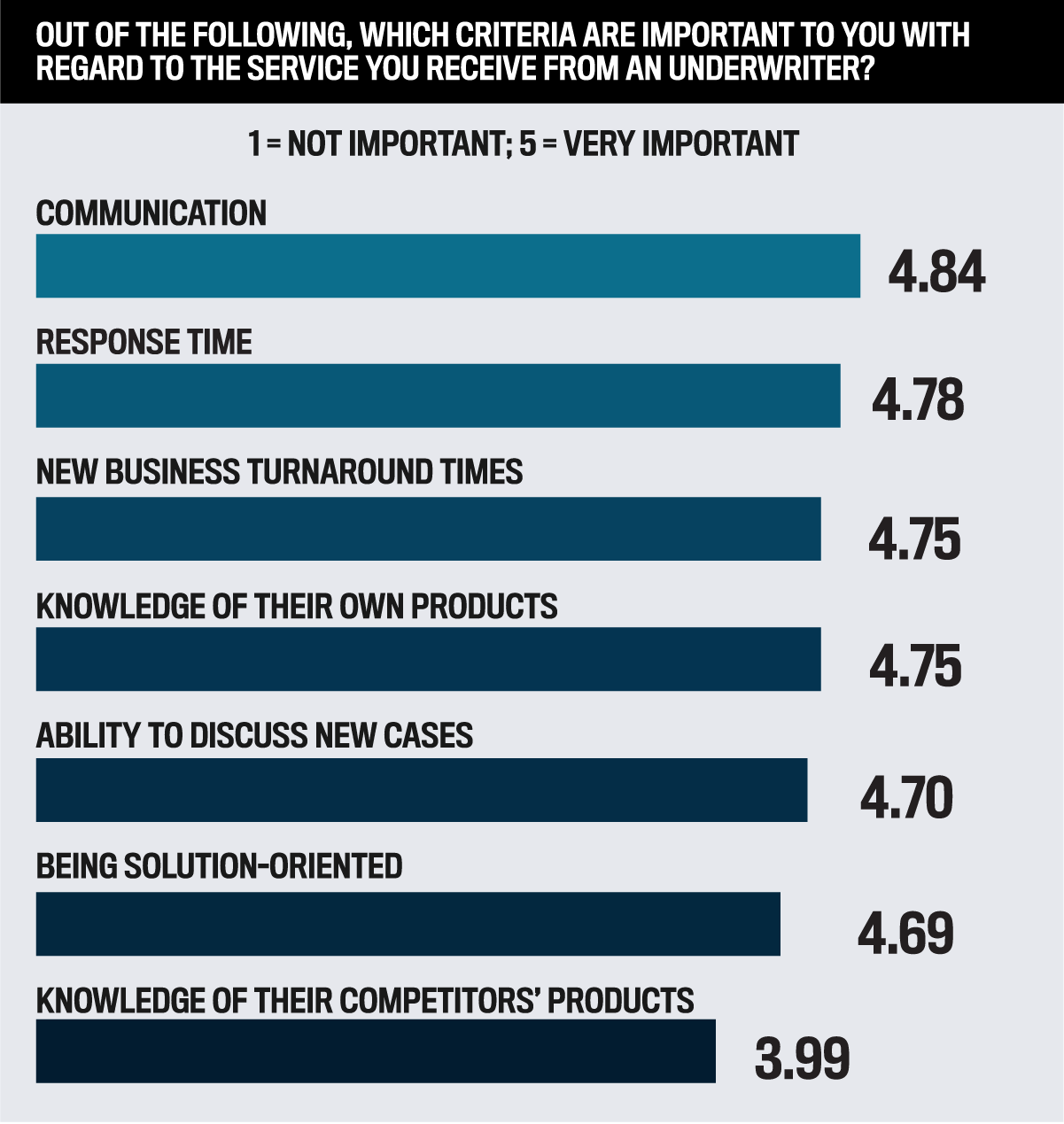

Brokers emphasize communication as crucial for underwriters, highlighting a growing desire to discuss new cases. The ability to speak with an underwriter has significantly increased, rising from a ranking of 4.57 in 2023 to 4.70 (out of 5).

This suggests underwriters being reachable to discuss and quickly assist brokers on a file will remain at the forefront.

“A 5-Star Underwriter is someone I can call to discuss the risk with directly and who takes into consideration all the underwriting and expertise I bring,” says survey respondent Linda Dohmeier, owner at MaxxCann Insurance Services in British Columbia.

For Julie Pilote, a customer service representative at Quebec-based Lemay Coulombe Assurance, the best underwriters are “solutions-oriented and available when we have questions or need confirmation on details.”

Other brokers highlighted attributes key to earning the title of 5-Star Underwriter:

“Knowledgeable, excellent communication skills, prompt in replying, excellent in problem-solving, and, of course, a great sense of humour.”

