Swiss Re cat bond index hits record 19.69% total-return for 2023

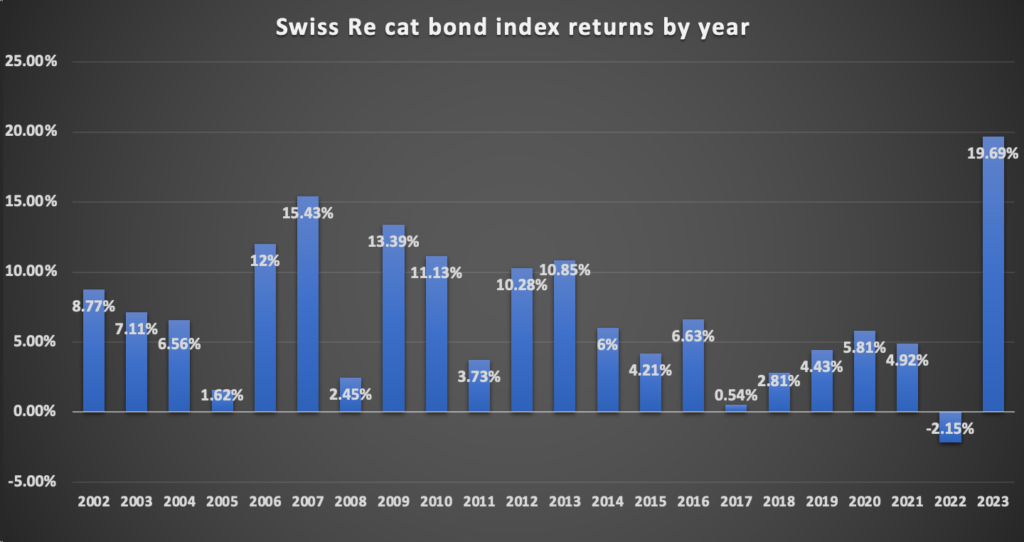

The total-return of the outstanding catastrophe bond market in 2023 reached a record level of 19.69%, according to full-year data from the Swiss Re Cat Bond Performance Indices.

While the Index failed to reach the magic 20% mark by the end of the year, it has still set an extremely high bar in 2023 for any future years to compete with.

The Swiss Re catastrophe bond Index is the most widely used benchmark for the total-returns delivered by the current pool of outstanding cat bonds.

As a measure of cat bond market performance, this Index has been on-track to set a record since the early part of last year.

The Swiss Re catastrophe bond Index had reached a 10.34% total-return by the end of June, which set a new record for any half-year in its history.

Then, by early October, the Swiss Re cat bond Index had surpassed 16%, which saw it beating the previous full-year record, cementing a new record investment return for the catastrophe bond market, according to this benchmark, as the highest annual total return of the Swiss Re Global Cat Bond Index had previously been 15.43% set way back in 2007.

We said at the time that the landmark 20% return was in sight, but as seasonality begins to drop out of the returns of hurricane catastrophe bonds after the season ends in November, the total-return of the cat bond market, as measured by Swiss Re’s Index, failed to reach that mark, to end the year’s final calculation of the cat bond Index for a 19.69% total-return.

As we’ve reported before, any record returns set in 2023 could prove hard to repeat or beat in future years.

As well as the rising pricing of new catastrophe bond issuance over the last year or two, that has clearly boosted cat bond market returns, a combination of other factors also swelled the cat bond market’s performance in 2023.

These include, the much higher risk-free returns added thanks to the floating-rate nature of the cat bond asset class that contribute to the total-return figure, some of the macro effects that were still influencing the market at the start of 2023, and perhaps most importantly the recovery in value of many US wind exposed cat bonds post-hurricane Ian.

These factors may never come together to be repeated in quite the same way again, although there is always a chance of similar factors coinciding to drive a stronger total-return again in future years.

But, 2023 is unlikely to be repeated in precisely the same way and with new issuance catastrophe bond pricing and spreads having now stabilised, some say roughly 10% down on its peak of earlier this year, it remains to be seen if we experience those levels of pricing again any time soon.

Still though, the total-return potential of the catastrophe bond market for 2024 also remains high, with cat bond fund managers predicting double-digit return potential again.

Cat bond funds have seen a wide-spread in terms of performance over the last year, with some managing high double-digits to even just over 20% for full-year 2023.

The reason some cat bond funds have outpaced the Swiss Re Index, is that the Swiss Re Cat Bond Performance Indices only include natural catastrophe bonds, so no life, health, specialty lines or cyber cat bonds are included in it.

Given there were four cyber catastrophe bonds issued in the final quarter of 2023, each offering relatively high-yields and some of the other specialty lines type cat bonds are also higher-yielding, this is one way cat bond funds have managed above 20%.

It’s also important to note that some cat bonds funds do also include private deals and transformed reinsurance deals, so are not a clear comparison to the Swiss Re Index.

But, differences aside, the performance of the catastrophe bond market has been stellar in 2023, cementing its place as one of (if not the) best performing alternative asset classes of the year.

Download your copy of our brand new catastrophe bond market report, reviewing Q4 and full-year 2023 cat bond issuance.

You can analyse the pricing and spreads of new catastrophe bond issuance in our charts displaying cat bond pricing and spreads, as well as cat bond multiples-at-market, by year and quarter.

Find all of Artemis’ catastrophe bond market charts and data here, or via the Artemis Dashboard.

All of our charts are updated as new catastrophe bond issues complete, and as older issuances mature, based on the data in Artemis’ extensive catastrophe bond Deal Directory.