Ten websites to help you find the best insurance jobs in New Zealand

Ten websites to help you find the best insurance jobs in New Zealand | Insurance Business New Zealand

Guides

Ten websites to help you find the best insurance jobs in New Zealand

Sifting through insurance jobs online can be a tedious and time-consuming task. Here are the top websites that can make your search easier

One of the biggest factors that make insurance jobs fulfilling is having the opportunity to leave a positive impact on other people’s lives. Armed with expert skills and industry knowledge, insurance professionals often serve as a guide to helping families and businesses secure coverage that delivers the best financial protection.

But finding the right insurance job can easily become a tedious and time-consuming task, especially with a single online search turning up a vast number of postings. Insurance Business is here to help ease the load.

In this article, we list the top websites in New Zealand where you can find great insurance jobs. These channels contain high-quality postings that you can filter down to suit your skills and qualifications. But because there’s no clear-cut best choice among these websites, we decided to arrange the list alphabetically. Check out if these channels have the insurance jobs that you’re looking for as you jumpstart your way to a fruitful insurance career!

1. Careers.govt.nz

Careers.govt.nz is a career development website administered by the Tertiary Education Commission of New Zealand | Te Amorangi Mātauranga Matua, so it does a lot more than just provide a venue for companies to post jobs. The website is designed to help Kiwis make informed decisions on their education and career. It caters to a range of demographics, including:

Job seekers

Job changers

Career practitioners such as career advisers and teachers

Primary, secondary, and tertiary learners

Careers.govt.nz has specialised sections on career advice and study and training, which include scholarship options for learners. The website also has a section about job profiles that gives a detailed description of more than 400 occupations in different industries. Users can likewise access a range of tools from CV builders and skill matches to career checkers and job comparisons. Its job board has around 90 insurance jobs, a fairly easy list to sort through.

2. GrabJobs

GrabJobs is an online recruitment platform that automates the sourcing, screening, and interview process, making talent acquisition easier for companies. The website automatically generates a jobseeker’s profile, so you don’t have to worry about crafting a killer CV. Applying for jobs also typically takes less than a minute while pre-screening interviews are conducted using chatbots.

GrabJobs’ job portal lists more than 6,000 vacancies across New Zealand, around 900 of these are for insurance jobs. The website has a section on career resources, which includes job profiles and job-hunting best practices, and a learning hub where you can access a range of online courses tailored for different industries.

3. Hays

Hays is a London Stock Exchange-listed recruitment agency operating in more than 30 countries. The global firm has offices in Auckland and Christchurch. Apart from talent acquisition, Hays offers workforce advisory services, including in the areas of brand positioning, career transition, and learning and development. According to its LinkedIn profile, the company aims to help candidates find their next careers and businesses to reshape their workforces and deal with staff shortages.

Hays has around 30 job postings for insurance jobs in New Zealand. Its website has a section on career advice that tackles various topics, including CV writing and interview preparation. You can also access the site’s salary checker and a range of free online training courses, as well as upload your CV for free and register for job alerts.

4. Indeed New Zealand

Indeed is one of the most visited employment websites globally, registering over 300 million unique users each month. The New Zealand version boasts all the features of the global website, including its user-friendly interface, which is what attracts jobseekers the most.

Indeed functions as a search engine aggregator, meaning it has access to millions of job postings worldwide. For Kiwi jobseekers looking for insurance jobs, Indeed New Zealand has more than 4,000 listings to choose from. The website also has a long list of filters that you can use to trim down this number.

Just like most job search engines, Indeed allows you to upload your CV to its database at no cost. Employers can also access these profiles to find qualified candidates. The website also has a section where employees can rate their jobs. This has become among Indeed’s most popular features as it gives jobseekers an idea of how it is to work in a particular company.

5. Jooble

Jooble is an international job search website operating in about 70 countries. It primarily serves as a search engine aggregator, compiling job vacancies from more than 140 sources worldwide, including:

Company websites

Social media platforms

Classified ads

Jooble’s partnership with LinkedIn and Google enables it to access a wide range of postings. For New Zealand, it has around 1,400 listings of insurance jobs, which can be sorted by date posted, salary, work experience, and employment type. Users can subscribe to job alerts to be notified of new vacancies. Jooble is available in 25 languages.

