The Best Insurance Companies to Work for in Asia | Top Insurance Employers

Jump to winners | Jump to methodology

Elite employers

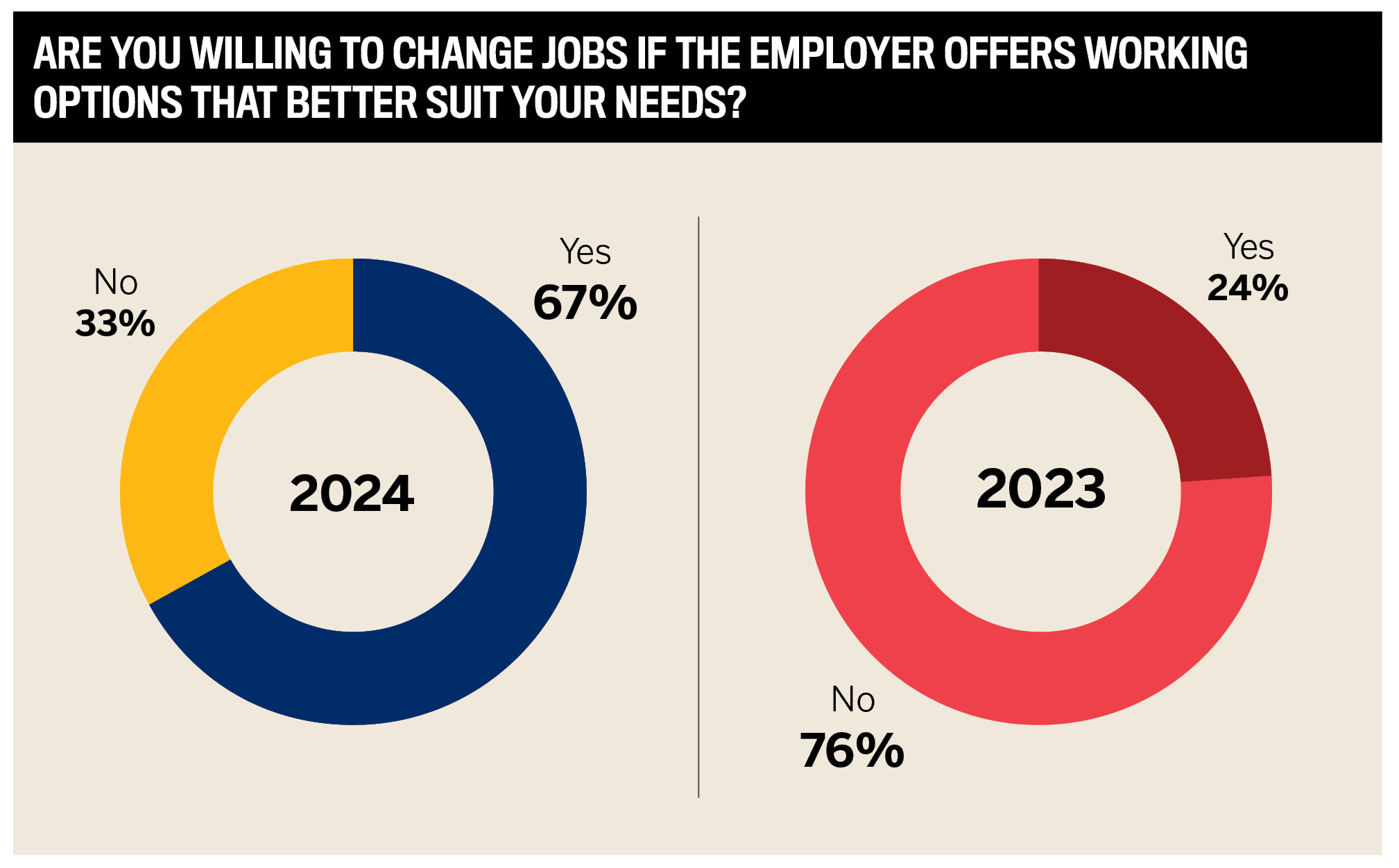

The competition to attract and retain employees across Asia is friend with Insurance Business Asia’s data revealing a significant shift in employee priorities: a willingness to change jobs has skyrocketed by 179% compared to 2023.

