The 3 Eras of Digital Point to Shifting Insurance Challenges

What were we thinking? It’s a common question in every area of life! We find ourselves in a particular state and we wonder what decisions we made that brought us to this point. These might be the good decisions that we made that have us prepared to take advantage of opportunities. They may also include decisions that seemed correct at the time and now have us wishing we had selected an alternate path.

Either way, Majesco has been carefully understanding and weighing insurers’ awareness, planning and execution across key areas that substantially influence growth for seven years now in a way that yields some highly-valuable insights. We know what the industry was thinking and doing seven years ago and we can compare it to what insurers consider to be important today. You can see the full set of insights in Majesco’s latest Strategic Priorities report, A Seven Year Itch – Changes in Insurers’ Strategic Priorities Defined by Three Digital Eras Over Seven Years, published last week.

Why a seven-year itch? It was made famous in the Marilyn Monroe movie. But the underlying concept about a seven-year itch is change. As compared to previous decades, change picked up in a disruptive way by mid-2010’s with the emergence of new technologies and InsurTech, and it accelerated in the last two years due to the pandemic.

The pace changed. The market changed. Technology changed. Competition changed.

And change changed.

A key question to ask yourself … Do you have a seven-year itch for change? Your competition is changing. Your customers demand it. And Leaders are making the change to adapt, innovate and thrive.

Over the last 7 years, we have seen three digital eras of insurance innovation and how insurers are now capitalizing (or not!) on what they have learned to firmly establish themselves as the next generation of Leaders. How do you compare?

The 3 Eras of Digital — Do you recognize them?

Hope you like roller coasters and can stomach the rapid highs, lows and curves because it has been a seven-year roller-coaster, with the ride continuing and not slowing down! New and constantly changing risks, shifting customer behaviors and expectations, and numerous insurance innovations have quickly erased the idea of status quo. Sources of data have proliferated. New distribution channels are highly-sought. Companies that had never considered partnering are now reaching out. InsurTech capital seemed like it was going to peak, but it hasn’t. The pandemic and numerous mergers and acquisitions added fuel to the changes.

If insurers have learned anything, it has been that it won’t pay to wait for the calm period. It’s okay to embrace the wild ride.

Seven years ago, Majesco also began our strategic priorities research. We wanted to focus on the challenges – both internal and external – facing insurers and how those shaped their current and planned strategic initiatives for growing their businesses. Looking back at the beginning to this year’s results, three distinct eras become clear.

Digital Disruption Era – In 2015 and the first era, InsurTech was new and booming, causing some hesitance and a wait-and-see attitude in the industry regarding technology and business investments.

Digital Transformation Era – A couple of years later the second era began with the industry’s outlook shifting and optimistic, driving a wave of technology, insurance innovation and business model digital transformation.

Digital Acceleration Era – We are now entering the third era due to COVID disruption and adaptation, reflecting strong signs of resurgence and resilience by insurers.

Throughout these seven years, the rising importance and adoption of advances such as platform technologies, APIs, microservices, digital capabilities, new/non-traditional data sources and advanced analytics capabilities are now crucial to industry leadership. Market trends like the gig/sharing economy, fading of industry silos with emergence of new competitors, the rise of ecosystems and partnerships, and much more, are driving insurance innovation with new business models, products, services, customer experiences, and distribution channels.

However, the different levels of awareness of these developments and the strategic responses to them have in many cases redefined industry players into three categories: Leaders, Followers and Laggards. Gaps between them remain and the size of the gaps continue to change as the goalposts continue to move ahead by Leaders.

Leaders continue to accelerate the pace and the placement of the goalposts that sets them apart from Followers and Laggards.

The view for the future — focus on growth

The future of insurance is picking up steam and continuing to evolve, driving strategic discussions on how insurers will prepare and manage the changes needed in their business models, products, channels, and technology. What is leading these conversations today?

According to our survey, growth remains the top focus of insurers’ business activities and performance over the past year, driven by changing or introducing new products (58% impact) and expanding channels (24% impact).[1] This focus was further highlighted with the reallocation of resources to change how insurers do business. The strong correlation between changing/new business models and growth (r=0.65) indicates deeper structural changes are well underway to the traditional ways of doing business and focused investment on the future of the business.

