Suncorp feels cost of hard reinsurance market, drops aggregate cover

Australian insurance giant Suncorp has completed its catastrophe reinsurance renewal for the coming year, but has clearly felt the cost of a hard market, with the tower shrinking, Suncorp’s retention rising, the cost being up and, perhaps most notable, its long-standing aggregate cover has not been renewed.

The company explained that, “The hardening reinsurance market results in both increased reinsurance premiums and increased risk retention for FY24.

“Increased risk retention impacts both the natural hazard allowance and the amount of capital required to be held by the Group.”

Suncorp said that the combined cost of its fiscal year 2024 catastrophe reinsurance premiums and its natural hazard allowance is expected to increase by around $250 million, or 12% from the prior year.

“This reflects the hardening global reinsurance market and the impact of adverse weather events through the La Niña cycle in recent years across Australia and New Zealand,” the company said.

Suncorp Group CEO Steve Johnston commented, “We continue to see a significant reassessment of risk by our reinsurance partners, which reflects elevated natural hazard activity in recent years both globally and in Australia and New Zealand. This, combined with broader inflationary pressures across the economy, continues to impact the cost of reinsurance across the industry.

“This renewal again underscores the challenges facing the insurance industry in Australia and New Zealand. If the proposed sale of Suncorp Bank to ANZ is approved, Suncorp would become a dedicated insurer at a time when the value of insurance to the economy and the public has never been greater.”

On the renewal, Suncorp said that it looks for an optimal balance between the cost of its reinsurance and retaining acceptable levels of earnings and capital volatility, so changes have been made to “ensure this balance is maintained in the context of the material hardening of the global reinsurance market in recent years.”