Retention has also seen a dramatic shift, with only one-third of employees indicating they would stay with their current employer, starkly contrasting the 76% who were not inclined to change jobs the year before.

There is also an issue across Asia of populations rising in age according to the Asian Development Bank 2024 Aging Well in Asia report. It defines older people as those 60 and above. The percentage of older people as part of the total population in 2010 was 9.7% but is sharply increasing in 2020 (13%), 2030 (17.4%), 2040 (21.2%) and 2050 (25.2%). This means that the best employers have to really raise their standards to attract a relatively diminishing talent pool of new entrants into the labour market.

This is compounded by World Economic Forum data that skills gaps and commitment to diversity, equity and inclusion (DE&I) initiatives are bigger issues in Asia, relative to the global averages.

All nine Top Insurance Employers of 2024 recognised by IB have achieved strong employee satisfaction across a range of factors, with the top six represented as averages out of 5:

4.35: safe work environment

4.23: diversity and inclusion tied with inspired to meet goals at work

4.20: flexible work options

4.18: overall job security tied with work-life balance and team building

4.15: feel valued and appreciated tied with transparent communication from senior leaders

4.03: overall compensation and healthcare-related benefits

IB’s Top Insurance Employers have gained a competitive edge by cultivating employee-centric cultures with flexible work options, leadership development and a commitment to diversity.