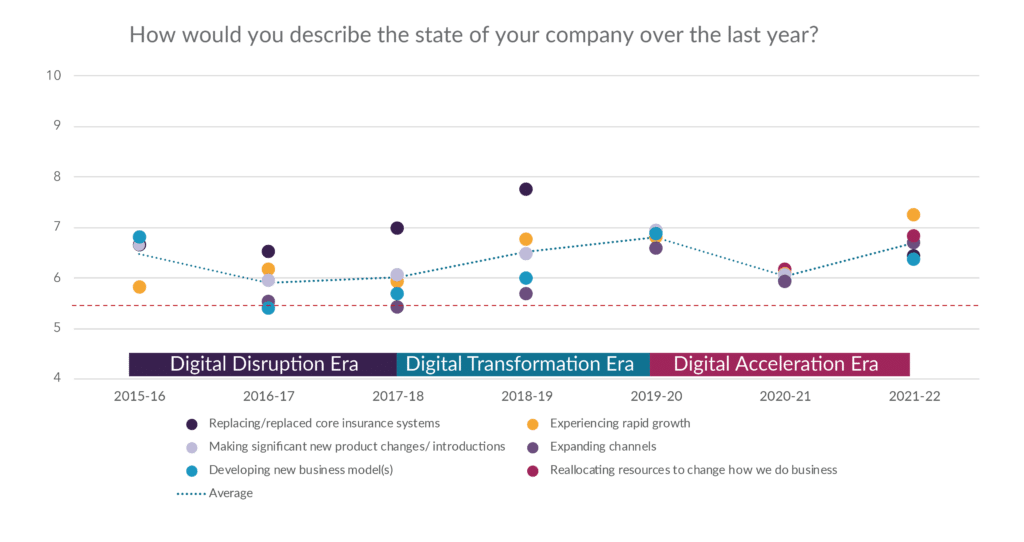

Figure 1: The state of insurers’ strategic activities in the past year

Seven-Year Trends

In the first era of Digital Disruption, we saw a decline in the average assessments of company performance and strategic activities as companies tried to understand the implications of InsurTech. This quickly led to the realization that legacy systems were holding insurers back and limiting their ability to compete with new InsurTech business models, products, channels, and technology capabilities. This pushed insurers to refocus on innovating by creating a new foundation of SaaS platform solutions that replaced legacy systems during the Digital Transformation Era. As legacy began to be replaced, channel expansion, new business models and new product development began to rise and converge. The pandemic once again saw a decline as insurers addressed implications of the pandemic. But as we enter the Digital Acceleration Era, it reflects the rapidly growing demand for digital capabilities by customers due to the experiences of the pandemic.

As digital transformation continues to accelerate, insurers are once again experiencing rapid growth as the top strategic factor, signaling they are successfully navigating and adapting to the new market conditions created by the pandemic. Insurers are turning their circumstances into insurance innovation and growth opportunities.

Figure 2: Seven-year trends in the state of insurers’ strategic activities in the past year

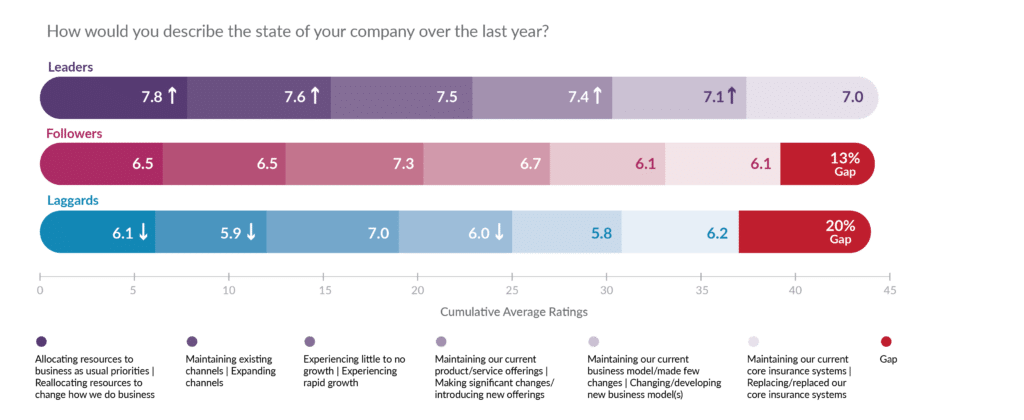

Strategic outlook based on industry positioning

The survey results for this year continue the trend of disparities between insurance Leaders, Followers and Laggards based on their strategic outlooks. Encouragingly, Laggards made significant progress in closing their gap from 64% to only 20% as compared to Leaders when considering the state of their company last year, influenced by an increased focus on digital transformation acceleration. However, Laggards still are too focused on the traditional business model with sizable gaps of 25% – 30% in reallocating resources to change how they do business, expand channels, or offer new products and new business models – which is reflected in their view of their company three years out.

