Surge in U.S. auto insurer claim payouts due to economic and social inflation

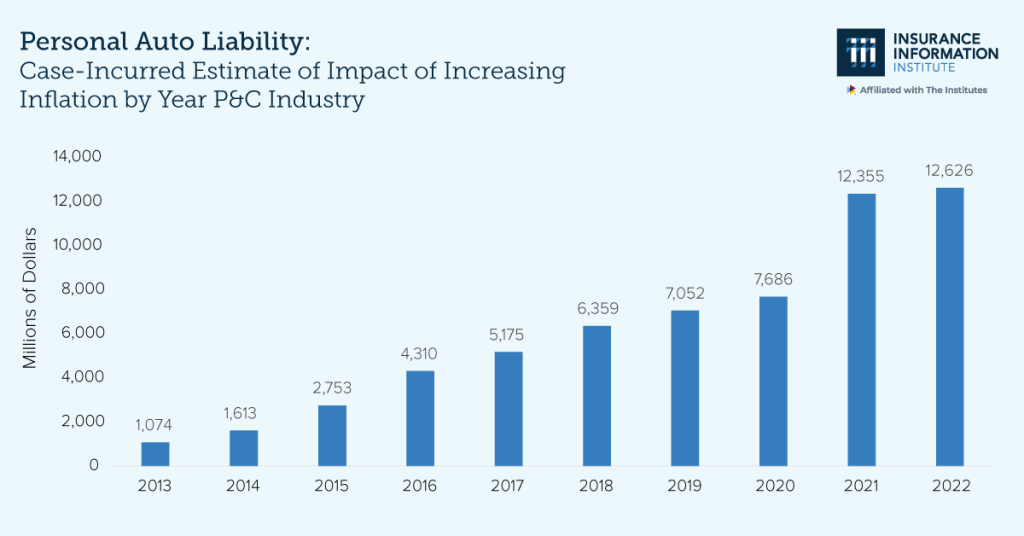

The latest Insurance Information Institute (Triple-I) research indicates that between 2013 and 2022, economic and social inflation fueled a $96 to $105 billion increase in combined claim payouts for U.S. personal and commercial auto insurer liability.

The report “Impact of Increasing Inflation on Personal and Commercial Auto Liability Insurance” outlines Triple-I’s continued exploration of the impact of social inflation on insurer costs and claim payouts. The study proposes that increasing inflation drove loss and DCC (defense containment costs) higher in both insurance lines– by 6.5 percent ($61 billion) of total loss and DCC for personal auto and by 19 to 24 percent ($35 to $44 billion) for commercial auto.

Key Takeaways

Estimates place the average annual impact of increasing inflation at 0.6 percent for personal auto and 2.7 percent for commercial auto. The accident rate (claim frequency) declined, and claim severity (size of losses) increased dramatically for personal and commercial lines. Increasing inflation was mainly driven by social inflation factors before 2021, and since that year, it has continued as a product of economic and social inflation.

Researchers Jim Lynch, FCAS, MAAA, Triple-I’s former chief actuary, Dave Moore, FCAS, MAAA, president, Moore Actuarial Consulting, LLC, and Dale Porfilio, FCAS, MAAA, Triple-I’s chief insurance officer, approached the topic in a manner similar to their prior collaborations (in 2022 and early 2023). They used loss development patterns to identify inflation for selected property/casualty lines in excess of inflation in the overall economy. However, they extended their methodology in this project to use annual statement data through year-end 2022. Also, in this report, the authors use the term “inflation” for the first time to convey the operative mix of social and economic inflation on insurers’ costs.

Commercial Auto Liability

Data indicates that commercial auto liability faces its share of challenges, too, as losses have outpaced the growth rate of the overall economy. Claim severity (size of losses) has risen 72 percent overall since 2013, with the median annual increase at 6.3 percent. The report compares this change to the annual median increase of 2.1 percent in the Consumer Price Index, an observation offered as evidence that before 2020, social inflation may have been a primary factor in loss trends.

Researchers estimate that from 2013 to 2022, increasing inflation drove losses up by between $35 billion and $44 billion, or between 19 percent and 24 percent. The pandemic brought significant change to commercial auto liability, decreasing claim frequency while increasing claim severity more dramatically. Researchers contend the loss development factors for this line of business signal an ongoing problem of inflationary factors.

Personal Auto Liability

This line took in four times the net earned premiums in 2022 as commercial auto liability. However, multimillion-dollar personal auto settlements are rare; consequently, the cases have less impact on insured losses or development patterns. Premiums and insurer losses in this line fluctuated over the prior two decades but continue to increase, albeit more slowly than the overall economy. In recent years, however, losses have been growing faster than premiums. Since 2020, premiums fell 13 percent, while losses rose 15 percent. And, after 2019, severity increased dramatically, with the compound annual increase holding 3.0 percent from 2013 to 2019, then tripling to 9.2 percent compounded annually.

The double whammy of economic inflation and social inflation

The report describes the nuanced findings of personal and commercial auto liability –understandably different as these markets differ in many aspects, including size and risk factors. The analysis reveals some trends in common, however. Findings in commercial and personal auto liability indicate that the overall accident rate (claim frequency) declined during the early pandemic years, yet the severity (size of losses) increased more dramatically.

The earliest study in this series looked at insurance trends through the end of 2019, focusing on loss development factors (LDFs). Since economic inflation was stable, but LDFs were increasing steadily during that time, the researchers concluded that economic inflation was likely not the cause of rising costs. Then, beginning in 2021, a sizable uptick in the CPI-All Urban signaled a rise in overall economic inflation.

The resulting implications for underlying insurer costs can be observed in factors that impact claim payouts, such as replacement costs. The report states that since 2008, replacement costs for commercial and personal auto insurance have outpaced overall prices in the economy by 40 percent. Since 2019, these costs have risen almost three times faster than prices overall. Thus, for the years prior, researchers continue to attribute the bulk of losses for both lines primarily to social inflation but propose that social inflation and increasing overall economic inflation share the credit beginning in 2020.

Triple-I plans to continue to foster a research-based conversation around social inflation. For an overview of the topic and other helpful resources about its potential impact on insurers, policyholders, and the economy, check out our knowledge hub, Social inflation: hard to measure, important to understand.