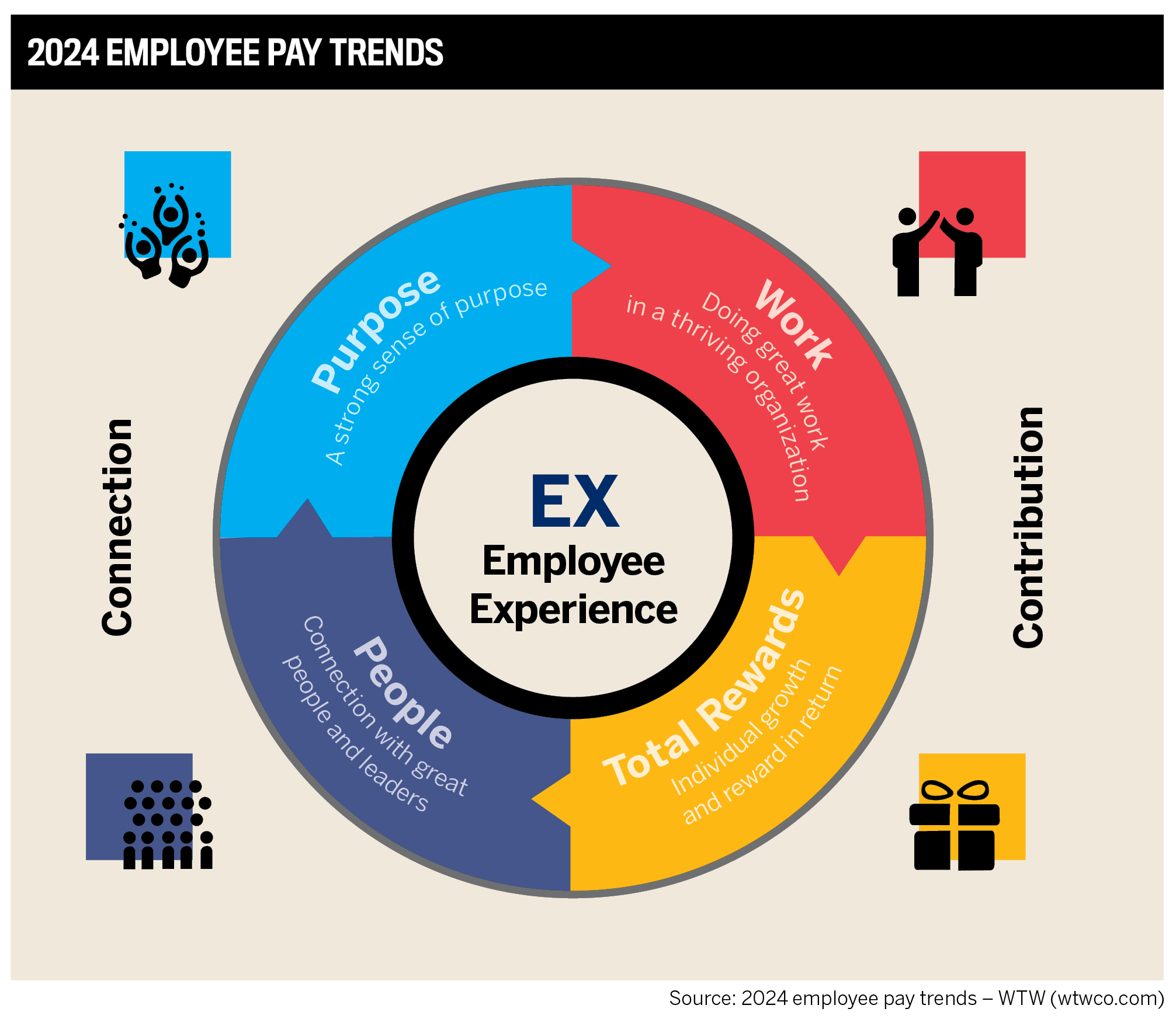

According to WTW’s extensive research, which includes surveys from over 500 companies and nearly 10 million employees, most organisations concentrate on compensation, goal planning and structuring workloads. As a result, employees’ experience with workplace basics is relatively similar across these organisations.

The best insurance companies to work for have gone above and beyond by prioritising the overall employee experience. They offer a comprehensive mix of initiatives demonstrating they’ve got the basics right, which are crucial for organisational success.