In contrast, Followers are treading water with a 13% gap to Leaders compared to 12% last year. Two of their biggest challenges, reallocating resources and expanding channels, are crucial for future growth. They likewise are too focused on today and not recognizing that customers’ rapidly changing needs and expectations will demand them to adapt to new products, business models and channels to meet customers on their terms.

Figure 3: The state of insurers’ strategic activities in the past year by Leaders, Followers & Laggards segments

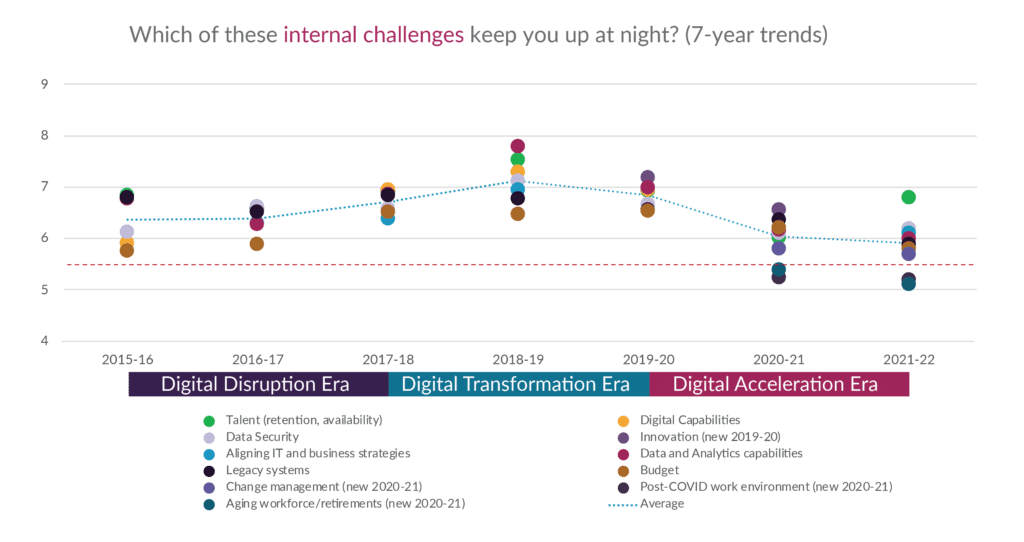

Internal Challenges Shape Insurers’ Focus

The Digital Disruption era saw a rise in internal challenges with a grand scale paralysis regarding many initiatives due to the unknown influence of InsurTech.

As the industry adapted and embraced InsurTech in the Digital Transformation era, budget and legacy systems challenges began to wane due to increased technology investment and replacement. However, data/analytics capabilities, data security, digital capabilities, and talent rose, driving the average concern level for internal challenges to its peak level in 2018.

On the cusp of the COVID and the Digital Acceleration era in late 2019, insurers were increasingly confident about internal challenges, consistent with the positive assessments of their companies’ past year performance and strategic activities.

Surprisingly, after the first year of the pandemic, internal challenges average levels dropped further, weighed down by low concerns for a post-COVID work environment and an aging workforce. Rather, innovation, digital capabilities, and legacy systems replacement rose to the top, driven by the pandemic-accelerated need to become digital-first businesses.

However, a new work reality is setting in, with attracting and retaining talent vaulting to the top challenge. Finding and keeping talent – both business and technical – is critical for insurers to build and grow their new digital-first businesses.

