Swiss Re scales alternative capital & ILS towards $100m annual fee income

Global reinsurance company Swiss Re gave some insights into its growing Alternative Capital Partners business this morning, explaining that the annual fee income earned from alternative reinsurance capital activities and insurance-linked securities (ILS) management is on track for US $100 million.

As we explained earlier this year, Swiss Re’s alternative capital and ILS assets under management had reached a new high at $3.2 billion, with expansion across the sidecar and ILS fund platform.

As the level of assets managed has increased so too has the fee income earned from these activities related to ILS, which alongside Swiss Re’s activity in structuring, arranging and selling ILS through its Swiss Re Capital Markets unit, now sees the company earning a significant contribution from its third-party reinsurance capital venture.

The Alternative Capital Partners business has become a much more core area of activity at Swiss Re, enabling the reinsurance company to partner with large institutional investors and share the results of its catastrophe underwriting performance with them, while benefiting from protection against peak peril events and also earning fee income.

This morning, the reinsurer noted that the Alternative Capital Partners (ACP) business has rapidly scaled up at Swiss Re.

Swiss Re noted “the continued expansion of the natural catastrophe business, which reported an average combined ratio of 75%,” and when taking favourable prior-year development into account, sees the ten-year average combined ratio for the Swiss Re catastrophe book fall to 69%.

For any ILS investor a large, globally diverse book of property catastrophe risks that delivers an average combined ratio at that level over a ten-year period is a very attractive investment proposition.

Swiss Re noted today that this performance track-record of the catastrophe reinsurance underwriting book has “attracted rising interest from third- party capital partners.”

Reinsurance remains at the core of the Swiss Re strategy, the company explained this morning, suggesting the partnership opportunity for third-party investors is unlikely to diminish, as the reinsurer now integrates alternative capital sources into its underwriting capabilities through its quota share sidecar structures, as well as its Swiss Re Insurance-Linked Investment Management Ltd. (SRILIM) investment management unit and 1863 ILS fund platform.