6. Jora

Jora is a subsidiary of the Seek Group, which operates several businesses that provide career development services, including another job search engine in our list, Seek.co.nz.

Jora users can search for jobs right from the homepage. Its job board currently has more than 9,000 insurance jobs for Kiwi candidates, about 1,200 of these are under general insurance. You can sort through jobs by location, role, and salary. Jora also has a section where you can have a free estimate of your salary based on your experiences and qualifications.

7. LinkedIn

LinkedIn primarily serves as a social media platform where you can search for quality listings, publish articles you’ve written, or simply post or share content. The platform is also designed to make it easy to send a direct message to job postings.

LinkedIn is the largest and most popular professional networking website in the world. Almost every jobseeker today probably has a LinkedIn account and uses it to search for new opportunities. At present, there are more than 2,000 insurance jobs available for New Zealand candidates, with dozens more added each day.

LinkedIn’s job board has all the standard filters present in other job search engines. The platform can also be accessed as a mobile app.

8. Seek

Seek is one of the largest employment marketplaces in New Zealand and Australia. It operates in about a dozen countries in the Asia-Pacific region and Latin America. There are almost 5,000 insurance jobs listed on the website’s job board for New Zealanders. If you’re a registered user, you can upload and update your profile on the site for free.

Companies can also use Seek to manage and post job ads, search the website’s database for potential candidates, and send job invites to qualified jobseekers. The site has a section on career advice as well.

The Seek Group operates several other businesses, which include:

Seek Business: A marketplace where businesses and franchises can be sold

Seek Learning: Offers a range of educational opportunities for individuals

Seek Volunteer: Catering to those searching for volunteer opportunities

9. Talent.com

Talent.com was known as Neuvoo before its rebranding in 2019. It has a global reach spanning more than 70 countries, attracting more than 28 million unique visitors every month. Talent.com’s mission is to “centralise all jobs available on the net.” At present, users can access over 30 million job vacancies through the job search aggregator. Hundreds of insurance jobs are available for New Zealand candidates. These are categorised under:

Insurance assessor

Insurance broker

Insurance broker support

Insurance consultant

Insurance representative

The postings can be filtered by location, company, and date posted. You can also access the website’s salary checker to get an idea of how much you should be paid based on your skills and experience, and tax calculator to know how much you will be earning after taxes have been deducted.

10. Trade Me

Trade Me is the largest auction and classifieds website in New Zealand, visited by an average of 650,000 Kiwis daily. Apart from listings of products and services, the website has a section on job postings, which yields more than 2,100 results for insurance jobs. You can use the job board’s standard filters, or you can narrow down your search based on best match, featured jobs, and the latest postings.

Trade Me’s job board also has sections where you can view job profiles and get career advice. You can likewise access its comprehensive salary guide, which is broken down by industry.

Knowing that you played a key role in changing someone’s life for the better is among the biggest reasons why people pursue a career in insurance. This sense of fulfilment, however, is just one of the many benefits of being an insurance professional. Here are more reasons why you should consider getting an insurance job.

Diverse opportunities: When choosing to pursue a career in insurance, you may find yourself taking traditional roles such as an insurance broker, agent, or insurance underwriter. However, professional opportunities may also open in different fields, including customer services, data analytics, accounting, IT, human resources, and investigation.

Career progression: Practically every role in the insurance industry enables you to continuously develop news skills to thrive and grow in your career.

Challenging and rewarding work: Because insurance is a dynamic industry, you can expect to regularly face challenges that will require you to be creative and innovative. This can give you a rewarding feeling at the end of the day.

Job security: Insurance jobs will remain in high demand as long as people are in need of financial protection. This includes when they are investing in their homes, seeking proper medical and health care, driving their vehicles, or managing their businesses.

Continuing education: To continue moving up careerwise, insurance professionals are encouraged to pursue educational opportunities to keep their skills and knowledge updated. Some insurers even offer financial assistance to their employees.