“The ability to prioritize occasional urgent requests. We might get in a bind, time-wise, and I appreciate an underwriter who can recognize the unique scenario and do me a solid by looking at the issue straight away.”

“Personable, friendly, cooperative, and with a mindset of working together as a team.”

Response time remained the second highest priority for brokers, and turnaround times on new business increased in importance to third from fourth in 2023. Brokers also ranked an underwriter’s knowledge of their products highly, indicating a drive to boost customer satisfaction by aligning products with needs. Being solutions-oriented received the same score as last year, 4.69.

“One way to earn more of my business is to be more out of the box with underwriting solutions,” says Alexander Rei, an Ontario-based business development manager at Echelon Insurance and recipient of IBC’s Rising Star award in 2023. “A 5-Star Underwriter is attentive, empathetic, creative, knowledgeable of their and competitors’ products, responsive, and flexible.”

Several brokers highlighted that they would be inclined to give more business to underwriters who prioritize:

being more accommodating

quickly turning around quotes and presenting their best offerings from the start

maintaining a customer-focused approach, transparency with clear wording, and competitive pricing

offering better coverage with competitive premiums

understanding the position brokers are in when trying to assist their clients, especially those facing challenging circumstances

An Alberta broker manager says, “People usually shop for premium, and it’s always best to be honest and transparent about the pricing. I would write more business with a company that was ethical and transparent with their costs.”

Why brokers remain loyal to underwriters

The survey data illustrates that brokers know what they expect from the best underwriters to excel and grow their businesses, with many noting they are satisfied with their current agency and have no plans to change.

“The best underwriters are extremely knowledgeable, able to prioritize and pivot when necessary, and, most of all, can assess, evaluate, and respond,” says Cindy Gravelle, vice president of commercial insurance at Ontario-based Youngs Insurance Brokers. “If our top underwriters left to go elsewhere, that would be a reason to change agencies.”

The top five factors brokers highlighted that would lead them to choose a competitor are:

underwriter relationship

service quality

price

coverage

claims service

Paisley Partners commercial lines and programs director Joanne Raymond notes that while she is “extremely happy” with her current underwriter, the reasons that would encourage her to change agencies are “most importantly, the relationship with the underwriter, pricing, willingness to work together, timing, and policy issuance.”

Brokers highly value proven solid coverage and products, coupled with underwriting expertise. They have selected the following top insurance products provided by underwriters in the last 12 months:

“A 5-Star Underwriter is knowledgeable, reachable, open to discussion with the broker on a file, and provides clear solutions and options”

