Starting a State Farm agency: a guide for entrepreneurs

Starting a State Farm agency: a guide for entrepreneurs | Insurance Business America

Guides

Starting a State Farm agency: a guide for entrepreneurs

Starting a State Farm agency comes with its pros and cons. Find out what these are and how you can launch your own insurance business in this guide

State Farm is among the industry’s most recognizable brands, being the largest property and casualty (P&C) insurer not just in the US but also in the world. The insurance giant is also the biggest provider of home and auto insurance in the country, controlling about a fifth of both markets. These reasons alone make the company an attractive partner for those aspiring to start an insurance business.

In this guide, we will give you a step-by-step walkthrough on starting a State Farm agency. We will also discuss the pros and cons of being a State Farm insurance agency owner. This is to give you an idea if this type of venture suits you.

If you’re wondering if launching a business under one of the biggest names in the industry is a great move careerwise, this guide can help. Read on and find out what it takes to start an insurance agency with the company that describes itself as “like a good neighbor.”

Before we go through the steps of starting a State Farm agency, let’s first delve deeper into why the company is among the industry’s leaders.

As the largest P&C insurer in the US, State Farm accounts for almost a tenth of the market with direct written premiums reaching around $94 billion. It boasts a network of over 65,000 employees in more than 19,000 agent offices. These agents service over 94 million policies and accounts. Around three million of these were added in the last financial year. Globally, the Bloomington, Illinois-headquartered insurer controls around 5% of the market.

State Farm is also the biggest auto and home insurance provider in the country. It controls almost a fifth – 17.8% (homeowners) and 18.3% (private auto) – of both markets. These figures are based on the latest data from the National Association of Insurance Commissioners (NAIC).

State Farm also gives back to the community. Along with the State Farm Companies Foundation, it supports more than 8,000 charitable institutions. To date, the insurer has provided more than 20,000 grants to various organizations in the country. Its employees have also volunteered 147,000 hours for different causes.

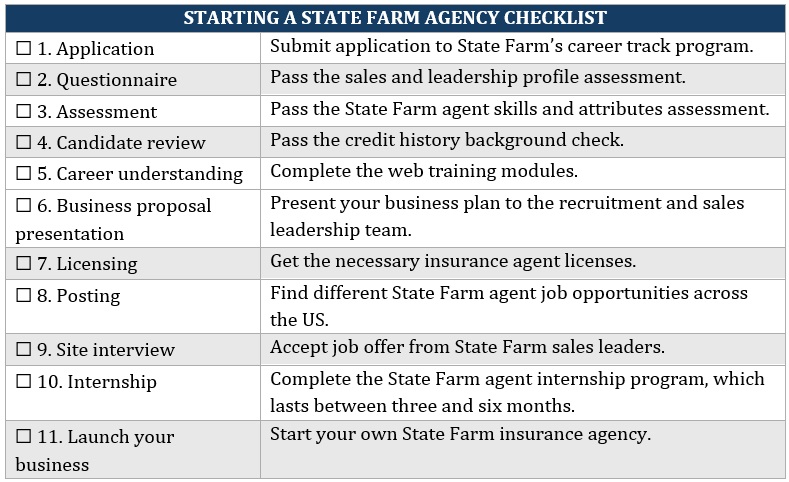

Before you start a State Farm agency, you must first pass a series of assessments designed to determine your suitability as a State Farm agent. This follows a 10-step process:

1. Application

Inform the company that you want to become a State Farm agency owner by submitting an application to the insurer’s career track program.

2. Questionnaire

State Farm uses a tool called the “sales and leadership profile” to predict your likelihood of succeeding in a sales and business leadership role. You will be asked to answer questions designed to gather information about your:

personal background

financial situation

recruiting experience

work preferences, goals, and motivations

familiarity with the role

business leadership skills

You need to get an “acceptable” score, meaning you have passed the initial assessment. Otherwise, you will need to wait 12 months to reapply.

3. Assessment

You will then undergo an assessment designed to identify if you have the skills and attributes needed to become a successful State Farm agent. Just like in the previous step, you will need to get an “acceptable” rating to move on. A “not acceptable” score will require you to wait a year before you can try again.

4. Candidate review

State Farm will then review and evaluate your credit history to determine your fiduciary ability to meet the licensing and sponsorship requirements. Depending on the rules in your jurisdiction, this step may not be taken until after the site interview (step 9).

Because of this, it’s important that you’re familiar with your state’s regulations, so that you’re also aware of the timing. Bear in mind that your application may be denied based on the results of the background check.

5. Career understanding

This web-based seminar is designed to help you build a better understanding of your role as a State Farm agent. You will be able to access a series of training modules and videos. You can also connect with State Farm contacts and other candidates through email and messaging tools.

Once you have completed the modules, which include a final counseling conversation, you can move on to the next step.

6. Business proposal presentation

At this stage, you will be asked to present your business proposal to the recruitment and sales leadership team. This gives you the opportunity to apply everything that you’ve learned in the career understanding program.