Strong earning potential: Insurance jobs typically provide a good living salary with a high potential for growth.

Social relevance: Being an insurance professional, you are given the chance to help people overcome hardships. Most insurers also encourage employees to do volunteer work as a way to give back to the communities they serve.

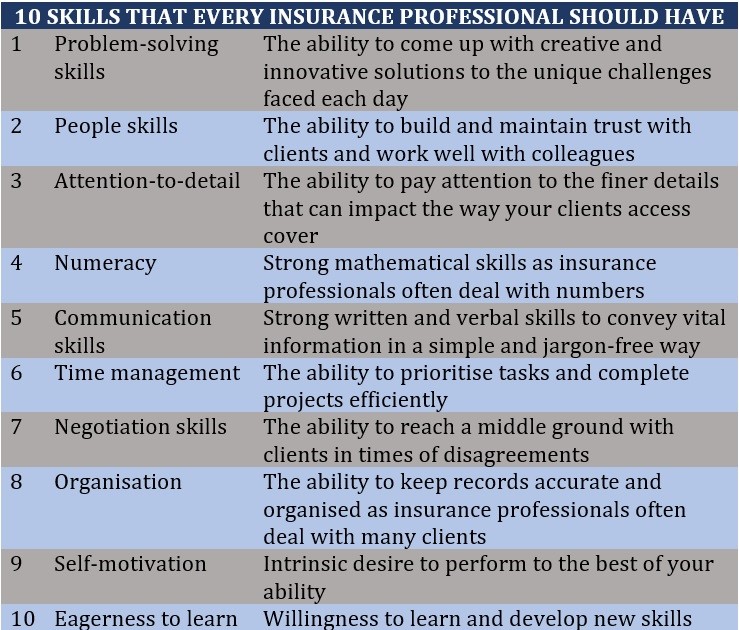

To be a successful insurance professional, you must have a combination of hard and soft skills that enable you to help clients secure the best coverage possible. The table below lists some of the most important skills and attributes that you should have to land the top insurance jobs and thrive and grow professionally.

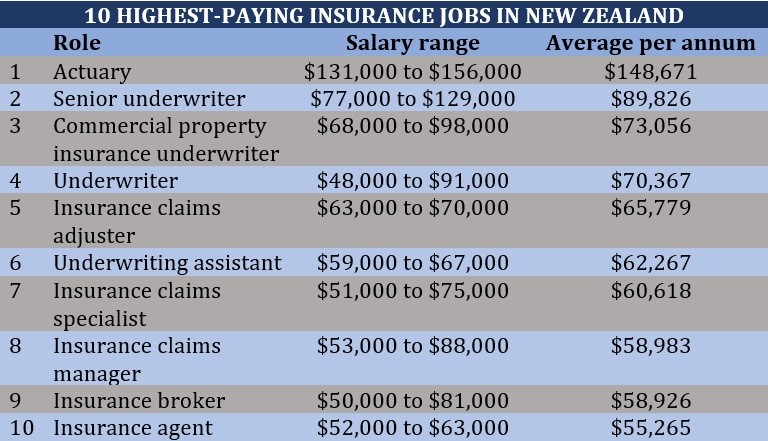

What entices many people to take up an insurance career is its strong earning potential. An insurance professional in New Zealand earns an average base salary of $61,000 per year, according to this website. Here are the 10 highest-paying insurance jobs in the country based on the website’s data.

Our Best in Insurance Special Reports page is the place to go if you’re in search of world-class insurance companies that offer the top insurance jobs in the country. The insurers featured in our special reports have been nominated by their peers and vetted by our panel of experts as dependable and trusted leaders in the industry.

Many of these insurance companies are also recognised as top employers committed to providing their employees with a positive workplace, a diverse and inclusive culture, and plenty of opportunities to grow their insurance careers. By choosing to be a part of these firms, you can be sure that you’re joining an organisation that puts a premium on their employees’ success and wellbeing.

Do you have experience in using the websites above to search for insurance jobs? We’d love for you to share your story in the comment box below.

Keep up with the latest news and events

Join our mailing list, it’s free!