Figure 4: Seven-year trends in concerns about internal challenges

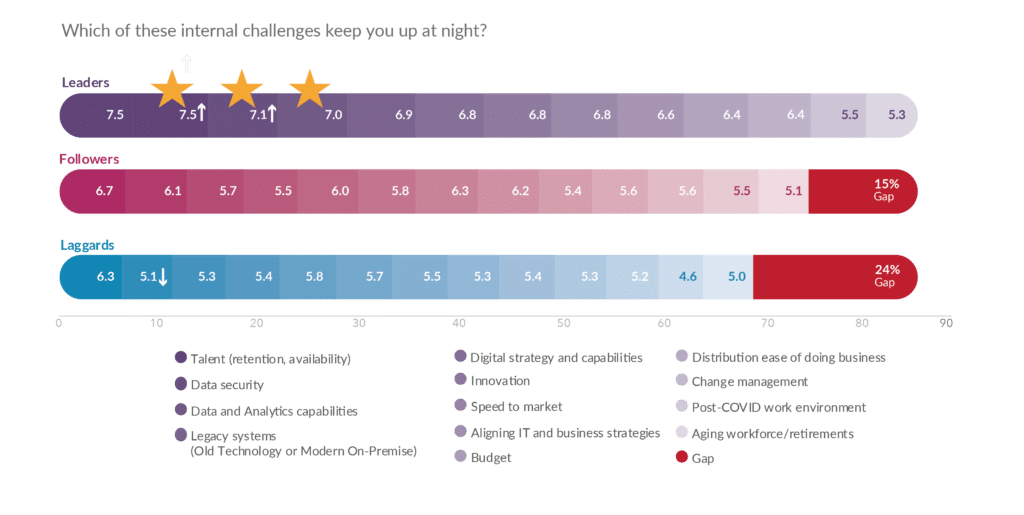

Internal Challenge Awareness and Execution

Consistent with their focus, Leaders demonstrate the highest levels of awareness regarding their internal strengths and weaknesses, reflected in gaps of 15% with Followers and 24% with Laggards. These differences are influenced by gaps between Leaders and both Followers and Laggards for data security (45%, 22%), data and analytics capabilities (35%, 24%), and legacy systems (28%, 27%). The lack of awareness and planning, let alone execution, puts Followers and Laggards dangerously at risk, particularly for game-changing data and analytics capabilities.

In assessing the gaps based on large (over $1B in DWP) versus mid to small insurers, large insurers reflect significantly higher awareness regarding speed to market (+10%), data and analytics capabilities (+9%), legacy systems (+14%), and aging workforce/retirements (+10%). While large insurers typically have access to greater resources – capital and people, mid-small insurers have less complexity, giving them an edge and opportunity to close these gaps if they can move more rapidly from awareness to execution.

Figure 5: Concerns about internal challenges by Leaders, Followers and Laggards segments

A notable set of internal challenges gaps that drive doing business differently – digital strategy (19%, 15%), insurance innovation (20%, 18%), aligning IT and business strategies (26%, 10%), distribution ease of doing business (22%, 15%) and change management (24%, 14%) – are of crucial concern. The large double-digit gaps, coupled with the pace of change, will likely expand and put Laggards and Followers at a significant disadvantage … impacting future growth.

External Challenges Confronting Insurers

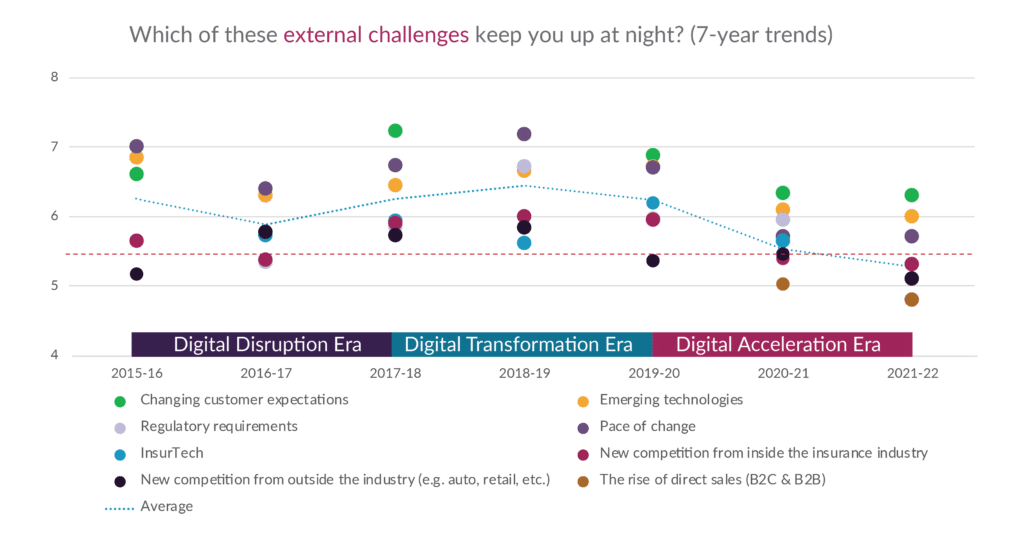

External challenges trends for insurers reflect the continuous, rapid pace of change and constantly changing market and business assumptions that insurers faced during each of the three eras. The lack of addressing the internal challenges exacerbates external challenges – putting insurers at a consistent disadvantage to other competitors.

