Swiss Re P&C result shows hard market improvements as renewal rates soar

Announcing its quarterly and half-year results this morning, global reinsurance giant Swiss Re has shown the effects of improved market conditions, with its P&C reinsurance arm delivering stronger results thanks to lower catastrophe impact and higher margins.

Higher rates and pricing at the reinsurance renewals this year are just part of the equation for Swiss Re, perhaps more important are the adjustments to attachment points and terms and conditions, as the company has avoided too much impact from what was a very costly second-quarter in the United States as well.

Overall, Swiss Re has reported very strong net income of US $1.447 billion for the first-half, significantly up on the prior year’s US $157 million.

In P&C reinsurance, the net income result reached $904 million for H1 2023, well up again on the previous year’s $316 million.

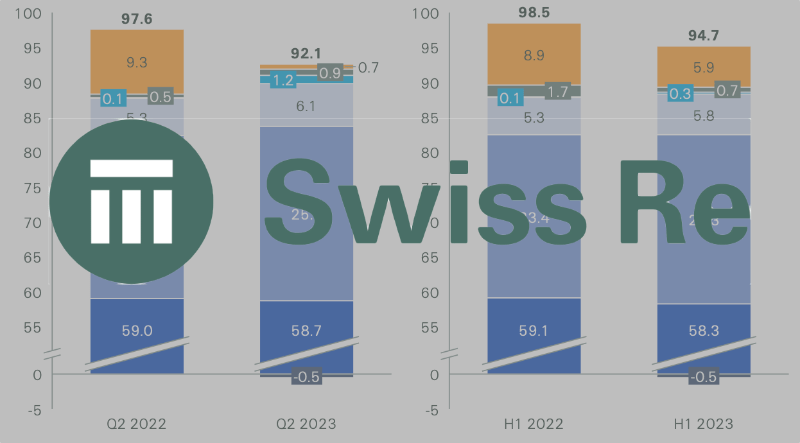

That has been helped by a combined ratio that fell to 94.7%, down on the H1 2022 figure of 98.5%.

At the same time, the reinsurance firm continued to expand, with net premiums written increasing 4.4% to US $22.1 billion in the first-half of 2023.

Swiss Re’s Group Chief Executive Officer Christian Mumenthaler explained, “The overall result in the first half of 2023 reflects the good positioning of Swiss Re, as well as the quality of our new business. The performance of P&C Re and Corporate Solutions contributed to a solid second quarter.”

Swiss Re’s Group Chief Financial Officer John Dacey added, “In spite of macro-economic volatility, higher interest rates and steadily increasing recurring income contributed to an improved investment result. We have maintained our very strong capital position, which allows us to take advantage of attractive business opportunities.”

Citing “contained natural catastrophe losses” for the first-half, Swiss Re actually reported $634 million of large nat cat losses for H1 2023, relating to the earthquake in Turkey and Syria, Cyclone Gabrielle and flooding in New Zealand, all of which were in the first quarter.

That compares to $938 million of large nat cat losses a year earlier.

Large man-made losses meanwhile, where just $76 million in the first half of 2023, down again on the previous years $178 million that had been affected by the war in Ukraine.

The P&C reinsurance result has benefited from higher margins coming through from renewed business and the lower-than-expected natural catastrophe loss burden.

But, the make-up of the Swiss Re property and nat cat book are clearly also helping, with renewed terms meaning the exposure has shifted to large nat cats more than attrition from weather and severe storms, it seems.

Swiss Re explicitly calls out the fact its renewed portfolio increasingly means “reduced exposure to low-attaching nat cat and aggregate covers.”

Given the reporting from US primary insurers, of very severe convective storm (SCS) loss activity, especially from hail, it’s surprising not to see any mention from the big reinsurers like Swiss Re.

In previous years, the reinsurers would almost always have taken a share of these losses that would have been worth citing in their reporting.

But, in 2023, with attachments higher, aggregate covers reduced and terms generally tighter across property and catastrophe reinsurance renewals, it now seems the bulk of those frequency type event losses are sitting with the primary market, if even Swiss Re isn’t being unduly affected by the near-record level of SCS loss activity in the United States in Q2.

At the July P&C reinsurance renewals, Swiss Re has reported $4.3 billion of premiums renewed, which was actually a reduction of -8% on the previous year.

This appears to have signified a reduction in US volumes written at the mid-year, as for the first-half renewal premium volumes fell by -6% across the Americas for Swiss Re.

For the first-half though, net P&C reinsurance premiums were driven higher by the January and April renewals, to reach $11.4 billion, up from $10.6 billion a year earlier.

At the July renewals Swiss Re saw price increases rising +21%, against higher loss assumptions of +16%, driving a +5% net price increase for the reinsurer.

Year-to-date renewal prices are up +18%, versus +13% higher loss assumptions, again for a +5% net price increase so far in 2023.

The natural catastrophe reinsurance book at Swiss Re has now increased by +12%, in premium volume terms, with property also up by +9%.

But rate is driving a lot of that increase and alongside the term changes the improvement in results, driving a higher performing portfolio of business at Swiss Re, especially (it seems) against secondary peril activity.

Which bodes well for Swiss Re, for its shareholders and its Alternative Capital Partners (ACP) investors, but also has a wider read-across for the rest of the reinsurance and ILS industry, as you can clearly see Swiss Re’s portfolio escaping too much impact from the storm activity we’ve seen.

This is also evident in Swiss Re’s property reinsurance segment, where it has reported a combined ratio of just 70.7%, much better than the prior year’s 101.1%, for the second quarter of 2023.

For the first-half, the property reinsurance combined ratio was just 74.9%, down from the previous year’s 98.8%.

Swiss Re highlights the “strong underlying profitability and favourable large nat cat experience” as drivers, but it’s also clear that it’s the quality of the underlying portfolio, that has now been improved through a number of hard market renewals, which is also driving better performance.

Looking ahead, CEO Christian Mumenthaler said, “An increased risk awareness and rising interest rates are contributing to a strong market for our industry. As we enter the second half of the year, our transition to a simpler organisational structure, which we began implementing in April 2023, is well underway.

“Given the positive contribution of all our main businesses, we are focused on achieving our profit target of more than USD 3 billion for the year.”