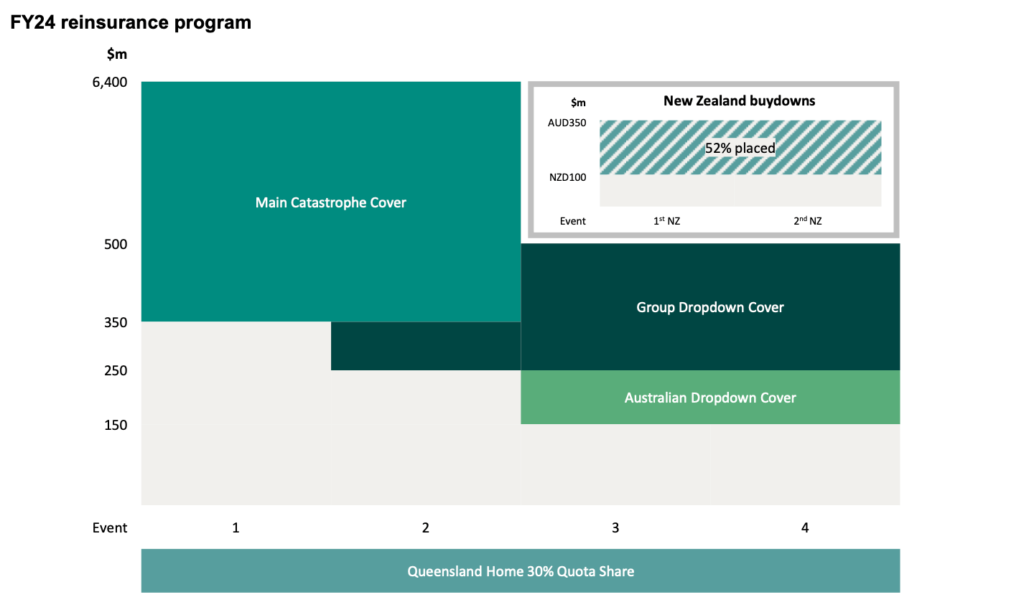

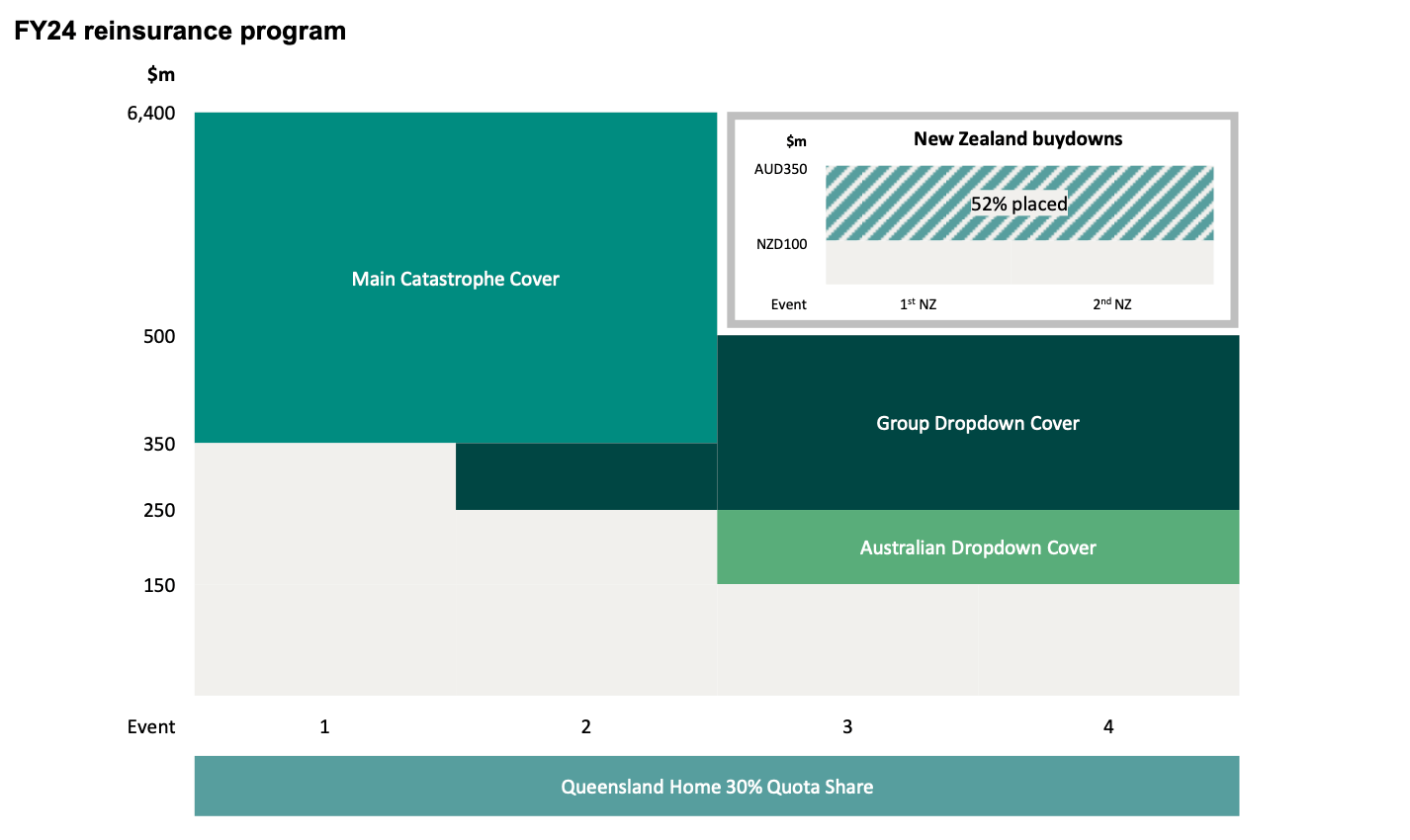

For the fiscal year 2024 renewal, Suncorp’s retention has risen to $350 million, up from $250 million a year ago.

As a result, Suncorp’s main catastrophe reinsurance tower will now cover losses from $350 million up to $6.4 billion for the 2024 fiscal year.

That is a reduction in cover, as last year Suncorp renewed the catastrophe reinsurance tower to cover losses from $250 million up to $6.8 billion.

Suncorp said the $6.4 billion limit remains in excess of the Australia and New Zealand regulatory requirements and that the reduction from 2023’s limit is due to having recently joined the Cyclone Reinsurance Pool (CRP) in Australia and secured increased coverage from the EQCover in New Zealand.

Suncorp has also purchased dropdown reinsurance covers that reduce the second, third and fourth event retention to $250 million, which it seems are higher attachments than the previous year’s dropdowns.

A specific Australian dropdown program has also been purchased, lowering the third and fourth event retention for events in Australia to $150 million, up from $100 million a year earlier.

In New Zealand, Suncorp said that buydown cover has only been 52% placed, as “Placing the remaining 48% of the buydown cover was not economically viable, although opportunities to do so in future will be considered.”

Here, in NZ, there is also an increased retention for this buydown cover, of $50 million over the previous years $25 million.

On aggregate reinsurance, for the coming year Suncorp will not have any in place.

In recent years, Suncorp has relied on this aggregate reinsurance for recoveries, as its losses exceeded the attachment point a number of times.

“Following comprehensive modelling on its cost and benefits, the aggregate excess of loss (AXL) cover has not been renewed,” the company explained.

Finally, Suncorp also maintained a 30% quota share arrangement for its Queensland home insurance book.

CEO Johnston explained that the insurer looked at various other forms of reinsurance cover, including a whole of account quota share, but, “We believe the cover that has been placed provides the best outcome, balancing optimal returns with an acceptable level of volatility.”

Because of the changes to the catastrophe reinsurance for fiscal year 2024, Suncorp said that its natural hazard allowance is expected to increase to $1,360 million (up from last year’s $1,160 million).

This reflects increased retention, the inflationary claims environment, and is partially offset by entering the cyclone reinsurance pool, Suncorp said.

The insurer said it will continue to reflect its increased costs, including of reinsurance, into the pricing of its insurance policies, as it looks to keep its underlying insurance margin within a 10%-12% range.

Suncorp also noted how the reduced reinsurance cover affects the way it will need to hold capital, with a roughly $340 million increase to the capital required to be held by its general insurance businesses.

Finally, Suncorp also highlighted this morning that its current year natural hazard losses are expected to go between $90 million and $120 million over budget.

Its natural hazard experience for the 2023 fiscal year is estimated to be between $1.25 billion and $1.28 billion, above the allowance of $1.16 billion.

It’s hard to say whether that means additional reinsurance recoveries at this stage, but its aggregate reinsurance deductible had been almost half eroded by the end of its fiscal year first-half.

Suncorp’s renewed catastrophe reinsurance arrangements for the coming year can be seen below.

.