Stocks Get Hit as War Jitters Fuel Rush to Bonds

What You Need to Know

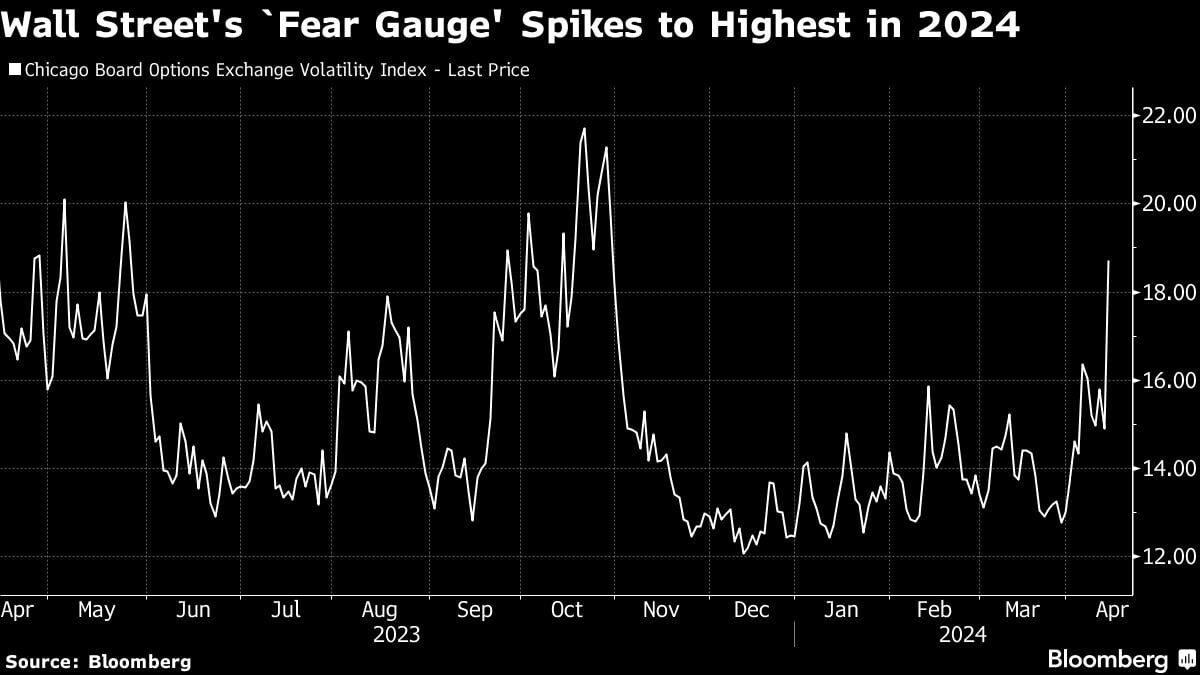

The S&P 500 was on pace for its worst day since January, Treasuries climbed, and the VIX spiked to levels last seen in October.

JPMorgan Chase & Co. and Wells Fargo & Co. both reported net interest income — the earnings they generate from lending — that missed estimates amid increasing funding costs.

Bond markets are now pricing two rate cuts by the end of the year, compared with six just three months ago, yet both the S&P 500 and the Nasdaq 100 are still hovering near record highs.

The global financial world was roiled by a flare-up in geopolitical risks that sent stocks sliding — while spurring a flight to the safest corners of the market such as bonds and the dollar. Oil rallied.

Equities fell at the end of a wild week on a news report that Israel was bracing for an unprecedented attack by Iran on government targets. Approximately 40 launches were identified crossing from Lebanese territory, some of which were intercepted, the Israel Defense Forces said in a post on X.

The S&P 500 was on pace for its worst day since January. Treasuries climbed as the greenback hit the highest in 2024. Wall Street’s ”fear gauge” — the VIX — spiked to levels last seen in October.

To Matt Maley at Miller Tabak, investors have been much too complacent about geopolitical issues.

“Since gold and oil markets have been pricing in a meaningful impact on the marketplace from this crisis, it’s not out of the question that the stock market will follow those other markets and see an outsized reaction before long,” Maley noted.

The S&P 500 fell over 1%, led by losses in banks and chipmakers. Treasury 10-year yields sank nine basis points to 4.5%. Andrew Brenner at NatAlliance Securities also cited “massive short covering” and rate locking amid an expected flurry of debt issuance by banks after earnings.

The dollar headed toward its best week since September 2022. Brent crude jumped to its highest since October. Haven currencies like the Japanese yen and the Swiss franc outperformed.

A direct confrontation between Israel and Iran would mean a significant escalation of the Middle East conflict and would lead to a significant rise in oil prices, according to Commerzbank analysts including Carsten Fritsch.

Escalating geopolitical tensions — most recently in the Middle East but also including attacks on Russian energy infrastructure by Ukraine — have spurred bullish activity in the oil options market. There’s been elevated buying of call options — which profit when prices rise — in recent days, as implied volatility climbs.

“Gold prices are up again this morning, as more investors view it as a better hedge against geopolitical risk than government bonds due to US inflation concerns,” Mohamed El-Erian, the president of Queens’ College, Cambridge and a Bloomberg Opinion columnist, wrote in a post on X earlier in the day.

Meantime, big banks’ results offered the latest window into how the U.S. economy is faring amid an interest-rate trajectory muddied by persistent inflation.

JPMorgan Chase & Co. and Wells Fargo & Co. both reported net interest income — the earnings they generate from lending — that missed estimates amid increasing funding costs.

Citigroup Inc.’s profit topped forecasts as corporations tapped markets for financing and consumers leaned on credit cards — signs that a prolonged period of elevated interest rates will benefit large lenders.

“Many economic indicators continue to be favorable. However, looking ahead, we remain alert to a number of significant uncertain forces,” JPMorgan’s Chief Executive Officer Jamie Dimon said. He cited the wars, growing geopolitical tensions, persistent inflationary pressures and the effects of quantitative tightening.

Treasuries rallied sharply, following the market’s worst two days since February, in which yields reached year-to-date highs after inflation readings savaged expectations for Federal Reserve interest-rate cuts this year.

Two-year yields — which briefly topped 5% this week — plunged on Friday.

And the latest economic data did little to alter the reduced risk appetite — with consumer sentiment down as inflation expectations rose.

Views on Fed Pivot

BlackRock Inc. Chief Executive Officer Larry Fink said he expects the Fed to cut rates twice at the most this year, and that it will be difficult for the central bank to curb inflation.

Fink told CNBC he would “call it a day and a win” if the inflation rate gets to between 2.8% and 3%, which is above the Fed’s 2% target.