Stocks Up as Jobs Report Fuels Push for Fed to 'Get on With It'

He still sees a first cut in November — but says the path to a September reduction got “a little wider.”

Chris Larkin at E*Trade from Morgan Stanley, says that the latest jobs data suggest the labor market is slowing — maybe not enough to speed up rate cuts, but perhaps enough to keep the Fed on track for September.

At Apollo Global Management, Torsten Slok’s view remains unchanged — no Fed cuts in 2024.

He says the jobs report confirms that it is going to take time for the Fed to cool down the economy and inflation.

“Looking ahead, the key discussion in markets will be whether this cooling will accelerate to the downside because of still-elevated costs of financing. Or whether we will see a reaccelerating economy because of high stock prices and tight credit spreads,” Slok noted.

After the jobs data comes Fed Chair Jerome Powell, who on Tuesday will deliver his biannual testimony on Capitol Hill at 10 a.m. in Washington. Then the consumer-price index is issued on Thursday.

“If next week’s CPI is cooperative, the case for a September cut will be that much stronger,” said Chris Low at FHN Financial.

“The Fed remains the biggest risk to the market,” said Ed Clissold, chief U.S. strategist at Ned Davis Research. “Recession risks are low, earnings growth is improving and economic data point to the Fed cutting rates this year, but if there’s a negative surprise then stocks are vulnerable to a bigger pullback, given the already strong rally in the first half of this year.”

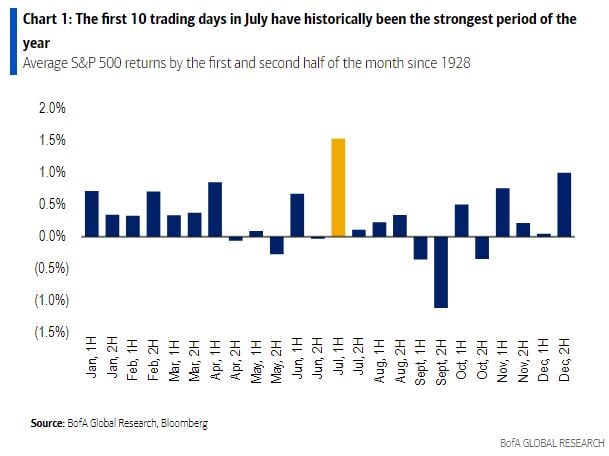

Strong seasonality is colliding with a slew of market-moving events over the next few trading sessions will be key catalysts in determining whether this year’s stock rally powers even higher — or stalls — as traders enter the best stretch of the year for equities.

Since 1928, the first 10 trading days of July have historically been the strongest period for the S&P 500 Index, with the benchmark stocks gauge advancing 1.5% on average, rising nearly 70% of the time, according to Bank of America Corp.

Stock Markets

The S&P 500 rose 0.4% as of 1:41 p.m. New York time.

The Nasdaq 100 rose 1%.

The Dow Jones Industrial Average was little changed.

The MSCI World Index rose 0.3%.

This story was produced with the assistance of Bloomberg Automation.

Credit: Shutterstock