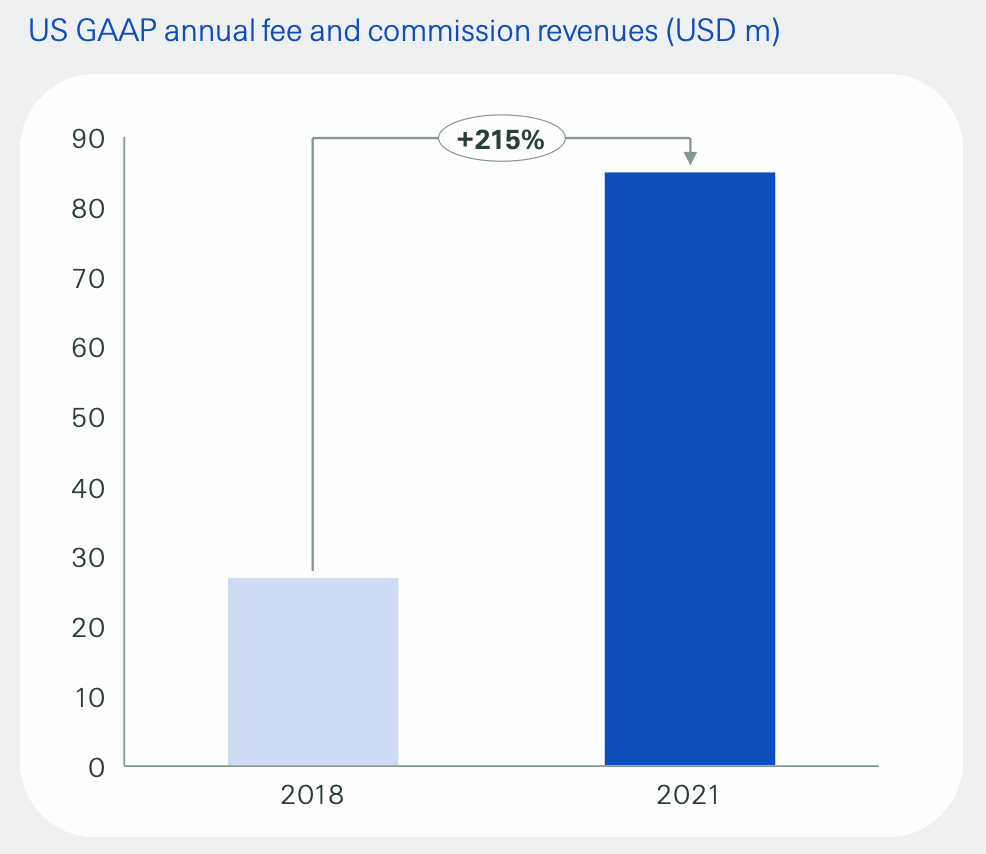

Having revealed this morning that annual fee income earned through ACP activities has now surpassed US $80 million, Swiss Re laid out a more ambitious target to take that to US $100 million, saying that as it continues to execute its strategy in the ILS space, that level of income from these operations is now approaching.

Having revealed this morning that annual fee income earned through ACP activities has now surpassed US $80 million, Swiss Re laid out a more ambitious target to take that to US $100 million, saying that as it continues to execute its strategy in the ILS space, that level of income from these operations is now approaching.

Swiss Re’s ACP fee income has now increased by 215% since 2018, to reach roughly US $85 million.

This is earned through asset management fee income, commissions and service provision fees as well.

Specifically, fee income is earned through proportional cessions via ceding and profit commissions, which is relevant to the sidecar platform at Swiss Re, as well as fees based on assets under management in the ILS fund operation, plus structuring fees for Swiss Re Capital Markets work in the catastrophe bond and broader insurance-linked securities (ILS) sector.

Swiss Re sees the growing ACP ILS activities as core to its strategy of being the leading catastrophe risk underwriter, as third-party capital helps the reinsurer manage its net risk exposure, by ceding excess risks to investors.

A commission, or spread, is earned between risk taking and hedging, with benefits far beyond the fee income, as Swiss Re recognises significant shortfall capital relief for its key peak peril exposures, such as US tropical cyclone risk thanks to its risk sharing with ACP investors.

Swiss Re’s reinsurance sidecar and ILS fund platform now carries 267% more in assets than it did in 2018, which has driven a corresponding 146% increase in shortfall relief for its major peak peril of US hurricane risk over the same period.

In addition, the ACP business provides capital relief too, through its use as a lever to improve diversification and this is having an increasing impact on the Swiss Re capital structure, as the third-party reinsurance capital management activities expand.

Underwriting capital relief attributed to the ACP activities has risen by 48% since 2018, Swiss Re said today.

The alternative capital market is an area Swiss Re wants to remain a leader in, with its own investment activities having increased, as a principal investor, and the Swiss Re Capital Markets unit remaining third in our leaderboard of catastrophe bond banks and brokers.

With Swiss Re’s assets under management growing strongly across its sidecars and ILS funds, benefits to the group expanding in terms of shortfall and capital relief, while remaining a leading player in the catastrophe bond and ILS capital markets arranging world, it seems likely the annual fee income run-rate will reach the $100 million mark before too much longer.

That’s a significant contribution to Swiss Re’s overall earnings and if you could value the other benefits, of hedging, shortfall and capital relief too, the monetary value of the Alternative Capital Partners and Swiss Re Capital Markets ILS activities is particularly significant for the company.

Swiss Re appears to be finding a level of scale and balance for the use of third-party capital that is now additive to the businesses results and will help it sustain its growth in natural catastrophe risk underwriting.

As we’ve explained many times before, this is the holy grail for those leveraging third-party capital within their reinsurance businesses, finding a strategy and scale that adds meaningful bottom-line income benefits, while allowing more growth, plus protecting from the downside as well.

The whole point of engaging with ILS and capital market investors is either to leverage their appetite for risk to help hedge your book, or to find a sweet-spot where working together delivers the returns they want, alongside growth and other benefits for your own book.

Which is where Swiss Re is clearly heading right now, with the ACP and ILS related benefits growing all the time for the reinsurer.

Match that with a partnership approach, and an alternative capital business within a traditional reinsurer can begin to deliver incremental growth opportunities as well, while there is also a significant chance to realise synergies across other areas of the business, such as, in Swiss Re’s case, across other lines of business and even with the Corporate Solutions unit.