Stocks Rally as Data Show Economy Is Holding Up

The market fallout from the “weak” early August U.S. data was “disproportionate” and largely reflected the unwind of crowded positions in some markets, according to Jonas Goltermann at Capital Economics.

“As such, we are sticking to our optimistic forecasts for equity markets and “risky” assets more broadly,” he said.

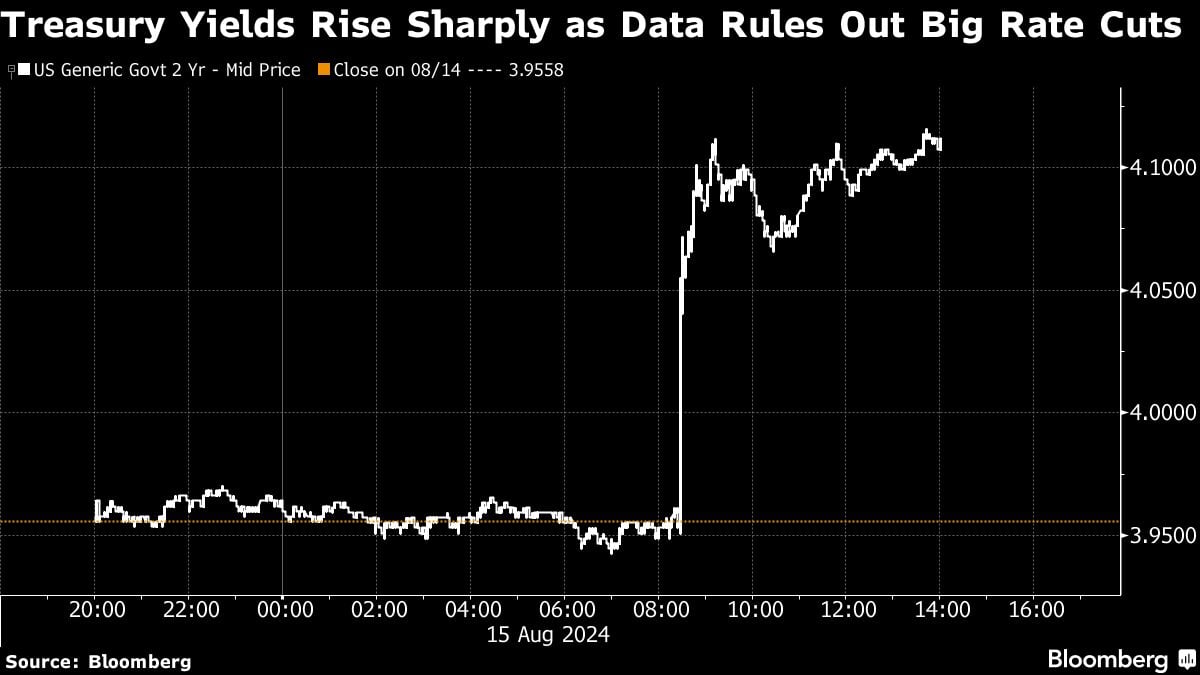

“Today didn’t deliver any major curveballs,” said Chris Larkin at E*Trade from Morgan Stanley. “More data like this could ease concerns that the economy is tilting toward recession, and take pressure off the Fed to cut rates more aggressively than they’d like to.”

The largest unwind in U.S. equities since the Covid-19 pandemic is over, and now trend-following quant funds are ready to return to the stock market.

Over the past month, so-called systematic funds — which buy stocks based on market signals and volatility moves rather than company fundamentals — have sold the largest dollar-volume of equities in four years, according to Scott Rubner at Goldman Sachs Group Inc.

Last week, the VIX volatility gauge doubled in three trading sessions, a feat accomplished only four times previously: 1987 crash, 2011 euro crisis, 2015 China devaluation, and 2018 Volmageddon, according to Ed Clissold at Ned Davis Research.

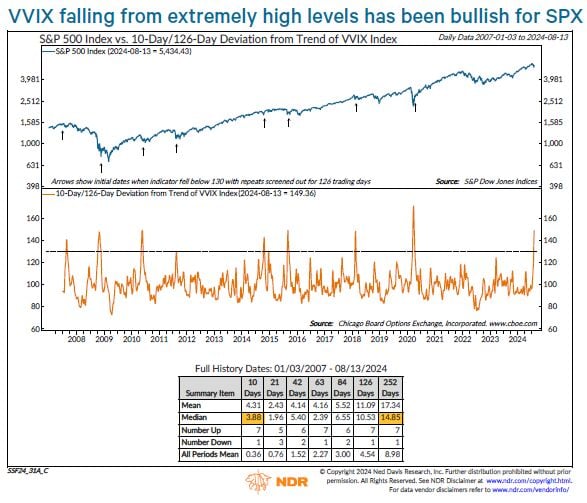

Another way to capture the volatility surge is through the VVIX — which measures the volatility of the VIX.

On Aug. 5, the gauge hit its highest level since March 2020. When the VVIX has fallen from such extremely high levels, the S&P 500 has rebounded sharply over the next few weeks, Clissold noted. The rally has continued for up to a year later, on average.

“If the markets continue to calm down, the VVIX indicator should give a bullish signal in the coming days, confirming that the bull market is intact,” he concluded.

Source: Ned Davis Research

Source: Ned Davis Research

As the S&P 500 headed for its fourth straight weekly decline, Goldman Sachs Group Inc.’s unit that executes share buybacks for clients saw record orders, with volume spiking to 2.1 times last year’s daily average.

A buying spree also occurred with BofA’s corporate clients, whose share repurchases picked up speed and stayed above seasonal levels for 22 weeks in a row.

While calm has seemingly been restored to Wall Street, Deutsche Bank AG’s Christian Nolting says investors still need to gird against wild asset swings to come.

“We expect volatility to stay at higher levels due to seasonality and change in markets which are no longer priced to perfection,” said Nolting. Expectations have been reset after the once unstoppable equities rally stumbled on a weak jobs report and the “good news is now good news and bad news is bad news.”

To Jeff Roach at LPL Financial, the jobs market — and what it means for consumer spending — is a key factor in why the Fed is expected to start cutting interest rates next month, he said. Measures of consumer sentiment have been subdued as the labor market cools and the presidential election nears, overshadowing progress in taming inflation.

“Investors should expect more volatility in the near term as the economic data likely give conflicting signals.”

Today’s Market Moves

The S&P 500 rose 1.5% as of 2 p.m. New York time.

The Nasdaq 100 rose 2.4%.

The Dow Jones Industrial Average rose 1.2%.

The MSCI World Index rose 1.2%.

Bloomberg Magnificent 7 Total Return Index rose 2.9%.

The Russell 2000 Index rose 2.8%.

(Photo credit: Adobe Stock)