The 10 best condo insurance providers in Canada

The 10 best condo insurance providers in Canada | Insurance Business Canada

Guides

The 10 best condo insurance providers in Canada

Condo living has gained popularity prompting the top condo insurance providers to step up the coverage game. Find out what kind of policies they offer

Condominium living has become increasingly popular for families in Canada’s biggest cities – and for several good reasons. Unlike in suburban houses, living in condos entails fewer repair and maintenance responsibilities. It also gives you access to on-site amenities, including swimming pools and saunas, that you might not otherwise be able to afford. Condominiums are often located close to public amenities, such as malls, hospitals, schools, and even your workplace, so convenience can also be a motivating factor.

And as preference for this kind of lifestyle grows, insurance companies have likewise stepped-up their efforts to provide coverage that suits the unique needs of the country’s rising population of condo dwellers.

But condo insurance providers offer varying levels of protection, and determining which one delivers the best coverage is largely dependent on the specific needs of the unit’s residents. Because of this, there isn’t a clear-cut choice as to which insurer is number one. We decided to arrange this list alphabetically instead and give you a rundown of the top condo insurance providers in Canada and what types of policies they offer.

1. Allstate Canada

As the name suggests, Allstate Canada is the Canadian subsidiary of American insurance giant Allstate. The Markham-headquartered property and casualty (P&C) insurer offers a range of auto and home insurance policies – including condo insurance – to customers in Ontario, Québec, Alberta, Nova Scotia, and New Brunswick.

Allstate’s condo insurance policy provides coverage for the unit, and your personal belongings and liability. It protects against a range of perils, including:

Explosion

Falling objects

Fire

Lightning

Malicious acts

Riot

Smoke

Theft

Vandalism

Water damage

Wind and hail

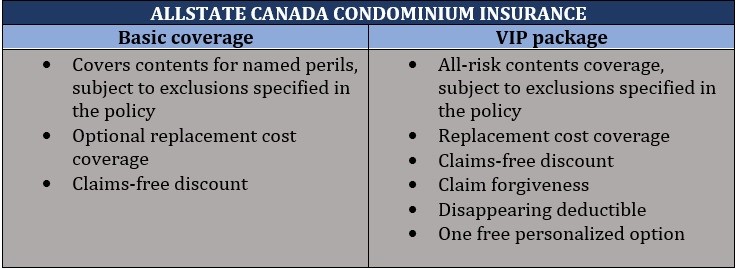

Condo dwellers can also choose among two levels of protection, with the features and inclusions listed below:

Allstate Canada clients can access their condo insurance policy through the myAllstate app. This includes paying their monthly or yearly premiums and updating personal and policy details.

2. Aviva Canada

Aviva Canada is among the largest P&C insurers in the country, providing a range of home, auto, personal, and commercial insurance to about 2.4 million customers. The Markham-headquartered company is a subsidiary of UK-based insurance giant Aviva Plc.

Aviva Canada’s condo insurance policy has the following standard inclusions:

Contents coverage for the unit

Coverage for upgrades done to the unit, including new flooring

Minimum $1 million personal liability coverage

Discount for bundling condo and auto policies

Claims-free discount

Policyholders can also customize their plans with the following add-ons:

Sewer back-up and overland water coverage

Identity theft coverage

Earthquake insurance

Claim protector for keeping the claims-free discount after the first claim

Disappearing deductible

3. Belairdirect

Belairdirect offers car and home insurance policies in Québec, Alberta, Ontario, New Brunswick, Nova Scotia, and Prince Edward Island. British Columbia residents can only access the company’s home insurance, which includes condo coverage. The Montréal-based insurer is a subsidiary of Intact Financial, one of Canada’s largest P&C insurers.

Belairdirect is also among the country’s top condo insurance providers. Its policies offer coverage for the following:

Personal property

Immovable parts of the unit

Improvements made in the condo

Personal liability

Additional living expenses (ALE)

Voluntary medical payments

Voluntary payments for damage to property

Coverage for water damage, including burst pipes and sewer back-ups, can be purchased as an add-on.

4. CAA

CAA’s insurance arm is a part of the Canadian Automobile Association South Central Ontario (CAA SCO), the largest CAA club in the country. It provides home, auto, and travel insurance, along with a range of services, to its more than six million members.