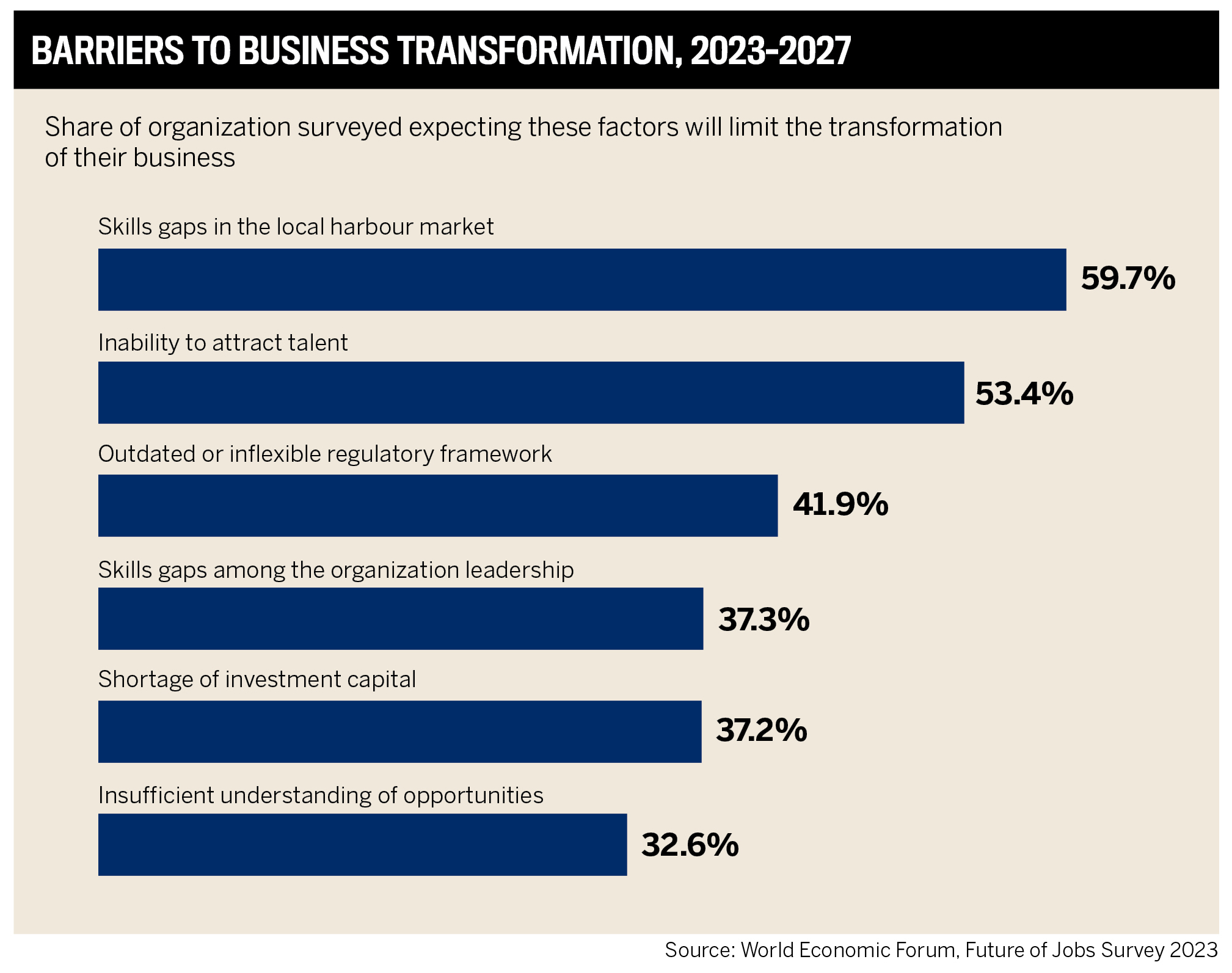

Being a Top Employer also has a significant impact on a firm’s performance. The World Economic Forum’s Future of Jobs 2023 report shows that skills gaps in local labour markets are the biggest barrier to business transformation, meaning those organisations who wish to thrive have to position themselves to attract the top talent from the available workforce.

The problem is exacerbated in Asia, according to WEF’s data:

Human capital stands out as a more pressing concern than investment capital in East Asia and the Pacific. A total of 64% of companies surveyed in the region cite the challenge of attracting talent as a primary hurdle to business transformation, surpassing the global average of 53%.

Specifically, in countries like Thailand and South Korea, three out of every four executives identify the unavailability of talent as the paramount barrier to transformation.

Yet, a mere 28% of executives within the region view the lack of investment capital as a key transformation barrier compared to the slightly higher global statistic of 37%.

The commitment to DE&I initiatives to increase talent availability in the region is evident, with 23% compared to the global benchmark of 18%.

To determine the Top Employers of 2024, IB invited companies across Asia to showcase their offerings and practices. Organisations that met the required number of employee responses and achieved a 75% or higher satisfaction rating across 21 time-tested metrics made the final winners’ list.

IB invited companies across Asia to showcase their offerings and practices. Organisations that met the required number of employee responses and achieved a 75% or higher satisfaction rating across 21 time-tested metrics made the final winners’ list.

HR expert and Hays Malaysia manager Nigel Thong highlights the factors that make the top insurance employers shine:

employee-centric work environments

flexible work arrangements

balanced approach to compensation and work-life balance

comprehensive DE&I initiatives

“For example, as Malaysia is a multi-cultural nation, employers are striving for DE&I across the board,” he says. “It’s not specifically on gender but also on race, culture and different age groups. It’s a holistic approach as opposed to a singular focus.”

