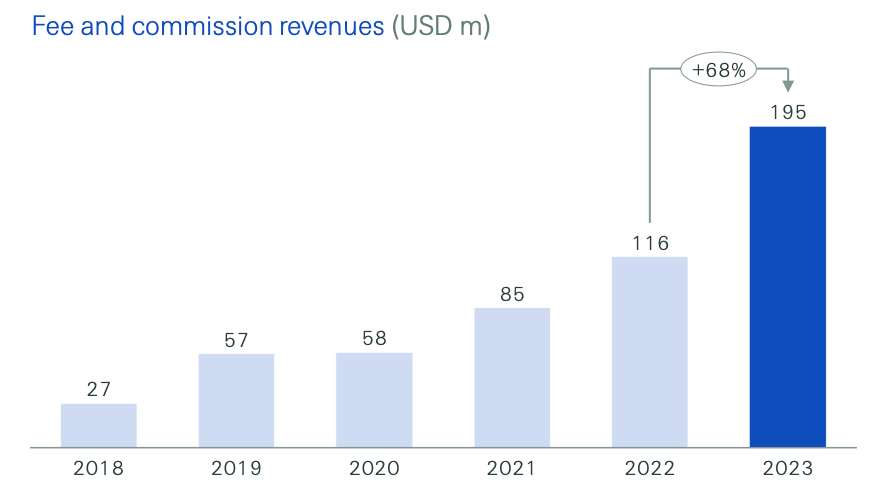

Swiss Re’s alternative capital fee income rises 68% to $195m in 2023

Swiss Re’s specialist insurance-linked securities (ILS) and third-party reinsurance capital management division, Alternative Capital Partners (ACP), has reported a 68% increase to its fee income earned for the full-year 2023, reaching $195 million.

With third-party investor assets under management (AUM), at the alternative reinsurance capital and insurance-linked securities (ILS) focused unit of Swiss Re, having reached $3.3 billion back at the end of the third-quarter, this larger pool of assets managed is now driving much higher fee income for the company.

Full-year 2022 had seen activities at the Alternative Capital Partners (ACP) division earning $116 million of fee income for Swiss Re.

Back at the mid-point of 2023, the reinsurer had reported that fee income earned from Alternative Capital Partners (ACP) activities had reached $74 million for the the first-half of 2023, which was already up by 72% year-on-year.

When the last report came in, the figure disclosed was for the 12-months running to September 30th 2023, over which period Swiss Re said its fee income has reached $174 million.

Now, reporting alongside its full-year 2023 results, Swiss Re has disclosed that full-year 2023 fee income earned by Alternative Capital Partners (ACP) reached an impressive $195 million.

Swiss Re also updated on its third-party capital AUM, which remained flat at $3.3 billion at January 1st 2024.

More details on Swiss Re’s ILS management activities can be found in our ILS manager directory.

While that is flat on the September 30th figure, it is now inclusive of movements in strategies, assets raised and capital due to be released, including across the Swiss Re range of quota share sidecars.

The company says it has experienced “Continued strong momentum in capital raising from new and existing partners,” in the ACP division.

While, “Growth in assets under management also benefitted from strong performance of the underlying strategies.”

As we reported earlier, on Swiss Re’s results, the reinsurer grew strongly in natural catastrophe business at the January renewals, which was also where the highest rate increases were seen.

With third-party capital levels having risen by 14% over the last year, from $2.9 billion at year-end 2022 to the now $3.3 billion level, this Alternative Capital Partner capacity will be making a significant contribution to Swiss Re’s nat cat underwriting firepower at renewals and helping to drive some of the growth.

Overall assets, including Swiss Re’s stake, in the range of ILS funds and sidecar structures managed by ACP, had been $3.8 billion at the end of 2022, but grew to $4.8 billion by January 1 2024, with the reinsurers own contribution rising again.

Remember, that fees earned by Swiss Re Capital Markets’ activities in the catastrophe bond and broader insurance-linked securities (ILS) sector also contribute to the fee income total.

Swiss Re Capital Markets still occupies third position in our leaderboard of catastrophe bond dealers, banks and brokers.