Swiss Re’s alternative capital fees soar to $174m, third-party AUM hits $3.3bn

The Alternative Capital Partners (ACP) division of global reinsurance giant Swiss Re has seen continued success in fundraising in recent months, with third-party capital under management rising to $3.3 billion over the course of the third-quarter.

The rising level of third-party investor assets under management (AUM), at the alternative reinsurance capital and insurance-linked securities (ILS) focused unit of Swiss Re, is delivering a growing quantum in fee income as well.

Back at the mid-point of 2023, Swiss Re had reported its fee income earned from Alternative Capital Partners (ACP) activities had reached $74 million for the the first-half of 2023, which was up 72% year-on-year.

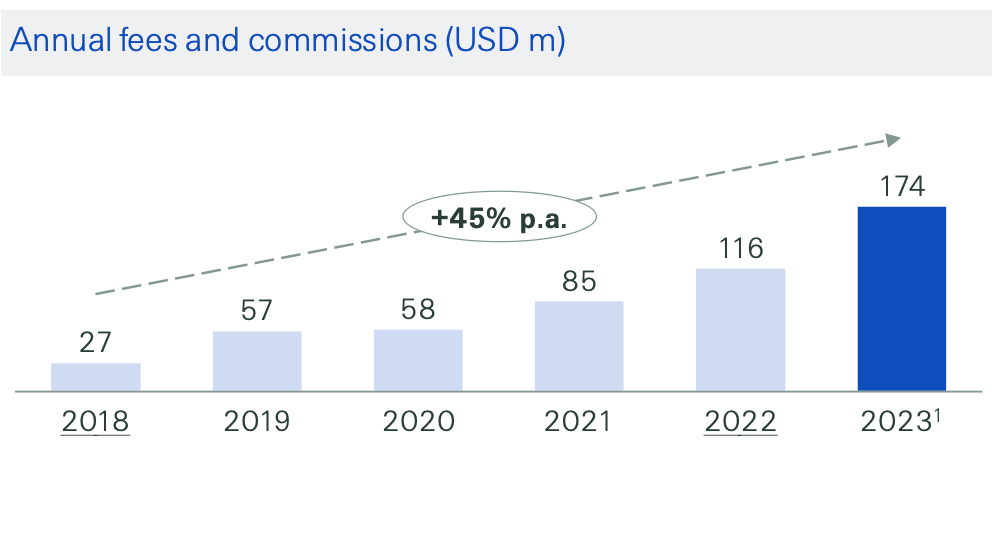

Full-year 2022 had seen the ACP division earning $116 million of fee income for the reinsurance firm.

Now, for the 12-months running to September 30th 2023, Swiss Re has reported that its fee income has reached $174 million, a clear step-up in earning potential.

This is likely driven by a number of factors, the rising third-party capital assets under management at Swiss Re’s ACP division, the performance of ILS instruments thus far in 2023, plus the higher spreads and returns available in ILS and reinsurance-linked investments that will be helping to boost fee income higher as well.

The chart below shows a strong 45% per annum growth trend in Swiss Re’s alternative capital and ILS related fee income earned (remember that the 2023 figure is a rolling 12-month number to September 30th).

A key driver of fee income growth, as well as the performance of the underlying reinsurance sidecars and ILS funds managed at Swiss Re, plus its catastrophe bond and ILS structuring and bookrunning activities, is the assets under management of the unit as well.

At June 30th 2023, Swiss Re had reported its third-party investor AUM managed by the ACP division was $3 billion. But, at September 30th that is now reported to have increased to $3.3 billion.

Alongside this, Swiss Re is itself a significant investor into ILS and catastrophe bonds, with around $1.3 billion allocated at September 30th, showing the reinsurer maintaining its aligned approach.

More details on Swiss Re’s ILS management activities can be found in our ILS manager directory.

Swiss Re manages the third-party assets in its range of collateralized reinsurance sidecar structures (Sector Re and Viaduct) and its insurance-linked securities (ILS) funds.

On the ILS fund side, Swiss Re has the more collateralized reinsurance focused Swiss Re Insurance-Linked Investment Management Ltd. (SRILIM) investment management unit and 1863 Fund platform, as well as the catastrophe bond focused SEC registered investment adviser, Swiss Re Insurance-Linked Investment Advisors Corporation (SRILIAC).

Overall assets, including Swiss Re’s stake, in the range of ILS structures managed had been $3.8 billion at the end of 2022. So growth to $4.6 billion by the end of September 2023 is significant for the company and for its fee production, as the numbers show.

Fee income from the Swiss Re ACP division is earned through asset management fee income, commissions and alternative capital related service provision to the reinsurance and ILS market.

More specifically, fee income is earned through proportional cessions via ceding and profit commissions, which is relevant to the sidecar platform at Swiss Re, while fees based on assets under management and performance are earned in the ILS fund operations.

On the service provision side, structuring and broker-dealer type fees earned by Swiss Re Capital Markets for its activities in the catastrophe bond and broader insurance-linked securities (ILS) sector also contribute to this total.

Swiss Re Capital Markets still occupies third position in our leaderboard of catastrophe bond dealers, banks and brokers.

While the fee income is now an increasingly impressive source of income for the Swiss Re group, there are additional benefits to managing third-party capital and the reinsurance firm is explicit in how this benefits its strategy.

The company notes that with the investment fundamentals of ILS and alternative reinsurance capital remaining intact, it sees growth ahead for aligned ILS structures, such as its sidecars, while the cat bond market is also outperforming.

The overall objective of the Alternative Capital Partners (ACP) division is to lower Swiss Re’s cost-of-equity, by supporting growth in a controlled manner through exposure management, generating additional revenues, providing underwriting capital relief, helping Swiss Re optimise its own use of economic capital.

Importantly, ACP has helped Swiss Re grow its own nat cat appetite and exposure, providing sustainable support while also moderating exposure, as it grows.

Swiss Re forecasts that it can continue its long-term growth trajectory in nat cat risks, thanks to the support of ACP and the growing third-party capital pool.

Given Swiss Re’s footprint in reinsurance, there is significant growth potential ahead for its alternative capital activities, and the trajectory of its assets under management and fee income is likely to continue.

Summing it all up, alternative capital and the ACP division’s activities are helping Swiss Re to do more in terms of underwriting catastrophe risks, while generating an increasingly attractive and meaningful source of income.

Swiss Re’s ACP is providing a good example of how bringing third-party capital more meaningfully into a reinsurance business can generate significant benefits and efficiencies for the company, while providing the third-party investors with access to one of the largest reinsurance portfolios in the world.