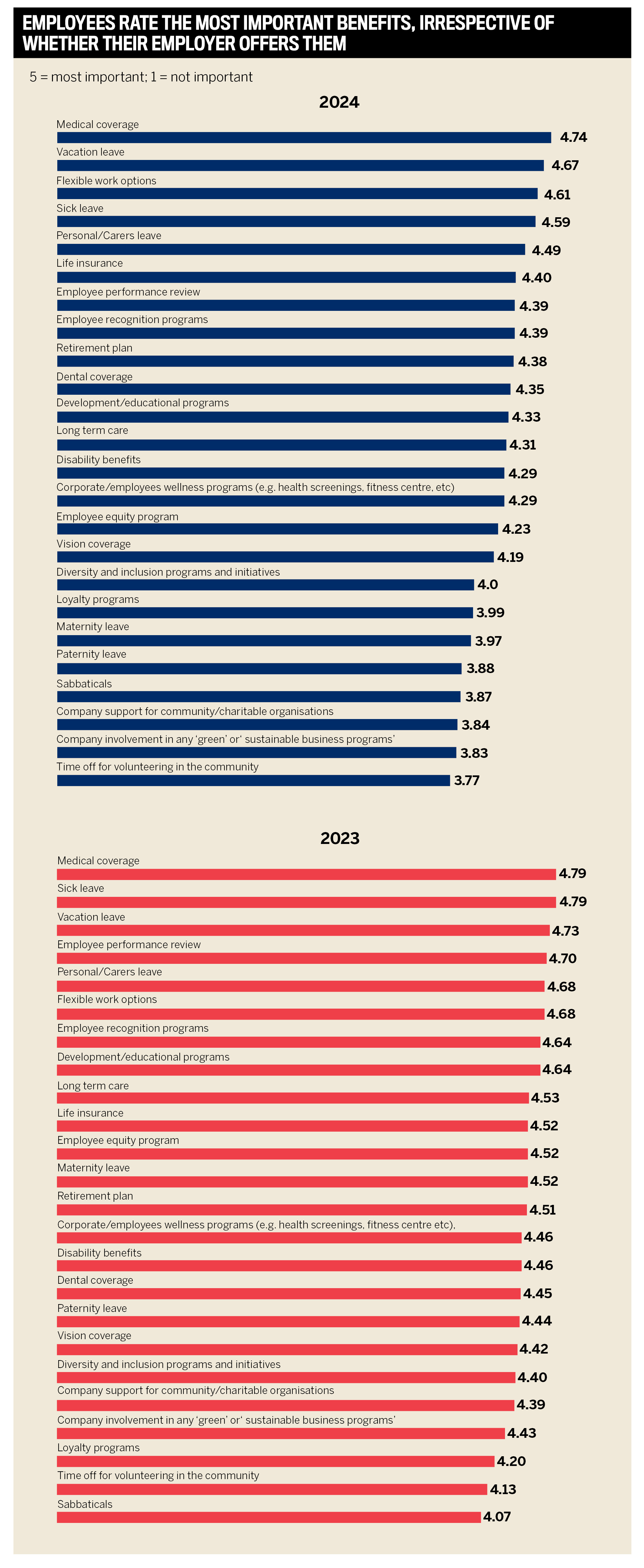

A deep dive into IB’s data shows a slight shift in the drivers of employees’ overall job satisfaction.

The highlights include decreased importance on medical coverage and vacation, sick and personal/carers leaves. Flexible work options retained its importance, moving from sixth place to third in 2024, and the fourth priority of employee performance review in 2023 dropped to seventh place this year.

According to respondents, the top three areas employees would like their employers to improve include:

