The 10 largest insurance companies in Canada based on total assets

The 10 largest insurance companies in Canada based on total assets | Insurance Business Canada

Guides

The 10 largest insurance companies in Canada based on total assets

The largest insurance companies in Canada offer a range of coverages to suit varying needs

The largest insurance companies in Canada hold combined assets of almost $2.6 trillion, indicating an industry that is on the path to continued growth, despite the challenges the sector faces. These insurers also registered a combined $227 billion in gross written premiums (GWP), an 11% rise from last year’s $204 billion. Unsurprisingly, most of these companies anticipate a rosy outlook for their businesses this year.

Here, Insurance Business gives you a rundown of the different policies these insurers offer and highlights some key figures from their latest annual reports. For Canadians who are searching for a reliable and stable partner for their coverage needs, this article can serve as a useful source. Insurance professionals can also share this piece with their clients to help them gain some industry knowledge that can guide them in their decision… and maybe make some decisions of their own about where they may want to work!

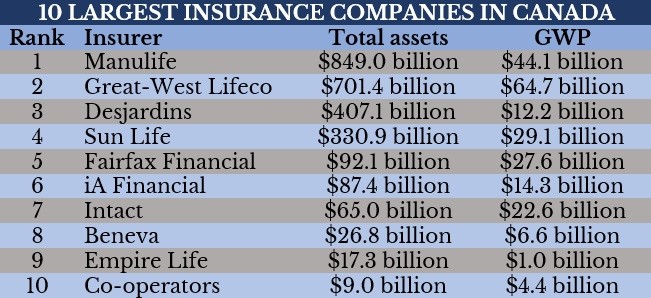

Here are the 10 largest insurance companies in Canada ranked on total assets. The list also includes their GWP from the latest financial year.

1. Manulife

Total assets: $849 billion

Gross written premiums: $44.1 billion

Headquarters: Toronto, ON

Manulife is not only Canada’s largest insurance company in terms of total assets, it also ranks among the world’s top 10 in the category. Apart from insurance products, the Toronto-based insurance giant offers financial advisory and wealth and asset management services for individuals, groups, and organizations. The insurer has offices across Canada and has a global reach spanning the US – primarily as John Hancock – Europe, and Asia.

Manulife boasts a workforce exceeding 40,000, and a business network consisting of 116,000 agents and thousands of distribution partners, catering to more than 34 million customers worldwide. It also holds $1.3 trillion in assets under management and administration, which include total invested assets of $400 billion and segregated funds net assets of $300 billion, according to its latest annual report.

Manulife’s gross written premiums dipped slightly from $44.3 billion from the previous year. The insurer trades under MFC on the Toronto, New York, and Philippine stock exchanges, and as 945 in the Hong Kong stock exchange.

Recently, the life insurance behemoth rolled out a policy combined with a health and wellness program, called Manulife Vitality, which rewards policyholders for adopting active lifestyles. Through the program, clients can access a range of wellness and prevention choices, items from popular retailers, and premium reductions.

2. Great-West Lifeco

Total assets: $701.4 billion

Gross written premiums: $64.7 billion

Headquarters: Winnipeg, MB

Great-West Lifeco tops all insurance companies in the list when it comes to GWP, posting an almost 13% rise in written premiums from $57.4 billion last year. The insurer is a subsidiary of investment giant Power Financial Corporation.

Great-West Lifeco’s portfolio consists of the following:

Life and health insurance products

Reinsurance products

Retirement and investment services

Wealth management services

The company employs about 31,000 staff and boasts a network of over 234,500 advisors, serving more than 38 million clients in Canada, Europe, and the US. The firm’s total assets jumped 11% from $630.5 billion last year. According to its latest financials, its total assets under management was worth slightly over $1 trillion while assets under administration reached almost $2.5 trillion.

3. Desjardins

Total assets: $407.1 billion

Gross written premiums: $12.2 billion

Headquarters: Lévis, QC

Besides being among the largest insurance companies in Canada, Desjardins functions as a financial services cooperative and is the biggest federation of credit unions – also called caisses populaires – in North America. The insurer boasts the largest regional presence of any financial institution in Québec, as well as a strong presence in Ontario. In these two provinces, the firm has 195 participating caisses. It also has 412 accredited trainers from 114 partner organizations across the country.

Desjardins has around 58,700 employees and nearly 2,460 directors in the caisse network. It serves more than 7.5 million clients and members. The insurer’s annual report shows that its total assets climbed 2.5% from $397.1 billion while GWP rose 5.2% from $11.6 billion last year.

To date, the company has invested almost $1.7 billion in the renewable energy infrastructure sector. Meanwhile, through its GoodSpark Fund, which supports economic, social, and environmental initiatives in communities, Desjardins has already pledged $161 million of the $250 million in total funding to 726 development projects.

4. Sun Life

Total assets: $330.9 billion

Gross written premiums: $29.1 billion

Headquarters: Toronto, ON

Sun Life ranks third among the largest life insurance companies in Canada, trailing only Manulife and Canada Life. It is also one of the biggest life insurers in the world, operating in 26 countries, including:

Australia

Hong Kong

Ireland

Japan

Singapore

United Kingdom

United States

Sun Life offers an array of insurance and asset management services. These include:

Based on its latest financials, Sun Life’s total assets dipped about 4% from the previous financial year. GWP, however, rose 14% from $25.5 billion. In addition, the insurer has announced recently that it is committing a total of $3.7 million in funding to support mental health programs for at-risk and marginalized youth across the country.