8. Posting

Once your state licenses and Securities Industry Essentials (SIE) exam results are confirmed, you can access a range of State Farm agent opportunities across the country.

9. Site interview

Sales leaders may prefer to conduct interviews for new agents in their market area. If you’ve been selected, you will be offered a job as an agent intern, depending on the results of your background and licensing checks.

10. Internship

Successful candidates will enter State Farm’s internship program for leadership and product training. This includes field development experience with an established agent. State Farm internships last between 17 and 26 weeks.

After completing the program, you may be able to start your own State Farm agency. But this depends on your sales performance. If you’re among the high performers, you can be assigned to lead an agency or allowed to start your own. You can rent office space and hire your own staff. State Farm will provide operational support.

Here’s a checklist of the steps on starting a State Farm agency. You can download this and keep it for reference.

State Farm is one of the top insurance brands in the country that work exclusively with captive agents. This means that the insurance agents and agencies it partners with are obligated to sell State Farm products only. Operating as a captive insurance sales professional or business comes with its share of benefits and drawbacks.

Pros of starting a State Farm agency

Product expertise

As an exclusive agent, you get extensive training on the different products and services State Farm offers. This helps you gain in-depth knowledge about the insurer’s policies and guidelines. Because of this, you can assist clients with choosing the right coverage and filing claims better.

Operational support

State Farm provides operational backing for their partner agencies. This includes office space and administrative support. State Farm agents also receive ongoing training to help sharpen their sales skills and industry knowledge.

Captive agencies often receive referrals and leads on potential buyers from their parent companies. However, you will still need to generate your own leads to meet quotas.

Employee benefits

As a State Farm agent, you will receive a regular salary on top of your commissions. As a salaried employee, you’re also entitled to regular employee benefits, including paid time off.

Cons of starting a State Farm agency

Limited product selection

State Farm agencies are often restricted to the types of products they can offer. This can sometimes prevent your business from providing buyers with a policy that best fits their needs. Independent agencies that work with more partner carriers, on the other hand, can offer clients a broader range of insurance coverage.

Business decisions

State Farm agencies are obligated to follow the rules and guidelines set by the company. Because of this, you have less freedom when making business decisions, even if you’re running your own insurance agency.

Lower commissions

Captive agents generally earn lower commissions than their independent counterparts. Independent agents, however, are responsible for their own business expenses, which offsets this benefit.

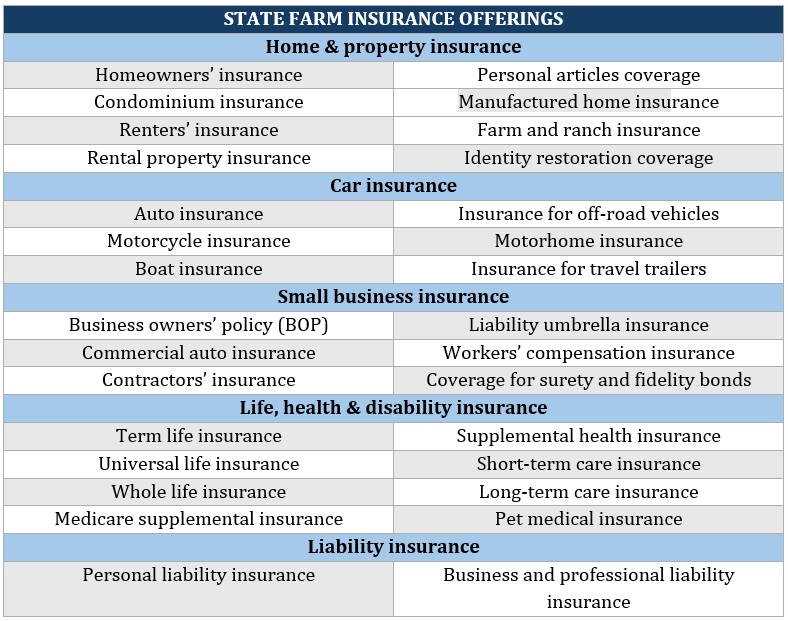

State Farm agencies can access a wide range of property and casualty insurance policies. Here’s a list of the different products the insurance giant offers:

The question of whether State Farm is a great company to partner with depends on the direction you want your insurance agency to go. If you’re looking for an insurer that is financially stable and provides job security, State Farm is a good option. It is among the largest insurers in the country and offers a wide range of coverage.

If you’re looking to earn an above-average salary, State Farm offers an amount that’s relatively lower than many of its industry rivals. The insurer, however, makes up for this by providing insurance agents with a comprehensive list of benefits. The company’s commission-based structure also gives agents the opportunity for higher earnings if they close more sales. This pressure to sell more, however, can lead to exhaustion and burnout.

Would you consider starting a State Farm agency? Why or why not? Let us know in the comments.

Keep up with the latest news and events

Join our mailing list, it’s free!