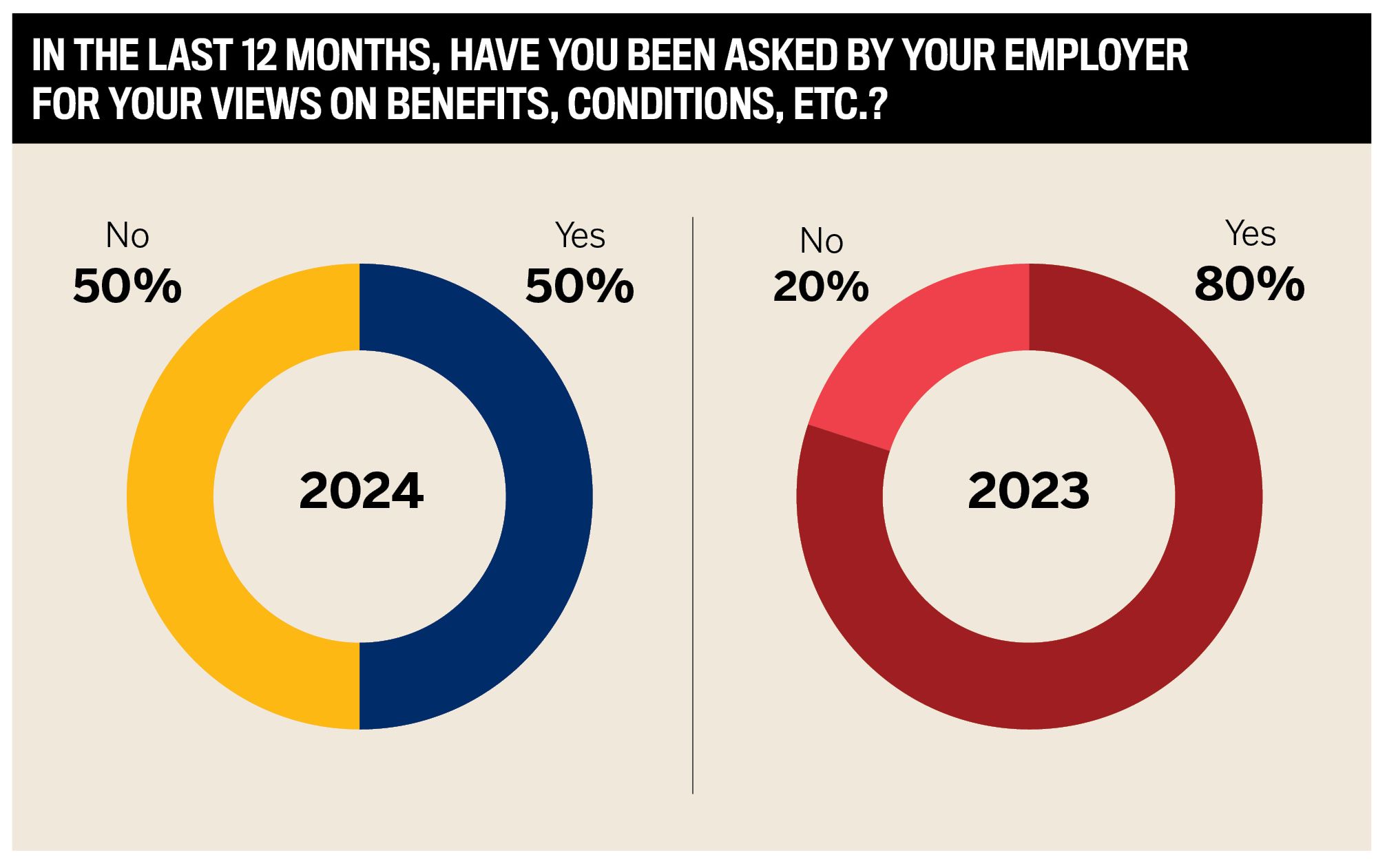

This year, there has been a significant decline in the number of employees who said their employers asked them for feedback on workplace issues compared to 2023. However, the overall high rate of employee engagement and satisfaction at the top insurance companies suggests they are focusing more on meaningful, targeted feedback rather than broad surveys.

As two of IB’s Top Insurance Employers demonstrate, whether their overall approach is structured or flexible, empowering employees to perform at their peak leads to higher job satisfaction and thriving organisations.

Best insurance companies to work for empower employees to thrive

Overall satisfaction: 82%

Top satisfaction factor: Flexible work options

The repeatedly recognised Top Insurance Employer embeds its approach to building a great workplace culture into its operational goals.

With a clear emphasis on what they plan to achieve and how they will accomplish it, the insurer instils a team spirit that stokes a sense of purpose and belonging.

“An integral part of this work is to foster an environment where everyone feels safe to speak up, where we are inclusive of diversity in every aspect, and where there is a balanced emphasis not just on what we do but also how we go about doing it,” says regional CEO Rob Kosova.

QBE’s what includes six strategic priorities across its global operations, two of which centre on people and culture. The how involves three cultural enablers, including a code of ethics, conduct and leadership attributes.

