The benefits of dividend investing

Doug Cooper, CFA, Senior Portfolio Manager, shares what can make a dividend growth investing strategy an attractive choice for investors, including:

The team’s investment philosophy and approach to selecting dividend investing companies.

What are the primary attributes of a high-quality dividend paying company.

Dividend investing insights with Doug Cooper, lead manager of the Empire Life Dividend Growth Fund

1. Can you explain the investment approach and overall philosophy you employ around dividend paying companies?

In the short term, the fair market value of a company typically doesn’t change much but the stock price of a company often does.

Taking advantage of any mispricing within equity markets – sometimes well below and above fair market value – is an important part of our investment approach.

The approach starts from the bottom-up with extensive company and industry level research to identify high quality dividend paying companies primarily in Canada but also globally.

A company is then only added if we think it is trading at an appropriate discount to its fair market value and providing it makes sense from a portfolio construction standpoint.

Macro-economic analysis will determine the sector and regional allocation and therefore overall defensiveness of the portfolio, but the primary focus is on bottom-up stock selection.

2. What would you identify as the primary attributes of a high-quality dividend paying company?

The primary attributes would include a good management team, a sustainable competitive advantage, a strong balance sheet, and both attractive and visible growth prospects that can support consistent dividend growth over the long run.

3. How is your investment approach differentiated compared to peers?

We believe our approach is differentiated through the significant amount of company and industry research that we complete to identify companies with high-quality attributes that are expected to remain in place over the long run so that the company’s earnings and dividends are well positioned to continue to grow, and ideally ahead of market expectations.

The one attribute that is critical and therefore stress tested by our team is a company’s competitive advantage or economic moat. We ask ourselves questions like – “what makes this company special that allows it to consistently outperform peers?” And “is there a big enough economic moat around the business so that it continues to outperform over the long run?” These are two important questions that our team spends a lot of time thinking about.

We also spend a lot of time on valuation to determine the fair value of a business.

Understanding how much a company is worth is a key enabler of the disciplined approach to only buying stocks of high-quality companies at an appropriate discount to that fair value and conversely to sell when that discount narrows or goes away.

4. What are some of the reasons that I should consider investing in a dividend growth fund?

A dividend growth fund can provide conservative exposure to equities so it can be expected to exhibit less volatility than the broader equity markets by focusing on high quality dividend paying defensive growth companies. These are businesses that have excellent visibility on growing earnings and dividends through most economic conditions.

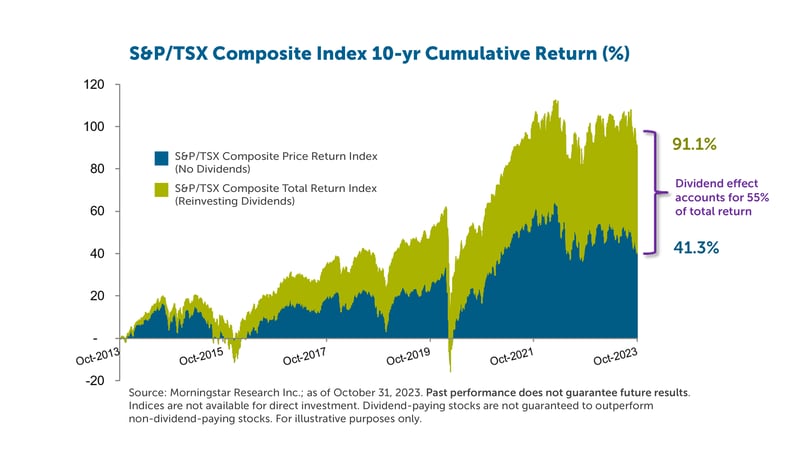

Re-investing dividends can also be a powerful driver of long-term returns. To put some numbers behind this, roughly half of the returns of the S&P/TSX’s Total Return Index over the past ten years have been the result of dividend re-investment.

Finally, because of the consensus or market view that we are in a higher for longer interest rate environment, valuation levels of interest rate sensitive dividend paying sectors (such as utilities, telecommunication companies, pipelines and consumer staples) have compressed significantly and are well below historical averages. Taking a longer-term view, we believe this bodes well for these sectors and in particular, for the higher quality stocks that have also participated in the underperformance.

To learn more about our dividend growth strategy please refer to our most recent commentary for Empire Life Dividend Growth Fund at empire.ca.

© 2023 Morningstar Research Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Segregated Fund contracts are issued by The Empire Life Insurance Company (“Empire Life”). Empire Life Investments Inc. is the Portfolio Manager of certain of the Empire Life segregated funds. Empire Life Investments Inc. is a wholly-owned subsidiary of The Empire Life Insurance Company. A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a segregated fund is invested at the risk of the contract owner and may increase or decrease in value. Past performance is no guarantee of future performance.

This video includes forward-looking information based on the opinions and views of The Empire Life Insurance Company and Empire Life Investments Inc. as of December 5, 2023 and is subject to change without notice. The information contained herein is for general informational purposes only and should not be considered a recommendation to buy or sell any security, nor should it be relied upon as investment, tax, or legal advice. Empire Life and its affiliates assume no responsibility for any reliance on, misuse of, or omission of any information contained in this video; and do not warrant or make any representations regarding the use or the results of the information contained herein in terms of its correctness, accuracy, timeliness, reliability, or otherwise, and do not accept any responsibility for any loss or damage that results from its use. Please seek professional advice before making any investment decisions.

December 5, 2023