CAA offers condo insurance as part of its home insurance plan. It covers fire, smoke, and water damage under the standard plan, but policyholders can choose to enhance their coverage with the following add-ons:

Home equipment breakdown insurance

Tire repair coverage when bundling condo and auto insurance

Legal expense insurance

Identity theft protection

5. Co-operators

Guelph-based Co-operators is a financial services co-operative that offers a range of insurance and investment products. The insurer provides coverage to over 700 Canadian companies, including employer-sponsored groups, professional associations, and affinity organizations.

Co-operators’ condominium insurance policies have coverage limits ranging from $250,000 to $2 million and come with the following features:

Unit insurance

Improvements and betterments coverage

Coverage for common property assessments

Deductible protection

Condo dwellers can access two types of policies, which provide different levels of protection. These are:

Classic: Provides basic coverage at slightly lower premiums

Prestige: Covers all perils under classic coverage, plus unintentional damage

Coverage for valuable items, including watercraft and jewellery, can also be purchased as an add-on.

6. CUMIS

CUMIS provides insurance products to credit unions across the country. It is the Canadian arm of US mutual insurer and financial services provider CUNA Mutual Group. It is also a subsidiary of The Co-operators. CUMIS serves around 380 credit unions, with a combined membership exceeding five million.

CUMIS offers condominium insurance under its home insurance umbrella. The company’s condo insurance policies come with the following features:

Extended water coverage for damage caused by sanitary systems and drains

Identity fraud coverage at no extra charge

Disappearing deductibles

Home claim forgiveness feature

Flexible payment methods

7. Desjardins

Desjardins is not only among the top condo insurance providers in the country, it also ranks as one of the largest insurance companies in Canada. The Lévis-based insurance giant also boasts the widest regional presence of any financial institution in Québec and has a strong presence in Ontario. Desjardins offers a range of auto, home, travel, life and health, and credit insurance policies.

Desjardins’ condo owner’s insurance provides coverage for the following:

Liability

Fire, theft, and vandalism

Accidental water damage

Tornadoes, lightning, freezing rain, hail, and wind

Fire, smoke, or explosion after an earthquake

Furniture and belongings

Building and condo improvements

Policyholders can also enhance the protection they are getting by purchasing endorsements for the following:

Ground water and sewer backup

Flooding

Rain, snow, or sleet

Earthquake

Home-based businesses and short-term rentals

8. Intact

Intact Financial is one of the country’s largest providers of property and casualty insurance and a major provider of specialty insurance in North America. The insurance giant boasts a global presence, servicing more than six million clients in Canada, the US, the UK, and Ireland.

In Canada, residents and owners can take out condo insurance with the following standard inclusions:

Condominium protection, which covers improvements and betterments, and loss assessment

Personal property coverage

Personal liability coverage

Loss-of-use coverage

As for additional protections, policyholders can purchase these endorsements:

Enhanced water damage package to cover sewer backups and overland water flooding

Lifestyle advantage for rebuilding or downsizing, where policyholders can keep any leftover money

Claims advantage, which serves as a claims-free rating protection for first loss and a deductible waiver of up to $1,000 on the first eligible loss

9. TD Insurance

TD Insurance is a general insurer operating under the TD Bank Group, one of Canada’s largest financial institutions. It is among the leading providers of personal insurance in the country, which includes its home, condo, and auto policies. The insurer also offers a range of business coverages.

TD’s condo insurance provides the following coverages:

All-risks cover for the unit and personal belongings

Unit improvements

Common areas

Personal liability

Additional living expenses

Loss assessment

Legal and home assistance

Policyholders can also opt for the following add-ons for extended protection:

Family coverage, including cyberbullying and parents in nursing homes

Eco-efficient rebuild following a loss

Claim forgiveness

Enhanced limitations, including coverage for high-value items

10. Wawanesa

Winnipeg-headquartered mutual company Wawanesa is among the country’s largest P&C insurers. It is also one of the leading condo insurance providers in Canada. Wawanesa owns three subsidiaries:

Wawanesa Life: Its life insurance unit.

Wawanesa General: Its subsidiary in the US.

Trimont Financial: Its brokerage support arm.

