Sustainable Investing – The Time is Now

Highlights:

Strong sustainable investing interest in the current environment

Record fund flows into Canadian sustainable investment funds

Wide interest/usage gap and demographic factors allude to potential for greater fund flows

Discussion and education will be important drivers going forward

![]()

Sustainable investing (often referred to as ESG investing) generally refers to approaches incorporating ESG (environmental, social, and governance) factors into the investment management process. Interest in these approaches has exploded in recent years. According to Google Trends, global interest in ESG investing is at its highest level over the longest observable period.

Google trends: Relative interest over time

Source: Google Trends, January 2004 – June 2021. Numbers represent search interest relative to the highest point on the chart for the given region and time. A value of 100 is the peak popularity for the term. A value of 50 means the term is half as popular. A score of 0 means there was not enough data for this term.

Arguably, climate change is considered the initial driver of interest in sustainable investing. However, the onset of the COVID-19 pandemic in early 2020 sharply accelerated the trend as an increased focus on social issues took hold. First, the scramble for PPE (personal protective equipment) put a spotlight on access to health care equipment when countries with manufacturing capabilities blocked exports of these critical items to ensure their own citizens were protected first. As economies locked down to prevent virus spread, workers in the lower-paying hospitality and tourism industries were disproportionately affected with job losses, while many professionals simply shifted to working from home. Essential workers in congregate care settings, food processing, and distribution centers were disproportionately exposed to workplace safety issues with virus outbreaks at their places of employment. And now the richest countries hoard vaccine supply for their own populations, again limiting global access to health care.

On another developing front, public companies are seeing increased pressure from shareholders and the courts to act more strongly on sustainability factors. May 2021 provided a prime example when three energy companies were subject to high-profile events relating to climate action. First, in the Netherlands, a court ruling against Royal Dutch Shell ordered the company to reduce their (and their suppliers and customers) CO2 emissions by a net 40% by 2030, compared to 2019 levels. The company’s previously announced carbon reduction goal was to reduce the carbon intensity of its energy products by 20% by 2030. The second event was a shareholder vote at ExxonMobil, where an activist investor won three director seats on the company’s twelve-member board. They were put forth to help Exxon’s longer-term value creation by addressing more disciplined capital allocations, an incentive policy better aligned with shareholder value, and in its transition to compete in a lower-carbon economy. The final event was at Chevron, where shareholders voted in favour of reducing the company’s Scope 3 emissions1, which was a vote against management’s recommendation.

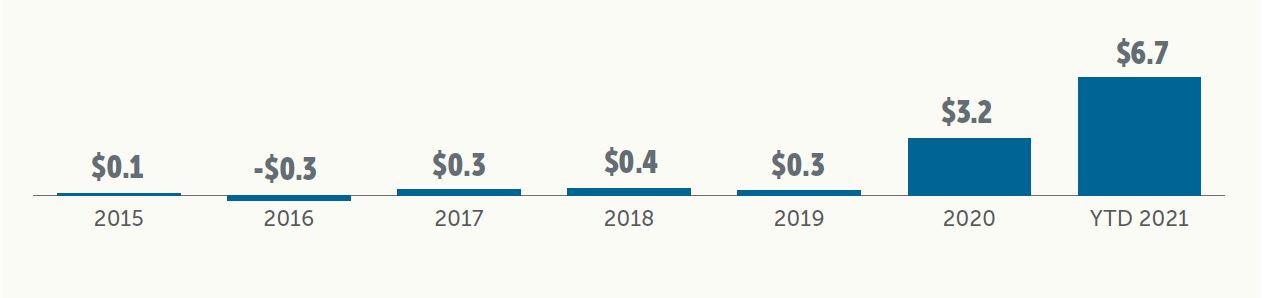

Evidence of the increased interest in sustainable investing can be seen in fund flows into Canadian domiciled sustainable investment funds (mutual funds, ETF’s, segregated funds). Fund flows in 2020 more than tripled those reported in the preceding five years COMBINED, and the parabolic trend continued into the first five months of 2021 alone, which more than doubled fund flows reported in all of 2020.

