State Lawmaker Group Attacks DOL Fiduciary Rule Revival

What You Need to Know

The U.S. Labor Department recently said a new fiduciary rule could be coming in August.

The National Council of Insurance Legislators opposed the old, 2016 DOL fiduciary rule.

The group is not happy with the idea of a DOL fiduciary rule reboot.

The National Council of Insurance Legislators wants to keep the U.S. Department of Labor from bringing back the 2016 fiduciary rule for sales of annuities and other retirement savings products.

NCOIL last week adopted a resolution opposing the revival of the DOL fiduciary rule effort at an in-person meeting in Minneapolis.

According to the resolution, a return to the fiduciary rule approach “would threaten the proven state-based legislative and regulatory structure by imposing a vague and burdensome fiduciary standard on non-fiduciary sales relationships, thereby upending the retirement savings marketplace.”

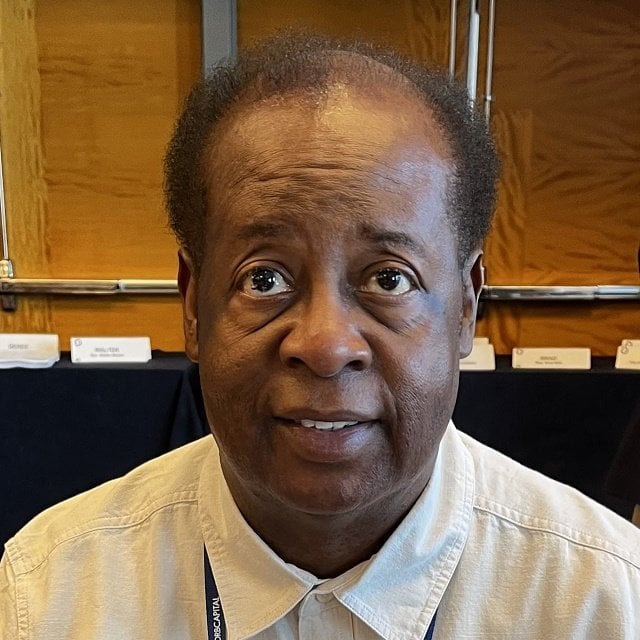

South Carolina state Rep. Carl Anderson, a Democrat who has worked as an insurance agent, sponsored the measure. He called NCOIL’s adoption of it “yet another example of NCOIL pushing back on unnecessary federal encroachment in the state-based system of insurance regulation.”

What It Means

Debate over any new Labor Department fiduciary rule proposal could be fierce.

A new DOL fiduciary rule could affect how you get paid, what kinds of disclosures clients get, what kinds of exposure to litigation you face, and what kinds of financial services products and retirement savings support tools and services are available to ordinary retail consumers.

The DOL Fiduciary Rule

The U.S. Securities and Exchange Commission already regulates sales of variable life insurance and variable annuities, as a result of rules classifying those products as securities.

The modern Labor Department fiduciary rule fight over sales of fixed annuities has its roots in a financial services regulatory principles commentary that officials in the administration of former President Barack Obama released in 2009.

The department completed fiduciary rule regulations in 2016.

The Labor Department fiduciary rule would have required sellers of non-variable indexed annuities and other products classified as fixed annuities to put the interests of consumers first. In practice, that might have upended traditional U.S. life and annuity sales strategies by requiring retail agents and brokers to offer all fixed annuities — or products from a wide range of issuers — and limiting or eliminating the use of commission-based sales compensation.

The 5th U.S. Circuit Court of Appeals blocked the rule in 2018.

The SEC then developed Regulation Best Interest, which requires annuity sellers to work in the best interest of the consumer, and the National Association of Insurance Commissioners developed model regulations meant to complement Reg Bi. Thirty-nine states have now adopted the Reg BI model, according to an implementation map posted by the NAIC’s Annuity Suitability Working Group.

The Labor Department recently suggested in a regulatory agenda that a new DOL fiduciary rule will be coming out in August.

Over the years, many insurers and groups representing insurance agents have tended to oppose the DOL fiduciary rule approach.

Financial regulators, groups for financial regulators, and groups representing investors and consumers as a whole have supported the fiduciary rule approach. One of the groups supporting the fiduciary rule approach has been the Center for Economic Justice, which has played a prominent role in representing consumer interests at the NAIC.

NCOIL

NCOIL is a Belmar, New Jersey-based group for state legislators from around the United States who have an interest in insurance, annuities and related topics.

The state insurance commissioners who belong to the NAIC run large departments that often generate large amounts of premium tax revenue and penalty revenue for their states.

Because the legislators work on their own, and they do not run the kinds of large state, their organization has to make do with an annual budget of about $1.1 million per year, compared with a budget of about $134 million per year at the NAIC.

But the NCOIL can have a big effect in some cases because its members can help or stop state regulatory efforts that require state legislative approval.

The NCOIL Resolution

Anderson, the state lawmaker who introduced the NCOIL legislation, has served in the South Carolina House since 2005. He is a vice chairman of the state House Regulation and Administrative Procedures Committee.

He is the chairman of NCOIL’s Life Insurance and Planning Committee.

The resolution he drafted is based on a similar resolution NCOIL adopted in 2016, in response to the Labor Department’s completion of work on the original DOL fiduciary rule.

In the resolution, Anderson states that NCOIL believes that financial professionals should always act in the best interests of clients and prospective clients, and that it believes that state insurance regulators have developed ongoing, substantive procedures for supervising sellers of retirement-related financial products.

Other NCOIL Meeting News

At the Minneapolis meeting, the NCOIL Life Insurance and Financial Planning Committee also talked about a draft model law, introduced by Indiana state Sen. Travis Holdman that could set rules for life insurers’ efforts to buy back policies from the insureds.

Holdman, a Republican, has proposed preventing life insurers from increasing a policy’s cash surrender value after the policy has been purchased.

Life settlement companies have argued that temporarily increasing a policy’s cash surrender value is a way for life insurers to buy life insurance policies without facing the same kinds of requirements that life settlement companies face.

Steve Schoonveld, a consultant, presented an update on Minnesota’s efforts to sketch out what a public long-term care benefits program in Minneapolis might look like.

Pictured: Carl Anderson. Credit: ALM