Kosova says, “Given we can’t achieve any of our organisational aspirations without people, they rightly default to the primary strategic priorities that must be in place if we are to achieve the remaining four: portfolio optimisation, sustainable growth, bringing the enterprise together and modernising our business.”

“We are continually focused on building a workplace culture that supports our people and represents our business and the world around us”

Rob Kosova QBE Asia

QBE differentiates itself with several initiatives that impact employees positively:

QBE Flexible Work Policy (Flex@QBE) offers employees alternative work options regarding where and when they work, centred on flexibility around customer needs. Since implementing this during the pandemic, wellbeing and team empowerment have improved, which fosters connection and collaboration.

Innovative learning and development agenda with a blended learning model, combining online and virtual interactions, and classroom programs, resulting in a 5% rise in engagement scores in 2023 (83%) compared to 2022 (78%). Its International Learning Campaign launched in Q2 2024 across its Asia and Europe divisions, offering employees access to global programs and renowned speakers, boosted learning hours by 81.7% compared to Q1 2024, driven by demand in live training over pre-recorded, also up 105.4%.

Promoting employee wellbeing through the Kaido Challenge wellness campaign each July, with over 80% of employees saying they feel supported. The friendly competition encourages teams to track physical activity and daily wellness objectives through a mobile app, such as healthy sleep and mindfulness habits. Notably, 56% of participants reported feeling calmer, 53% felt more motivated, and 40% experienced increased energy. In the 2024 Olympic year, the Asian region teams excelled, winning gold and bronze medals in competition with colleagues from the UK, Europe, and the Middle East.

Through transparent communication, open dialogue, and regular feedback loops, the leadership team encourages employees to voice their concerns and share ideas, contributing to ongoing improvements across the company.

Initiatives such as its monthly country town halls, the Asia Wrap newsletter and the biannual Voice of the Employee survey ensure that employees are well-informed about company goals and challenges, building trust and a sense of belonging.

“At QBE, we believe that strong leadership is the foundation of a supportive and empowering environment for our employees,” says Kosova. “Our leaders are committed to fostering a culture of trust, open communication and mutual respect. We create a workplace where employees feel valued, motivated and empowered to excel by demonstrating key leadership attributes such as empathy, accountability and adaptability.

Overall satisfaction: 76%

Top satisfaction factor: Safe work environment

As a globally Hong Kong-headquartered reinsurance company, Peak Re aims to “make the world a better place” by listening to its employees, clients and partners and fostering two-way conversations reinforcing its culture and mission.

Its workforce diversity underpins its industry-leading status:

47% women/53% men

173 employees representing 22 nationalities and 21 languages spoken

“Our diversity helps us to be successful in every way, and it’s our strength,” says Tony Falso, head of human resources. “People here collaborate constantly; you can feel the energy when you walk around.”

“We’re entrepreneurial and flexible, which is important to us. We may be small, but we value our ability to stay nimble and want to keep that entrepreneurial spirit alive”

Tony Falso Peak Re

Its proactive and forward-thinking approach contributes to overall employee wellbeing in several ways:

Falso says, “These approaches make our people feel more like owners than employees, allowing them to be market leaders and make a tangible impact on our company’s performance.”

A specific initiative that has positively impacted employees is the top employer’s practice of identifying internal talent with future leadership potential and creating development plans to advance their careers.

As a reinsurer, many of Peak Re’s employees have highly technical backgrounds, such as actuaries, who have strong analytical skills but have not had the opportunity to develop their leadership skills. The company provides these employees with safe opportunities to lead small teams and delivers training and support to help them grow.

“We take pride in home-grown success stories and celebrate them,” says Falso.

Members of its four-person executive committee regularly walk about its headquarters, chatting with staff and engaging in discussions, fostering genuine connections that build trust and loyalty.

Overall satisfaction: 94%

Top satisfaction factor: Flexible work options

The organisation fosters a supportive, dynamic and inclusive work environment that attracts and retains top talent. This approach has earned Allianz Indonesia repeated recognition as one of the best insurance companies to work for.