5. Fairfax Financial

Total assets: $92.1 billion

Gross written premiums: $27.6 billion

Headquarters: Toronto, Canada

Fairfax Financial is a holding company behind some of the insurance industry’s leading brands not just in Canada but also globally, including:

Fairfax Financial offers a range of property and casualty insurance and reinsurance products, and investment services. It employs about 47,000 staff. The company’s annual report shows that its total assets dropped 17% from $111.5 billion while GWP jumped more than 15% from $23.9 billion.

6. iA Financial

Total assets: $87.4 billion

Gross written premiums: $14.3 billion

Headquarters: Québec City, QC

iA Financial is one of the largest insurance companies in Canada, as well as one of the nation’s biggest wealth management services providers. It serves more than four million customers, which include individuals, small and mid-size businesses, and large corporations.

iA Financial functions as the holding company of iA Financial Group. Its insurance portfolio consists of:

Life insurance

Home insurance

Auto insurance

Travel insurance

Critical illness insurance

Accidental death insurance

Disability insurance

Group insurance

The company also offers a range of financial services, including:

Annuities

Retirement plans

Savings products

Car and home loans

Mutual and segregated funds

Securities

Investment advice

Private wealth management

iA Financial has a 7,000-strong workforce. Its total assets slid around 8% from $94.7 billion while GWP experienced an uptick from $14.2 billion from last year, according to its annual report.

7. Intact

Total assets: $65 billion

Gross written premiums: $22.6 billion

Headquarters: Toronto, ON

Intact Financial is Canada’s largest provider in the property and casualty insurance market and a major provider of specialty insurance in North America. The company has a customer base of about six million, consisting of personal, business, public sector, and institutional clients in Canada, Ireland, the UK, and the US.

In its latest financials, Intact registered an over 25% rise in GWP from the previous year’s $18 billion, although total assets slightly dipped from $66.3 billion. The company has a workforce of more than 26,000. At the end of last year, Intact also unveiled the results of its Generosity in Action campaign, where it has pledged to give funds to charitable organizations selected by its own employees. Intact employees were able to raise over $2.3 million in a span of two weeks and every dollar was matched by the insurer, upping the total to about $4.5 million.

8. Beneva

Total assets: $26.8 billion

Gross written premiums: $6.6 billion

Headquarters: Québec City, QC

In mid-2020, general insurers La Capitale and SSQ Insurance merged into a single entity, paving the way for the formation of Beneva. Beneva has since risen to become one of the largest insurance companies in Canada, with more than 900 offices and 600,000 employees. La Capitale’s total assets grew 7.2% from the previous year while GWP also increased 10% from $6 billion.

9. Empire Life

Total assets: $17.3 billion

Gross written premiums: $1 billion

Headquarters: Kingston, ON

Just like its parent company E-L Financial, Empire Life serves as an insurance and investment firm. The insurer’s portfolio consists of life and critical illness insurance, and group benefits. The company also has its own subsidiary, Empire Life Investments Inc. (ELII), which functions as an investment manager and advisor of Empire Life segregated funds and provides a suite of mutual funds.

Empire Life’s total assets decreased from $26.8 billion last year while GWP remained almost the same. E-L Financial, meanwhile, which trades on the Toronto Stock Exchange, has more than $19.6 billion in assets under management for its over 600,000 clients.

10. Co-operators

Total assets: $9 billion

Gross written premiums: $4.4 billion

Headquarters: Guelph, ON

Co-operators operates as among the largest multi-line insurers in the country, catering to more than 240 credit unions, with a combined membership numbering almost six million. The insurance cooperative offers a range of policies, including:

Auto insurance

Business insurance

Home insurance

Life insurance

Farm insurance

Travel insurance

Group benefits

On the investment side, its portfolio consists of:

Annuities

Tax-free savings accounts (TFSA)

Registered retirement savings plans (RSSP)

Registered education savings plans (RESP)

Segregated and mutual funds

Co-operators also provides brokerage and institutional asset management services. In its latest financials, the company revealed that total assets reached $9 billion while GWP grew to $4.4 billion.

Methodology for ranking the largest insurance companies in Canada

To come up with the list, Insurance Business sifted through the latest annual reports from Canada’s largest insurance companies and looked at each insurer’s total assets. We chose this metric because it is a good indicator of a company’s scale, as well as financial stability.

We also included gross written premiums, which refer to the sum of direct and assumed written premiums before reinsurance and ceding commissions are deducted. GWP indicates the level of sales for the risks that an insurer retains for itself.

Here’s a summary of the 10 largest insurance companies in Canada based on total assets.

If you want to find Canada’s top insurance companies offering the type of coverage that best matches your needs, an experienced insurance agent or broker can help you in your search. You can also visit our Best Insurance Canada page, where you can find a long list of dependable and trusted insurance specialists across the nation.

In this page, we feature only the insurance companies that are nominated by their peers and vetted by our panel of industry experts as reliable market leaders. These insurers can provide you with the best coverage during the most challenging times.

What do you think about the largest insurance companies in Canada? Have you experienced dealing with them? Share your story in the comment section below.

Keep up with the latest news and events

Join our mailing list, it’s free!