Caroline NettoW.N Atkinson Insurance

Brokers’ wish lists highlight room for improvement

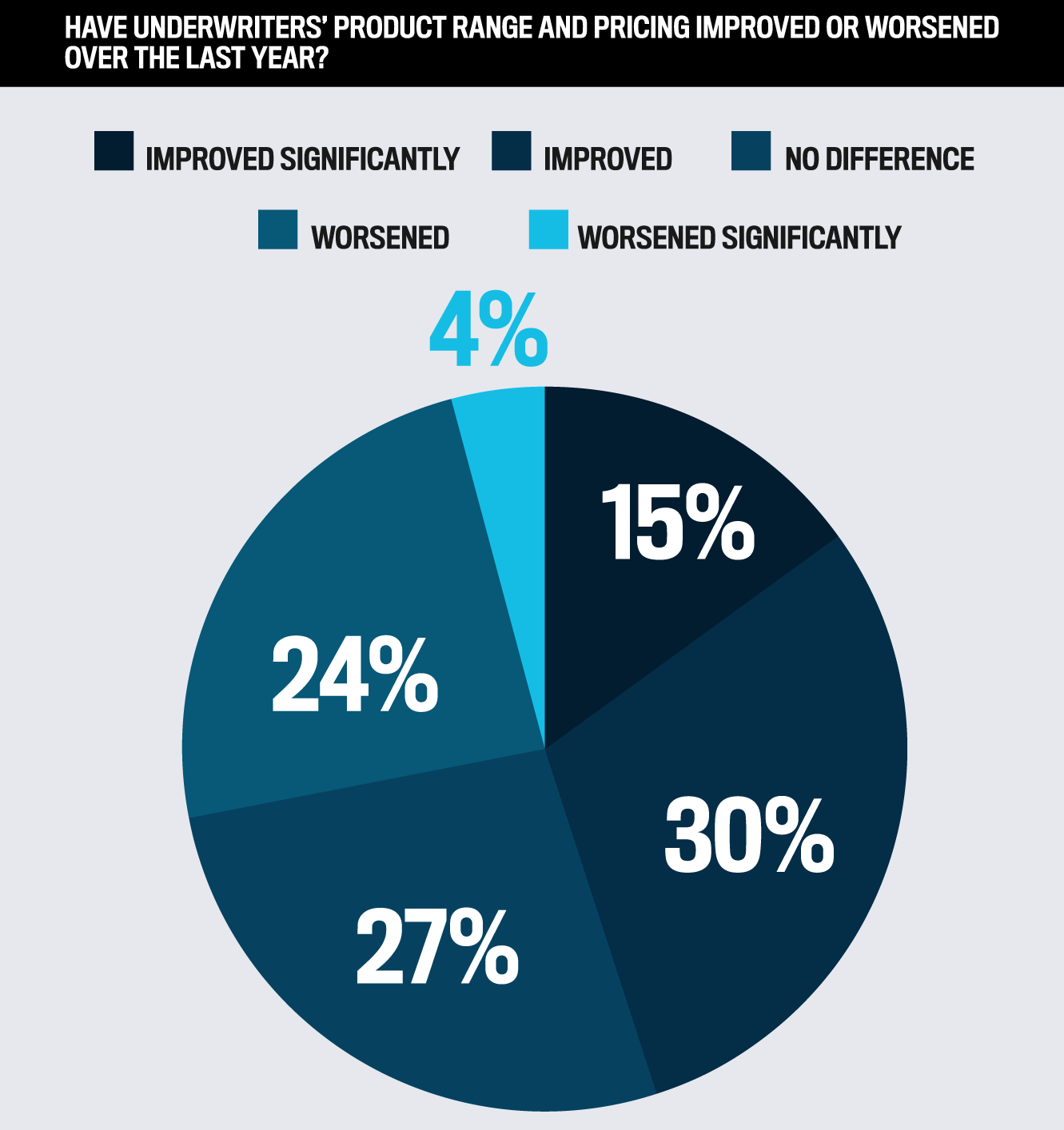

The broker-underwriter relationship remains strong, as evidenced by a significant increase in 2024 of more than half of brokers reporting to IBC that turnaround times have improved or significantly improved. Similarly, underwriters’ product range and pricing showed a similar positive trend. However, it appears there is room for improvement in these areas, as 24 percent of brokers surveyed noted a worsening in those areas.

When asked what’s the one thing they’d like to see their underwriter change or offer in the future, brokers clearly advocated for the chance to build more personal relationships with their underwriter, more efficient processes, quicker response times, and increased appetite and coverage options.

Cathy Wright, commercial marketing manager at Olsen-Sottile Insurance Brokers in Ontario, says, “In a perfect world, they would read my submission within the day of receiving it and email me to let me know they have read it and ask any questions they may have. Or, if they’re declining, let me know immediately.”

Other items on brokers’ wish lists include:

“I’d like to be able to track my submissions in real time.”

“I’d love to meet them in person, spend some time with them, and see what their day looks like.”

“Higher bicycle/e-bike coverage limits”

“Face-to-face time”

“Wider range of allowable work-from-home coverage”

“Coverage for small snow removal companies at a reasonable price”

As selected by Canada’s broking community members, the 5-Star Underwriters are leading the pack with their expertise, knowledge, and ability to communicate and work in tandem with their broker partners. They understand the importance of taking profitable risks and genuinely care about finding a solution, even in the most challenging situations.

One broker says, “I have a high level of communication with my underwriter, and she has gone above and beyond for me when needed, making us both look great.”

“The best underwriters are always available to discuss new business, educate the broker on products, and determine what additional coverage might be considered”

Jay ShearsPrimeService Insurance

Angel Chen

Economical Insurance

Chris Sheehan

Gore Mutual Insurances

Christine Ridings

Intact

Connie Leung

CAA Insurance

Darlene Strong

Portage Mutual Insurance

Dylan Roth

Chubb

Gabriel Morneau

CHES Solutions Spécialisées

Ivan Yanchev

Peel Mutual Insurance Company

Jared Hoogendoorn

Family Insurance Solutions

Jen Cardinal

Hagerty

Jenifer Fox

CannGen Insurance Canada

Jennifer Scott

Great American Insurance Group – Canada

Joan Black

Aviva Canada

Kathy Bianco

Intact

Melissa Trevenen

Northbridge Insurance

Monica Moreto

Intact

Neville Harriman

Special Risk Insurance Managers

Page Forron

Foxquilt

Steve Hrab

Burns & Wilcox Canada

Teresita Delrosario

Intact

To uncover the best underwriters in the Canadian insurance industry, the Insurance Business team undertook a rigorous marketing and survey process, leveraging its connections to brokers across the country. Brokers were asked to nominate their underwriters and rate them on six key criteria: communication, new business turnaround times, knowledge of their own products, knowledge of their competitors’ products, being solution-oriented, and ability to discuss new cases. The top 20 underwriters that were rated 80 percent or greater were named 5-Star Underwriters for 2024.