The Benefits of Short-Term Health Insurance

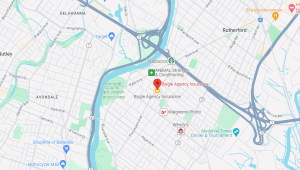

Map Directions To Bogle Agency Insurance

Short-term health insurance in NJ is a type of health insurance that provides coverage for a limited period of time, typically anywhere from 30 days to 12 months. These plans are designed to provide temporary coverage for individuals who are in between jobs, waiting for employer-sponsored coverage to begin, or who are not eligible for other types of health insurance.

Affordable Premiums

Short-term health insurance plans typically have lower premiums than traditional health insurance plans. This is because short-term plans are designed to provide coverage for a limited period of time and do not have to meet the same requirements as other types of health insurance. This makes them a more affordable option for individuals who need temporary coverage.

Flexibility

Short-term health insurance plans offer a great deal of flexibility. These plans allow you to choose the length of coverage that best fits your needs, ranging from 30 days to 12 months. They also offer a variety of deductibles and copays to choose from, allowing you to customize your coverage to fit your budget and healthcare needs.

Fast Coverage

One of the biggest advantages of short-term health insurance is the speed at which coverage can begin. In most cases, coverage can start as soon as the next day after you enroll. This is particularly beneficial for individuals who need coverage quickly, such as those who are in between jobs or waiting for employer-sponsored coverage to begin.

No Network Restrictions

Short-term health insurance plans do not have network restrictions, meaning you can choose any healthcare provider you want. For those who travel often or live in areas where healthcare options are limited, this type of plan could be quite appealing.

Additional Benefits

Many short-term health insurance plans offer additional benefits, such as telemedicine services, prescription drug discounts, and wellness programs. These benefits can help you save money on healthcare costs and improve your overall health and well-being.

Seek Professional Guidance

Bogle Agency Insurance offers assistance and guidance to choose the best insurance protection for your unique needs. Our experienced knowledgeable agents stand ready to help you decide what insurance coverage offers the most protection for your particular circumstances. Give us a call at (201) 939-1076 for an appointment to discuss your needs for Insurance.