Engaging employees with multiple surveys throughout the year and acting on their feedback contributes significantly to its vibrant work culture, underscoring a commitment to:

diversity and inclusion: an employee club facilitates networks of various demographics to form a sense of community and belonging

talent development: internal mobility and mentorship programs that promote career advancement

learning and development: AllianzU offers a range of training modules, courses and opportunities tailored to competencies and career paths

work-life balance: flexible working arrangements and programs that support physical, mental and financial wellbeing

transparent communication: One Allianz Town Hall, weekly CEO messages and other channels keep employees informed, building trust

“We engage in regular check-ins with team members during performance reviews to understand challenges, provide mentorship and offer guidance on career growth”

Alexander GrenzAllianz Indonesia

“In addition to prioritising employee wellbeing and aligning with Allianz’s mission to safeguard employees’ futures, Allianz also facilitates easier access to insurance products,” says Alexander Grenz, country manager and president director. “This is achieved through offering cashback and special discounts, as well as providing valuable education on insurance options.”

Since 2021, a flexible and hybrid working arrangement has been in place, including a 25-day per year work-away perk from anywhere outside the home or office, reducing commuting stress and costs.

Employees’ physical and mental health are also prioritised and supported by an Employee Assistance Program (EAP), an in-house doctor, and teleconsultation services. Spiritual health also receives attention, with Kajian Muslimah offered for Muslim employees and Persekutuan Doa for Christians.

Other perks that demonstrate Allianz’s dedication to going above and beyond include:

Allianz Indonesia’s leadership team nurtures an empowering environment for employees by promoting open and transparent communication, inclusivity and continuous development.

“By investing in their development, we, as a company, not only boost employee satisfaction but also cultivate a more capable workforce, ultimately driving the company’s success and innovation,” says Grenz.

The executive team also prioritises transparent decision-making, encourages employee feedback and invests in comprehensive learning and development programs, ensuring that employees feel valued, heard and equipped to grow within the organisation.

“Additionally, we also do organisation streamlining to enhance communication and decision-making, allowing employees to act swiftly and feel more empowered,” Grenz says. “This increases efficiency by eliminating redundancies and clarifying roles, leading to higher job satisfaction and productivity.”

Challenges push top employers to greater heights of excellence

QBE Asia

Kosova notes that the organisation’s biggest concern is consistently providing the right balance of support and challenge for its employees to realise their full potential.

“We recognise that the demands placed on any global organisation, especially an insurance organisation focused on enabling resilience for its customers, partners and the communities it serves, are significant,” he says. “By nurturing our internal resources and fostering an environment that promotes growth and innovation, we aim to enable everyone to perform at their highest level, driving success for our people and the company.”

Peak Re

As the only reinsurance company with its headquarters in Hong Kong, the location creates a scarcity of talent, making attracting the right people a challenge. An aging workforce and declining birth rates also contribute to a shrinking talent pool. To address this, the top employer prioritises developing its people internally and casts a broader talent net into the Asian, European and even American markets.

“We look at finding people with the right skills and cultural fit, not necessarily the right job title today,” Falso says.

Allianz Indonesia

Over the past year, Allianz Indonesia navigated significant industry challenges, including economic uncertainty, digital transformation, regulatory changes such as PAYDI (unit-linked products) and the shift to remote work.

In response, Allianz Indonesia prioritised employee development through digital skills training and leadership programs, including the Data Literacy Upskilling Program and Allianz Leadership Program.

It revamped its unit-linked products to meet evolving regulations, emphasising cross-functional collaboration to mitigate risks. Employee wellbeing was also a focus, with enhanced mental, physical and financial health initiatives and flexible work policies to support work-life balance.

“By taking these proactive steps, we successfully navigated industry challenges while maintaining a strong focus on our employees,” says Grenz. “This approach led to sustained employee satisfaction and organisational resilience.”

Allianz PNB Life Insurance

Crawford & Company – Asia

Finology

Generali Hong Kong

Igloo

Singapore Life