Insurers’ external concerns have focused on changing market dynamics reflected in the pace of change, emerging technologies, and changing customer expectations. This suggests insurers are more concerned about their own internal capabilities to rise to these challenges than about new competitors doing so (an inside-out view instead of an outside-in view). Similar to the lowest rated concerns, these three remained the top 3-4 issues over the seven years of the research.

Figure 6: Seven-year trends in concerns about external challenges

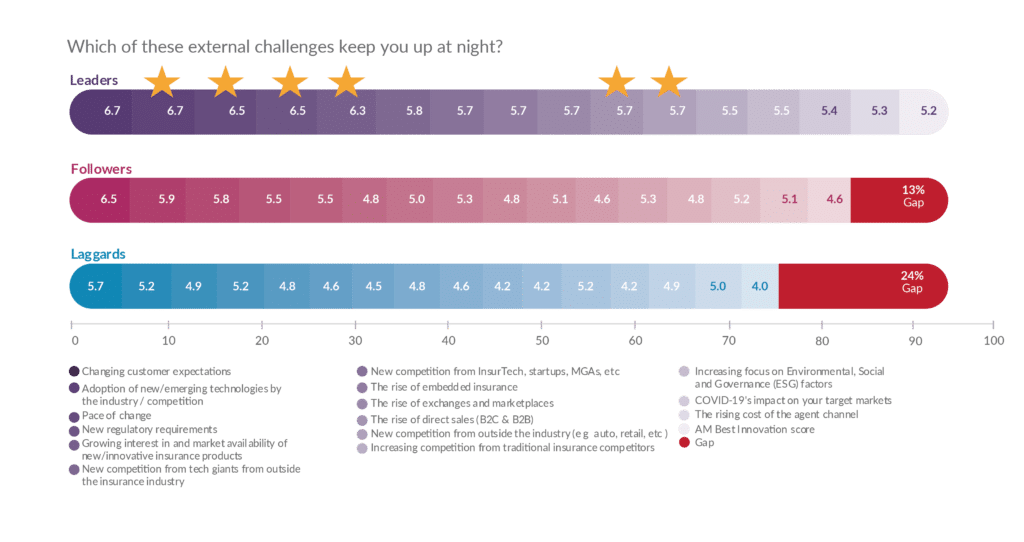

External Challenge Awareness and Execution

Overall gaps between Leaders, Followers and Laggards for external challenges are nearly identical to the internal challenges gaps. However, the differences emphasize the view that Leaders are more forward-thinking and visionary while Followers and Laggards are still stuck in yesterday’s and today’s paradigm.

In particular, Laggards are explicitly behind Leaders across more external challenges including pace of change (35%), rise of direct sales (35%), embedded insurance (24%), exchanges (34%), and new/innovative insurance products (31%). Likewise, Followers are most vulnerable on the rise of direct sales (23%), embedded insurance (19%) and new competition from outside the industry (22%). For both Laggards and Followers, these areas are substantially reshaping insurance and are directly related to insurance innovations that are driving growth for the next generation of leaders.

This reflects a major blind spot for Laggards and Followers in the changing customer and market dynamics that will have significant retention and growth implications over the coming years, putting them at a competitive disadvantage.

Figure 7: Concerns about external challenges by Leaders, Followers and Laggards segments

Large insurers are significantly more aware of and focused on the external challenges as compared to the mid-smaller insurers. Mid-small insurers must keep themselves abreast of these external challenges that influence customer and market dynamics. Taking concerted efforts to actively engage outside their organizations with others involved in innovation, InsurTech, and other industries is crucial to thinking outside the box. This outside-in perspective is vital in today’s rapidly shifting marketplace.

Insurance’s new wake-up call

If the insurance roller coaster has taught us anything through all three digital eras, it might be this: the time it takes to go from recognizing change (social, climate, technology) to reacting to change (insurance innovations such as new products, new distribution, new technologies) must grow shorter to remain competitive. The only shortcut is through partnerships to track, assess, engage and respond to these trends to better position themselves and their partners to succeed in the future.

Majesco has created an environment of rapid learning and response to improve insurers’ speed to market and opportunities to innovate.

In our next Strategic Priorities blog, we’ll examine business and technology trends and how they are playing a role in current priority shifts across insurance. We’ll look at their impact on business models, assess growing opportunities in product development and touch on the emerging technologies that may assist insurers as they aim for greater profitability.

To consider how your organization measures up to Leaders’ strategic priorities, be sure to download A Seven Year Itch – Changes in Insurers’ Strategic Priorities Defined by Three Digital Eras Over Seven Years today.

[1] Based on Linear Regression Relative Importance Analysis