Wawanesa offers condo insurance with the following features:

Personal belongings coverage

Loss-of-use coverage

Collectively owned condominium property coverage

Condominium unit coverage

Unit owner improvements coverage

Deductible coverage

It also allows policyholders to customize their condo insurance with a range of add-ons, covering expensive jewellery, watercraft, cottages, and home-based businesses.

Condo insurance is a type of home insurance policy that protects the condominium owners against damages to their unit’s interior and the contents inside it. It also frees them from the financial liability for injuries that occur within their units. In British Columbia, where the portion of households living in condos are the highest based on the latest census, this kind of coverage is also called strata insurance.

Condo insurance or condo owner’s insurance varies from another from of coverage called condominium corporation insurance, which covers the building’s structure outside of the unit. This includes common areas like hallways, elevators, stairwells, and lobbies.

Condo residents typically pay for common area coverage through their condominium fees. Personal condo coverage, meanwhile, is something that they need to purchase themselves. This type of coverage is designed to fill the gap that condominium corporation policies leave.

Most policies from the top condo insurance providers cover the unit’s interior, along with personal belongings. It also pays for damages to other units caused by incidents from your unit such as fire and water leakage.

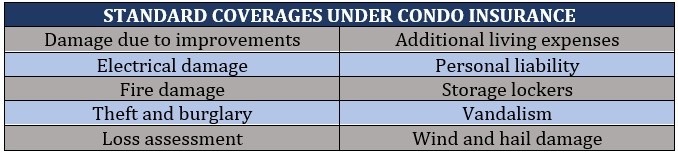

The table below lists some of the standard inclusions in a condo insurance policy.

Some policies also provide coverage for certain forms of water damage, including those resulting from burst pipes and leaky appliances from a neighbouring unit. Through endorsements, this can be extended to include sewer back-up, overland flooding, and heavy rainfall. Coverage for identity theft and expensive possessions such as artworks and jewellery can also be purchased as an add-on.

Condo insurance does not usually cover damages due to normal wear and tear, as well as those caused by animals, and those resulting from war and terrorism. Some policies do not provide flood cover if the building is located in a flood-prone area. Intentional losses and those arising from criminal activities are also not covered.

How much does condo insurance cost?

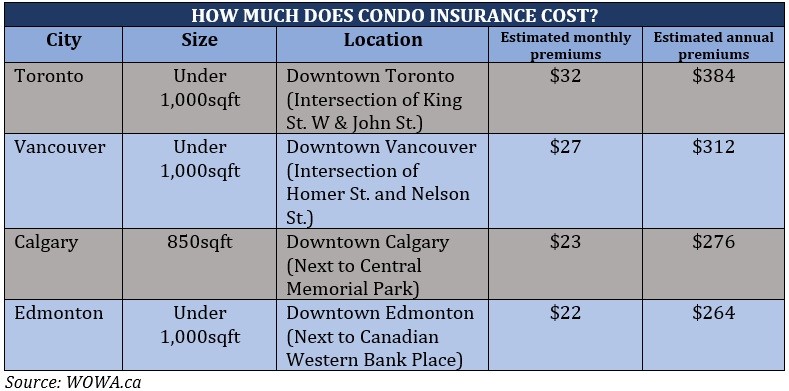

The table below shows a sample calculation of how much coverage costs for a two-bedroom condo in four of Canada’s major cities. To come up with the figure, this website compiled premiums from various condo insurance providers.

Condo insurance providers calculate premiums based on a range of factors, reflecting the unit owner’s likelihood of making a claim. These include:

The condo’s age

The condo’s geographic location

The condo’s market value

Construction materials

Improvements and renovations made

Replacement costs of the insured contents

The type of coverage

The amount of coverage

If you want to find out Canada’s top condo insurance providers from our previous listing, feel free to click on the link.

You can find the best insurance companies that provide quality coverage on our Best in Insurance Special Reports page, where we feature the industry’s most trusted and dependable leaders. These include property insurers that offer top-of-the class condo insurance. By choosing policies from these insurance providers, you can be sure that you can access the right coverage when the need arises.

Also, if you’re following the latest developments in the home and condo insurance market, be sure to visit and bookmark our Property Insurance section, where you can find breaking news and industry updates.

What do you think of the top condo insurance providers on our list? Is taking out condo insurance worth the cost? Let us know your thoughts in the comments section below.

Keep up with the latest news and events

Join our mailing list, it’s free!