Estimated Canadian fund flows

(billions $CAD)

Source: Morningstar Research Inc., as at May 31, 2021 – excludes fund of funds

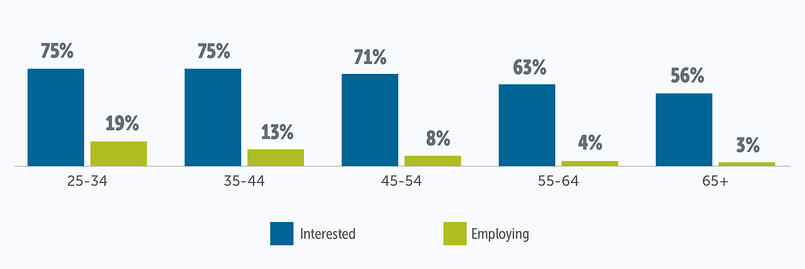

Despite the growth in fund flows, evidence suggests these trends could be much stronger due to a significant interest/usage gap. A 2020 research report by the CFA Institute2 reveals that among global investors, interest in sustainable solutions far exceeds actual usage across age groups. With usage gaps (% interest minus % employing) consistently in the 53%-63% range, this represents a great deal of untapped potential for sustainable investment solutions.

Percentage of investors interested/employing sustainable strategies by age group

A very similar dynamic holds true among Canadian investors. According to the Responsible Investment Association (RIA) , 73% of investors surveyed indicated an interest in sustainable investments, however, only 33% employed sustainable strategies. Among younger investors (aged 18-34) 83% expressed interest and only 50% employed sustainable strategies, while in older groups (aged 55+) the results were 59% and 20%, respectively.

As noted previously, there is a higher level of interest in sustainability among younger investors. Not a surprising view, considering younger populations will likely bear the brunt of climate change’s impact on their quality of life. They are more willing to act now to prevent the “tragedy of the horizon”, a term coined by the former Bank of Canada (and Bank of England) governor Mark Carney. The term refers to the timing of climate change’s devastating effects being beyond the time horizon global leaders typically consider when making policy decisions. However, when it is close enough to be considered a threat within their policy window, it will likely be too late.

Combining this younger demographic’s views with the ongoing intergenerational transfer of wealth, demand for sustainable investment products may further explode. According to Investor Economics3, an estimated $1 trillion of wealth will be transferred from Baby Boomers to younger generations by the year 2026 in Canada.

What does sustainable investing look like?

Sustainable investing today is no longer about just avoiding companies considered to have involvement in areas considered unethical. That was in the past. It is now about realizing that environmental, social, and governance factors can have a real impact on the value of an investment and on one’s portfolio. It is also about directing capital towards companies and opportunities that may foster positive change for all. It is a shift in mentality that considers profits, people, and the planet. Advisors and financial institutions that are not aligned with this evolution in investor demographics and priorities may see their business prospects significantly affected.

![]()

Related articles:

Sustainable investing: Common myths and misconceptions

Sustainable investing: Common myths and misconceptions – Part 2

Sustainable investing: Common myths and misconceptions – Part 3

Sustainable investing at Empire Life

1 Scope 3 emissions are indirect emissions from sources not owned by the company – for example when gasoline is burned by their customers

2 Future of Sustainability In Investment Management: From Ideas to Reality (2020)

3 2019 Investor Economics Household Balance Sheet Report

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value. Please read the information folder, contract and fund facts before investing. Performance histories are not indicative of future performance.

This content reflects the views of Empire Life as of the date published. The information in this document is for general information purposes only and is not to be construed as providing legal, tax, financial or professional advice. The Empire Life Insurance Company assumes no responsibility for any reliance on or misuse or omissions of the information contained in this document. Please seek professional advice before making any decisions.

July 2021